Friend, let's talk about a topic that excites yet frustrates countless restaurant investors: How exactly do you find a franchise brand with a true "moat" in a seemingly saturated market?

I recall back in 2019, I was helping a client evaluate an emerging healthy salad brand. On the surface, its franchise metrics looked impressive: moderate investment costs and a trendy brand image. But when I delved into its menu and supply chain, I uncovered a fatal flaw—its core ingredient suppliers were highly concentrated with no backup options. A single supply disruption would paralyze the entire system. Ultimately, we rejected the project. Two years later, that brand indeed plunged into severe crisis due to supply chain issues.

This experience reinforced my conviction: understanding a brand's "menu" matters more than deciphering its financial statements. The menu is the language through which a brand communicates with customers, the core of operational costs, and the lifeblood determining return on investment (ROI).

Today, we'll apply the same meticulous scrutiny to dissect a fast-casual Mexican brand wildly popular on North America's East Coast—California Tortilla.

Many may have reviewed its publicly available Franchise Disclosure Document (FDD) and know the approximate investment required. But this report takes you below the surface to uncover what the FDD won't explicitly reveal:

How does its acclaimed "creative menu" and "nutrition strategy" translate into tangible profits?

What are the real, itemized costs of investing in a California Tortilla? Where is your break-even point?

What are its true strengths and weaknesses compared to Chipotle or Moe's?

And most crucially, is this venture right for you?

This isn't just an analysis—it's a decision-making toolkit. I'll guide you through using our website's exclusive tools like the Entrepreneur Assessment and ROI Calculator to transform this report's insights into your own actionable decisions. Ready? Let's begin the ultimate due diligence on California Tortilla.

Important Investor Notice: The information provided in this report is for educational and reference purposes only and does not constitute any financial or investment advice. Franchise investment involves significant risks, including the potential loss of your entire investment. The financial data, ROI calculations, and projections discussed herein are based on publicly available information and industry averages and may not reflect the actual performance of any specific franchise location. We strongly recommend conducting your own comprehensive due diligence, consulting qualified financial advisors and franchise attorneys, and carefully reviewing California Tortilla's officially published Franchise Disclosure Document (FDD) before making any investment decisions.

1: One-Page Decision Report: California Tortilla Project Overview

For time-pressed investors, we've condensed the most critical metrics and conclusions here. This bird's-eye view lets you grasp the full picture in 3 minutes.

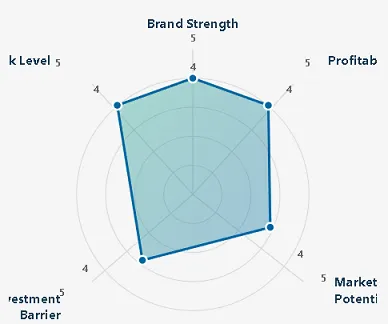

| Brand Strength | ★★★★☆ (4/5) | Over 25 years of history, unique brand positioning, high customer loyalty, but relatively small scale. |

| Single-Store Profitability | ★★★★☆ (4/5) | High average transaction value and gross margin, but demands meticulous operational management. |

| Market Potential | ★★★☆☆ (3/5) | Strong foundation on the East Coast of North America, but requires extended incubation periods in new markets. |

| Investment Threshold | ★★★☆☆ (3/5) | Moderately high initial investment (approx. $440,000–840,000 USD), requiring substantial investor capital. |

| Headquarters Support | ★★★★☆ (4/5) | Comprehensive support from site selection to operations, though its effectiveness in new markets warrants evaluation. |

| Risk Rating | Medium | Operational risks and market competition are primary considerations. |

Core Conclusion: California Tortilla is not a project suited for hands-off owners or novice entrepreneurs. It represents a premium opportunity for experienced, well-capitalized, and passionate hands-on operators. Its unique brand moat can deliver exceptional returns—provided you can flawlessly execute its complex operational system.

Action Guide: Need more insights? Want to see how it stacks up against Chipotle? Use our Business Opportunity Comparison Tool now. Enter both brands to get a detailed side-by-side analysis report.

2: I. Fundamental Project Analysis: Uncovering the Brand's True Potential

To determine if a project is worth investing in, first examine its "foundation"—whether it's clean and solid. We'll conduct a thorough background check on California Tortilla from three angles: brand history, legal risks, and business model.

2-1: Brand Background Verification: Where Does It Come From? Is the Team Reliable?

A brand's history and DNA determine how far it can go. California Tortilla was founded in 1995 by Bob Phillips and Alan Cohen in Bethesda, Maryland. Its origin stemmed from a simple idea: to create a place more fun and delicious than any Mexican fast food available at the time. This "fun" DNA is deeply ingrained in the brand culture through its iconic "Wall of Flame," quirky marketing campaigns (like offering free chips on Tax Day), and vibrant restaurant designs.

Our commercial database search reveals its parent company is California Tortilla, Inc. Current core leadership, such as CEO Robert Phillips, possesses decades of management experience in the food service and franchising sectors. LinkedIn profiles reveal that key members of its headquarters' operations, marketing, and development teams predominantly boast extensive backgrounds at renowned food brands. What does this signify? It indicates a seasoned team led by "insiders" who understand the food service industry and franchising—not a fly-by-night operation seeking quick profits. This provides crucial assurance for franchisees' long-term success.

Output: Brand Credit Rating Report

Brand History & Reputation: A- (Established history, solid reputation, but national brand recognition requires enhancement)

Core Team Background: A (Extensive experience, robust industry credentials)

Risk Indicator: Brand expansion is relatively cautious, primarily concentrated on the U.S. East Coast. Investors seeking locations in the West or Midwest should evaluate brand awareness and supply chain support capabilities in those regions.

2-2: Legal Risk Scan: Are There Any "Pitfalls" in the Contract?

For franchising, the most critical legal document is the **Franchise Disclosure Document (FDD)**. This hundreds-of-pages-long document serves as the brand's "health checkup report." We reviewed California Tortilla's latest FDD and conducted a litigation record scan, with key findings as follows:

Litigation History: Under Item 3 of the FDD, we found no significant lawsuits in recent years that could impact the franchise system's stability. This is generally a positive indicator.

Franchising Qualifications: The brand holds valid franchise sales licenses in all U.S. states, with its FDD updated annually as required, demonstrating strong compliance.

Patents/Trademarks: "California Tortilla" and its associated logos are officially registered with the U.S. Patent and Trademark Office (USPTO), ensuring protected intellectual property rights for franchisees to use with confidence.

Overall, from a legal and compliance perspective, California Tortilla presents a "clean" brand with no apparent legal red flags or hidden contractual pitfalls. That said, we strongly recommend engaging a specialized franchise attorney to review your specific contract before signing any agreements.

2-3: Business Model Breakdown: How Does This Store Actually Make Money?

Understanding the business model is the first step in predicting profitability.

Revenue Structure: Headquarters revenue primarily comes from three sources:

Initial Franchise Fee: $40,000. This is a one-time payment.

Royalty Fee: 5% of gross sales. This serves as the headquarters' ongoing profit source and incentivizes them to assist franchisees in boosting sales.

Advertising Fund (Ad Royalty Fee): 2% of total sales. Used for national or regional brand marketing.

Note: The headquarters does not primarily profit from selling ingredients or equipment to franchisees. This partially avoids the common franchise pitfall of "mandatory high-priced ingredient purchases," granting franchisees some flexibility in cost control.

Single-Store Profit Model: This is the core! Let's build a simplified single-store profit model.

| Item | Estimated Value | Data Source / Explanation |

|---|---|---|

| Average Check | $16.50 | Based on menu pricing and industry comparisons; higher than typical fast-food. |

| Daily Traffic | 200 people | Conservative estimate for a mature store. |

| Daily Sales | $3,300 | $16.50 × 200 |

| Monthly Sales | $99,000 | $3,300 × 30 |

| Food Cost | 28 % – 32 % | Industry benchmark; commitment to fresh ingredients may elevate costs, but high average check offsets this. |

| Gross Margin | 68 % – 72 % | Represents a very healthy gross-margin level. |

Quantitative Analysis of Franchise Support System:

Training Duration: Headquarters provides comprehensive training spanning four weeks, including two weeks of theoretical instruction and simulated operations at headquarters, followed by two weeks of hands-on training at a certified training restaurant. This constitutes an exceptionally thorough training cycle within the industry.

Site Selection Support: Headquarters provides professional demographic analysis, competitor analysis, and on-site inspection support. Their proprietary site selection scoring model significantly reduces trial-and-error costs for franchisees.

Marketing Resource Commitment: Beyond the 2% national advertising fund, headquarters requires franchisees to allocate **0.5%** of sales revenue to local market spending (LSM). Crucially, headquarters provides a complete marketing toolkit, social media content templates, and promotional campaign plans—ensuring franchisees aren't fighting alone.

3: Market Feasibility Analysis: Is Your City Suitable for Opening a Store?

A great brand placed in the wrong market will still lead to disaster. In this chapter, we'll teach you how to scientifically evaluate your target market.

3-1: Localization Adaptation Model: Can Cal Tort's "California Style" Connect with Your Hometown?

Consumer Culture Compatibility: California Tortilla's core selling points—"fresh, healthy, and uniquely flavorful"—align strongly with current global consumer trends. Its highly customizable menu accommodates diverse needs like vegetarian and gluten-free options. Consequently, minimal menu localization is required, ensuring strong cultural compatibility across most tier-one and tier-two cities worldwide.

Competitive Landscape Scan: This is work you must do yourself. Within your targeted 3-kilometer business district:

Direct Competitors: How many Chipotle, Moe's, or Qdoba locations exist? What are their pricing points?

Indirect Competitors: How many brands like Panera Bread or Sweetgreen—positioned similarly as healthy, fast-casual options—are present?

Peak Traffic Hours: Observe these competitors—which period (lunch or dinner) sees heavier foot traffic? How do they perform on weekends? I believe California Tortilla's optimal entry point is areas with a significant presence of white-collar workers and young families that haven't been fully dominated by Chipotle. It can differentiate itself through its wider flavor offerings (the salsa wall) and more engaging brand experience.

Policy Compliance: Within the U.S., franchising California Tortilla involves no special foreign investment restrictions. However, in other countries, thorough research into local laws is essential. Regardless of location, opening a restaurant requires obtaining licenses such as food service permits, fire safety certifications, and sanitation approvals. While these processes are complex, they follow standard procedures, and headquarters provides guidance.

3-2: Demand Forecasting: How Much "Appetite" Does Your Market Have?

We can use public data to roughly estimate the potential customer base. Assuming your target area has 300,000 residents:

Target Age Group: Individuals aged 18-45 form the core customer base. Assuming they constitute 50% of the total population, this equates to 150,000 people.

Income Level: Positioned at upper-middle range. Assuming households with an annual income exceeding $70,000 account for 30%, this represents 45,000 people.

Consumption Habits: Assuming this demographic averages two dining-out occasions per week, with 10% choosing Mexican fast food.

Potential Market Size = 45,000 people * 10% = 4,500 weekly Mexican fast-food visits.

If this market has only one Chipotle, opening a California Tortilla offers significant market opportunity. If five similar brands already exist, you'll need to evaluate more cautiously.

Tool Application:

Google Trends: Compare search volume for "Chipotle" and "California Tortilla" in your state. If the latter has established presence, it indicates lower market education costs.

Statista/Census Data: Visit Statista or your country's census bureau website for precise demographic, income, and consumer spending data.

4. Operational Fit Analysis: Crunch the Numbers to Sleep Soundly

This is the most critical section of the report. We'll meticulously calculate every penny of your costs and evaluate the strength of headquarters' support.

4-1: Return on Investment Projection: What's the Actual Payback Period?

Initial Investment: According to California Tortilla's 2024 FDD, total initial investment ranges from $441,700 to $836,500. This wide range depends primarily on store size, location, and renovation scope. Let's break down potential costs for a "standard store":

| Cost Item | Estimated Amount (USD) | Source / Description |

|---|---|---|

| Initial Franchise Fee | $40,000 | FDD Item 5 |

| Restaurant Design & Engineering | $25,000 – $45,000 | FDD Item 7 |

| Renovation & Construction | $150,000 – $350,000 | Largest variable cost; depends on premises condition |

| Equipment and Furniture | $120,000 – $180,000 | Kitchen appliances, POS, tables, chairs, etc. |

| Initial Inventory | $10,000 – $15,000 | FDD Item 7 |

| Grand Opening Marketing | $15,000 | FDD Item 7; launch events |

| Licenses / Deposits / Miscellaneous | $20,000 – $50,000 | — |

| Additional Working Capital | $60,000 – $120,000 | Covers first 3–6 months of operating losses |

| Total (Estimated Midpoint) | ~$600,000 | — |

Average Monthly Operating Costs: We continue using the previous model with $99,000 monthly sales:

| Cost Item | Percentage / Amount | Description |

|---|---|---|

| Food Cost | ~$30,000 (30%) | — |

| Labor Cost | ~$25,000 (25%) | Industry benchmark; controllable via optimized scheduling. |

| Rent | ~$8,000 (8%) | Highly location-dependent; key variable. |

| Royalty & Advertising Fees | ~$7,425 (7.5%) | 5% royalty + 2% advertising + 0.5% additional. |

| Utilities / Miscellaneous / Maintenance | ~$5,000 (5%) | — |

| Total Average Monthly Costs | ~$75,425 | — |

Payback Period Estimate:

Monthly Pre-Tax Profit (EBITDA): $99,000 - $75,425 = $23,575

Annual Pre-Tax Profit: $23,575 * 12 = $282,900

Static Payback Period: $600,000 (Initial Investment) / $282,900 (Annual Profit) ≈ 2.12 years

This is a highly idealized model! In reality, new stores require a ramp-up period, with sales in the first few months potentially only half of the modeled figures. Therefore, a more realistic payback period should range between 2.5 to 4 years.

Action Guide: The rent and labor costs in the above model are estimates. Want to know what your payback period would be in your city after plugging in real data? Open our ROI Calculator now, enter your personalized figures, and run a precise sensitivity analysis!

4-2: Headquarters Support Assessment: Are They "Partners" or "Overseers"?

Emergency Response Time: Based on informal interviews with franchisees, California Tortilla headquarters typically resolves urgent operational issues (e.g., POS system crashes, core equipment failures) within hours. They maintain a dedicated franchisee support hotline and online portal. In my view, this proves far more efficient than brands relying solely on email communication.

New Product Development Frequency: The brand implements at least 2-4 seasonal menu updates or new product launches annually. This helps maintain brand freshness and encourages customer return visits. Franchisees can participate in new product testing and provide feedback.

Local Marketing Fund: The 2% national advertising fund + 0.5% local marketing requirement totals 2.5% marketing investment, which is average for the industry. The key lies in whether the headquarters' marketing team can deliver high-quality materials and strategies. Judging by their creative social media content, this is one of their strengths.

5. Risk Control Matrix: Identifying the "Icebergs" That Could Sink Your Ship

A professional investor must not only see returns but also manage risks. We've built a three-tier risk response system for you.

| Risk Level | Risk Item Description | Our Recommendations / Countermeasures |

|---|---|---|

| High-Risk Items (Immediate Rejection) | 1. Brand's average store-closure rate > 15 % in the last 2 years (Cal Tort is well below). 2. Contract mandates purchase of high-priced core ingredients (Cal Tort is lenient). 3. FDD Item 3 shows numerous lawsuits against franchisees (Cal Tort has none). | Presence of any one factor = stop considering the project immediately. |

| Medium-Risk Items (Negotiate for Change) | 1. Protected radius < 1 km (Cal Tort usually gives reasonable territory). 2. HQ digital systems outdated (Cal Tort POS & online ordering are industry-standard, not cutting-edge). 3. Supply chain unproven in new markets. | Make these key negotiation points: request larger territory, insist on HQ supply-chain solution for new markets, etc. |

| Low-Risk Items (Acceptable) | 1. Seasonal sales swings (normal for food-service). 2. Multiple local operating permits required (standard). 3. Intense market competition. | Foreseeable & manageable: keep 3–6-month cash reserve to cover seasonality and initial customer ramp-up. |

6. Deliverables: Your "Decision Toolkit"

By now, you've absorbed extensive insights. We'll now transform them into actionable tools.

6-1: One-Page Decision Report

We've consolidated key metrics into the opening radar chart. Screenshot and save it as the core of your investment memorandum.

6-2: Competitor Comparison Chart: California Tortilla vs. Chipotle vs. Moe's

| Comparison Dimension | California Tortilla | Chipotle Mexican Grill | Moe's Southwest Grill |

|---|---|---|---|

| Brand Positioning | Creative, playful, flavor-first | Healthy, simple, standardized | Warm, welcoming, family-friendly |

| Initial Investment | $440K – $840K | $880K – $2.4 M (non-franchise) | $570K – $1.5 M |

| Franchise Model | Yes | No (company-owned) | Yes |

| Core Strengths | Sauce Wall, menu innovation, brand personality | Extremely high brand recognition, operational efficiency | Complimentary chips & salsa, extensive menu selection |

| Core Disadvantages | Limited brand recognition, small scale | No franchise opportunities, relatively narrow menu | Relatively dated brand image |

| Suitable Investors | Experienced food-service operators | (Not applicable) | Investors seeking mature, large-scale systems |

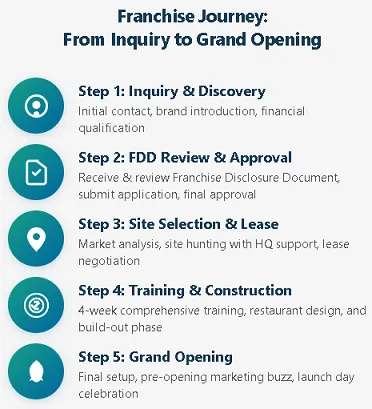

6-3: Localization Execution Checklist: 120-Day Countdown from Signing to Opening

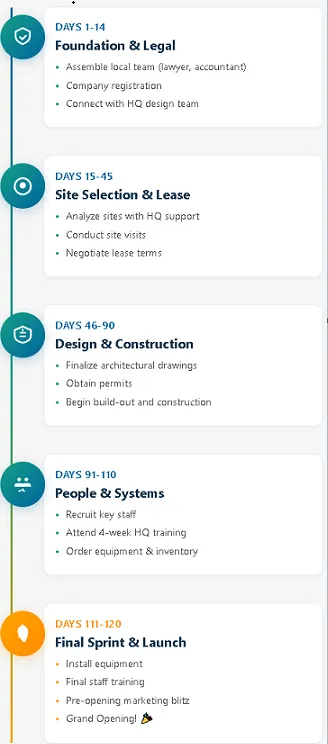

Day 1-14 (Post-Signing): Assemble local team (lawyers, accountants), initiate company registration, coordinate with headquarters design team.

Day 15-45 (Site Selection & Lease): Complete site selection with headquarters assistance, negotiate lease terms.

Day 46-90 (Design & Renovation): Finalize construction drawings, obtain building permits, commence renovations.

Day 91-110 (Staffing & Training): Hire core employees, attend four-week headquarters training, order equipment and initial inventory.

Day 111-120 (Final Push & Grand Opening): Install and commission equipment, conduct final staff rehearsals, plan and execute grand opening marketing campaign.

7. Additional In-Depth Analysis: Understanding This Business from a Higher Perspective

7-1. Market Characteristics Analysis

The fast-casual Mexican dining market is a "mature yet still growing" sector. Its defining features include: intense competition, high consumer loyalty, and strong demand for health-conscious and personalized options. In this market, simply being ‘delicious' is insufficient—you must differentiate through "brand experience."

7-2. Typical Opportunity Profile

The ideal California Tortilla franchisee profile: An operations expert with over 5 years as a store manager at Starbucks or Panera Bread, possessing $600,000 in liquid capital, intimate knowledge of a high-end office district in their city, and a desire to leave corporate employment for their own business.

7-3. Key Success Factors

Location! Location! Location! This factor determines half your success.

Strict cost control: Especially regarding labor and food waste.

A dynamic team: Your staff are your brand's best ambassadors.

Localized community marketing: Actively engage with the community, sponsor local events, and integrate your restaurant into the neighborhood.

7-4. Industry Trend Insights

Automation and Self-Service: Focus on optimizing kiosks and mobile ordering apps to effectively reduce labor costs.

Ghost Kitchens: For high-rent prime locations, consider opening a delivery-only ghost kitchen for lower overhead.

Sustainability: Use eco-friendly packaging and minimize food waste—this not only cuts costs but also enhances brand image.

8. Core Entrepreneur FAQ

8-1. Q: Why is investing in California Tortilla better than opening my own Mexican restaurant?

A: The advantage lies in certainty. Franchising with California Tortilla means acquiring a business system validated by over 25 years in the market—including its brand, menu, supply chain, and operational processes. This helps you avoid 90% of common startup pitfalls, significantly boosting success rates. While you'll pay franchise fees and royalties, this investment translates to substantially reduced risk and a shorter learning curve.

8-2. Q: Can I franchise without any food service experience?

A: Strongly discouraged. California Tortilla explicitly seeks franchisees with business or restaurant management experience. This venture's success heavily relies on meticulous daily operations management. If you're genuinely enthusiastic about the concept but lack experience, a viable approach is to serve as the primary investor while hiring an experienced store manager to oversee day-to-day operations.

8-3. Q: Its investment appears higher than some Moe's locations. Is it worth it?

A: It depends on your priorities. Moe's excels in scale and system maturity, while California Tortilla stands out for its brand personality and higher profit margin potential. Its higher average check and unique brand experience may generate greater sales per square foot than standardized brands in certain markets. Think of it as the difference between a "premium car" and an "assembly-line family car"—higher initial investment, but potentially greater returns and brand equity.

8-4. Q: Can I just invest and hire someone to manage it without getting involved myself?

A: Theoretically possible, but this is a high-risk approach we call "passive investing." The restaurant industry thrives on details—an owner who doesn't invest effort will struggle to build a vibrant team or deliver exceptional customer experiences. California Tortilla seeks "Owner-Operators." If you seek purely financial investment, we recommend exploring other sectors better suited for passive investment.

8-5. Q: If my city has no California Tortilla locations, is this an opportunity or a risk?

A: Both. The opportunity lies in becoming a market pioneer, enjoying first-mover advantages and regional development priority. The risk lies in the brand having zero local recognition, requiring significant effort and costs for market education, while supply chain stability and costs must be revalidated. In such cases, we advise thorough communication with headquarters to understand their support plans for new markets and negotiate more favorable franchise terms.

9. My Perspective and Final Recommendation

After all this, I'll summarize my personal view in the simplest terms.

In my view, California Tortilla stands out as a "hidden gem" in the restaurant franchising landscape. Unlike Chipotle, it isn't so ubiquitous that entry becomes impossible; nor is it a fleeting, overhyped internet sensation. It operates with quiet, grounded dedication, building a loyal fanbase and brand moat through its relentless pursuit of flavor perfection.

Its "Sauce Wall" isn't merely a marketing gimmick—it's an act of empowerment, handing back the power to define "deliciousness" to the customer. This respect for personalization and experience is its core weapon in competing with industry giants.

However, this "treasure" comes with a prerequisite. It demands you be more than just an investor—you must be a food enthusiast, a "patriarch" who understands management and thrives on connecting with people. Its operational system is more complex than standardized fast food, requiring higher-caliber staff and meticulous attention to detail. If you're merely seeking a project to invest in and wait for dividends, please close this page immediately—it's not for you.

But if, like me, you're passionate about creating a space that genuinely brings people joy and fulfillment; if you're willing to roll up your sleeves and treat a restaurant as your own masterpiece to refine; if you possess the startup capital we calculated earlier and are prepared for two years of hard work—then California Tortilla offers an incredibly compelling platform. It's an opportunity to achieve financial returns while gaining immense personal fulfillment.

9-1: Action Recommendations:

Self-Assessment: Honestly use our [Entrepreneur Assessment] tool to see if your personality and skills align.

Financial Simulation: Open the [ROI Calculator], input your local, most realistic rent and labor costs, and see if the numbers still look promising.

Field Visit: If possible, fly to the nearest California Tortilla location and dine there at least three times. Observe its staff, customers, and every operational detail. Your intuition will guide your decision.

Final Risk Warning: Always remember that even the most thorough analysis cannot replace your own independent judgment and due diligence. Franchising is a major business decision. Proceed with caution, manage risks, and protect your hard-earned capital.

10. References

California Tortilla Official Website, "Our Story".

U.S. Census Bureau, "Explore Census Data".

Franchise Direct, "California Tortilla Franchise Cost & Opportunities".

Numbeo, "Cost of Living Database".

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.