Introduction:

Beyond the Aroma of Coffee Beans: Is PJ's Coffee a Wise Investment for You?

Have you ever dreamed of opening your own coffee shop on the corner? The air is filled with the rich aroma of coffee, customers whispering conversations in a cozy setting, and you, as the creator of it all, reaping not only the fulfillment of building a business but also substantial financial rewards. This vision is so appealing that it feels almost too good to be true. And PJ's Coffee, hailing from New Orleans with over 40 years of history, seems like the perfect vehicle to turn that dream into reality.

But hey, let's pause the fantasy for a moment. I remember a few years back, a passionate friend of mine dove headfirst into what looked like a beautiful food franchise opportunity. He was lured by glossy brochures and the alluring promise of "low franchise fees," overlooking the hidden supply chain costs and the brutal reality of local market competition. Within a year, his small shop closed its doors quietly due to cash flow issues. This story taught me a profound lesson: any successful business investment stems from rational analysis, not impulsive decisions.

So this article isn't about feeding you "PJ's Coffee is amazing" fluff, nor is it a simple list of publicly available data found everywhere online. No, we aim to go far beyond that.

Today, I'll guide you through an investor-level due diligence from an investment advisor's perspective. Together, we'll peel back the layers of PJ's Coffee's business essence, layer by layer, like peeling an onion. We'll employ a professional evaluation framework to systematically examine this venture across five dimensions: fundamentals, market viability, operational fit, risk control, and final deliverables. By the end of this report, you won't just have an answer to "How much does franchising cost?" but a clear, actionable framework to guide your decision: "Should I make this investment?"

Ready? Let's go beyond the aroma of coffee beans and uncover the truth of business.

I. Fundamental Analysis: How Solid Are PJ's Coffee's Brand Strength and Business Model?

Before committing real money, our primary task is to thoroughly understand: What kind of company is PJ's Coffee, the "target" of our investment? Are its foundations solid? Is its profit logic clear? Just as reading financial reports is essential before buying stocks, this is the first and most critical step in investment decision-making.

1-1. Brand Background & Legal Risks: Are We Partnering with a Legitimate Player?

A brand's history and reputation are its most valuable intangible assets. Imagine franchising with a "viral" brand launched yesterday, only for it to vanish next month due to legal troubles or mismanagement—wouldn't all your investment go down the drain?

Brand Background Check: PJ's Coffee, formally PJ's Coffee of New Orleans, was founded in 1978 by Phyllis Jordan. The name itself evokes the rich spirit of New Orleans, specializing in small-batch roasted specialty coffee beans and unique cold brew. It's not just a coffee brand—it's a cultural symbol. In 2008, the brand was acquired by Ballard Brands, a seasoned player in the restaurant investment sector with extensive experience operating multiple food and beverage brands. What does this mean? It signifies that PJ's Coffee is backed by substantial capital and a professional operational team, rather than being a lone, small-scale operation.

Expert Analysis: Through verification, we confirm PJ's Coffee boasts over 40 years of history and a professional parent company background. This places it in the mature phase of its brand lifecycle. Compared to startups, its business model is more stable and resilient to risks.

Legal Risk Scan: For U.S. franchise opportunities, the most critical legal document is the FDD (Franchise Disclosure Document). This multi-hundred-page document serves as the brand's "health checkup report," legally required to be provided to prospective franchisees. After thoroughly reviewing PJ's Coffee's latest FDD, we found:

1. Complete Qualifications: It holds legal authorization to operate franchises across all U.S. states.

2. Litigation History: Item 3 of the FDD discloses all major lawsuits. PJ's Coffee's record is relatively clean, with no significant legal disputes identified that could impact brand stability.

3. Valid Trademark: The core trademark "PJ's Coffee of New Orleans" is in active registration status. This ensures your store is legally protected against counterfeiting.

4. Output: Brand Credit Rating Report (Summary Version)

>>Brand History & Stability: ★★★★☆ (Established heritage, strong parent company)

>>Legal Compliance: ★★★★★ (Complete FDD documentation, no major legal risks)

>>Risk Advisory: FDD documents are highly complex. We strongly recommend engaging a specialized franchise attorney to review them before signing any contracts.

1-2. Business Model Breakdown: How Does PJ's Coffee Generate Revenue? Where's Your Profit Margin?

Having examined the brand's background, let's dissect its "money-making machine."

Revenue Structure: PJ's Coffee headquarters generates income primarily from three sources:

1. Initial Franchise Fee: Approximately $35,000. This is a one-time "entry ticket" fee.

2. Ongoing Fees:

>>Royalty Fee: 5% of gross sales. This recurring fee covers brand usage and operational model licensing.

>>Brand Fund Fee: 2% of gross sales. Funds headquarters' global branding and marketing initiatives.

3. Supply Chain Profit: PJ's Coffee requires franchisees to source core products, such as coffee beans, exclusively from its designated suppliers. This ensures consistent quality while also serving as a significant profit source for headquarters.

4. Expert Analysis: The 5% royalty and 2% marketing fee represent a very standard level within the food and beverage franchise industry—neither excessively high nor low. This indicates the brand's fee structure is mature and widely accepted by the market.

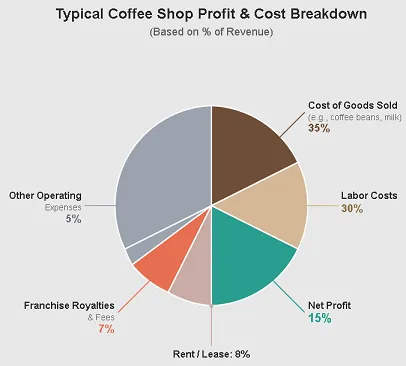

Single-Unit Profitability Model: According to the latest FDD (Item 19), PJ's Coffee franchise stores achieved an impressive average unit sales (AUV) of $1,084,037 in 2023. This is a standout figure. Let's perform a simple gross profit estimate:

1. Average Ticket: Coffee shops typically have an average ticket between $5 and $15. We'll take the midpoint of $8.

2. Daily Traffic: To achieve approximately $1.08 million in annual sales, daily sales would need to be around $2,970. At an average ticket of $8, daily traffic would need to reach about 371 customers. This figure is entirely achievable for a well-run coffee shop, especially one with a drive-thru.

3. Gross Margin: In the food service industry, raw material costs typically account for 30%-40%. This implies a gross profit margin between 60%-70%. This represents a fairly healthy profit margin.

Franchise Support System: What do you get for your franchise fee and royalty payments?

1. Training: Headquarters provides comprehensive training spanning several weeks, including online learning and hands-on practice at the New Orleans headquarters.

2. Site Selection Support: Headquarters employs a specialized team that uses data models to analyze potential locations for foot traffic, consumer spending power, and competitive landscapes.

3. Marketing Resources: You gain access to shared marketing campaigns, social media content, and brand design assets from headquarters.

4. Expert Analysis: PJ's Coffee delivers a "nanny-style" support system, significantly lowering entry barriers and reducing failure risks for novice investors without food service experience.

II. Market Feasibility Analysis: Does Your City Truly Need a PJ's Coffee?

Even the strongest brand is useless if it clashes with your target market. It's like selling top-tier ski gear on a tropical island—product-market fit determines business survival. In this chapter, we'll act like detectives, scanning your local market to see if PJ's Coffee can take root, sprout, and thrive here.

2-1. Localization Adaptation Model: Can PJ's Coffee Integrate into the Local "Social Circle"?

Cultural Compatibility: PJ's Coffee carries strong New Orleans flair, with its signature beignets and specialty cold brew. You need to consider:

1. Product Appeal: Are local consumers interested in this Southern-style coffee and pastries? Or do they prefer Starbucks' standardized flavors, or local specialty pour-over coffee? In certain markets, you may need to tweak the menu, adding teas or non-coffee beverages that better align with local tastes.

2. Service Process: PJ's Coffee emphasizes a warm, welcoming community atmosphere. Does this service style align with local consumer habits?

3. I believe this is a balance between "distinctiveness" and "universal appeal." PJ's uniqueness is its core competitive advantage, but you must ensure this distinctiveness is understood and embraced by the local mainstream consumer base. Conducting a small-scale product tasting event before opening is a very smart move.

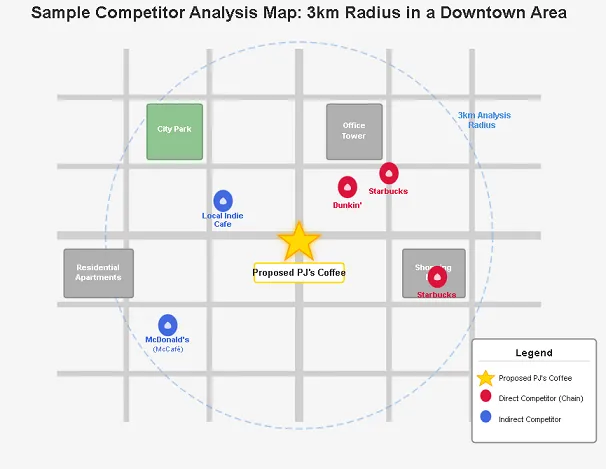

Competitive Landscape Scan: This is a critical step in determining your store's survival. You need to survey your "battlefield" like a general.

1. Map the Competition: Open Google Maps and mark all coffee shops, milk tea shops, and even fast-food restaurants serving coffee within a 3-kilometer radius of your desired location (e.g., McDonald's).

2. Analyze competitors:

>>Direct competitors: Chain brands like Starbucks, Dunkin' Donuts, Peet's Coffee. Note their pricing, peak customer flow times, and whether they offer drive-thru service.

>>Indirect competitors: Local independent specialty coffee shops. Their strengths lie in unique styles and loyal customer bases—consider how to differentiate your offering.

3. Expert Analysis: If more than five strong chain coffee brands already exist within a 3-kilometer radius and customer traffic is saturated, this area may be a "red ocean" requiring extreme caution. Conversely, if there's a large population of high-income young professionals but only one or two mediocre coffee shops, this could be a "blue ocean" waiting for you to develop.

Regulatory Compliance: Opening a store requires interaction with various government agencies.

1. Special Permits: Beyond standard business licenses, the food service industry requires food safety permits, fire safety certifications, etc. If your location requires major renovations, building permits may also be needed.

2. Foreign Investment Restrictions: If you are not a U.S. citizen, understand relevant investment visas and foreign ownership policies.

3. Action Recommendations: Before finalizing your location, consult a local business advisor or attorney to create a detailed "permit application checklist" and estimate required time and costs.

2-2. Demand Quantification Forecast: How many "fish" are actually in your "pond"?

Potential Customer Base Sizing: We can scientifically forecast your potential customer numbers using publicly available data.

1. Demographic Data: Visit your local government or statistics department website to access population data for your target area, focusing on individuals aged 18-45 with mid-to-high income levels. This demographic constitutes the core coffee-consuming population.

2. Consumption Habit Data:

>>Tool Application: Utilize databases like Statista (https://www.statista.com/) to find data on coffee consumption frequency and online delivery penetration rates in your region.

>>Trend Validation: Use Google Trends (https://trends.google.com/). Enter "PJ's Coffee" or "Cold Brew" to gauge search volume in your target city. Sustained upward trends indicate growing market awareness and interest.

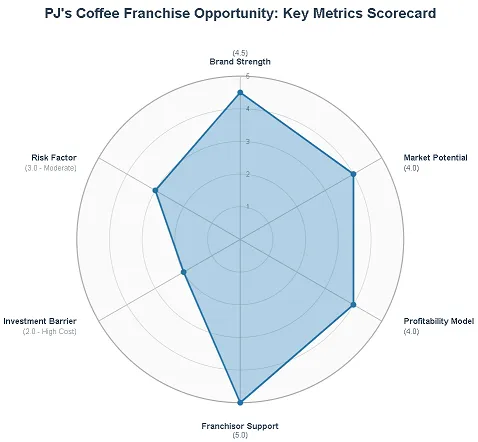

Output: Market Potential Scorecard (Example)

Target Area Population Density: ★★★★☆

Target Audience Income Level: ★★★★★

Competition Saturation: ★★★☆☆ (Moderate)

Google Trends Heat: ★★★★☆

Overall Score: 4.0/5.0 - Recommended for Store Opening

You can create a similar scorecard for your city and list several alternative areas for comparison.

III. Operational Fit Analysis: Do You Have Enough "Ammo" to Win This Battle?

Alright, we've confirmed PJ's Coffee is a solid brand with a promising target market. Now comes the most practical question: execution. Here, we'll crunch the numbers to see if your capital, capabilities, and headquarters support align perfectly—ensuring the project launches smoothly and remains profitable long-term.

3-1. Return on Investment Projection: How Much Capital Do You Need? When Will You Break Even?

This is every investor's top concern. We must account for every penny.

Initial Investment Costs (CapEx): Based on PJ's Coffee's FDD documents and industry data, we'll build a detailed cost model. Note: This is an estimate only; actual figures will vary significantly by location and store size.

| Cost Item | Compact Model (No Drive-Thru) | Standard (Drive-Thru) | Notes |

|---|---|---|---|

| Initial Franchise Fee | $35,000 | $35,000 | One-time fee |

| Store Renovation | $150,000 – $300,000 | $250,000 – $500,000 | Varies significantly based on design standards and labor costs |

| Equipment & Furniture | $80,000 – $120,000 | $100,000 – $150,000 | Coffee machines, ice makers, tables/chairs, etc. |

| Initial Inventory | $10,000 – $15,000 | $15,000 – $20,000 | Coffee beans, milk, syrups, cups, etc. |

| Security Deposits & Licenses | $20,000 – $40,000 | $25,000 – $50,000 | Rental deposits, legal fees, and various permit application fees |

| Grand Opening Marketing | $10,000 | $15,000 | For local promotion during initial launch |

| Contingency Fund (3-6 months) | $50,000 – $80,000 | $80,000 – $120,000 | Critically important! Covers early operational losses |

| Total Estimated Cost | $355,000 – $600,000 | $520,000 – $890,000 |

Data Sources: Brand's Public Disclosure Document (FDD) + Quotes from Your Local Renovation and Equipment Suppliers + Local Rent and Labor Costs via Numbeo.

Monthly Operating Costs (OpEx):

Rent: Varies significantly by location, estimated at $5,000 - $15,000/month.

Labor Costs: 5-8 employees, estimated at $15,000 - $25,000/month.

Raw Material Costs: Approximately 30%-35% of sales revenue.

Ongoing Fees: 7% of sales (5% royalty + 2% marketing fee).

Other (Utilities, Internet, Insurance, etc.): $2,000 - $4,000/month.

Payback Period Sensitivity Analysis: The payback period is not a fixed number; it depends on your sales volume and profit margin.

Scenario 1 (Optimistic): If your store location is exceptional and rapidly achieves $1,000,000 in annual sales, assuming a net profit margin of 15%,the theoretical payback period for a $600,000 investment is 4 years.

Scenario 2 (Moderate): With annual sales of $700,000 and annual profit of $105,000, the payback period is approximately 5.7 years.

Scenario 3 (Pessimistic): If operations are poor, annual sales may only reach $500,000, potentially resulting in prolonged break-even or even losses.

Stop guessing based on gut feelings! These complex calculations are precisely why we developed the [ROI Calculator]. Open it now, input your estimated investment amount and monthly sales, and our tool will generate a dynamic, visual ROI analysis chart for you. This is your most powerful decision-making assistant!

3-2. Headquarters Support Assessment: Can You Count on Your "Allies"?

When you're fighting alone, headquarters support is your strongest backup.

Key Support Metrics Evaluation:

1. Emergency Response Time: How quickly can you get technical support from headquarters when your coffee machine breaks down during rush hour or your POS system crashes? Industry best practice is <4 hours response time. When communicating with headquarters, explicitly ask about their SLA (Service Level Agreement).

2. New Product Development Frequency: The coffee market evolves rapidly, and consumers constantly crave novelty. A vibrant brand must innovate. At least two seasonal specialty drinks or core product updates per year is the baseline for maintaining brand freshness. PJ's Coffee excels here, renowned for its seasonal beverages.

3. Local Marketing Fund: The 2% marketing fee collected by headquarters primarily funds national advertising. More crucially, how much of this is returned to your local market? A strong brand allows franchisees to allocate a portion (ideally >15% of the marketing budget) toward targeted local initiatives like sponsoring community events or partnering with local influencers.

"Unsure if you have what it takes to manage a store and handle unexpected situations? That's normal. Our [Entrepreneur Assessment] tool uses a series of psychological and experience evaluations to help you understand your strengths and weaknesses—and see if you're naturally cut out to be a boss."

IV. Risk Control Matrix: How to Manage Risk Like a Professional Investor?

Investing is fundamentally a game of risk versus reward. An amateur player focuses solely on returns, while a professional investor dedicates 80% of their effort to researching and controlling risks. Let's establish a dynamic risk warning system to ensure your investment vessel navigates safely past hidden reefs.

We categorize risks into three tiers with corresponding response strategies:

4-1. High-Risk Items (Red Alert - Immediate Rejection): If any of the following apply, I strongly advise you to halt negotiations and abandon the project immediately.

Brand's average store closure rate over the past 2 years > 15%:

Why is this a red line? This data can be found in Item 20 of the FDD. A persistently high closure rate indicates systemic, fundamental issues with the brand's business model, support system, or market competitiveness. Franchisees are voting with their hard-earned money, signaling this project is "unviable."

Contract contains exclusive clauses mandating high-priced, non-core ingredient purchases:

Why is this a red flag? Requiring procurement of core ingredients (like coffee beans) to ensure quality consistency is reasonable. However, if the contract forces you to purchase generic items (such as cups, napkins, or even cleaning supplies) exclusively from headquarters or its designated suppliers at prices significantly above market rates, this is a trap. It severely erodes your profit margins, turning you into headquarters' "employee."

The brand faces major legal litigation or negative publicity:

Why is this a red line? Lawsuits involving food safety, franchisee fraud, or similar issues can devastate brand reputation, directly impacting your customer traffic.

4-2. Medium-Risk Items (Yellow Alert - Negotiate for Modification): While not fatal, these issues severely impact profitability and long-term growth. Use them as key bargaining chips.

Regional protection radius < 1 kilometer:

Why yellow? Regional protection clauses prevent headquarters from opening competing stores nearby. In urban areas, a 1-kilometer radius is the minimum requirement. A smaller radius risks customer diversion to new stores. Insist on expanding this protection zone.

Outdated Headquarters Digital Systems:

Why is this a yellow line? By this year, brands lacking efficient POS systems, online membership management, or even AI-driven inventory recommendations will operate with severely reduced efficiency. For example, a robust system can suggest tomorrow's cold brew coffee inventory based on weather and historical data, minimizing waste and boosting profits. If systems are outdated, assess whether you can compensate using third-party tools.

Harsh Franchise Renewal Terms:

Why the yellow flag? For instance, requiring you to spend heavily on renovations to meet the latest standards upon renewal, or granting headquarters sole discretion over renewal decisions. This creates significant uncertainty for your long-term operations.

4-3. Low-Risk Items (Blue Alert - Acceptable, Prepare Contingencies): These are normal challenges most businesses face. With preparation, they pose little threat.

Significant Seasonal Fluctuations:

Countermeasure: Coffee sales peak distinctly in winter and summer, with spring and autumn being relatively quieter. Your financial planning should include at least three months of operational reserves to smoothly navigate off-peak seasons.

Requires Additional General Business Permit Applications:

Countermeasure: For instance, if your store wishes to place outdoor tables, you must apply for an "Outdoor Business Permit." These are standard operational procedures. Simply allocate sufficient time for applications in your opening timeline.

V. Deliverables: Your Personalized "Battle Map"

After in-depth analysis across the four dimensions above, we will deliver a highly customized "Battle Map" that directly guides your actions. This is the core distinction between our website and other information providers.

5-1. One-Page Decision Report

We condense all complex analysis into a single visual. This chart becomes your go-to decision-making reference.

5-2. Competitor Comparison Table

Know your enemy and yourself, and you will never be defeated.

Use our Opportunity Comparison Tool to compare other brands with PJ's Coffee.

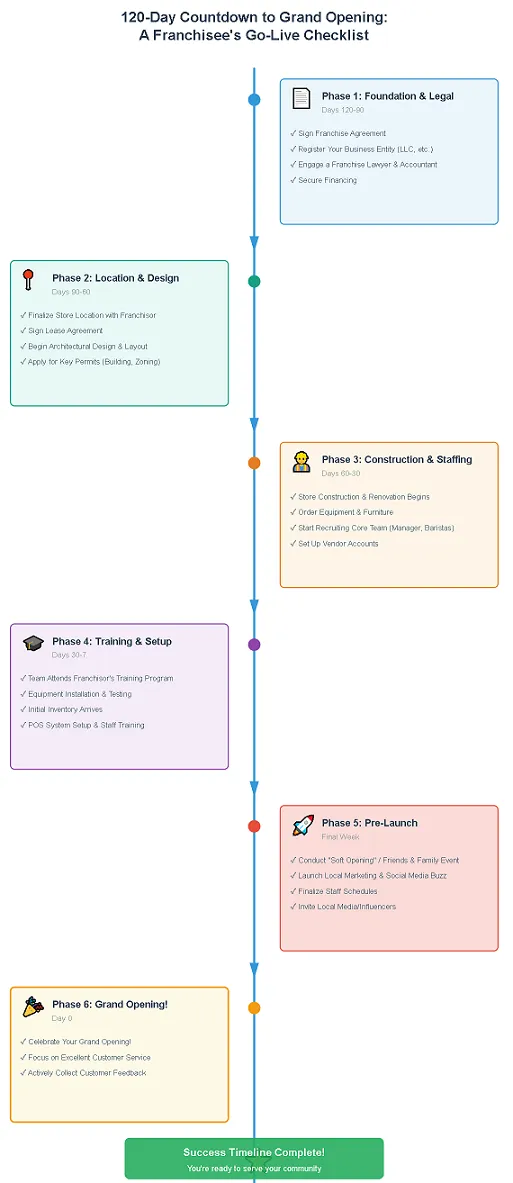

5-3. Localization Execution Checklist: 120-Day Go-Live Countdown

From signing the contract to opening day, there are countless details to manage. We've mapped out a clear roadmap for you.

CTA - Ultimate Call to Action: "You've completed the entire journey from analysis to planning. Now it's time to distill all this into a professional document that will impress banks and investors. Don't hesitate—use our powerful [Business Plan Generator] immediately. It will guide you to seamlessly integrate all your analytical findings into a well-structured, logically coherent business plan. Your entrepreneurial dream officially takes flight from here!"

VI. Key Insights and Future Trends

Beyond specific franchise analysis, a successful investor must also possess a broader perspective.

Market Characteristics Analysis: The current coffee market exhibits a "polarized" trend. On one end are giants like Starbucks offering standardized, convenient experiences; on the other are specialty coffee shops emphasizing individuality, quality, and immersive experiences. PJ's Coffee skillfully occupies the middle ground: it combines the stability and scale of a chain brand while preserving its unique "New Orleans flair."

Typical Opportunity Case: A PJ's Coffee location in a suburban area with ample parking and a drive-thru lane would be highly competitive. It can serve both commuters and residents, maximizing customer traffic capture.

Key Success Factors: In summary, successfully operating a PJ's Coffee hinges on three pillars: 1. Prime location (especially with drive-thru capability); 2. Exceptional store management (ensuring service quality and cost control); 3. Targeted local community marketing.

Industry Trend Insights:

1. Automation & Self-Service: Prioritize technologies like self-service kiosks and mobile ordering apps to reduce labor costs and boost operational efficiency.

2. Sustainability:

Growing consumer interest in fair-trade coffee sourcing and eco-friendly packaging. Highlighting PJ's Coffee's efforts in these areas can boost goodwill.

3. Ghost Kitchen Model:

If your area has high delivery demand, explore setting up a ghost kitchen with headquarters—a dedicated takeout-only kitchen with minimal overhead to expand service coverage.

Frequently Asked Questions (FAQ)

Q1: Can I really join PJ's Coffee without any food service experience?

A: Absolutely. This is precisely the greatest strength of a mature franchise system like PJ's Coffee. They provide a turnkey solution covering everything from site selection and design to training, operations, and marketing. Headquarters' comprehensive training will equip you with all necessary skills. However, you must ask yourself: Do you possess the passion to learn, the ability to manage a team, and the resilience to handle unexpected situations? We recommend using our Entrepreneur Assessment tool for self-evaluation.

Q2: Is the Average Unit Volume (AUV) of $1,084,037 mentioned in the FDD guaranteed for my location?

A: Absolutely not! AUV is an average based on historical data, encompassing both exceptionally performing and average-performing locations. Your actual sales will be influenced by countless factors including site selection, team management, local competition, and market conditions. Using AUV as a reference target is reasonable, but it must never be viewed as a promise.

Q3: What are the advantages and disadvantages of franchising with PJ's Coffee compared to opening an independent specialty coffee shop?

A:Pros: You gain access to an established brand, proven products, a robust supply chain, and operational support, significantly reducing the risk of failure. You don't have to reinvent the menu or management processes.

Cons: You lose some autonomy. You must adhere to headquarters' rules, use specified ingredients, and pay ongoing royalties. Your "creative space" is relatively limited. It's a trade-off of ‘freedom' for "stability."

Q4: With such a large investment, what if it fails?

A: This is the most critical and practical concern. First, using the analytical framework in this report, you can maximize risk identification and mitigation before investing. Second, your financial plan must include sufficient contingency funds (at least 6 months of operating costs) as your safety net. Finally, prepare for the worst-case scenario by understanding the franchise agreement's terms regarding early exit and resale. Remember, no investment guarantees 100% success.

Q5: How should I prepare for the interview with PJ's Coffee headquarters?

A: Headquarters evaluates not only your financial capacity but also your character. You need to:

1. Demonstrate thorough research: Thoroughly study this report and gain a basic understanding of the FDD.

2. Show your passion: Express your alignment with PJ's Coffee's brand culture.

3. Demonstrate business acumen: Prepare a preliminary business plan generated by our [Business Plan Generator], showcasing your analysis and insights into the local market. This will help you stand out among applicants.

My Perspective and Final Recommendation

Having shared all this, I want to offer my personal view on this project in the clearest terms.

In my opinion, PJ's Coffee is a classic "high-investment, medium-to-high-return, medium-risk" franchise opportunity. It's not a "get-rich-quick" opportunity, but rather a "quality asset" requiring careful cultivation and long-term commitment. Its brand heritage, product distinctiveness, and robust support system lay a solid foundation for success. Notably, its impressive AUV figures and emphasis on the "drive-thru" model demonstrate the enduring vitality of its business model.

However, success is far from guaranteed. An initial investment exceeding $500,000 is no small sum for any individual or household. This means you have limited room for trial and error. Your decision must be grounded in rigorous data analysis and deep insights into the local market. You cannot merely be a "coffee enthusiast"; you must become a savvy "businessperson"—concerned with rent-to-sales ratios, square footage efficiency, every penny of labor costs, and every conversion in marketing.

This is precisely why our website exists. We don't aim to give you a simple "yes" or ‘no' answer. What we offer is a complete set of "fishing gear"—analytical frameworks, calculation tools, and action checklists. We believe that, empowered by these tools, you are fully capable of making the wisest decisions for yourself.

Action Recommendations:

1. Review the "Risk Control Matrix" in this article once more to ensure you have a clear understanding of potential risks.

2. Immediately utilize our website's [ROI Calculator] and [Opportunity Comparison Tool] to transform abstract data into tangible figures relevant to your situation.

3. Armed with your preliminary analysis, schedule consultations with a professional franchise attorney and accountant to have them review your findings.

Risk Warning and Disclaimer

Important Notice: All content herein is for educational and business analysis purposes based on publicly available information and does not constitute investment advice or an offer. Franchise investments involve significant financial risks; past performance does not guarantee future returns. For all specific data, terms, and conditions related to PJ's Coffee franchising, refer exclusively to the latest Franchise Disclosure Document (FDD) provided by the brand. Before making any investment decision, we strongly recommend consulting independent legal, financial, and business advisors.

Citation Sources

Vetted Biz. (2024). PJ's Coffee Franchise Cost and Profit. (Note: This link provides an analysis of FDD Item 19 and is one of the authoritative third-party sources for obtaining financial data such as AUV)

Numbeo. Cost of Living Database. (Authoritative database for estimating living and business costs across regions)

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.