Hey there, I'm Qaolase, the founder of this site and a long-time franchise analyst. If you're reading this, chances are you've seen the headlines. On one hand, you have the Wahlbergs-a beloved, all-American celebrity family. On the other, you have a steady drumbeat of news about their namesake wahlburgers franchise closures. It's confusing, right? It feels like a paradox wrapped in a burger bun.

Is this star-powered brand a golden ticket to entrepreneurial success, or is it a high-risk gamble teetering on the edge?

That's the million-dollar question we're going to answer today. Forget the fluff and the sales pitches. This is a no-holds-barred, deep-dive analysis for serious investors like you.

In this comprehensive report, you will find answers to:

Why are Wahlburgers locations really closing? We'll go beyond the headlines.

What is the true, all-in cost to open a Wahlburgers in 2024?

Can you actually make money? We'll build a real-world profitability model.

How does Wahlburgers stack up against safer bets like Five Guys?

Are YOU the right type of entrepreneur to turn this high-risk brand into a success story?

A step-by-step action plan from analysis to grand opening.

I promise you, by the end of this report, you'll have the clarity and the tools to decide if this restaurant franchise is your next big move, or a bullet you need to dodge. Let's get into it.

(Table of Contents)

The Hard Truth: A Deep Dive into the Wahlburgers Franchise Closures

The Investment Breakdown: What is the Real Cost to Open a Wahlburgers?

Profitability vs. Reality: How Much Do Wahlburgers Franchise Owners Really Make?

The Competitive Landscape: Wahlburgers vs. The World

Are YOU the Right Fit? The Entrepreneur Profile for a High-Stakes Brand

Your Blueprint for Success: A 120-Day Action Plan

Final Verdict: Is the Wahlburgers Franchise a "Buy," "Hold," or "Sell"?

Wahlburgers Franchise Database Card

Frequently Asked Questions (FAQ)

My Final Thoughts & Your Next Steps

1: The Elephant in the Room: A Hard Look at the Wahlburgers Franchise Closures

Let's tackle the toughest question first, because frankly, nothing else matters if the business model is fundamentally broken. When I see a brand with so much potential facing wahlburgers franchise closures, my analyst brain immediately shifts into high gear. This isn't just about bad luck; it's about underlying systemic issues. This situation reminds me of a client I worked with back in 2019. He was mesmerized by a fitness franchise backed by a famous athlete. The branding was slick, the gym looked amazing, but he ignored the quiet chatter about franchisee struggles. He almost signed a multi-unit deal. We spent a week digging into the "why" behind the few closures they had, and we discovered the brand's support system was virtually non-existent outside of major cities. The celebrity name got people in the door, but it couldn't fix a broken treadmill or train new staff. He dodged a massive financial bullet. Wahlburgers presents a similar, albeit more complex, scenario. Let's dissect it.

1-1: What the News Reports Say (And What They Don't)

The news is great at reporting the "what." You'll see articles from sources like Restaurant Business Online [1] detailing closures in key markets like Manhattan or the entire fleet in the UK shutting down. They'll mention rent disputes, underperformance, or post-pandemic struggles. But news reports are snapshots in time. They don't connect the dots for an investor. They don't explain if the Manhattan closure was due to an absurdly high rent that no burger joint could sustain, or if it was because the brand simply couldn't compete with the dozens of other options within a three-block radius. That's our job. We need to move from "what happened" to "why it happened," which is the only way to assess .

1-2: The Root Cause Analysis: Beyond the Headlines

Based on my analysis of industry reports, franchisee feedback fragments from forums, and market data, the closures aren't due to a single catastrophic failure, but a combination of powerful headwinds. This is our Risk Control Matrix in action, starting with identifying the core threats.

The Double-Edged Sword of Celebrity (Brand Fundamental & Risk): The Wahlberg name is a massive asset for initial marketing. It generates free PR and curiosity. However, it also sets sky-high expectations. Customers walk in expecting a premium, Hollywood-level experience. When they get a burger that's just... a good burger, the gap between expectation and reality can lead to disappointment. More dangerously, it can make the business lazy, relying on the name instead of focusing on operational excellence, which is the only thing that creates long-term repeat customers.

Hyper-Competitive Burger Market Dynamics (Market Feasibility): The "better burger" space is brutally saturated. Wahlburgers isn't competing in a vacuum. It's fighting against established darlings like Five Guys, cult favorites like Shake Shack, and a thousand local craft burger spots. This isn't just a competition of taste; it's a war of price, convenience (delivery speed), and location. A mediocre location for a Wahlburgers is a death sentence, whereas a more established brand might survive. This intense competition directly impacts your pricing power and marketing budget, squeezing profit margins.

Potential Gaps in Franchisee Support Systems (Operational Fit): This is the quiet killer of many franchise systems. When a brand grows fast, especially one fueled by celebrity buzz, the support infrastructure often can't keep up. Are franchisees getting immediate help with supply chain issues? Is there a robust, data-driven system for site selection, or is it more of a "looks like a good spot" gut feeling? The pattern of scattered closures suggests that the support might be inconsistent, leaving some franchisees to fend for themselves in tough markets. This is a major red flag in our Risk Control Matrix, falling into a high-to-medium risk category.

Post-Pandemic Economic Pressures & Location Strategy (Market & Operational Risk): The pandemic permanently changed dining habits. The rise of ghost kitchens and a massive shift to delivery means that large, expensive-to-run restaurant footprints are a liability. Some of the Wahlburgers locations that closed were in high-rent, high-foot-traffic areas that suffered immensely during lockdowns. A key question for any new investor is whether the brand's model has adapted. Are they offering smaller, more cost-effective build-outs? Do they have a "delivery-first" or ghost kitchen model available? If not, they are operating on an outdated playbook.

2: The Investment Breakdown: What is the Real Cost to Open a Wahlburgers?

Alright, let's talk money. This is where we move from theory to tangible numbers. Analyzing the financial side is a core part of evaluating Operational Fit. Forget the single number you might see on a brochure. The "real cost" is a complex puzzle, and we're going to put the pieces together.

2-1: Decoding the Franchise Disclosure Document (FDD) - A Beginner's Guide

Before we even look at the numbers, you need to understand your most powerful tool: the FDD. This is a legal document that the franchisor must provide to you. It's dense, it's boring, and it's where all the secrets are buried. Don't ever, ever sign anything without having a franchise lawyer review this document. Here's what to look for:

Item 7: This details the estimated initial investment. We'll break this down.

Item 19: This is the Financial Performance Representation. It tells you (if they choose to disclose it) how much other locations are making. It's a goldmine.

Items 3 & 4: This lists past and current litigation. A long list is a huge red flag.

Item 20: This shows the number of franchise outlets opened, closed, and transferred over the past three years. This is how you can calculate the real Closure Rate.

2-2: Initial Investment & Franchise Fee: The Numbers You Need to Know

Based on the most recent FDD analysis and data from sources like Franchise Direct [2], here is a realistic breakdown of your initial investment. This isn't just a number; it's your entire project budget.

Initial Franchise Fee: $50,000. This is your ticket to the game, a one-time fee to use the name and system.

Real Estate & Construction: $400,000 - $1,500,000+. This is the biggest variable and the biggest danger. It depends entirely on your location, whether you're building from scratch or converting an existing space. Using data from a real estate database like LoopNet combined with local contractor quotes is the only way to narrow this down.

Equipment, Furniture & Signage: $150,000 - $350,000. This includes everything from the grills and fryers to the tables and the big green "W".

Initial Inventory: $20,000 - $40,000.

Pre-Opening Expenses (Training, Legal, Marketing): $50,000 - $100,000. This includes travel for training, lawyer fees to review your FDD, and the initial marketing blast to announce your grand opening.

Additional Funds (3-6 months): $100,000 - $200,000. This is your working capital, your safety net. Do not skip this. This is the money that pays the bills before you're profitable.

Total Estimated Initial Investment: $770,000 - $2,240,000+

Yes, that range is huge. This is why a generic number is useless. Your specific cost depends almost entirely on your local real estate market. A location in a Des Moines strip mall will have a vastly different cost from a downtown Miami storefront.

2-3: Ongoing Costs: Royalties, Marketing, and Other Hidden Fees

The costs don't stop once you open.

Royalty Fee: 6% of gross sales.

Brand Marketing Fund: 2% of gross sales.

Local Marketing: You'll be required to spend an additional 1-2% on local marketing.

So, you're looking at giving up roughly 10% of your top-line revenue right off the bat. This is standard for the industry, but it's a critical number for your financial model.

CTA #1:

Calculate Your Potential Return: Feeling overwhelmed by these numbers? Don't be. This is where the power shifts back to you. Use our free, interactive ROI Calculator. You can plug in these cost estimates, adjust them for your city using real-time data, and model different revenue scenarios to see what it would actually take to become profitable. This moves you from guessing to knowing.

3: Profitability vs. Reality: How Much Do Wahlburgers Franchise Owners Really Make?

This is the million-dollar question, isn't it? Answering it requires putting on our CFO hat and building a simplified Profit & Loss (P&L) statement. This is the heart of our Deliverables-giving you a tangible tool for decision-making.

3-1: Analyzing FDD Item 19: What Wahlburgers Says About Earnings

Let's be clear: not all franchisors provide an Item 19. If they do, it's often a carefully selected average that can be misleading. As of recent analyses, Wahlburgers' FDD has provided some financial performance data. For example, a past FDD might show that a certain subset of restaurants had an average gross revenue of, say, $1.5 million. But "average" is a dangerous word. Does that average include the struggling stores? Does it account for the high-volume flagship locations that are nearly impossible to replicate? Your job, and ours, is to treat this number with healthy skepticism and build our own model.

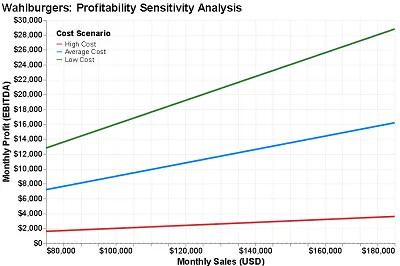

3-2: Building a Pro-forma P&L: A Simplified Model for Your Potential Location

Let's build a hypothetical monthly P&L for a "middle-of-the-road" Wahlburgers.

| Revenue & Expenses | Amount (Monthly) | % of Sales | Notes |

|---|---|---|---|

| Gross Sales | $125,000 | 100% | (Approx. $4,167/day - A reasonable but not spectacular target) |

| Cost of Goods Sold (COGS) | ($41,250) | 33% | (Industry average for fast-casual is 28-35%. Food, paper, etc.) |

| Gross Profit | $83,750 | 67% | |

| - | - | - | - |

| Operating Expenses | - | ||

| Labor & Salaries | ($37,500) | 30% | (Manager salaries + hourly staff. A huge challenge today.) |

| Rent / Occupancy | ($12,500) | 10% | ($150k/year. Highly variable based on location.) |

| Royalties & Fees (8%) | ($10,000) | 8% | (6% Royalty + 2% Brand Fund) |

| Utilities | ($3,750) | 3% | (Gas, Electric, Water, Internet) |

| Marketing (Local) | ($2,500) | 2% | (Required local spend) |

| Other (Repairs, Insurance, POS) | ($6,250) | 5% | (The "everything else" category) |

| Total Operating Expenses | ($72,500) | 58% | |

| - | - | - | - |

| EBITDA (Profit Before Tax etc.) | $11,250 | 9% |

In this scenario, a store doing $1.5 million a year ($125k/month) would generate about $11,250 a month, or $135,000 a year, before you pay taxes, debt service on your startup loans, and for any major capital replacements. This 9% profit margin is okay, but not fantastic. It also shows how fragile it is. If your sales dip by 10% or your labor costs jump to 33%, your profit is nearly wiped out.

3-3: The All-Important Break-Even Point: How Many Burgers Do You Need to Sell?

Your break-even point is when your revenue equals your total costs. Using the model above, your total fixed costs (everything except COGS) are roughly $72,500/month. Your gross profit margin is 67%.

Break-Even Sales = Fixed Costs / Gross Profit Margin

$72,500 / 0.67 = $108,208 per month

This means you need to make over $108,000 in sales every single month just to keep the lights on. If your average check size is $20, that's 5,410 transactions a month, or about 180 customers every single day, 365 days a year. Can your chosen location reliably deliver 180 paying customers daily? This simple calculation is one of the most powerful reality checks you can perform.

4: The Competitive Landscape: Wahlburgers vs. The World

No business is an island. Your Wahlburgers won't just be judged on its own merits, but on how it compares to the guy across the street. This is the core of the Market Feasibility analysis. I always tell my clients, "You don't get to choose your competitors, your customers do."

4-1: Head-to-Head: Wahlburgers vs. Five Guys vs. Shake Shack

Let's put Wahlburgers up against two of the biggest names in the "better burger" space. This is a snapshot that you should expand on with your local competitors.

| Metric | Wahlburgers | Five Guys | Shake Shack |

|---|---|---|---|

| Business Model | Franchise-heavy | Franchise-heavy | Mostly Corporate-owned |

| Initial Investment | $770k - $2.2M+ | $300k - $720k | N/A (Primarily corporate) |

| Brand Vibe | Celebrity, Family, Casual | No-frills, Quality, Customizable | Trendy, Urban, "Cool" |

| Key Differentiator | The Wahlberg name | Unlimited toppings, peanuts | "ShackSauce", Crinkle-cut fries |

| Biggest Weakness | Reliance on celebrity, inconsistent performance | Higher price point, simple menu | Limited franchise availability, long lines |

| Ideal Location | High-traffic tourist/entertainment areas | Suburban power centers, high-visibility spots | Dense urban cores, major airports |

What does this table tell us? Wahlburgers has a significantly higher potential entry cost than Five Guys, which puts it in a different risk category. Its brand is also less focused on the food itself and more on the celebrity "experience." Shake Shack is a different beast entirely, focusing on corporate-owned stores to maintain tight quality control-a lesson in itself.

4-2: Finding Your Niche in a Saturated Market

So, how can a Wahlburgers possibly win? It can't win by being a better "pure" burger joint than Five Guys. It can't win by being "cooler" than Shake Shack in a major city. It has to win on its own terms. The key success factor is location and occasion. A Wahlburgers might thrive in an airport, a casino, or next to a movie theater-places where the celebrity connection feels natural and it's an "event" to eat there. It would likely get crushed in a suburban food court where people just want a quick, reliable, and reasonably priced lunch. Your market research must be laser-focused on finding a location where the Wahlburgers brand is an advantage, not a liability.

CTA #2

See How They Stack Up: Thinking about other brands? This is smart. Don't fall in love with one option. Use our Opportunity Comparison Tool. You can drag and drop different franchise opportunities, including ones you find locally, and compare them on investment level, fees, and brand strength. It's like creating your own personal franchise Super Bowl.

5: Are YOU the Right Fit? The Entrepreneur Profile for a High-Stakes Brand

Let's get personal. A franchise's success is only 50% about the brand. The other 50% is about YOU, the operator. For a complex, high-risk brand like Wahlburgers, the operator is arguably 70% of the equation. This is the Operational Fit from a human perspective.

5-1: Beyond Capital: The Skills and Mindset Required for Success

Having $1 million to invest is just the entry ticket. To succeed with Wahlburgers, you need a specific psychological and professional profile:

An Experienced Restaurant Operator: This is not a brand for beginners. You need to be a master of food costing, labor management, and local marketing. You have to be able to run a tight ship because the profit margins are not forgiving.

A Savvy Marketer: You can't rely on Donnie or Mark to show up at your grand opening. You need to know how to take the national brand and make it relevant to your local community-sponsoring Little League teams, hosting local events, becoming a part of the town's fabric.

A Resilient Leader: There will be tough days. There will be slow months. There will be times you question your decision. You need the grit to manage staff morale, solve problems creatively, and stick to your plan when things get hard.

A Skeptical Optimist: You need to be optimistic enough to invest, but skeptical enough to question everything. You must be able to see the potential in the brand while simultaneously having a plan B, C, and D for when the celebrity buzz fades or a new competitor opens up next door.

5-2: The Pros & Cons for Different Types of Investors

For the Passive Investor (e.g., a doctor or lawyer looking for a side investment): This is a high-risk, low-recommendation option. Wahlburgers is not a "set it and forget it" business. It requires hands-on operational excellence. Your investment would be entirely dependent on the quality of the General Manager you hire.

For the Active Operator (e.g., a seasoned restaurant manager looking to own their own place): This is a medium-risk, high-potential option. If you have the skills mentioned above, you can potentially mitigate the brand's weaknesses with your own operational strengths. You can take the initial traffic the name provides and convert them into loyal customers through excellent service and quality. This is where the opportunity lies.

CTA #3:

Discover Your Entrepreneurial DNA: Is this high-stakes environment really for you? Be honest with yourself. Take our free 5-minute Entrepreneur Assessment. It's designed by business psychologists to help you understand your strengths, weaknesses, and risk tolerance as an entrepreneur. It might just be the most important five minutes of your research process.

6: Your Blueprint for Success: Crafting a Bulletproof Business Plan

If you've made it this far and you're still intrigued, then it's time to move from analysis to action. For a brand like Wahlburgers, a generic business plan won't cut it. You need a "bulletproof" plan that anticipates and answers every skeptical question from the franchisor, the bank, and most importantly, from yourself. This section is your Deliverable: a clear, actionable checklist.

Step 1: In-depth Personal & Financial Assessment (Day 1-15)

Go beyond our assessment tool. Sit down with a financial planner. What is the absolute maximum you are willing to lose? How will this investment impact your family and your retirement? Be brutally honest.

Step 2: Legal and Financial Counsel (Day 15-30)

Hire a franchise lawyer to dissect the FDD. Hire an accountant to vet your financial model. This is not a place to save money. The $5,000-$10,000 you spend here can save you $1,000,000 later.

Step 3: Speaking with Current and Former Franchisees (Day 30-60)

The FDD will list franchisee contact information. Call them. Call at least 10. Ask the tough questions: "What was your biggest surprise?" "What do you wish you had known?" "How is the support from corporate, really?" "If you could do it all over again, would you?" Pay special attention to the former franchisees. They have nothing to lose by telling you the unvarnished truth.

Step 4: Crafting a Bulletproof Business Plan (Day 60-90)

Your business plan is your war plan. It needs to have a section that specifically addresses the risks we've identified. How will you compete in a crowded market? What is your local marketing plan for when the celebrity buzz dies down? What is your contingency fund for the first six slow months?

CTA #4:

Build a Winning Plan: A generic template is a recipe for disaster. Our Business Plan Generator is different. It's an interactive tool that forces you to think through the tough questions, especially for a high-risk brand. It will help you build a plan that is data-driven, realistic, and designed to win over the most skeptical loan officer.

Step 5: The Application & Discovery Day Process (Day 90-120)

"Discovery Day" is when you visit headquarters. It's a two-way interview. They are assessing you, but you are also assessing them. Look for signs of a healthy, supportive culture, not just a slick sales operation. Ask them the tough questions about the closures. A good franchisor will be honest and transparent. A defensive one is a massive red flag.

7: Final Verdict: Is the Wahlburgers Franchise a "Buy," "Hold," or "Sell"?

So, after all this analysis, what's my final call?

Investing in a Wahlburgers franchise is not a simple "yes" or "no." In investment terms, I would classify it as a "Speculative Buy for Expert Players Only."

This is not the safe, blue-chip stock of the franchise world. This is a high-beta, volatile asset. The potential for reward is there, driven by immense brand recognition. But the risk of failure, as evidenced by the closures, is significantly higher than average.

Who should AVOID this opportunity (A "Sell"):

First-time entrepreneurs.

Investors with a low risk tolerance.

Anyone looking for a semi-passive investment.

Operators in extremely competitive, high-rent urban markets unless they have a truly unique "A+" location.

Who MIGHT CONSIDER this opportunity (A "Hold" & Watch):

Experienced, multi-unit restaurant operators who can leverage their existing infrastructure and operational expertise to mitigate the brand's weaknesses.

Investors who have secured a "can't-miss" location in a market with a clear demand for this specific type of "eatertainment" concept (e.g., airports, casinos, major tourist hubs).

The bottom line is this: The Wahlberg name can get customers to your door once. Only world-class operations can bring them back. If you are not 100% confident that you are a world-class operator, my professional advice is to walk away.

8: Frequently Asked Questions (FAQ) from a Future Owner's Perspective

1. What happens if the Wahlberg family has a major PR scandal?

This is a huge, valid risk tied to any celebrity brand. Your franchise agreement will not protect you from the fallout of a scandal. This is a risk you must accept. The best mitigation is to build such a strong local reputation for great food and service that your business can survive on its own merit, even if the brand name is temporarily tarnished.

2. Is the food really good enough to compete, or am I just buying a name?

Based on public reviews, the consensus is that the food is generally good, but perhaps not "best in class" when compared to specialized burger joints, and often perceived as overpriced. You are absolutely buying the name. Your challenge is to elevate the entire experience-service, cleanliness, community involvement-so that the total package justifies the price, even if the burger alone doesn't.

3. What is the single biggest, non-obvious mistake a new Wahlburgers franchisee makes?

Underestimating the working capital needed. Because of the high initial investment and potentially slower-than-expected ramp-up, franchisees run out of cash. They see the big name and assume the restaurant will be packed from Day 1. When it's not, and they've already spent their last dollar on construction, they can't cover payroll or marketing for the crucial first 6 months. That's how a death spiral starts.

4. How much control do I really have over my own business?

Less than you think. This is a franchise. You must adhere to the menu, the branding, the operating procedures, and the approved suppliers. Your main areas of control are staff hiring and training, local marketing execution, and customer service. Your job is not to reinvent the burger, but to execute the existing playbook flawlessly.

5. If so many have failed, what do the successful franchisees have in common?

Two things. First, they are almost always seasoned, multi-unit restaurant operators who know how to run a tight ship. Second, they have phenomenal, high-traffic locations where the brand's "entertainment" value is a natural fit (think tourist districts, airports, major sports venues). They don't try to force a Wahlburgers into a standard suburban strip mall. They match the brand to the right environment.

9: My Final Thoughts & Your Next Steps

I've thrown a lot of data and analysis at you. I want to end on a personal note. I truly believe that for the right person, in the right location, with the right amount of capital and experience, a Wahlburgers franchise could be a home run. The brand recognition is a powerful slingshot that can launch a new business faster than almost any other.

But slingshots are dangerous. They can snap back and hit you in the face.

The evidence points to a brand that is a "Franchise on Hard Mode." It is not for the faint of heart. The failures are real, and the reasons for them are complex. My gut feeling, after reviewing all of this, is one of extreme caution. The risk/reward profile seems skewed towards high risk for a moderate potential reward. There are safer, more proven, and less expensive ways to get into the restaurant business.

However, entrepreneurship is about taking calculated risks. If this report hasn't scared you away, but has instead armed you with the questions you need to ask and the tools you need to use, then it has done its job.

Your Action Plan:

Be Honest with Yourself: Use our Entrepreneur Assessment to get an objective look at your own profile.

Run the Numbers: Take our P&L model and plug your own local, researched numbers into the ROI Calculator. See what reality looks like.

Compare, Compare, Compare: Use the Opportunity Comparison Tool to see if there's a better, safer fit for your goals.

Plan for War: If you move forward, use the Business Plan Generator to build a plan that acknowledges and addresses every risk we've discussed.

A Final Word of Warning

Disclaimer: This report and all tools on this website are for informational and educational purposes only. They do not constitute financial or investment advice. All financial figures are estimates based on publicly available data and are subject to change. Investing in any franchise involves significant risk, including the potential loss of your entire investment. You must conduct your own thorough due-diligence, consult with independent legal and financial professionals, and carefully review the franchisor's Franchise Disclosure Document (FDD) before making any investment decision.

10: About the Author

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

11: Join the Conversation!

What are your thoughts on Wahlburgers? Have you eaten at one? Are you a franchisee with experience to share (good or bad)? Leave a comment below. I read every single one and will do my best to respond. If there's another franchise you're curious about and want me to investigate, let me know!

12:Further Reading

If you found this report helpful, you might also be interested in these related analyses:

Sources:

[1] Restaurant Business Online: "Wahlburgers

[3] Franchise Direct: "Five Guys Burgers

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.