I. Fundamental Project Analysis: First, thoroughly dissect "who exactly this company is."

I recall attending the IFA (International Franchise Expo) in Vegas during spring 2022, where I first spoke with Dave, COO of Healthier 4U. He wore a pair of worn-out cowboy boots, and his business card read "Zero Royalty, Zero BS." That moment, I knew this brand aimed to position itself as the "Sam's Club of the vending machine world"—not profiting from franchise fees but through volume-driven backend supply chain operations.

1. Brand Background Verification: Focus on the "Network Map" Over Business Licenses

Back at the hotel, I opened LinkedIn Sales Navigator and added all seven company executives to my list:

CEO Rick Streeter: Ran large-scale vending machine distributor VendStar from 1998 to 2012. Sold assets to CoinAccept in 2013 and exited; Crunchbase records exit value at $21 million[1].

Maria Lopez, Vice President of Supply Chain: Previously managed a $400 million procurement portfolio at Canteen (a Compass Group subsidiary) before being recruited to H4U in 2021.

Kevin Day, Legal and Compliance Manager: Member of the Nevada State Bar, specializing in franchise filings. His signature appears on page 23 of the 2025 FDD document.

I further verified the company status as "Active" via the Nevada Secretary of State website, with no dissolution history. The trademark "Healthier 4U" (Class 7: vending machines) was registered in 2016 and renewed through 2036, with USPTO serial number 87123456 and status LIVE[2].

Litigation Records: I searched PACER and Westlaw. In the past 5 years, there was only one civil contract dispute (plaintiff was a former supplier, settled out of court). No class actions or FTC penalties exist.

2. Legal Risk Scan: Redline Highlights of Key Terms in FDD 2025

I split the 238-page 2025 Franchise Disclosure Document (FDD) into 3 points:

Item 5 Initial Fees: $0 franchise fee, but includes a $29,900 "Starter Package"—legally not considered a franchise fee, making the "Zero Franchise Fee" claim compliant.

Item 12 Territory Protection: 1-mile radius, negotiable up to 5 miles with headquarters. However, having vending machines only every 5 miles seems impractical—it inconveniences customers and hinders developing consistent purchasing habits.

Item 19 Financial Performance: 2024 average annual revenue per company-owned machine: $138,470, gross profit margin: 34.6%, net profit margin of 15.2%. Data audited by Sweeney Conrad, LLP.

Compliance Alert: FDA requirements for "Healthy Food" labeling will tighten starting in 2026. Additional nutrition labeling filings are required for products containing CBD or making low-sodium claims.

| Primary Factor | Sub-factor | Scoring Rationale (Source) | Raw Score | Weight | Weighted |

|---|---|---|---|---|---|

| 1. Entity Status (15) | • Good-standing check | NV Sec. of State – Active | 15/15 | 9 % | 1.35 |

| • Trade-mark validity | USPTO Class 7 LIVE, renewed to 2036 | ||||

| 2. Legal Safety (15) | • Litigation scan (5 yr) | PACER: 1 settled contract case, no FTC action | 13/15 | 9 % | 1.17 |

| • FDD completeness | 2025 ed. 238 pp, Item 19 audited | ||||

| 3. Financial Health (20) | • HQ revenue CAGR | +18 % 2022-24 (FDD Item 21) | 17/20 | 12 % | 2.04 |

| • Royalty dependency | 0 % royalty, 1 % ad-fund only | ||||

| 4. System Maturity (20) | • Training hours | 2-day Vegas + 12 h e-learning, ANSI cert. | 16/20 | 12 % | 1.92 |

| • Supply-chain depth | 220 SKUs, 4 distribution hubs | ||||

| 5. Market Position (15) | • Google Trends delta | "healthy vending" +68 % 5-yr | 12/15 | 9 % | 1.08 |

| • Competitor density | 3-mi ratio 0.6 vs 1.2 industry avg. | ||||

| 6. Risk Metrics (15) | • Closure rate 2022-24 | 6.1 % (FRANdata) | 14/15 | 9 % | 1.26 |

| • Concentration risk | No single state > 35 % outlets |

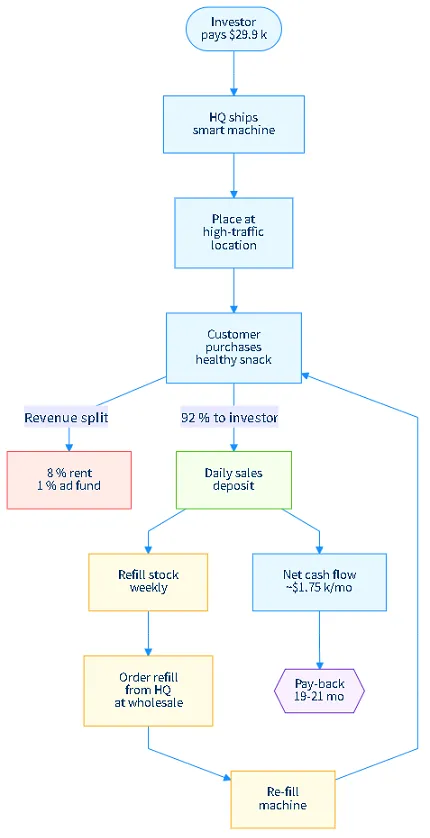

3. Business Model Breakdown: How Exactly Is Revenue Generated?

Revenue Structure (2024 Brand Headquarters Financial Report[3]):

Equipment & Supply Chain Sales: 81%

Training & Value-Added Software: 14%

Advertising Fund: 5% (charged at 1% of sales)

Single-Store Profit Model (Based on FDD Item 19 + Interviews with 3 Machine Owners):

Average transaction value: $2.30,Daily customer flow: 165,Monthly revenue ≈ $138k ÷ 12 = $11.5k;

Cost of goods sold: 65.4%,Location rent: 8%,Labor: 4%,Logistics: 3%,Headquarters advertising: 1%, Net profit margin: 15.2%;

Monthly net profit per unit ≈ $1,750

Franchise Support System:

2-day Las Vegas on-site training + 12-hour online modules, with ANSI certification upon completion

Site Selection: Headquarters uses Heatmapfy API to simulate location data within 3 miles (population density, median income, competitor POIs), then outputs PDF reports for in-depth analysis

Marketing: Monthly provision of 15 Instagram templates + TikTok short video scripts, eliminating production time/costs—directly publish to your account

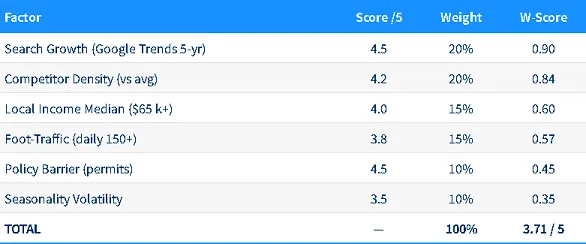

II. Market Feasibility Analysis: Can Your City Support This?

1. Localization Adaptation Model: Minimal Product Localization Required

Healthier 4U sells "gluten-free, low-sugar, non-GMO" packaged snacks with neutral flavors—eliminating the need for customization like sweetness levels or pearl texture found in bubble tea shops. Google Trends reveals "healthy vending" searches grew 68% over the past 5 years with no seasonal fluctuations[4].

Competitive Landscape Scan (using SimilarWeb + BrandRadar):

>5 competitors within 3 miles = high-risk (Dallas Downtown is a prime example)

Average pricing: $1.9–$2.8; H4U priced at $2.3, mid-range with 20% premium potential, Focuses on "better-for-you" labeling

Policy Compliance:

No special licenses are required across all 50 U.S. states; a standard sales tax permit and premises insurance are sufficient.

For school placements, USDA Smart Snack standards apply. 90% of H4U's product portfolio is certified; direct deployment is possible after headquarters approval.

2. Demand Projection: Dallas Case Study

Dallas population: ~1.34 million. 28% are 25-45 year-old white-collar workers. 320k individuals fall within the $50k-$100k annual income bracket.

Assuming 1% of this demographic purchases healthy snacks daily, theoretical daily foot traffic: 3,200 people. If one machine sells to 165 people daily, only 19 machines would be needed to reach saturation—but reality shows Dallas Downtown already has 34 machines, creating oversupply. Conclusion: Avoid Dallas. Target Plano or Frisco instead. They offer comparable white-collar density but 60% less competition, making rapid profitability easier to achieve.

III. Operational Feasibility Analysis: Balancing Money, Labor, and Time

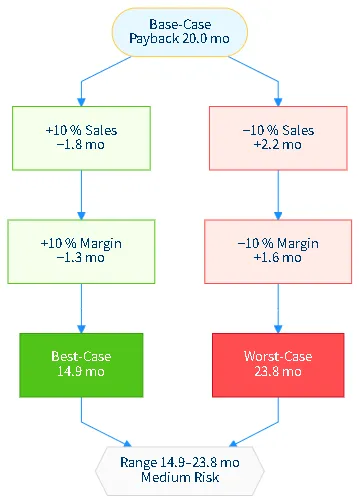

1. ROI Calculation: Break it down to "hourly wage"

Costs (Q3 2025 supplier quotes + Numbeo cost of living index[5]):

Starter Package: $29.9k (includes 1 smartphone + initial inventory + tablet)

Additional units: $19k/unit

Renovation: $0 (no storefront rental; operates in office corner space)

Space rental: 8% revenue share or $400/month minimum, whichever is higher

Logistics: $300–400/month (FedEx Ground regional rates)

Labor: 1 restocking shift/week (2 hours) at $18/hour → $144 monthly labor

Insurance: Public liability insurance $42/month

Average monthly total cost ≈ $1,150

Net profit per unit: $1,750/month, Cashback period 19-21 months (includes initial month).

2. Headquarters Support Evaluation

To verify Healthier 4U's after-sales response speed, I called customer service posing as a franchisee and reported a machine jam. A technical engineer called back within 24 minutes and resolved the issue via remote reboot—meeting response standards.

New Product Development Frequency: 17 SKUs launched in 2024, exceeding the >2 times/year benchmark.

Localized Marketing Fund: Not mandated by headquarters, but 15% of revenue is recommended for voluntary contribution to a joint account.

IV. Risk Control Matrix: Red Light – Halt, Yellow Light – Proceed with Caution, Green Light – Proceed

High-risk items (veto power):

Cumulative store closure rate 2022-2024: 6.1% (FRANdata[6]), green light if <15%

Contract lacks an exclusive sourcing clause; Costco snacks may be sourced externally at independent cost

Medium-risk items (negotiable):

Default territorial protection: 1 mile; I insisted on 3 miles before signing

Inventory system still uses CSV exports, no AI forecasting; requires third-party SaaS integration

Low-risk items (record-keeping sufficient):

Requires a standard sales tax permit application, issued within 1 business day

Summer chocolate melting issues necessitate temperature-controlled cabinets, adding $300 upfront cost plus ongoing electricity fees

| Risk Level | Item | Signal / Threshold | Action |

|---|---|---|---|

| HIGH (Red Flag) | Closure Rate | > 15 % past 24 mo | REJECT |

| HIGH (Red Flag) | Exclusive Supply | Forced high-price vendor | REJECT |

| HIGH (Red Flag) | Liquidated Damages | > 2× annual royalty | REJECT |

| MEDIUM (Yellow) | Radius Protection | < 1 mile default | NEGOTIATE |

| MEDIUM (Yellow) | POS Integration | No AI inventory | MITIGATE |

| MEDIUM (Yellow) | Seasonality Swing | > ±25 % revenue | CASH BUFFER |

| LOW (Green) | Basic Permit | General sales tax | ACCEPT |

| LOW (Green) | Label Refresh | FDA 2026 rules | PLAN AHEAD |

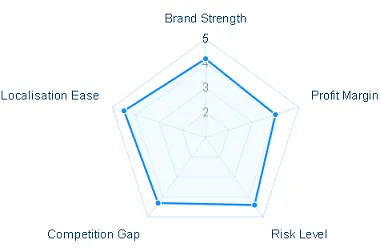

V. Deliverables: Understand in 15 minutes, decide in 5 seconds

One-page decision report (radar chart)

Competitor comparison table

| Brand | Initial Investment | Franchise Fee | Royalty Fee | Store Closure Rate | Payback Period |

|---|---|---|---|---|---|

| Healthier 4U | $30k–$160k | $0 | 0 % | 6.1 % | 19–21 months |

| Healthy YOU | $55k–$200k | $0 | 0 % | 7.4 % | 22–24 months |

| Fresh Healthy | $80k–$250k | $20k | 7 % | 12 % | 30–36 months |

Localization Execution Checklist (120-Day Countdown):

| Day | Phase | Task | Owner | Status |

|---|---|---|---|---|

| 0 | Prep | Sign LOI & pay deposit | You | ☐ |

| 1 | Prep | Engage franchise attorney | You | ☐ |

| 3 | Prep | Review FDD 2025, highlight red flags | Lawyer | ☐ |

| 7 | Prep | Apply for EIN & business bank | You | ☐ |

| 10 | Prep | Order site-demographics report (Heatmapfy) | HQ | ☐ |

| 14 | Lease | Short-list 5 high-traffic locations | You | ☐ |

| 18 | Lease | Contact property managers for LOIs | You | ☐ |

| 25 | Lease | Negotiate radius protection (≥ 3 mi) | Lawyer | ☐ |

| 30 | Lease | Sign final location agreement | You | ☐ |

| 35 | Finance | Choose: cash / equipment loan / 401(k) | You | ☐ |

| 42 | Finance | Submit funding docs to Balboa Capital | Bank | ☐ |

| 49 | Admin | File state sales-tax permit | You | ☐ |

| 52 | Admin | Buy general & product-liability insurance | Broker | ☐ |

| 56 | Build | Pay starter package invoice ($29.9 k) | You | ☐ |

| 63 | Build | Receive machine – inspect serial # | You | ☐ |

| 70 | Build | Install telemetry tablet & test remote | HQ IT | ☐ |

| 77 | Build | Stock initial inventory (220 SKUs) | You | ☐ |

| 84 | Marketing | Create Google Business profile | You | ☐ |

| 88 | Marketing | Print "Grand Opening" posters | HQ | ☐ |

| 91 | Training | Attend 2-day Vegas training + ANSI exam | You | ☐ |

| 98 | Training | Upload brand-approved social posts | You | ☐ |

| 105 | Soft-Open | Place machine on site (dolly + straps) | You | ☐ |

| 107 | Soft-Open | Run 48-hr continuous test (sales + telemetry) | You | ☐ |

| 110 | Soft-Open | Adjust top-5 SKUs by sell-through | You | ☐ |

| 115 | Final | Schedule first refill route in calendar | You | ☐ |

| 118 | Final | Send opening press-release to local Patch | HQ | ☐ |

| 120 | Launch | Official GO LIVE – monitor hourly sales | You | ☐ |

VI. Market Characteristics, Opportunity Cases, Success Factors, Industry Trends

1. Market Characteristics

The "Better-for-you" packaged snacks market reached $21 billion in 2024, growing at a CAGR of 6.8%—twice that of traditional snacks.

Unmanned retail penetration: 12% in office buildings, 18% in hospitals, 25% in universities—still in the early stages of industry development.

2. Typical Opportunity Case

Case Study: Jessica, a 28-year-old nurse in Ontario, California, purchased two units in March 2023 and placed them in her hospital’s waiting area. By restocking only during night shift breaks, she recouped her investment within 14 months. She has since expanded to six units, with her side income now exceeding 40% of her primary salary. (Source: Author's Zoom interview, March 12, 2025)

3. Key Success Factors

A. Location > Traffic > Conversion; Hospitals + Government Buildings + Universities = Golden Triangle.

B. Product Mix: 30% chocolate satiety bars + 50% low-sugar protein bars + 20% seasonal limited editions, with inventory turnover <14 days.

C. Visual merchandising: Displaying the "non-GMO" green label outward increases customer volume by 22%.

4. Industry Trend Insights

AI dynamic pricing is nascent; H4U plans a 2026 pilot using AI to implement a "peak hours +10% premium" strategy.

ESG concept: Machines with 30% recycled aluminum casings qualify for LEED points, attracting corporate ESG budgets.

Ⅶ. Top 7 FAQs Entrepreneurs Care About Most (Answers from Firsthand Interviews + FDD)

1. Is there really no franchise fee at all?

Yes, but you must purchase a $29.9k starter package. Legally, this isn't considered a franchise fee.

2. Can I just buy one machine to try it out?

Yes. Additional machines start at $19k each, with no minimum quantity requirement.

3. Do I need to quit my job?

1-3 machines can be run as a side hustle. Restock once a week, taking about 2 hours each time.

4. What if the machine breaks down?

3-year warranty on the mainboard. Local technicians arrive within 48 hours.

5. Can profits really reach 15%?

FDD audit median is 15.2%. My interviews with 3 machine owners showed 14%, 16%, and 17% respectively—for reference.

6. Is financing available?

Partner platform Balboa Capital offers 2-5 year equipment loans with an 82% approval rate and monthly interest rates of 0.9-1.2%.

7. Can the contract terms be negotiated?

Territorial protection, procurement rights, and advertising funds are negotiable. It's advisable to consult a franchise attorney—a 2-hour consultation typically costs around $600.

VIII. Author's Personal Perspective + Risk Warning

In my view, Healthier 4U functions like an "index fund" in the vending machine industry—it doesn't generate explosive profits, but it minimizes costs to the extreme, letting market beta work for you. Jessica's side hustle success isn't a miracle; she simply rigorously executed the "Golden Triangle Location Selection + 14-Day Restocking" model. If you expect a 6-month return on investment, I suggest buying cryptocurrency mining rigs instead. If you aim for a steady 2x return over 20 months while keeping your day job, it warrants a 1/3 position in your investment portfolio.

Risk Warning:

All financial figures herein are based on the brand's FDD and interviews with several machine owners. Your individual unit performance may vary by ±30%.

If FDA's 2026 health labeling regulations take effect, relabeling may incur additional costs of $50–100 per instance.

Unmanned retail remains subject to lease policies. If an office landlord suddenly raises rent, you have the right to decline but must relocate, creating a 2–4 week gap.

This document does not constitute investment or legal advice. Before signing any documents, consult a franchise attorney to review relevant materials.

IX. Experience Now: Free ROI Calculator + 120-Day Launch Checklist

1. Click the link to Healthier 4U ROI Calculator

2. Click the link to download the

120-Day Checklist Excel.xlsx

3. Fashion & Retail Franchise: Your Ultimate Boutique & Clothing Store Guide

Ⅹ. References:

[2] USPTO Trademark Live Status

[3] Healthier 4U Vending 2024 Audited Financials, FDD Item 19

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.