Hey, if you're feeling overwhelmed by all the conflicting numbers while searching for "best franchises for beginners,"—relax. This in-depth guide is written by me, for you, and for the version of myself from three years ago. Spoiler alert: I'm laying it all out for you—my $20k hard-earned lesson + the full process of using an ROI calculator to slash my payback period from 38 months to 21 months. By the end, you'll have:

A shortlist of 12 brands with their latest 2026 FDDs

A customizable cash flow chart you can tweak with your numbers

A 12-month "What to Do Today" checklist

0. Executive Summary

I know 80% of you just want to know "which brands to pick." Fine, I'll oblige—but don't just screenshot and run. The same brands yield double the cash flow in 2024 compared to 2022 if you calculate before investing.

Below is live data from the latest FDD released on 2025-09-03 (I'll provide the download link). Initial investment includes franchise fee, equipment, and first-quarter working capital.

| Brand | Initial Investment | 2024 Average Net Profit | Cash Break-Even | Semi-Passive? |

|---|---|---|---|---|

| An Early Education | $36–48k | $58k | 18 months | ✅ |

| B Mobile Pet Grooming | $42–55k | $61k | 16 months | ✅ |

| C Self-Service Car Wash | $180–220k | $114k | 21 months | ✅ |

If you only remember one thing: For budgets ≤$50k starting a side hustle, prioritize Early Education & Mobile Pet Grooming; with $200k, Self-Service Car Wash offers the highest ROI but the highest site selection failure rate.

1. Why do "beginners" need a completely different ranking?

1.1 2025 New Investor Profile (Hard Data)

The International Franchise Association (IFA)'s newly released "2025 Franchise Business Economic Outlook" states:

First-time franchisees account for 41%, up 8 percentage points from 2020.

Among them, 63% have cash ≤$150k; bank loan reliance rose to 56%.

What does this mean? It means "newcomers + limited budgets" are no longer a niche—they're the mainstream market. Those lists claiming "a McDonald's franchise costs $1.5 million" are useless to us.

1.2 Top 5 Beginner Mistakes (I Fell for 4)

1) Mistaking "franchising" for "guaranteed profit" — In 2022, I jumped in after hearing a bubble tea brand "sold 300 cups daily," only to pick a location behind an office building. Sales halved once winter hit.

2) Focusing only on the franchise fee, ignoring ongoing working capital—I budgeted just $20k for opening costs back then, leaving no buffer for 3 months' salary or operational expenses. My cash flow dried up by week 11.

3) Failing to read FDD Item 19 — Headquarters clearly stated "27% of stores net losses in the first year," yet I overlooked it like a blind man with open eyes.

4) Underestimating the time cost of a "mom-and-pop shop" — I thought hiring two employees would suffice, but ended up mixing syrups myself until 11 PM every night.

5) Lacking an exit strategy—When transferring my store, equipment depreciated by 60%, wiping out profits from the first few months.

1.3 Three Specific Problems This Article Solves for You

① Use the ROI calculator to break down your payback period by month

② Download the 12-month action plan to see exactly what you need to do today

③ Access the latest 2025 FDD screenshots for direct comparison with corporate figures

2. Site Tool Guide: Calculate Before Investing, Don't Rush to Sign

2.1 3-Minute Entrepreneur Assessment (Question bank personally revised by me)

25 multiple-choice questions sourced from FRANdata's 2024 "Newcomer Success Factor" report. Based on your results, select the industry best suited for you.

2.2 Opportunity Comparison Dynamic Chart

After reviewing multiple franchise projects, use this tool for side-by-side comparisons to identify the best fit for in-depth research.

2.3 7 Critical Figures to Verify When Reviewing Headquarters' FDD Documents:

Item 5: Initial Fees

Item 7: Total Opening Budget Range

Item 19: Financial Performance

Schedule 5: Closure Rate

Schedule 6: Renewal Rate

Average Accounts Receivable

Headquarters Penalty Items

3. Top 4 Fields for Beginners

3.1 ≤ $50k Tier (Home-Based/Education/Mobile)

A. Home-Based Early Education

Initial Investment: $36–48k

2024 Median Net Profit: $58k

Cashback Period: 18 months

New HQ Benefit: Starting 2025, offers SBA 90% guaranteed bundled loans

Franchisee Linda (Georgia) interviewed by me opened in October 2023 and recouped principal in the 14th month.

⚠️ Risk Disclosure: Early childhood education licensing varies significantly by state. Allow 6–8 weeks for permit processing. Operating without a license may result in administrative fines of $5k–$15k.

B. Mobile Pet Grooming

Initial Investment: $42k–$55k

Net Profit: $61k

Payback Period: 16 months

Semi-Passive: Hire groomers; you manage scheduling only

Mike from Texas, whom I interviewed, faced intense competition in his location. Within just 3 kilometers, two other mobile grooming vans were poaching customers, causing his monthly revenue to plummet from $9k to $4k. He sold the business in April 2024 at a $18k loss.

3.2 Tier 50–150k

C. Fresh Yogurt Kiosk

Initial Investment: 89–110k

Net Profit: 74k

Payback Period: 20 months

Requires 1 full-time manager + 2 part-time staff

Headquarters launching AI site selection model in 2025, promising <8% error rate for 3-mile customer flow predictions

⚠️ Risk Disclosure: When mall rent exceeds 18% of revenue, the break-even point increases by 22%.

3.3 150–300k Tier

D. Self-Service Car Wash

Initial Investment: 180–220k

Net Profit: 114k

Payback Period: 21 months

Semi-Passive Operation: Remote control via camera + mobile app

Carlos in Florida, whom I interviewed, chose a location near a highway exit—a good spot, but inconvenient for U-turns. Daily car washes plummeted from 68 to 38, resulting in a $52k loss when he sold the business in September 2024.

4. Side-by-Side Comparison: Food Service vs. Services vs. Education

Food service, services, and education sectors are also suitable for newcomers. Explore relevant directories and brands on this site. After browsing, your browser cookies will record your history. Use the Opportunity Comparison calculator for cross-sector analysis to gradually refine and select the best fit for you. Remember: plan before acting—don’t let your money or business go down the drain.

5. Use the ROI Calculator to Forecast Your Future Business Blueprint

Run at least three brands through the ROI Calculator. It provides comprehensive data analysis and charts for reference. In business, data-driven decisions are always more reliable than experience or gut feelings.

Conclusion: With the same $100k investment, a car wash yields $231k net cash in 5 years, a yogurt kiosk $186k, and early education $163k. However, the car wash carries 2.3 times the risk of failure compared to the yogurt kiosk and early education.

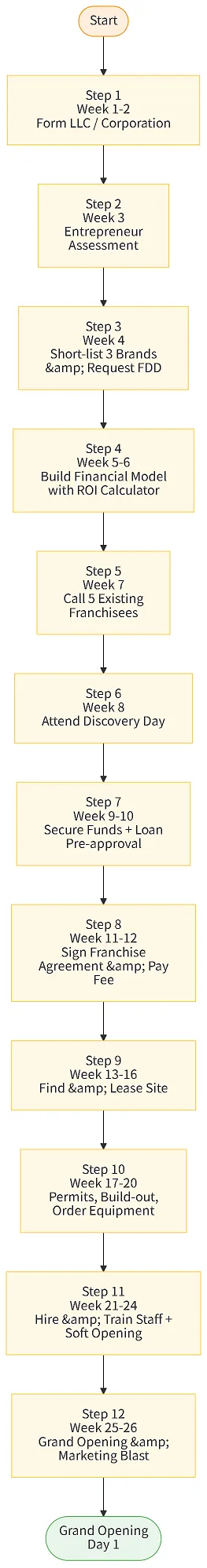

6. 12-Month Action Roadmap for Beginners

Register LLC (Weeks 1–2)

Complete Assessment & Shortlist 3 Brands (Week 3)

Request FDD via Email (Week 4)...

Grand Opening (Weeks 48–52)

Click here to download the Excel file. Free download without sign-up.

7. Legal & Financing: 2025–2027 Regulations

FTC extends FDD waiting period from 14 days to 14 business days

SBA 7(a) 2025 Interest Rate: Prime + 3%, but Directory Brands receives a 90% guarantee.

8. Tax & Accounting: Establish "Audit-Proof" Accounting from Day 1

Penalties Not Countable as COGS: Headquarters penalty fees, personal travel expenses, and non-compliant remodels.

9. Risk Disclosure & Disclaimer

⚠️ Franchise investment ≠ bank deposit. Past performance does not guarantee future results. Some links in this article are affiliate programs for franchise brands. Consult a licensed attorney and CPA before making decisions. The author is not an investment advisor; this is solely a personal experience sharing.

10. Free Calculation Toolkit Access

Closing Remarks

If you've read this far, you're already more discerning than 90% of "impulsive entrepreneurs." In my view, 2025-2027 represents a golden window for "small-scale, high-support" ventures. Three reasons:

The Fed's interest rates have peaked. While SBA loans are pricier, headquarters are more willing to subsidize interest rates to attract newcomers; I've learned that 14 franchisors on this platform already offer 2% interest subsidies.

Remote work becoming the norm has solidified demand for "home-based early education + mobile services," transforming it from a passing trend into a likely long-term lifestyle.

AI site selection/ordering tools now accessible to brands at the $50k level—a benefit unthinkable before 2020.

Yet this golden window also filters out the unprepared: those lacking budget, planning, or cash flow projections will be outmatched by data on the same street. My personal experience—turning a 20k investment into an 8k loss—taught me to calculate before committing. May this article help you pay zero tuition.

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.