1. 15 Low-Cost, High-Profit Franchises Worth Owning(The Ultimate 2026 Guide)

Hi there! I'm Qaolase.

Have you ever spent countless late nights pondering that dream of "becoming your own boss"? It sounds so appealing, but the reality—especially the financial barriers—often feels out of reach. You've probably scrolled through countless "Top 10 Best Franchises" lists online, but after reading them, did you end up with just another bookmark—and even more confusion? "Is this really right for me?" "How high are those ‘high profits' they claim?" "Where do I even start researching?"

Trust me, you're not alone in this struggle. Years ago, I stood exactly where you are now—drowning in a sea of information and exaggerated claims, feeling utterly lost and anxious. I realized the market wasn't lacking lists of opportunities, but a true "navigation system" to guide you through the entire journey. That's precisely why I created this website and wrote this comprehensive, in-depth guide for you.

This article is far more than just another list of brands. It's a complete decision-making toolkit. I'll take you deep into how to identify genuine "low-cost, high-profit" opportunities, how to scrutinize complex legal documents like an expert, and most importantly, I'll show you how to use our website's unique tools to transform vague "possibilities" into clear, quantifiable data. By the end of this guide, you won't just have a list of brand names—you'll possess a scientific decision-making methodology that will serve you throughout your entire entrepreneurial journey. Ready? Let's turn that distant dream into a tangible reality, step by step.

1-1: Step One: Know Yourself: Are You Truly Cut Out to Be a Franchisee?

Before diving headfirst into those tempting brand lists, I urge you to hit the brakes and conduct the most crucial assessment—an assessment of yourself. This might sound like motivational fluff, but trust me: it's the single most critical step determining your future success—even more important than choosing the right brand itself.

I recall a friend of mine from a few years back—let's call him Mark. Mark was a tech whiz with sharp logic and meticulous work habits. He was deeply drawn to a children's coding education franchise promising "rapid ROI." Every financial model looked flawless; he felt this was the opportunity he'd been waiting for. So, he invested most of his savings and opened his business with great enthusiasm. But problems surfaced quickly: the venture demanded extensive street promotions, community events, and enthusiastic parent outreach to recruit students. For introverted Mark, who struggled with public speaking, each flyer distribution in shopping malls or lengthy parent consultations felt like enduring hell. He loved coding but intensely disliked sales and social interactions. Just six months later, despite the project's inherent potential, he was physically and mentally exhausted, dreaming daily of shutting down.

Mark's failure stemmed not from the project's merits, but from its complete mismatch with his personality and core strengths. This costly lesson taught me profoundly: The most profitable business isn't necessarily the best fit for you. Entrepreneurial success hinges on the perfect alignment of your personal traits, skills, and business model. You must honestly ask yourself:

What is your risk tolerance? Are you willing to take high risks for high rewards, or do you prefer stable, predictable income?

Do you enjoy interacting with people? Does your business require you to be the community star, or can you manage operations quietly behind the scenes?

What are your strengths? Are they in sales and marketing, or in meticulous operational management and cost control?

What lifestyle do you desire? Can you handle the grueling hours and holiday work of the food service industry, or do you prefer a more regular schedule?

There are no right or wrong answers to these questions, but they will help you sketch your own "entrepreneurial blueprint." To avoid repeating Mark's mistakes, I strongly recommend spending just 5 minutes using the tool we've developed specifically for you on our website before continuing.

Before exploring external opportunities, explore yourself internally. Click here to immediately use our Entrepreneur Assessment tool. Through a series of scientific questions, it will help you clearly understand your entrepreneurial profile, providing a solid personalized foundation for your upcoming choices.

After completing the assessment, you may be surprised to discover that what you thought suited you best might not be the optimal choice. Armed with this new self-awareness, your judgment will be far more precise as we explore the following content.

2. Unmasking the True Nature of "Low Cost, High Profit"

The phrase "low cost, high profit" is like a magic spell in the business world, captivating every entrepreneur's attention. But as rational investors, we must peel back this alluring packaging to see its true structure and hidden pitfalls. Without correctly understanding the composition of costs and profits, you risk getting caught in a numbers game and making flawed decisions. This chapter serves as your "X-ray glasses," helping us uncover the most easily overlooked details.

2-1: Beyond Franchise Fees: Unveiling the Full Truth About Initial Investment

When evaluating franchise opportunities, many focus first on the "franchise fee." Remember: this is merely the "entry ticket"—not your total startup cost. The true initial investment is far more complex, with all details hidden within a legal document called the Franchise Disclosure Document (FDD), specifically Item 7 (Item 7).

I once mentored a young man aspiring to open a fast-food restaurant. He was initially drawn to a brand advertising a "just $50,000 franchise fee." But when we analyzed its FDD Item 7 line by line, he broke out in a cold sweat. Beyond the $50,000 franchise fee, he needed to prepare at least:

Store rent and deposit: $20,000

Renovation and remodeling: $80,000

Equipment and furnishings: $60,000

Initial inventory and supplies: $15,000

Grand opening marketing: $10,000

Required permits and insurance: $5,000

And most crucially-at least 3-6 months of operating reserve funds: $30,000

You see, that tempting "$50,000" project actually required nearly $270,000 in startup capital! This operational reserve is especially critical because your new store won't turn a profit on day one. You need sufficient cash to cover months of rent, employee wages, and utilities until the business stabilizes. Neglecting this is the primary reason new stores fail before they even get off the ground.

To provide a clearer picture, here's a typical breakdown of initial investment costs for a low-cost franchise:

| Cost Category | Description | Estimated Cost Range |

|---|---|---|

| Franchise Fee | Cost for brand usage rights and initial support. | $10,000 – $50,000 |

| Real Estate/Rent | Leasing space and security deposits. | $5,000 – $20,000 |

| Leasehold Improvements | Renovating the storefront to brand standards. | $10,000 – $100,000+ |

| Equipment/Tools | Purchase of all operational equipment. | $5,000 – $75,000 |

| Initial Inventory | Cost of the first merchandise purchase. | $2,000 – $15,000 |

| Grand Opening Marketing | Advertising expenses for promoting the new store opening. | $2,000 – $10,000 |

| Professional Fees | Consulting fees for lawyers, accountants, company registration fees, etc. | $1,000 – $5,000 |

| Additional Funds | Reserve funds to cover the first 3–6 months of operating costs. | $10,000 – $50,000 |

| Estimated Total | — | $55,000 – $335,000+ |

So when a brand tells you it's "low-cost," your first reaction should be: "Show me your FDD Item 7." Always assess your funding adequacy based on the total investment, not just the appealing franchise fee.

2-2: What Does "High Profitability" Really Mean? Decoding FDD Item 19

Now let's discuss "high profitability." This term is even more misleading than "low cost." A franchise sales rep might tell you: "Our franchisees average $500,000 in annual revenue! " Sounds fantastic, right? But this ‘income' likely refers to "Gross Revenue," not the "Net Profit" you actually pocket.

The key to how much you ultimately earn lies in FDD Item 19—the Financial Performance Representation. This is the only non-mandatory disclosure in the FDD, but a strong, confident brand typically chooses to disclose it. It reveals key data like sales, costs, and profits from existing franchise locations.

However, interpreting Item 19 requires skill. You need to pay attention to:

Data source: Does the data come from all franchise locations, or only from the top-performing ones? An honest brand will clarify this.

Definition of key metrics: Is the "profit" reported gross profit, EBITDA, or net profit after all expenses? These differ significantly.

Completeness of cost structure: Beyond material costs and labor wages, does the data account for rent, marketing expenses, ongoing royalty fees, technical service fees, credit card processing fees, etc.?

Let me illustrate with an example: A low-cost pizza franchise claims "average annual sales of $600,000" in Item 19. Let's run a simple simulation:

Annual Sales: $600,000

Food Cost (30%): -$180,000

Labor Cost (25%): -$150,000

Store Rent (10%): -$60,000

Royalty Fee (6%): -$36,000

Marketing Fund Fee (2%): -$12,000

Utilities, Insurance, Miscellaneous (7%): -$42,000

Annual Net Profit (Pre-Tax): $120,000

See? With $600,000 in sales, the final pre-tax net profit might be $120,000. This return (relative to, say, a $250,000 total investment) could still be quite solid, but it's likely worlds apart from what you imagined when you first heard "$600,000 in revenue." More importantly, if a brand refuses to provide Item 19, you need to raise a huge red flag. What are they hiding? In such cases, your due diligence must be doubled.

2-3: Unique Risks Hidden Behind Low-Cost Franchises

Pursuing low costs is wise, but we must recognize that reduced expenses sometimes come with increased specific risks. This doesn't mean we should avoid them, but rather manage these risks with clear awareness. In my view, low-cost franchises primarily carry three potential pitfalls:

1. Weak Brand Power and Inadequate Support Systems: Paying lower franchise fees typically indicates a smaller franchisor with limited national brand recognition. What does this entail? First, you won't benefit from the powerful brand effect of a McDonald's. Consumers are unfamiliar with your brand, forcing you to invest more time and money into local market promotion and education. Second, the franchisor's support system may be underdeveloped. Their training programs may be brief, and operational manuals may be rudimentary. When you encounter challenges in daily operations, the guidance and assistance available could be severely limited. You'll feel more like a "lonely entrepreneur" than a "member of a supportive family."

2. Profit margins may be thinner: Many low-cost franchises focus on services or low-priced retail. While startup costs are low, profits per transaction can be minimal. This demands extremely high operational efficiency and massive order volumes to achieve significant overall profits. For example, a low-cost cleaning service franchise might require completing several jobs daily while strictly controlling transportation and material costs to turn a profit. This "high volume, low margin" model places immense demands on the manager's meticulous operational skills. Waste in any single process can directly devour your already slim profit margins.

3. Higher entry barriers and lower exit barriers: Precisely because startup costs are low, the threshold for entering this field is also low. Your neighbor, your friend, or anyone with a few thousand dollars in savings could become your direct competitor. Multiple similar service providers can rapidly emerge within a single area, making price wars inevitable. Simultaneously, your relatively small initial investment means the sunk cost of "giving up" when facing difficulties is also low. While this might sound advantageous, it can sometimes undermine your resolve to persevere. In contrast, franchisees who have invested millions will exhaust every effort to make their business succeed—because they can't afford to lose.

Recognizing these risks empowers you to ask more probing questions when evaluating opportunities: "How well-known is your brand in my city?" "How many hours of initial training and ongoing support do you provide?" "How do you help franchisees navigate local price competition?" A strong low-cost franchise brand will have clear answers and proven solutions to these questions.

3. Top Low-Cost, High-Profit Franchise Opportunities

Alright, now that we've covered the groundwork, we can finally dive into the most exciting part—specific brand opportunities. Below is a list of 15 low-cost franchise opportunities with tremendous potential in 2026, carefully curated by me based on market trends, return-on-investment potential, brand reputation, and publicly available data from FDD filings.

Important Note: This list serves as a starting point, not an endpoint. Its purpose is to provide high-quality candidates to spark your thinking. All investment figures are estimates and will vary based on location, store size, and specific choices, with brands updating them regularly. You must use the latest official FDD documents you obtain as your sole basis for decision-making.

As you review the list, note how I've categorized them. This helps you quickly identify sectors that align with your interests and the self-assessment results from Step 1.

3-1: Home & Commercial Services

This sector is a "gold mine" for low-cost franchises, as most don't require expensive street-front locations, offer flexible operational models, and cater to ongoing essential needs.

JAN-PRO (Commercial Cleaning)

Industry: Commercial Cleaning

Initial Investment Range: $4,170 - $56,120

Franchise Fee: $2,520 - $44,000

High Profit Potential: Extremely low startup barrier. JAN-PRO's unique model provides you with initial client contracts, ensuring revenue from day one. You decide whether to operate solo or build a team based on your goals and capabilities, with complete scalability control.

Ideal Franchisee: Diligent, detail-oriented, and responsible individuals seeking low-risk entry to gradually build their business.

Chem-Dry (Carpet Cleaning)

Industry: Residential & Commercial Carpet/Floor Cleaning

Initial Investment Range: $71,145 - $189,575

Franchise Fee: $23,500

High Profit Potential: Chem-Dry is a household name with strong market credibility. Its unique "Hot Carbonation Extraction" cleaning technology is a core selling point, delivering excellent results with fast drying times that customers love. This is a business you can start from a home office and expand as it grows.

Ideal Franchisee: Derives satisfaction from delivering premium service, excels at building customer relationships, and is willing to work hands-on or manage a small team.

Oxi Fresh Carpet Cleaning

Industry: Eco-Friendly Carpet Cleaning

Initial Investment Range: $48,905 - $84,045

Franchise Fee: $42,900

High Profit Potential: Leverages the dual selling points of "eco-friendly" and "quick-dry" to precisely target modern consumer preferences. A robust central dispatch center and online booking system handle extensive administrative tasks for franchisees, allowing greater focus on service delivery.

Ideal Franchisee: Committed to environmental sustainability, adept at utilizing modern technology, and seeking a business with a simplified operational model.

Mosquito Joe (Outdoor Pest Control)

Industry: Outdoor Pest Control

Initial Investment Range: $115,600 - $158,000

Franchise Fee: $42,500

High Profit Potential: This is a high-demand seasonal business, particularly in the Southern and Midwestern United States. Customers typically book services for the entire season, generating predictable recurring revenue. The business can start from a home office with relatively low operating costs.

Ideal Franchisee: Enjoys outdoor work, adapts well to seasonal business rhythms, excels at local community marketing.

3-2: Travel & Leisure

If you crave a "lifestyle" venture that blends passion with work, this sector warrants attention.

Cruise Planners (Travel Planning)

Industry: Travel Agency

Initial Investment Range: $2,295 - $23,767

Franchise Fee: $10,995

High Profit Potential: This is a classic home-based model with minimal overhead. You'll operate as an American Express Travel representative, leveraging strong brand credibility and access to top-tier supplier resources. Revenue comes from commissions on cruises, hotels, and resorts, offering high profit margins.

Ideal Franchisee: Passionate about travel, enjoys sharing experiences, skilled in networking and relationship-building, and seeks a flexible, independent work style.

Dream Vacations (Travel Planning)

Industry: Travel Agency

Initial Investment Range: $3,495 - $21,800

Franchise Fee: $10,500 (Discounts often available for veterans, etc.)

High Profit Potential: Similar to Cruise Planners, this is another top-tier home-based travel franchise brand. It provides robust technology tools and marketing support, enabling you to operate like a professional travel consultant. This is an ideal choice to start part-time and gradually transition to full-time.

Ideal Franchisee: Passionate about travel, service-oriented, and seeking to launch a business with minimal startup costs.

3-3: Food & Beverage

The food and beverage industry is always full of opportunities. The key is finding niche leaders with streamlined operations and manageable investment.

Maui Wowi Hawaiian Coffees & Smoothies (Mobile Beverage)

Industry: Coffee & Smoothies

Initial Investment Range: $33,900 - $326,000

Franchise Fee: $15,000 - $30,000

High Profit Potential: Maui Wowi's appeal lies in its flexible model. You can start with a mobile cart (Ka'anapali Cart), operating at events, markets, and sporting events with an investment of just a few thousand dollars. This model has zero rent costs, allows you to go where the crowds are, and offers significant profit margins.

Ideal Franchisee: Energetic, loves interacting with people, and thrives in fast-paced, dynamic event environments.

Pretzelmaker Industry: Fast-casual snacks

Initial Investment Range: $55,300 - $401,500

Franchise Fee: $5,000 - $30,000

High Profit Potential: Its low-cost options include non-traditional locations like adding a counter in existing movie theaters or convenience stores, or choosing a mobile food truck model. The product line is simple, operations are standardized, labor requirements are low, and waste is easily controlled. Pretzels are a high-margin impulse purchase item.

Ideal Franchisee: Seeks a food concept with simple products and uncomplicated operations, skilled at selling in high-traffic areas.

3-4: Personal Care & Fitness

Businesses catering to people's pursuit of health and well-being never go out of style.

Jazzercise (Fitness Classes)

Industry: Fitness

Initial Investment Range: $3,750 - $21,750

Franchise Fee: $1,250

High Profit Potential: This is a long-established and highly dynamic brand. You don't need to invest in building a full gym; simply rent community centers, school auditoriums, or similar venues to hold classes. Investment is minimal, with primary costs being training and music licensing fees. Revenue comes from student class fees, making it a classic "light-asset" business model.

Ideal Franchisee: Passionate about dance and fitness, charismatic, and enjoys being a community fitness leader.

3-5: B2B Services (Business-to-Business Services)

Serving other businesses typically means greater specialization, higher average transaction values, and more stable client relationships.

Proforma (Marketing & Print Materials)

Industry: Print Materials & Promotional Products

Initial Investment Range: $5,130 - $53,195

Franchise Fee: $0 - $34,500 (Varies based on experience)

High Profit Potential: This operates as a "middleman" model within the B2B sector. You don't need to own a printing plant or factory. Instead, leverage Proforma's robust supplier network to provide businesses with all marketing materials—from business cards and brochures to custom T-shirts and gifts. Operate from home with no inventory; profits come from markups.

Ideal Franchisee: Sales or marketing background, skilled at building business relationships, enjoys solving problems for clients.

Property Management Inc. (PMI) (Property Management)

Industry: Real Estate Property Management

Initial Investment Range: $53,225 - $214,500

Franchise Fee: $50,000

High Profit Potential: This business generates stable, recurring income. Manage residential, commercial, or vacation rental properties, earning a percentage of rent as management fees. PMI provides robust software systems and operational support to efficiently manage multiple properties.

Ideal Franchisee: Interested in real estate, organized, strong communicator (with owners and tenants), seeking to build long-term, stable cash flow.

3-6: Automotive Services

Cars are a necessity for Americans, creating massive and consistent demand for related services.

SuperGlass Windshield Repair

Industry: Automotive Glass Repair

Initial Investment Range: $19,985 - $88,905

Franchise Fee: $9,900 - $25,000

High Profit Potential: This is a classic mobile service model where your primary assets are a service vehicle and specialized repair tools. Operating costs are extremely low. Windshield repair is a high-margin service typically covered by insurance with no out-of-pocket cost to customers, making it easy to sell.

Ideal Franchisee: Hands-on individuals with attention to technical detail who can work independently and excel at building partnerships with automotive dealers, insurance companies, and other channels.

3-7: Education & Children's Services

Investing in the next generation is a timeless need for parents.

Kumon Math & Reading Centers (After-School Tutoring)

Industry: Children's Education

Initial Investment Range: $67,428 - $145,640

Franchise Fee: $2,000

High Profit Potential: Kumon is a globally renowned after-school tutoring brand with exceptional parental trust. Franchise fees are remarkably low, and headquarters provides substantial subsidies to assist with startup. Revenue comes from monthly student fees, delivering excellent cash flow once a stable student base is established.

Ideal Franchisee: Passionate about education, patient, enjoys interacting with children and parents, holds a bachelor's degree.

3-8: Pet Services

The "pet economy" is booming, with people willing to spend generously on their furry companions.

Fetch! Pet Care

Industry: Pet Sitting & Dog Walking

Initial Investment Range: $68,455 - $83,355

Franchise Fee: $60,000

High Profit Potential: This is a management-focused franchise. You won't walk every dog yourself; your role involves recruiting, training, and managing a team of pet sitters and dog walkers, assigning tasks through an app. It's a scalable home-based business meeting significant demand in the pet owner market.

Ideal Franchisee: Animal lover with strong organizational and management skills, proficient in using tech tools.

Wag N' Wash Natural Pet Food & Grooming

Industry: Pet Retail & Services

Initial Investment Range: $149,950 - $804,450 (Note: This wide range reflects lower-cost options like smaller storefronts and self-service wash models)

Franchise Fee: $49,950

High Profit Potential: I include this because it represents an "experiential retail" trend. It goes beyond selling pet food by offering self-service pet washing and professional grooming services, creating multiple revenue streams. By focusing on natural, healthy products, it attracts high-spending pet owners.

Ideal Franchisee: Genuine pet lover who enjoys building a community pet hub, with retail and service management skills.

By now, you may have developed an initial interest in several brands. However, a brand's advertised "average return on investment" holds limited personal relevance. Your city's rent, labor costs, and market potential will determine your actual ROI. Now, use our "ROI Calculator" tool to run a personalized financial simulation! Select a brand you're interested in, input its investment data and fees alongside your local market projections (e.g., estimated monthly sales), and see the most realistic, tailored ROI picture for your specific situation.

4. Your Due Diligence Action Guide: How to Review Your Top Targets

After selecting 2-3 preferred brands, the real hard work begins. We call this phase "Due Diligence." This is absolutely not a step you can skip—every effort you put in here strengthens the security of your future investment. Many people rush through this step to avoid hassle, only to regret it later. But you won't, because you now have a clear action guide.

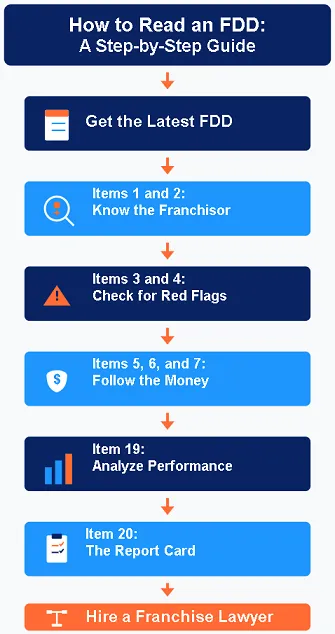

4-1: How to Read an FDD Like a Pro

The FDD is an intimidating legal document, often hundreds of pages thick. But you don't need to be a lawyer to understand it. You just need to know where to focus. Think of it as a treasure hunt, where the treasure is the critical information that determines your success or failure.

Remember, the FDD is your most powerful tool. Franchise brands are legally obligated to ensure the information in the FDD is accurate. Spend a few days, grab a cup of coffee, and read it through quietly. Your understanding of the brand will undergo a qualitative leap.

4-2: 20 Critical Questions to Ask Existing Franchisees

The FDD tells you the "official story," while existing franchisees share the "real-world story." The contact list provided in FDD Item 20 is invaluable. I recommend calling at least 10-15 franchisees, mixing locations and years in operation. Don't hesitate to reach out—most are happy to share their experiences.

However, avoid broad questions like "Are you profitable?" You need specific, strategic questions to uncover the real gold. Here's a prepared list you can print:

On Financials & Returns:

1. Was your actual total investment higher or lower than the maximum estimate in FDD Item 7? By how much?

2. How long did it take to break even? How long before you started paying yourself a salary?

3. If your FDD includes Item 19, do you feel it accurately reflects your actual situation? Was it overly optimistic or conservative?

4. Beyond the expenses listed in FDD Item 6, what unexpected "hidden costs" did you encounter?

5. Are you satisfied with your current return on investment? If you could start over, would you make the same choice?

Regarding Headquarters Support:

6. Was the initial training provided by headquarters sufficient? What aspects did you find most useful, and which were least helpful?

7. When facing urgent operational issues, how quickly do you receive effective responses from headquarters?

8. Does the marketing support provided by headquarters (e.g., national advertising, social media content) offer tangible benefits to your local business?

9. Are the technical systems provided by headquarters (e.g., POS, reservation software) user-friendly? Or do they frequently malfunction?

10. Do you feel headquarters is focused on helping you succeed, or more concerned with collecting your royalty fees?

About Daily Life and Challenges:

11. Can you describe a typical day for you?

12. How many hours do you work per week? How does this compare to your first year versus now?

13. How has this business impacted your family life?

14. What has been your biggest challenge? How did headquarters help you overcome it?

15. Is competition intense in your area? How do you stand out?

Forward-Looking Questions:

16. How is your relationship with headquarters? Would you describe the franchisee community as collaborative or more complaint-driven?

17. Do you have confidence in headquarters' future direction?

18. Would you recommend this franchise brand to your closest friends and family? Why?

19. If you could give one piece of advice to a potential franchisee like me, what would it be?

20. Are there any questions I should be asking that I haven't?

After asking these questions, you'll gain a 360-degree, real-world understanding of the brand. You'll hear success stories and complaints about failures. This information will help you make a final, rational decision.

4-3: Side-by-Side Comparison of Your Finalists

Now, you might be torn between two excellent brands. One might be in your preferred industry but requires a higher investment; the other has lower investment costs, but you're less enthusiastic about its day-to-day operations. At this stage, emotional preferences can easily lead to poor decisions. You need an objective tool to help you:

Don't decide based on feelings! Enter your final two or three options into our"Opportunity Comparison" tool. This tool will guide you through side-by-side scoring and comparison across multiple dimensions: investment costs, fee structures, potential returns, headquarters support, personal fit, and more. Ultimately, you'll receive a clear, quantified result showing which option logically stands out. This will give you greater confidence when making your final decision.

5. Taking the Final Step: From Decision to Business Plan

Congratulations! By completing all the steps above, you've made a decision grounded in thorough research and rational analysis. You've already surpassed 90% of potential franchisees. But the journey isn't over yet—now you need to transform your decision into an actionable blueprint: a business plan.

Many people cringe at the mention of "business plan," viewing it as a complex document meant for bankers and investors. In reality, it's primarily written for yourself. It forces you to think through every operational detail: Who is your target customer? How will you reach them? What is your pricing strategy? What are your detailed financial projections for the first three years?

A solid business plan serves two core purposes:

1. Navigate for yourself: It serves as your roadmap for the first year of operation, ensuring you don't lose sight of your goals amid daily distractions.

2. Secure funding: If you need loans from banks or the U.S. Small Business Administration (SBA) to cover initial investments, a professional, comprehensive business plan is your essential stepping stone.

I know starting from scratch can feel daunting. You might stare at a blank document, unsure where to begin. Don't worry—we've got you covered.

Overcome "blank page anxiety"! Use our"Business Plan Generator" tool. It guides you step-by-step through all key sections—market analysis, marketing strategy, organizational structure, and financial projections—by asking targeted questions. You don't need to be a business writing expert—just follow its rhythm to generate a well-structured, detailed first draft of your business plan. This saves you significant time and effort, allowing you to focus on refining your business concept.

6. Critical Disclaimer and Risk Warning

In this section, I must remind you in serious and clear terms:

The content herein is provided solely for educational and informational purposes and does not constitute any form of financial, legal, or investment advice.

Franchising represents a significant business investment accompanied by substantial risks, including the potential loss of your entire investment.

1. Timeliness of Information: All brand information, investment data, and other details referenced in this article are based on publicly available information at the time of writing. Franchise brands regularly update their FDDs and policies. You must rely solely on the most current, official FDD documents obtained directly from the franchisor as your basis for decision-making.

2. Data is illustrative only: All profit and cost calculations and analyses presented herein are hypothetical examples intended to explain concepts. Your actual financial results may vary significantly due to factors such as geographic location, management capabilities, and market conditions.

3. Consult Professionals: Before signing any legally binding documents or paying any fees, I strongly, strongly recommend hiring a franchise attorney to review the FDD and franchise agreement, and consulting an experienced accountant to evaluate financial models and tax implications. Their professional fees represent your best investment protection.

4. No Guarantee of Success: No franchise brand can guarantee your success or profitability. Ultimate success always hinges on your diligence, managerial acumen, and relentless effort as the operator.

For authoritative guidance on protecting your interests, refer to the U.S. Federal Trade Commission's (FTC) official guide, A Consumer's Guide to Buying a Franchise.

7. Personal Perspective and Final Summary

Having written this far, I hope you sense that choosing a franchise brand is far more than just "picking a project." It's more like a marriage—you need to be highly aligned with your "partner" (the franchisor) in values, goals, and communication styles to grow together over the long haul, rather than wearing each other down.

In my view, the core of this entire process is a cycle of "looking inward" and "looking outward." You begin by understanding yourself, then apply that self-awareness to examine the external world (the list of brands). Next, through tools and research, you internalize external information to inform your decision-making. This process can be arduous, even tedious at times, but it maximizes your ability to avoid mistakes caused by information asymmetry or impulsive decisions.

I believe the best entrepreneurial opportunities today belong to those who master tools and make rational decisions. In the past, ordinary individuals struggled to access deep business analytics. Now, tools like those offered on our website are democratizing this capability. They act as your personal business advisor, delivering objective, unbiased analysis precisely when you need it most. This is precisely our unique value compared to other information sites—we don't just give you a map; we provide GPS navigation and a high-performance off-road vehicle.

7-1: Summary and Action Recommendations

You now possess all the knowledge and tools to become a savvy franchise investor. Let's outline your action path:

1. Self-Assessment: Use the Entrepreneur Assessment Tool to define your personal profile.

2. Research & Screening: Thoroughly examine the brand list and analysis methods provided in this article to select 2-3 candidate brands.

3. Quantitative Analysis: Use the ROI Calculator to generate personalized financial projections for each candidate brand.

4. In-Depth Due Diligence: Obtain and study the FDD, call existing franchisees, and complete your due diligence checklist.

5. Final Decision: Use the Opportunity Comparison Tool to make your final, data-driven, rational choice.

6. Plan Your Future: Use the Business Plan Generator to build your action blueprint and prepare to launch your venture.

7-2: Final Risk Warning

Please remember: All investments carry risk. Never invest funds you cannot afford to lose. Stay cautious, keep learning, and your entrepreneurial journey will be steadier and more enduring.

7-3: Continue Reading

Want to learn more about franchise fundamentals or explore other business opportunities? We've prepared more in-depth content for you:

Best of luck, future entrepreneur! If you have any questions, feel free to leave a comment below—I'll do my best to help.

8. List of References

Federal Trade Commission (FTC). "A Consumer's Guide to Buying a Franchise".

U.S. Small Business Administration (SBA). "Franchise businesses".

10 Easiest Low-Investment, High-Profit Franchises

Top Inexpensive Franchises to Buy: Food & Restaurant

Best Affordable Franchises to Own: Your Ultimate Guide to Smart Investing in 2026

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.