Have you ever sat in front of your computer screen late into the night, just like me, with a burning desire to "work for yourself"?

That longing to take control of your own destiny and build your own business—it's truly irresistible.

You've probably scrolled through countless web pages, dazzled by headlines promising "effortless entrepreneurship" and "rapid returns." Especially when you spot the words "low-cost franchise," your heart skips a beat. Yes, a low barrier to entry seems like the shortest path to your dreams.

But in my view, this road is littered with carefully packaged "sweet traps." I've seen too many passionate friends stumble because they couldn't see through these traps.

So today, I won't just give you a cold list of facts. I want to share some heartfelt advice and insights from someone who's been there, helping you cut through the fog to see the real truth behind "low-cost franchises."

This article will serve as your guide—not just telling you "what options exist," but more importantly, teaching you "how to choose" and how to avoid the pits that could cost you everything. We'll dive deep together and leverage our website's unique tools to help you find that truly suitable, solid starting point.

Important Disclaimer and Investment Risk Warning

Before we begin, please allow me to state this very seriously: The information provided herein is for educational and reference purposes only and does not constitute any form of financial or investment advice. Franchising is a significant business investment involving substantial risks, including but not limited to the potential loss of your entire investment. All investment amounts mentioned are estimates based on publicly available information; actual costs may vary significantly depending on your geographic location, local market conditions, personal management capabilities, and other factors. Before making any investment decision, you must and should engage independent legal, accounting, and business advisors, and carefully read and fully understand the Franchise Disclosure Document (FDD) provided by the franchisor. This website and its authors assume no liability for any business decisions made based on the information herein. Investing involves risks; proceed with caution.

1. The Myth of "Under Ten Thousand Dollars": The Truth About "Low-Cost" You Must Know

I have a friend we'll call Mark. Several years ago, Mark was deeply intrigued by a mobile coffee cart franchise opportunity advertised as requiring "only $8,000 in franchise fees." He excitedly told me, "Man, becoming a boss for under ten grand? It's like money falling from the sky!" He was on the verge of signing the contract. Fortunately, after my persistent urging, we sat down together and meticulously examined the thick FDD document. The results left us sweating bullets. That $8,000 was merely the "franchise fee"—essentially the "entry ticket" to join the brand. But the actual costs went far beyond that. This experience taught me a profound lesson: for hopeful entrepreneurs like us, the most dangerous thing is being blinded by an enticing number. Therefore, before reviewing any project list, we must establish two critical understandings. These will form the foundation for all your future decisions and save you far more than just $10,000 in "tuition fees."

1-1."Franchise Fee" vs "Initial Total Investment": The Number You Must Focus On

Imagine buying a house. The "franchise fee" is like the ‘deposit' or "qualification fee" you pay to the developer when you find a property you like. It grants you the right to purchase the house and use the neighborhood's name and facilities. But this is far from the total cost of moving into that house. The "Initial Total Investment" is the true sum of "property price + renovations + furnishings + various taxes." This is the full capital required to transform an empty space into a move-in-ready location. In franchising, this principle holds exactly the same. The franchise fee is merely a small portion of the total investment. The Initial Total Investment typically also includes equipment costs, initial inventory expenses, store renovation fees, training and travel expenses, opening marketing costs, and most crucially—at least 3 to 6 months of "operating reserve funds." This money covers rent, utilities, and employee wages, serving as your lifeline until your business becomes profitable.

| Cost Type | Explanation | Common Range (Low-Cost Project Example) |

|---|---|---|

| Franchise Fee | The "entry ticket" paid to the franchisor for brand usage rights, training, and support. | $5,000 – $20,000 |

| Equipment | Essential operational equipment like computers, specialized tools, vehicle wraps, etc. | $2,000 – $15,000 |

| Initial Inventory | Products or raw materials needed for the first opening. | $500 – $5,000 |

| Training Costs | Typically included in the franchise fee, but travel and lodging are often self-funded. | $500 – $2,500 |

| Grand Opening Marketing | Expenses for local advertising and promotional activities announcing your opening. | $1,000 – $5,000 |

| Additional Funds | Critically important! Covers initial (3-6 months) rent, wages, utilities, etc. | $5,000 – $25,000+ |

| Initial Total Investment | The sum of all above costs—this is the actual capital you must prepare! | $15,000 – $75,000+ |

So remember: when a brand advertises "franchise opportunities under $10,000," your first reaction should be: "Okay, what's the initial total investment?" This question will filter out 90% of misleading information.

1-2. Beyond the Entry Fee: 7 "Hidden Costs" You Must Uncover Before Signing

Remember my friend Mark? After digging deeper, we discovered that the $8,000 coffee cart project hid a slew of ongoing "bloodsucking" fees beyond the visible cart and equipment costs. These expenses are usually buried in a single line of fine print in brochures, yet they directly impact your future profitability. These are the so-called "hidden costs," or more accurately, "ongoing fees." They operate like subscription services, steadily eroding your profits month after month, year after year. In my view, signing a contract without fully understanding these is like diving into a river without knowing its depth.

Below are the 7 critical recurring fees you must clarify before signing any agreement:

1. Royalty Fees: The most common charge, typically 4%-10% of your monthly gross revenue. That means for every $100 you earn, $4-$10 goes to headquarters. Insist on clarifying whether it's based on gross revenue or net profit—most are gross, meaning you pay even if you break even or lose money, as long as there's cash flow.

2. National Advertising Fund: Usually 1%-3% of your total revenue. This money is used by headquarters for national brand promotion, such as TV commercials and celebrity endorsements. Theoretically, this benefits you, but you have no control over how the funds are spent and cannot verify if these ads are effective in your local market.

3. Local Marketing Requirement: Beyond the national advertising fee, many brands mandate monthly spending on local marketing—either a fixed amount (e.g., $500) or a percentage of revenue (e.g., 2%). You fund this yourself, but spending is mandatory and monitored by headquarters.

4. Software/Technology Fee: In this digital age, nearly all franchise brands have proprietary software systems like POS systems, customer relationship management (CRM) systems, appointment scheduling systems, etc. You must pay monthly or annual fees to use these systems, typically ranging from $50 to $300.

5. Required Purchases: Many franchise systems mandate that you purchase raw materials, products, or even items like business cards and uniforms from headquarters or its designated suppliers. These products are often priced higher than market rates, effectively serving as a recurring revenue stream for headquarters.

6. Renewal Fee: Franchise agreements are usually for 5 or 10 years. Upon expiration, you must pay a "renewal fee" to continue operations. This fee can range from thousands to tens of thousands of dollars.

7. Transfer Fee: If you decide to exit the business and transfer your franchise to someone else, headquarters will charge a "transfer fee" to vet the new franchisee's qualifications.

Understanding these fees is essential to accurately estimate the total investment required for the business and determine the monthly profit margin needed to cover all costs and achieve profitability. This is precisely why our website's ROI Calculator exists—it factors in all these complex numbers to provide a more realistic profit projection.

2. Top 10 Low-Cost Franchise Opportunities Under $10,000

Alright, now that we've put on our "expert-level" glasses, we know how to distinguish between "franchise fees" and "total investment," and we're aware of hidden recurring costs to watch out for. With this new, more rational perspective, I've carefully selected 10 franchise opportunities from hundreds on the market that genuinely offer relatively low "initial total investment" and feature clear, transparent business models.

Please note: The "estimated initial total investment" figures below are sourced from brand websites or authoritative franchise portals (e.g., Entrepreneur.com, Franchise Business Review) for the 2024-2025 period. These represent a range, and your actual costs will vary by location and individual circumstances. I strongly recommend using this information as a starting point and conducting thorough due diligence.

2-1. Dream Vacations (Travel Planning)

Industry: Travel Services

Franchise Fee: ~$10,500 (Discounts often available, especially for veterans, community heroes, etc.)

Estimated Initial Investment: $1,800 - $21,900

Business Overview: This is a work-from-home travel consultant franchise. You'll operate as a professional travel planner, assisting clients with booking cruises, resorts, vacation packages, and more. The brand is part of World Travel Holdings, one of the world's largest cruise retailers, offering robust purchasing power and supplier relationships. This enables you to provide clients with competitive pricing and exclusive deals.

Pros:

Extremely Low Startup Costs: No physical storefront required, no inventory pressure—all you need is a computer and a phone.

High Flexibility: Work entirely from home with flexible scheduling—ideal for balancing family commitments or starting as a side hustle.

Robust Headquarters Support: Access over 1,500 hours of online training, one-on-one mentor guidance, and a powerful marketing support system.

Industry Outlook: Post-pandemic travel demand is rebounding strongly, especially for complex itineraries and group tours requiring professional planning.

Disadvantages (Be Honest!):

Commission-based income, unstable earnings: Your income relies entirely on commissions from successfully booked travel products. During the initial client-building phase, earnings may be highly irregular.

Intense competition: Online travel platforms (e.g., Booking.com, Expedia) and countless independent travel consultants are your competitors. You must develop unique services to attract clients.

Requires extreme self-discipline: Working from home sounds appealing but severely tests your self-management skills.

CTA & Tool Integration: "Does this business model—highly dependent on personal sales skills and client relationship management—align with your personality? Take 3 minutes to complete our Entrepreneur Assessment and discover where your strengths can be maximized."

2-2. Jazzercise (Fitness Dance)

Industry: Fitness & Wellness

Franchise Fee: ~$1,250

Estimated Initial Investment: $2,400 - $38,000

Business Overview: This is the first fitness program on our list and a truly iconic brand. Jazzercise blends dance with strength training, yoga, Pilates, and other elements to create fun group fitness classes. As a franchisee, you'll become a certified instructor teaching classes at community centers, schools, rented studios, and similar venues. Its investment floor is exceptionally low since you don't need an expensive dedicated gym from the start.

Pros:

Delivers on the headline promise: This is a genuine "low-cost fitness franchise" option, perfectly aligning with user search intent.

Turn passion into a career: If you love fitness, dance, and music, this program lets you turn your passion into income, offering high job satisfaction.

Flexible Venue Options:

Start by renting community activity rooms at minimal cost. As your student base grows, consider establishing your own studio—manageable risk.

Strong Brand Recognition:

Jazzercise is a global brand with over 50 years of history, offering ready-made choreography and music libraries—no need to develop your own programs.

Disadvantages (Be Honest!):

High Personal Competency Requirements: You're not just the owner but also the instructor. Your physical stamina, teaching charisma, and ability to energize the class directly determine your income.

Relatively Low Income Ceiling: Relying solely on teaching limits your time and energy, capping your earnings. This ceiling can only be broken by scaling to hire additional instructors.

Requires ongoing training and certification: To maintain teaching quality and safety standards, you must continually attend headquarters training and renew certifications.

CTA & Tool Integration: "Curious how long it might take to recoup your initial investment in opening a Jazzercise studio? Try our ROI Calculator. Enter your projected class size and pricing, and it'll generate a preliminary profitability timeline for you."

2-3. Buildingstars (Commercial Cleaning)

Industry: B2B commercial cleaning services

Franchise Fee: ~$995 - $1,995

Estimated Initial Investment: $2,245 - $10,499

Business Overview: This isn't ordinary residential cleaning. Buildingstars specializes in providing professional overnight cleaning services for office buildings, medical facilities, schools, and similar venues. Its model is unique: the franchisor handles client acquisition and provides initial client contracts, significantly reducing the biggest headache for new franchisees—finding customers. You only need to focus on delivering high-quality cleaning services and maintaining strong client relationships.

Pros:

Franchisor Provides Clients: This is the biggest highlight. For entrepreneurs who aren't strong in sales and marketing, it solves the biggest pain point.

Recurring Revenue: Commercial cleaning typically involves long-term contracts, ensuring stable, predictable monthly income.

Nighttime Work, Part-Time Flexibility: Most cleaning occurs after business hours, allowing you to operate evenings or even start as a side hustle.

Stable Demand: Commercial spaces require cleaning regardless of economic conditions, making this a relatively recession-proof industry.

Cons (Be Honest!):

Physical Demands: This is hands-on, labor-intensive work, especially during the startup phase.

Potentially Low Profit Margins: The cleaning industry is highly competitive with transparent pricing, leaving limited profit margins. Boosting profitability requires efficient management and scaling operations.

Staff Management Challenges: As your business grows and you hire employees, you'll face the challenges of recruiting, training, and managing cleaning personnel.

CTA & Tool Integration: "Buildingstars' model has headquarters securing clients while you handle service delivery. Another cleaning brand might require you to find clients yourself but offers higher commissions. Which suits you better? Add both to our Opportunity Comparison tool for a clear side-by-side comparison across startup costs, profit models, headquarters support, and more."

2-4. TSS Photography (Sports & Event Photography)

Industry: Photography Services

Franchise Fee: $0 (Yes, you read that right, but other startup costs apply)

Estimated Initial Investment: $8,580 - $46,550

Business Overview: TSS Photography specializes in capturing youth sports leagues, school events, and corporate functions. They pioneered a unique "zero franchise fee" model, though you must purchase a proprietary equipment and software package valued at approximately $7,500. You'll photograph school sports captains, proms, corporate award ceremonies, and more, selling photos through an efficient online system.

Pros:

Massive Market Demand: Every family with children is willing to pay for photos capturing their child's milestones. Schools and sports leagues also require professional photography services.

Highly Efficient Business Model: Headquarters provides a complete workflow from shooting and post-processing to online sales and order fulfillment, allowing you to focus solely on photography.

Work from Home with Flexible Scheduling: Except for on-location shoots, most post-processing and administrative tasks can be completed remotely.

Seasonal Peaks: Business volume intensifies during spring/fall sports seasons and graduation season, enabling rapid income generation in short bursts.

Cons (Be Honest!):

Requires Photography Skills and Passion: While training is provided, this job will be challenging if you lack interest in photography or struggle with interacting with children and parents.

Significant Seasonal Income Fluctuations: Peak seasons are busy, but off-seasons may yield minimal income, requiring careful financial planning.

Substantial Equipment Investment: Though there's no franchise fee, the initial equipment package represents a significant upfront cost.

CTA & Tool Integration: "Photography businesses require equipment investment, while cleaning businesses demand time and physical effort. Different business models have entirely distinct requirements for capital and personal skills. Before committing, why not use our Business Plan Generator to build a preliminary business plan? It guides you through critical questions about market, operations, and finances, making your decisions more informed."

2-5. Complete Weddings + Events (Wedding and Event Services)

Industry: Wedding and Event Planning

Franchise Fee: ~$10,000

Estimated Initial Investment: $10,000 - $15,000

Business Overview: This is a one-stop wedding and event service provider. As a franchisee, you'll build a team of DJs, photographers, videographers, lighting technicians, and photo booth operators to offer clients bundled services. You'll function more as a manager and salesperson rather than personally performing each service.

Pros:

High Profit Potential: Weddings and large events typically have higher budgets, and bundling multiple services significantly boosts profit per event.

Strong Scalability: Start by managing a small team and expand your service roster as business grows, offering a high income ceiling.

Headquarters provides robust system support: Headquarters offers CRM systems, marketing materials, and nationwide sales training to help you manage your team and acquire clients.

Cons (Be Honest!):

High management pressure: You must oversee a team of multiple freelancers, ensuring service quality and punctuality—a significant test of your leadership and organizational skills.

Weekends and holidays are peak work times: Weddings and events mostly occur on weekends and holidays, requiring you to be prepared to sacrifice personal time off.

High stakes: Weddings are once-in-a-lifetime events for clients. Any misstep can lead to disastrous consequences and a collapse in reputation.

CTA & Tool Integration: "Managing a team and going solo are two entirely different entrepreneurial experiences. What is your leadership style? Do you prefer managing people or managing tasks? Our Entrepreneur Assessment can help reveal your innate management potential."

5 Additional Low-Cost Franchise Options Worth Considering

To broaden your perspective, here are five equally promising low-cost ventures for preliminary research:

1. Cruise Planners: Similar to Dream Vacations, this work-from-home travel consultant franchise is backed by American Express, offering strong brand endorsement. Initial investment: approximately $2,295 - $23,617.

2. Fit4Mom: Another unique fitness franchise specializing in prenatal and postnatal exercise programs for mothers. Classes are typically held outdoors in locations like parks, significantly reducing venue costs. Initial investment ranges from $7,185 to $26,525.

3. Jan-Pro Cleaning & Disinfecting: Similar to Buildingstars, it's a major player in commercial cleaning, also emphasizing "headquarters-provided clients" as its key selling point. Initial investment ranges from $4,170 to $55,820.

4. N-Hance Wood Refinishing: Offers wood floor and cabinet refinishing services instead of full replacement. This provides a lower-cost, more eco-friendly home improvement solution with unique market demand. While the initial investment is slightly higher, some smaller package options offer relatively manageable starting points.

5. Corvus Janitorial Systems: Another major player in commercial cleaning, offering tiered franchise packages with highly competitive investment levels for the entry-level option.

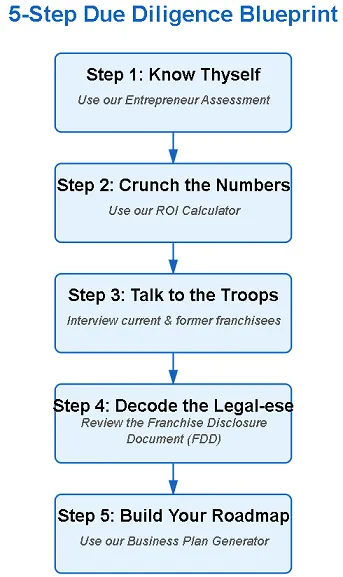

3. Your 5-Step Due Diligence Blueprint: From Dreamer to Decision-Maker

Alright, you might have two or three promising projects bookmarked now. But don't act impulsively! The real test begins here. The following process is my "5-Step Due Diligence Blueprint," tailored for you after synthesizing advice from numerous successful entrepreneurs and business consultants. It will guide you to think like a professional investor, systematically validate your choices, and ultimately make a decision you won't regret for years to come. This process embodies the full value of all tools on our website.

Step 1: Know Yourself - Entrepreneur Self-Assessment

In my view, one of the biggest reasons for startup failure is "mismatch between people and projects." An introverted tech enthusiast diving into a sales-driven business requiring daily interactions with strangers will likely suffer. Similarly, someone seeking stability and averse to risk will live in constant anxiety if they invest in a high-risk, high-return venture. Therefore, the first step in our due diligence isn't external research—it's introspection. You must answer these questions with utmost honesty:

How much capital can I realistically invest, fully prepared to lose it all in the worst-case scenario?

How many hours per week am I willing to commit? Can I accept working weekends and holidays?

What are my core competencies? Sales, management, technology, or service?

Is my primary goal to make quick money or build a meaningful, sustainable business?

How much pressure and uncertainty can I tolerate?

These questions may feel vague when pondered alone. That's precisely why we developed the Entrepreneur Assessment tool. Through a series of psychological and behavioral questions, it helps you quantify your risk tolerance, management style, work values, and core competencies. Upon completion, you'll receive a detailed report revealing which business model—service-oriented, management-focused, or sales-driven—aligns most naturally with your disposition. Think of it as your "entrepreneurial personality manual," providing clear direction for future decisions.

Step 2: Crunch the Numbers - The ROI Reality Check

Once you've identified a direction aligned with your personality, the next step is the brutal but necessary "number crunching." While any franchise brand will present you with rosy profit projections, you must conduct your own independent, conservative ROI analysis. The core questions to focus on are: "Considering all upfront investments and ongoing costs, what monthly revenue do I need to break even?" How long will it take to recoup my entire initial investment?" Ninety percent of first-time entrepreneurs either cannot or are unwilling to delve into these calculations. This is where the ROI Calculator comes into play. It's more than just a simple addition and subtraction tool. We'll guide you through inputting the following key variables:

Initial Total Investment: Based on our previous analysis, enter a relatively conservative total investment amount.

Estimated Monthly Revenue: Don't just use the highest figure provided by the brand. Try inputting low, medium, and high-scenario revenue projections.

Variable Costs: This refers to your product costs or raw material expenses, typically a percentage of revenue.

Fixed Monthly Costs: These are the "hidden costs" we mentioned earlier—royalties, advertising fees, software subscriptions, rent (if applicable), and your own base salary (yes, you must pay yourself!). The calculator instantly generates a report clearly showing your projected break-even point, monthly net profit, and payback period. Seeing that even under optimistic conditions it takes two years to recoup your investment will immediately ground your expectations. The value of this tool lies in forcing you to shift from the emotional mindset of a "dreamer" to the rational mindset of a "businessperson."

Step 3: Talk to Your "Comrades" - How to Interview Current and Former Franchisees

If the FDD is the official manual, then talking to real franchisees is like reading "genuine user reviews." This is by far the most crucial and valuable step in the entire due diligence process. The franchisor must provide a contact list for all current franchisees in Item 20 of the FDD, sometimes including former franchisees who exited within the past year. Your task is to muster the courage to make at least 10-15 calls. But don't engage in small talk. Prepare a list of pointed questions that get straight to the heart of the matter. Remember, these are ordinary people just like you. Approach them sincerely, and most will be willing to share. Essential questions for current franchisees:

1. How much did your actual total investment differ from the FDD's estimates? By how much?

2. How long did it take you to truly break even? How long before you started paying yourself a decent salary?

3. Was the training and support provided by headquarters truly useful after opening? Or did you mainly figure things out on your own?

4. Do you feel the royalty and advertising fees are worth paying? How many actual customers did headquarters' marketing bring you?

5. On a scale of 1 to 10, how satisfied are you with headquarters? Why?

6. How many hours do you actually work daily/weekly? Does this match your expectations before signing the contract?

7. If given the chance to choose again, would you still join this brand? Even more crucial are questions for former franchisees:

8. Why did you decide to exit/not renew?

9. What was your biggest operational challenge? How did headquarters help resolve it (or fail to)?

10. What do you consider the brand's biggest pitfall? The answers to these questions will paint a far more authentic picture than any official brochure. You'll hear success stories alongside complaints of failure—and both are invaluable.

Step 4: Decoding the "Bible" - Your FDD Speed-Reading Guide

The Franchise Disclosure Document (FDD) is a thick, legalese-laden document that can intimidate even the most passionate entrepreneurs. But understand this: it's the only legally mandated channel through which the franchisor must disclose all critical information to you—it exists to protect you. You don't need to decipher every word, but you must focus on these core items:

Item 1 & 2: Company Background and Executive Experience. Examine the brand's years in operation and whether executives have a history of bankruptcy or lawsuits. An unstable headquarters poses significant risk.

Item 3 & 4: Litigation and Bankruptcy History. If the franchisor or its executives frequently litigate against franchisees, this is an extremely dangerous signal.

Item 5 & 6: Initial Fees and Ongoing Costs. This section details all fees discussed earlier. Carefully review it to spot any charges you may have overlooked.

Item 7: Estimated Initial Investment. This is the official total investment estimate. Examine its breakdown and compare it to your own estimates.

Item 19: Financial Performance Statement. This is the most "sexy" part of the FDD, though not all brands provide it. If included, it shows average revenue, profit, and other metrics for existing franchisees. Note: This is historical data only and does not guarantee your future earnings. Approach these figures critically.

Item 20: Franchisee List. This is where you'll find your "goldmine" for follow-up calls. Examine how many franchisees joined and how many exited over the past three years. If the exit rate is excessively high, be sure to investigate the reasons. My recommendation is that once you've firmly established your intent, spend a few hundred dollars to hire a lawyer specializing in franchise law to review the FDD for you. This investment may be the most worthwhile one you make throughout your entire entrepreneurial journey.

Step 5: Build Your Roadmap - Business Plan Generator

Congratulations! After completing all the steps above, you've transformed from a novice into a near-professional project analyst. You've gathered a wealth of information: your self-assessment report, ROI calculations, franchisee interview notes, key insights from the FDD... Now, you need a place to consolidate all this scattered information into your own clear roadmap for action. That's the mission of our website's Business Plan Generator. It's not about writing a complex, multi-page report for the bank. It's a guided tool that asks questions to help you organize all your gathered information into a structured framework:

Part One: Executive Summary. Summarize your business concept and goals in a few sentences.

Part Two: Company Description. Explain why you chose this franchise brand and how it aligns with your personal assessment.

Part Three: Market Analysis. Describe potential customers and competitors in your region.

Part Four: Organization and Management. Outline your role and whether hiring employees will be necessary in the future.

Part Five: Services and Products. Detail the services you will provide.

Part Six: Marketing and Sales Strategy. Develop your own localized marketing plan, incorporating insights from headquarters and existing franchisees.

Part Seven: Financial Projections. Integrate your ROI calculations to form a financial outlook for the next 1-3 years. As you complete this preliminary business plan guided by our tools, you'll discover your understanding of this project has reached a whole new level of depth. You're no longer making decisions based on gut feelings, but on data and thorough research. Your confidence will be built on a solid foundation.

4. Red Flags: When a "Great Opportunity" Seems Too Good to Be True

During your research, you may encounter opportunities that feel "too good to be true." Trust your instincts. Through years of observation and interaction, I've identified several clear "red flags." When you encounter them, immediately sound the alarm, slow down, or walk away altogether.

Excessive Sales Pressure: If a franchise brand's sales representative constantly urges you to "sign quickly," tells you "this offer expires tomorrow," or claims "only one spot remains in your area," this is usually a major red flag. A reputable, confident brand will give you ample time to conduct due diligence.

Avoiding Key Questions: When you inquire about Item 19 financial data, average franchisee income, or contact information for former franchisees, and the representative gives vague answers, evades the question, or outright refuses to provide it, be immediately wary. Transparency is the foundation of trust.

Guaranteeing Profits: In the U.S., franchise brands are strictly prohibited by law from making any "guarantees" to potential franchisees regarding income or profits. If someone tells you "guaranteed return on investment within a year" or "our franchisees earn at least XX thousand," they are not only lying but also breaking the law.

Poor Franchisee Feedback: If multiple franchisees you speak with complain about inadequate headquarters support, difficult-to-use systems, or feeling deceived, this is more persuasive than any FDD document. Don't believe you're the exception who can change all that.

Excessively high franchisee attrition rate: You can calculate this yourself using Item 20 of the FDD. If a system with 200 stores has seen 30 closures or transfers in the past year, the attrition rate is a staggering 15%. This is a highly dangerous signal indicating potential fundamental flaws in the system's business model.

Remember my words: The loss from abandoning a bad opportunity is zero. But seizing a bad opportunity could cost you everything.

5. Closing Thoughts & My Personal Perspective: Your journey has just begun, but you are not alone

Having written this far, I wish to share some deeper personal reflections. While this article outlines tools, steps, and methodologies, the core idea I ultimately want to convey is this: Entrepreneurship is a journey of cultivating "cognitive discipline." How far you go depends not on how much capital you start with, but on how deeply you understand business and how profoundly you respect risk.

In my view, 99% of "franchise ranking" articles out there are fundamentally flawed: they attempt to give you ‘answers' directly. They tell you "this is good" or "that is great," yet never teach you "why it's good" or "how to judge if it's good for you." This is an extremely irresponsible approach. Because when it comes to entrepreneurship, there is never one universal "best answer." A project that's perfect for a social butterfly could be a disaster for a tech geek.

That's why I created this website and developed these tools—to change this model. I don't want to give you "fish"; I want to teach you "how to fish." I firmly believe a great entrepreneurial service platform derives its value not from delivering information, but from providing frameworks; not from offering answers, but from posing the right questions; not from peddling opportunities, but from empowering decision-making.

Our tools—Entrepreneur Assessment, ROI Calculator, Opportunity Comparison, and Business Plan Generator—aren't designed to tell you "what to do." Instead, they guide you in "what to think." They are your training wheels for thinking, your dashboard for decision-making. By using them, you'll transform from a passive information receiver into an active business analyst. This, I believe, is the "unique value" our website offers you—something competitors simply cannot replicate.

6. Final Summary and Actionable Recommendations:

You've just finished reading what might be the longest "low-cost franchise guide" online. Your takeaway should be more than just 10 franchise options—it should be a complete, reusable decision-making system.

Your major gains:

You've learned to evaluate franchise opportunities like an expert, understand the difference between "franchise fees" and "total investment," uncovered the truth about "hidden costs," and gained a 5-step due diligence blueprint. Most importantly, you now have 4 powerful tools ready to assist you at every step.

Next Steps: Don't just save this article. Knowledge only gains power when applied. I strongly urge you to take the first step now:

1. Click to visit our Entrepreneur Assessment page and spend a few minutes completing an in-depth self-analysis.

2. With your assessment report in hand, revisit the 10 opportunities outlined in this article and select 2-3 that align best with your profile.

3. Begin your due diligence journey—boldly reach out to brands and speak with actual franchisees.

7. Final Risk Warning:

Allow me one final reminder: entrepreneurship is a path fraught with uncertainty. Even with flawless due diligence, risk remains ever-present. Markets shift, competition intensifies, and unforeseen challenges arise. Always maintain reverence for risk—never invest money you cannot afford to lose. Prepare for the worst, then strive for the best.

Good luck, future entrepreneur! We'll be with you every step of the way.

8. Citations:

Dream Vacations Franchise Cost & Fees | Entrepreneur.com

Jazzercise, Inc. Franchise Cost & Fees | Entrepreneur.com

Buildingstars International Franchise Cost & Fees | Entrepreneur.com

TSS Photography Franchise Cost & Fees | Franchise Gator

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.