Hey, friend! Great to connect with you here.

I bet you're staring at your screen right now, mulling over one burning question: "Is this Brain Balance franchise really worth risking everything I have?"

I totally get that feeling. Back in 2021, one of my clients—let's call him Alex—almost fell into a similar "hot project" trap. It was a flashy restaurant brand—trending online, with influencer lines and social media buzz. Alex was about to sign a $100,000 franchise agreement. But at the last minute, we sat down and peeled back layer after layer: dissecting the business model, uncovering hidden costs, and exposing the carefully "packaged" negative reviews. What do we uncover? A staggering closure rate and a mandatory, inflated supply chain that would bleed any new franchisee dry within a year. Alex walked away, disappointed but relieved. Two years later, he still counts himself fortunate to have dodged that bullet.

I share this story to emphasize: any business investment decision—especially in franchising, a realm rife with allure and pitfalls—must never be judged by appearances alone. You must become a detective, an analyst, a skeptic.

Today, this report serves as your "detective toolkit." Together, I'll guide you through a thorough, systematic, and meticulous dissection of the Brain Balance project—inside and out. We won't sing praises, nor will we engage in malicious smear campaigns. We focus solely on data, logic, and reality. This article has one goal: After reading it, you should be able to answer that core question clearly—"Is this the right opportunity for me?"

So brew a cup of coffee, and let's embark on this deep dive into business exploration.

Compliance and Risk Warning (Required Reading):

This report is for informational and educational purposes only and does not constitute any financial or investment advice. All key data regarding costs, financial performance, etc., must be independently verified by reviewing the Franchise Disclosure Document (FDD) provided by Brain Balance and consulting professional financial advisors and attorneys. Any franchise investment involves significant risks, including the potential loss of your entire investment.

1: Fundamental Project Analysis: How Solid Are Brain Balance's Brand Strength and Business Model?

Before committing real money, the first step is always due diligence. A brand's history, legal standing, and the health of its business model determine whether your investment rests on bedrock or quicksand. Here, we'll delve deep into Brain Balance's "financial foundation."

1-1: Brand Background Verification: Is It Truly a "Top Student"?

A brand's credibility isn't built on advertising hype—it's forged by its history, team, and legal track record.

Brand History & Parent Company: Brain Balance Achievement Centers was founded in 2007 by Dr. Robert Melillo, a renowned expert in pediatric neurobehavioral disorders. This provides the brand with a powerful "professional" endorsement. Its parent company is BBA Development, LLC. With over 15 years of operational history, it has weathered multiple economic cycles, demonstrating resilience against risks. Unlike fleeting "trendy" brands that fade after a year or two, its roots run relatively deep.

Core Team Background: I believe evaluating a company requires examining its executive team's credentials. I specifically checked LinkedIn and found that Brain Balance's current CEO, Dominick T. Fedele, along with several other executives, possess extensive experience in franchise management and market operations. What does this signify? It means they understand franchisees' pain points and know how to operate a nationwide chain system. This makes them far more reliable than a company led purely by "idealistic scientists."

Legal Risk Scan (Importance of the FDD): This is the most critical part of due diligence! In the U.S., all legitimate franchise brands must provide a document called the **FDD (Franchise Disclosure Document)**. This hundreds-of-pages document is the brand's "medical report." I strongly recommend focusing on the following items once you obtain this document:

Item 3 (Litigation History): Check if the franchisor has been involved in numerous lawsuits with franchisees. If they're mired in litigation—especially regarding contract fraud or site selection disputes—it's a major red flag.

Item 4 (Bankruptcy History): Verify if the brand founder or parent company has a history of bankruptcy.

Trademarks & Patents: Verify that the "Brain Balance" trademark is validly registered and that its core curriculum methodology is protected by intellectual property rights. This safeguards you from the sudden proliferation of "knockoff" competitors after joining.

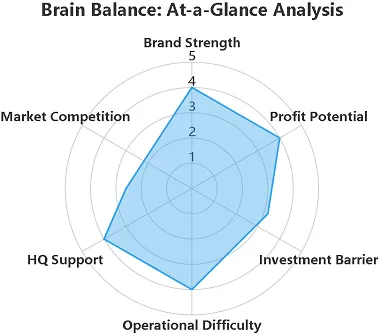

Brand Credit Rating Report (Preliminary)

Brand Strength: ★★★★☆ (4/5) - Features expert founders and a professional operational team; compelling brand narrative.

Historical Stability: ★★★★☆ (4/5) - Over 15 years of operation; market-proven business model.

Legal Risk (Based on Public Information): Low. Must be verified against the latest FDD document.

Risk Warning: Any program involving children's health demands exceptional professionalism and safety standards, posing potential reputational risks during operations.

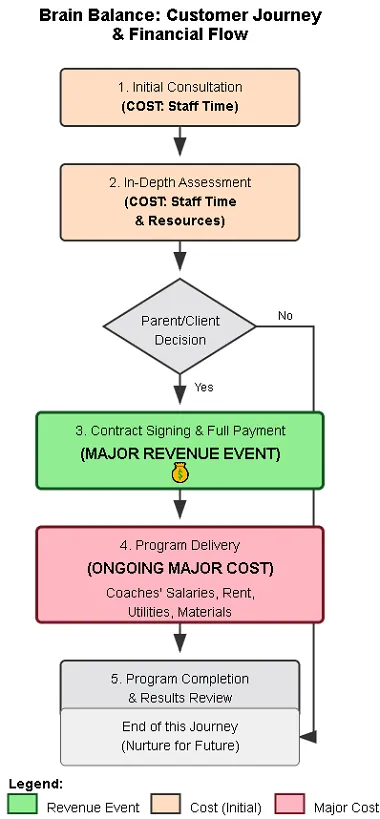

1-2: Business Model Breakdown: How Does This Venture Generate Revenue?

Vision and background alone aren't enough—we must analyze the financials.

Revenue Structure: Brain Balance's income primarily comes from personalized training programs purchased by clients for their children. These programs are typically offered as packages at substantial costs (ranging from thousands to tens of thousands of dollars). As a franchisee, your revenue stems from these program fees. Your payments to headquarters consist of three main components:

1. Franchise Fee: A one-time payment covering brand usage rights, initial training, etc.

2. Royalty Fee: Typically charged monthly or weekly as a percentage (e.g., 7%-9%) of your gross revenue. This is an ongoing expense.

3. Marketing Fee: Also charged as a percentage, supporting the headquarters' national brand promotion efforts.

Single-Store Profit Model (Estimated):

Average Ticket: Extremely high. A complete program may range from $10,000 to $15,000. This means you don't need to handle hundreds of customers daily like a fast-food restaurant; serving just a few families per month can generate substantial revenue.

Customer Flow: Low frequency but high value. Your primary task isn't attracting massive foot traffic, but precisely identifying families with genuine needs and purchasing power, then earning their trust.

Gross Profit Margin: Since the core "product" is training programs (services) rather than physical goods, gross profit margins are theoretically higher. The primary costs are labor (professional coaches) and rent. Compared to industry benchmarks (typically 50%-70% gross profit), Brain Balance likely falls in the upper-middle range of this spectrum.

Franchise Support System:

Training: Headquarters provides highly systematic training covering program delivery, center management, and marketing. This is crucial for investors without prior industry experience.

Site Selection Support: Headquarters offers data models to help identify optimal locations, significantly reducing trial-and-error costs.

Marketing Resources: Franchisees gain access to shared brand advertising, website traffic, and standardized marketing materials.

Overall, Brain Balance operates a classic "high-ticket, service-intensive, expertise-driven" business model. Its strengths lie in substantial profit margins and strong client retention; its challenges demand exceptional staff expertise and highly precise marketing execution.

2. Market Feasibility Analysis: Does Your City Need a Brain Balance?

Even the best project is doomed to fail if launched in the wrong market. In this chapter, we'll act like urban planners to assess whether your target market truly has the fertile ground for this "seed" to sprout.

2-1: Localization Adaptation Model: Can the Project "Take Root" in Your Territory?

Consumer Culture Compatibility: Brain Balance's core philosophy is "non-pharmaceutical intervention." Assess how receptive parents in your region are to this concept. Do they prioritize traditional medicine, or are they willing to invest in this emerging, training-based approach? While acceptance is generally high in upper-middle-class communities in the U.S., other cultural contexts may require more market education.

Competitive Landscape Scan: This is a hands-on analysis. You need to:

1. Open Google Maps, center on your target location, and search for all competitors within a 3-5 km radius.

2. Direct competitors: Other child development centers, sensory integration training facilities.

3. Indirect competitors: After-school tutoring centers (e.g., Kumon, Sylvan Learning), special education schools, even pediatric rehabilitation departments in hospitals.

4. What you need to do: Visit these places in person, or at least browse their websites and social media. Record their pricing, service offerings, and customer reviews. They are your most direct future "customer poachers."

Policy Compliance: What specific permits are required to open such a center in your state or city? Beyond a basic business license, are education or health-related licenses needed? Consult a local lawyer or business advisor in advance.

2-2: Demand Forecasting: How Many "Fish" Are in Your Pond?

This section relies on data, not intuition.

Demographic Analysis:

1. Target Audience: Your core clients are families with children facing attention, behavioral, social, or learning challenges. These households typically have upper-middle-class or higher incomes.

2. Data Tools: Utilize public demographic websites (e.g., U.S. Census Bureau's data.census.gov) to find median household income and number of school-age children (ages 5-17) in your target area.

3. A Simple Estimation Model: (Total school-age children in area) x (Prevalence rate of relevant issues, approx. 10%-15%) x (Percentage of middle-to-high-income households) x (Your projected market share) = Your potential customer base.

Search Volume Validation:

Tool Application: Open Google Trends (trends.google.com).

Action: Enter keywords like "ADHD help for kids," "learning disabilities support," or "sensory integration therapy," and set the location to your target city.

Analysis: Observe search trend patterns for these keywords. Sustained high or rising search volume indicates genuine and active local demand.

Output: Market Potential Scorecard

Market Demand (based on population and search data): High / Medium / Low

Competition Intensity: High / Medium / Low

Cultural & Policy Fit: High / Medium / Low

Overall Rating: ★★★★★ (1-5 stars)

Recommended City List (Examples):

>>>City A, e.g., Plano, TX: High household income, excellent school districts, moderate competition, significant potential.

>>>City B, e.g., Irvine, CA: Strong demand but extremely competitive; requires differentiated operations.

>>>City C, e.g., Tampa, FL: Rapidly growing market, blue ocean opportunity.

3: Operational Fit Analysis: Can You Really Handle This Store?

Alright, we've confirmed the project's viability and market demand. Now comes the most practical question: How much will it cost to launch and operate this center? When can I expect a return on investment? What level of support will headquarters provide?

3-1: Investment Return Calculation: Let's Get the Numbers Straight

This is the most nerve-wracking yet exciting part. I'll provide a framework, but you'll need to fill in the specifics based on local conditions and the FDD.

Initial Investment: This is a one-time startup capital.

Franchise Fee: ~$49,500 (Based on public data; subject to FDD)

Leasehold Improvements: ~$50,000 - $150,000+ (Depends on store size and condition)

Equipment & Software: ~$40,000 - $60,000

Initial Training Travel Expenses: ~$5,000 - $10,000

Grand Opening Marketing: ~$15,000

Additional Funds (3-Month Reserve): ~$50,000 - $100,000 (Critical! Covers initial rent, wages, etc.)

Data Sources: Brand FDD Document Item 7 + Local Renovation Company Quotes + Numbeo Cost of Living Database www.numbeo.com for estimating rent and labor costs.

Total: Based on public information, Brain Balance's total initial investment typically ranges from $200,000 to $400,000 USD. This is a significant amount.

Monthly Operating Costs:

Rent: One of the largest fixed costs.

Payroll: Salaries for the center director, coaches, and administrative staff. This is the largest variable cost.

Royalties & Marketing Fees: Paid as a percentage of gross revenue.

Other: Utilities, internet, insurance, consumables, etc.

Payback Period Sensitivity Analysis: The payback period is not a fixed number; it depends on your profitability. I recommend creating a simple spreadsheet for sensitivity analysis:

| Monthly New Client Enrollment | Monthly Revenue (Est.) | Monthly Net Profit (Est.) | Annual Net Profit (Est.) | Estimated Payback Period |

|---|---|---|---|---|

| Pessimistic Scenario (2) | $20,000 | $1,000 | $12,000 | >10 years (Unfeasible) |

| Neutral Scenario (4) | $40,000 | $8,000 | $96,000 | ~3–4 years |

| Optimistic Scenario (6) | $60,000 | $15,000 | $180,000 | ~1.5–2 years |

Tool Application Tip: Does this table look complicated? Don't worry! This is exactly where our website's ROI Calculator tool comes in handy. Simply input your estimated costs and potential revenue, and it will automatically generate a more detailed return analysis for you. But remember, the tool is an aid—the accuracy of the data you input determines the value of the results.

3-2: Headquarters Support Evaluation: Can They Be Counted On When It Matters?

Franchising isn't just about buying a brand—it's about acquiring a support system.

Emergency Response Time: When critical equipment malfunctions or you face a difficult customer complaint, headquarters' response speed becomes your lifeline. When speaking with existing franchisees, always ask: "How long does it take to get an effective response from headquarters during an emergency?" Below 4 hours is excellent; over 24 hours warrants caution.

New Product Development Frequency: The child development field is constantly evolving. A stagnant brand will quickly become obsolete. Does headquarters update curriculum content or introduce new technologies annually? At least 2 updates per year is the industry baseline.

Localized Marketing Support: Headquarters collects your market fees, but how much is actually invested in your local market? Do they provide generic ad templates, or do they collaborate with you to analyze your local market and develop precise marketing strategies?

You must obtain this information through interviews with existing franchisees—it's the most authentic firsthand data. Item 20 of the FDD lists contact information for all current and former franchisees.

4: Risk Control Matrix: How to Avoid Pitfalls and Cut Losses in Time?

No investment is 100% safe. A mature investor doesn't seek "zero-risk" projects but knows how to identify, assess, and manage risks. I've designed a three-tier risk response system for you.

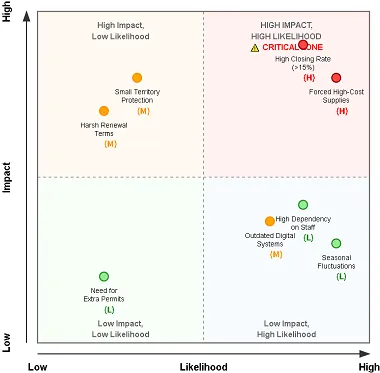

4-1: High-Risk Items (Red Alert, Immediate Rejection)

If you encounter any of the following situations, I personally recommend that you immediately stop considering this project.

Brand's average store closure rate over the past 2 years > 15%: This is the most critical indicator. Item 20 of the FDD discloses franchisee count changes over the past three years. If closures significantly outnumber new openings, it indicates serious systemic issues.

Contract contains mandatory high-price procurement clauses: If the contract requires you to purchase equipment or materials from headquarters or its designated suppliers at prices significantly above market rates, this constitutes a "legal" trap.

FDD Item 19 (Financial Performance Statement) data is vague or unavailable: If the franchisor is evasive about "how much franchisees can actually earn," it typically means the real data is unfavorable.

Numerous litigation records with franchisees: As mentioned earlier, this is direct evidence of relationship breakdown.

4-2: Medium-Risk Items (Yellow Alert: Requires Negotiation or Focused Evaluation)

These issues aren't necessarily fatal but can severely impact your profitability and operational freedom.

Excessively small territorial protection radius (e.g., <1 km): This allows headquarters to open another store adjacent to yours, creating direct internal competition. Negotiate for a larger protected zone with clear demographic or geographic boundaries.

Outdated headquarters digital systems: By 2025, chains still managing customers and inventory via Excel will suffer severely from operational inefficiency. A robust CRM (Customer Relationship Management) system and AI-driven management platform are standard requirements.

Harsh franchise renewal terms: For instance, requiring payment of a high renewal fee or granting the headquarters the right to refuse renewal without cause.

4-3: Low-Risk Items (Green Alert: Acceptable but Requires Preparation)

These are normal challenges most businesses encounter, requiring advanced contingency planning.

Requires additional standard operating permits: For instance, health or education licenses in certain regions. This is merely a procedural matter requiring time and modest investment.

Significant seasonal fluctuations: For example, summer is peak season while back-to-school season is off-peak. You must plan cash flow in advance, setting aside at least three months' operational reserves to weather slow periods.

High reliance on key employees: For instance, if your star coach leaves, they may take clients with them. Establish standardized training systems and incentive mechanisms to reduce dependence on any single employee.

5: Industry Insights: Viewing Brain Balance from a Higher Perspective

To truly understand a project, you must look beyond its immediate context to the broader industry landscape.

Market Characteristics Analysis: Children's education and health constitute a "recession-proof" sector. Regardless of economic conditions, parents consistently demonstrate the strongest willingness to invest in their children. Simultaneously, this market is becoming increasingly segmented and specialized.

Typical Opportunity Case: Imagine an emerging middle-class neighborhood with numerous young families and top-tier schools, yet no comparable services within a 5-kilometer radius. This represents a classic "blue ocean" market. As the first entrant, you gain a significant first-mover advantage.

Key Success Factors:

1. Trust: Parents entrust their children to you—trust is the sole foundation. Your professionalism, transparency, and empathy outweigh any marketing tactic.

2. Results: Ultimately, customers vote with their feet. Whether your training programs deliver observable improvements for children is central to word-of-mouth growth.

3. Localized Community Marketing: Building strong partnerships with schools, pediatricians, and community centers proves more effective than national media advertising.

Industry Trend Insights:

1. Personalization & Technology: AI-assisted assessments and customized training plans represent the future.

2. Holistic Family Support: Moving beyond child training to provide guidance and support for parents will be a new growth area.

3. Hybrid Model: Offering some courses or assessments online increases convenience and flexibility. You should review Brain Balance's development plans in this area.

6: Frequently Asked Questions (FAQ): Top 5 Questions Entrepreneurs Ask

6-1. Can I join without any background in child education or neuroscience?

Answer: Yes, but with a caveat. Brain Balance positions you as a manager and operator, not as a hands-on instructor. You will need to recruit and manage a professional team. Therefore, your business management skills, marketing capabilities, and leadership are more critical than specialized expertise. Of course, passion for this field is a significant plus.

6-2. Brain Balance's approach sounds somewhat "esoteric." Is it pseudoscience?

A: This is an excellent and controversial question. Brain Balance's theoretical foundation is "Functional Disconnection," which posits poor connectivity between the brain's hemispheres. Its methodology is not widely accepted as a standard therapy within mainstream medicine, and some studies question its efficacy. However, numerous parents and case studies report significant positive outcomes. As an investor, you must recognize this: you are selling a complementary, non-medical program. When marketing, you must strictly adhere to headquarters' guidelines, avoiding any medical terminology or promises to "cure" any disease, or you will face significant legal risks.

6-3. How much can I actually earn? Is Item 19 in the FDD reliable?

Answer: Item 19 of the FDD provides historical data on franchisee revenue or profits. This data itself is audited and legitimate. However! It typically shows only averages or medians, and these are historical figures. They do not represent your future. Your profitability depends on your location selection, cost control, marketing skills, and team management. Therefore, treat Item 19 as a reference benchmark, not a guarantee. Then, use our website's ROI Calculator combined with your own local data to perform a more personalized assessment.

6-4. What if I want to exit due to poor performance?

A: Franchise agreements are typically long-term contracts spanning 5-10 years. Early exit usually constitutes a breach of contract, potentially resulting in the loss of your entire investment and possible penalties. The primary exit strategy is reselling your franchise rights to another investor. However, an unprofitable center is difficult to sell at a favorable price. Therefore, before committing, you must be prepared to "burn your boats" and ensure you have sufficient reserves to weather the most challenging startup period.

6-5. What are Brain Balance's advantages compared to more established brands like Kumon or Sylvan Learning?

Answer: This is an excellent positioning question. Kumon and Sylvan primarily focus on academic tutoring (math, reading). Brain Balance, however, addresses a more fundamental area—brain function and learning capacity itself. Its target audience is families where "the child is intelligent but struggles to absorb information." This represents a more niche, less competitive blue ocean market. Your marketing message isn't "boosting grades," but "unlocking your child's full potential." This differentiated positioning is precisely its core competitive advantage.

7. My Personal Perspective and In-Depth Insights

Alright, friends, we've thoroughly examined Brain Balance inside and out. Now, I want to step outside the framework of objective analysis and share some of my personal thoughts with you.

In my view, Brain Balance is a quintessential "high-risk, high-reward, high-idealism" business venture.

First, it carries immense "passion" value. This isn't a business selling burgers or bubble tea. Your daily work involves helping children in distress and anxious families. When you see a child become more confident and happier because of your support, that sense of accomplishment is priceless. If you're an entrepreneur driven by a sense of mission, hoping your work creates a positive social impact, this aspect will hold unparalleled appeal for you.

Second, its business model inherently holds "high-reward" potential. Premium pricing means you avoid getting bogged down in low-cost competition. Once you establish local reputation and trust, profitability becomes substantial. It's akin to running an exclusive private clinic rather than a mass-market pharmacy.

However, you must also acknowledge its inherent "high risks." The first risk is the substantial initial investment and operational costs. This makes it unsuitable for small-scale entrepreneurs. You need robust financial resources and strong risk-bearing capacity. The second risk is the high dependence on human capital. Your center director and coaching team are your core assets. Recruiting, training, and retaining these professionals will be your greatest daily management challenge. The third risk is the scientific controversy we mentioned earlier. You must possess exceptional communication skills to clearly explain the program's principles and limitations to parents, manage their expectations, and avoid disputes over "unmet promises."

So, what kind of investor is this project suited for?

1. Someone with ample capital and a long-term investment mindset. Don't expect a six-month return on investment.

2. Someone with outstanding management and marketing abilities, particularly skilled at building local community relationships.

3. Genuine passion for child development, not merely treating it as a money-making machine.

4. Proven risk management skills, with clear recognition of the program's strengths and weaknesses, and contingency plans in place.

If you embody these qualities, Brain Balance could truly be an exceptional opportunity to achieve both financial freedom and personal fulfillment. However, if you lack these traits, forcing entry could turn into a nightmare.

8: Summary, Action Recommendations, and Final Risk Warning

8-1: Deliverable: Your One-Page Decision Report

To facilitate your decision-making, I've condensed all key information into a "Decision Map."

Competitor Comparison Table:

| Feature | Brain Balance | Kumon | Sylvan Learning |

|---|---|---|---|

| Positioning | Brain-function development | Academic skills (math & reading) | Personalized academic tutoring |

| Investment | High (US$200k–400k) | Low (US $70 k–150k) | Medium (US $80 k–1180k |

| Average Revenue per Customer | Extremely high | Low | Medium-high |

| Core Barriers | Proprietary curriculum system | Standardized textbooks | Personalized instructional plans |

| Target Audience | Well-funded, operation-focused managers | Educators seeking sta able cash flow | Entrepreneurs with teaching or management experience |

Localization Execution Checklist (120-day countdown):

Day 1-30: Legal and financial consultation, obtain and review FDD, conduct preliminary market research.

Day 31-60: Submit franchise application, interview existing franchisees, finalize financing plan.

Day 61-90: Sign contract, begin site selection, attend headquarters training.

Day 91-120: Store renovation, staff recruitment, launch pre-opening marketing, prepare for grand opening!

8-2: Your Next Steps

1. Self-Assessment: Honestly evaluate whether you align with the investor profile outlined above. Use our website's Entrepreneur Assessment tool to assist you.

2. Contact the Official Site: Visit Brain Balance's official franchise website to formally submit an information request and obtain the latest FDD documents.

3. Seek Professional Assistance: Hire a lawyer familiar with franchise law to review the contract, and engage an accountant for detailed financial projections.

4. Site Visits: Identify several Brain Balance centers near you and experience them firsthand as a prospective client. Observe their service processes, professionalism, and environment.

5. Conversations with Franchisees: This is the most critical step! Locate contact information for at least 5 current and 2 former franchisees from the FDD and engage in in-depth conversations. Ask them the most candid and probing questions.

8-3: Final Risk Warning

I must reiterate: this report is based on publicly available information and industry experience. It cannot replace your own due diligence. There are no "guaranteed success" magic bullets in franchising. Market shifts, policy changes, or even a single negative incident could impact your business.

Stay vigilant and cautious. Prepare for the worst while pursuing the best outcome.

Best of luck, future entrepreneur!

9:Citation Sources

U.S. Census Bureau Data

Numbeo - Cost of Living

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.