Chapter 0: Introduction - Your Franchise Journey: A Wise Investment or a Blind Gamble?

Beyond the Hype: Why Most Franchise Reviews Miss the Mark

Hey there, friend! Welcome to this space.

I know why you clicked on this article. A fire may be burning inside you—a flame of desire to take control of your destiny and build your own business. Franchise. The word sounds like that paved "shortcut"—someone builds the brand for you, someone teaches you how to run it, and all you need to do is invest your money and passion to reap the rewards. Right? Honestly, I've seen too many people clinging to this idea. I recall around 2018, I knew a friend named David, a talented baker passionate about crafting exquisite cakes. Tired of working for others, he saved every penny, determined to open his own cake shop. That's when a flashy, trendy cake franchise caught his eye. Their brochures featured long customer lines, sleek storefronts, and enticing projected returns. He was thrilled, feeling his dream was about to come true. He attended their headquarters' franchise seminar, where the atmosphere was electric and people were signing contracts left and right. He was almost ready to swipe his card on the spot.

Fortunately, he called me first. Over the phone, I asked him just a few questions: "Have you reviewed their Financial Disclosure Document (FDD)? Have you spoken with at least five former franchisees who've closed their shops? Do you understand exactly where their marketing fees go and what the conversion rates are?" Silence followed. He couldn't answer a single question. All he'd focused on was the brand's fame and that seemingly perfect "projected" return.

This incident struck a chord with me. I realized that most articles out there about "how to choose a franchise" just regurgitate platitudes. They give you a checklist, list the pros and cons of real brands, but they don't explain how they reached those conclusions. They're giving you fish instead of teaching you to fish. When you look at the next brand, you're still lost.

That's why this article aims higher. I won't simply declare "Brand A is better than Brand B." Instead, I'll share with you—without reservation—a decision-making system I've refined through years of research and observation: a complete, actionable framework. After reading it, you'll stop being a passive information consumer and learn to actively, critically dissect any franchise opportunity. I'll also guide you step-by-step on how to use tools like our [ROI Calculator] and [Entrepreneur Assessment] to transform fuzzy feelings into clear data, empowering you to become your own franchise consultant.

Ready? Let's turn your franchise journey from a high-stakes gamble into a carefully calculated investment with higher odds of success.

Chapter 1: The Foundation of Evaluation: 5 Core Characteristics of Any Excellent Franchise System (The C.O.R.E.S. Framework)

Forget complex business models. In my view, a franchise system worthy of your life savings boils down to five core dimensions for evaluation. I summarize these as the C.O.R.E.S. framework, standing for: Cash Flow, Operations, Reputation, Ecosystem, and Scalability. These five letters form the "yardstick" you'll use to measure every future business opportunity—the "fishing rod" you build with your own hands.

C - Cash Flow & Capital Efficiency

Remember, friends: we're discussing a business, and cash flow is its lifeblood. No matter how dazzling a franchise brand's pitch may be, if its single-store model fails to generate healthy, sustainable cash flow, it's a bottomless pit. Capital efficiency determines how long it takes for your investment to yield returns—and whether those returns justify the risks you're taking. That's why our first step in evaluation is to strip away the glossy marketing veneer and confront the cold, hard numbers.

How to Read FDD Section 19 Like a Pro (Financial Performance Report)

The Franchise Disclosure Document (FDD) is the "bible" of franchising—a legally required document that the franchisor must provide you. Section 19 is one of its most critical chapters, as it reveals the financial performance of existing franchise locations. But franchisors often play tricks here. Don't just look at the most attractive average revenue figure. Investigate like a detective: Is this data from all stores, or just the top 10%? Is this Gross Revenue or Net Profit? Have major expenses like franchise fees, marketing costs, rent, and labor been deducted? Many brands only give you a vague revenue range. What you need to find is the most unassuming, even seemingly poor, "median" or "bottom 25%" figure. Base your expectations on the worst-case scenario so you can stand firm when reality hits. According to the U.S. Federal Trade Commission (FTC), any profit promises made by the franchisor outside the FDD should be treated with extreme caution¹.

Uncovering Hidden Costs: Far More Than Just the Initial Franchise Fee

The initial franchise fee is merely your entry ticket into this game. The true cost "monster" lurks behind it. Grab a piece of paper or open an Excel sheet to list all potential expenses:

Startup Costs: Renovation, equipment, initial inventory, security deposits, legal fees, training travel expenses...

Ongoing Fees: Royalty fees (typically 4%-8% of sales), national marketing fund contributions, local marketing expenditures, SaaS software subscriptions, POS system maintenance fees…

Reserve Fund: This is critical! The U.S. Small Business Administration (SBA) recommends setting aside at least six months' worth of operating expenses (without profit) as working capital reserves². Personally, I believe 9-12 months would be safer in today's uncertain times.

O - Operational Simplicity & Support

The greatest value of a good franchise system lies in providing a market-proven, replicable "recipe" for success. This "formula" should be simple enough that ordinary people like you and me can quickly get up to speed after training. Simultaneously, the headquarters' support system must function like a safety net, reliably catching you when problems arise. If a franchise opportunity relies heavily on personal talent, resources, or "super sales" abilities, it defeats the purpose of franchising. What you're buying isn't a system—it's an extremely expensive job.

Is This System Truly "Turnkey"? A Brutally Realistic Test

"Turnkey" is the franchise industry's favorite buzzword, implying "pay, get the keys, open, and profit." While partially true, it obscures critical details. You must dig deeper:

Operations Manual: How thick is this manual? Is it a foolproof guide detailing everything down to "how to clean the coffee machine filter," or just a glossy PowerPoint with broad principles? A good operations manual should be your store's encyclopedia.

Supply Chain: Must core ingredients or products be sourced exclusively from headquarters? Are prices fair? Are there alternative suppliers for contingencies? Would your business grind to a halt if the supply chain breaks?

Technology Systems: Are the POS and CRM systems provided by headquarters user-friendly? Are they efficiency-boosting tools or daily headaches?

Evaluating the Value of Training Programs and Ongoing Support

Pre-franchise training is crucial, but post-franchise ongoing support matters even more. Many brands shower you with enthusiasm before signing, only to become "absentee landlords" afterward.

Training: Is it just a few days of online courses, or weeks of hands-on, in-person training? Does it cover only product preparation, or include operational "soft skills" like local marketing, hiring, and financial management?

Support Team: When facing urgent issues (e.g., POS system crashes, customer complaints), how quickly can you reach headquarters support? Are they professional regional managers or script-reading customer service agents? A simple test: During your evaluation phase, call their franchise support hotline posing as a potential investor inquiring about an operational detail. Observe their response speed and expertise.

R - Reputation & Relevance (Brand Reputation and Market Alignment)

The brand represents one of the most critical intangible assets you acquire through royalty payments. A strong brand naturally attracts foot traffic and builds trust. However, a brand's "fame" and its "health" are distinct concepts. Moreover, whether the brand aligns closely with current market trends and consumer demands determines its future viability.

Brand Strength vs. Fleeting Trends: How to Distinguish Between Them?

The market is never short of "viral" brands that may dominate social media, expand rapidly, but often fade just as quickly. A truly robust brand possesses the following characteristics:

Clear Brand Positioning and Customer Profile: It doesn't aim to sell to everyone but clearly defines its core customer base and builds everything around that group.

Long-term market presence: Has it weathered at least one full economic cycle (e.g., 5-7 years)?

Positive public image: Google search "[Brand Name] + complaints/lawsuits/scams" to see what surfaces. While all brands face occasional negativity, you must discern whether these are isolated incidents or widespread issues.

Analyzing National vs. Local Marketing Strategies

How does the National Marketing Fund collected by the headquarters operate? This is a question you must thoroughly investigate.

Transparency: Does headquarters regularly disclose to franchisees the specific allocation of marketing funds and the results achieved?

Synergy: Do headquarters' national advertisements (e.g., TV, social media influencer promotions) genuinely benefit your local community store? Or is most of this budget spent in major cities where headquarters is located?

Local Marketing Support: Does headquarters provide localized marketing toolkits, design templates, and strategic guidance? Or are you entirely on your own for local marketing? A strong franchise system operates as a coordinated effort between "Air Force (Headquarters) + Ground Forces (You)."

E - Ecosystem Health (Franchisee Ecosystem Health)

This is the most critical—and most overlooked—element in the entire C.O.R.E.S. framework. The true state of a franchise system isn't revealed by headquarters' salespeople, but by the franchisees in the trenches running stores daily. Their satisfaction, profitability, and morale collectively form the system's "ecosystem." A healthy ecosystem will support and empower you; a toxic one will drag you into the mire.

Golden Rule: Talk to Current (and Former) Franchisees

Section 20 of the FDD lists all current franchisees and those who left within the past year. This is your treasure map. Headquarters sales may provide contacts for a few "star franchisees" who will naturally speak highly of the system. What you need to do is reach out to others on the list yourself—especially those who have been open for just 1-2 years and those who have already left. The former can share the most recent experiences of opening a store, while the latter may reveal the system's most genuine issues.

[Actionable Checklist[20 Critical Questions You Must Ask Franchisees

When calling, avoid vague questions like "Are you making money?" That will only yield equally vague answers. You need to act like a journalist, using specific, open-ended questions to draw out their real stories.

I've categorized these questions into three groups: Financial and Investment Reality, Day-to-Day Operations and Support, and the "Real Feelings" of Those Who've Been There. Start with the lightest topics and gradually delve deeper.

Part One: The Financial Reality

1. Was your actual total investment higher or lower than the range estimated in the FDD? By how much? Which areas saw the most significant cost overruns?

2. How long did it take you to reach breakeven? How long to recoup your initial investment? Did this align with the headquarters' original projections?

3. Do you feel the royalties and marketing fees charged by headquarters are "worth it"? Can you clearly see the return on these investments?

4. Regarding the national marketing fund, have you observed direct, measurable benefits to customer traffic at your local store?

5. Beyond what's listed in the FDD, what unexpected recurring costs have you encountered? (e.g., mandatory system upgrades, additional local compliance fees)

Part Two: The Operational & Support Reality

1. How long did it take from signing the contract to officially opening? What unexpected difficulties or delays did you encounter during this period?

2. Was the pre-opening training from headquarters practical? Which parts did you find most useful, and which were a complete waste of time?

3. After opening, how quickly could you reach your area manager or support team when facing urgent issues? Did they proactively check in, or only appear when problems arose?

4. Are you satisfied with headquarters' supply chain? Were prices fair? Did you experience stockouts or quality issues?

5. Did the mandatory tech systems (e.g., POS, CRM software) enhance efficiency or create headaches?

6. What's your biggest challenge in recruiting and retaining top talent? What effective support did headquarters provide?

Part Three: The "Human Factor" & Big Picture

1. How many hours do you actually work per week now? Does this match your initial expectations? How do you feel about your work-life balance?

2. When headquarters launches new products, policies, or promotions, do they communicate with franchisees beforehand? Whose interests do you think these new initiatives primarily serve?

3. Is there a community or committee among franchisees? Do you believe headquarters genuinely listens to and incorporates collective feedback from franchisees?

4. What is the prevailing sentiment among other franchisees you've spoken with? Optimistic, anxious, or just "okay"?

5. What are the most common compliments and complaints you hear from actual customers?

6. How do you assess this brand's competitiveness and growth prospects over the next 3-5 years?

7. Are any franchisees around you selling or transferring their stores? To your knowledge, has the process been smooth?

8. If you could give yourself one piece of advice from a year ago before signing the contract, what would you remind yourself to pay attention to?

9. (This is the most important question) Considering all the positives and negatives, if you had to choose again, would you still join this brand? Why?

S - Scalability & Exit Strategy

You may only want to run one store now, but that doesn't mean you shouldn't think ahead. A good business model should have growth potential while also offering a respectable exit route. Life is full of uncertainties, so you need to ensure your investment today has multiple possibilities for the future.

Can you open a second or third location?

Multi-unit ownership is a primary pathway to wealth growth for many successful franchisees. You need to understand:

Territory Protection Policy: How large is the protected territory granted by headquarters? How strict is the policy? Could you face the awkward situation of a "teammate" opening a store right next door?

Multi-Unit Discounts: Are there preferential policies for franchise fees, royalties, etc., if you open a second location?

Management Complexity: Is this business model easily "hands-off"? Can you train a capable store manager to run the shop while you focus on broader management and expansion? If the business can't operate without you, scaling up will be difficult.

Understand Resale Value and Exit Terms

Life is unpredictable. One day, due to family, health, or other reasons, you may need to sell your store. You must clarify these points in advance:

Resale Rights: Are you permitted to sell your store to a third party? What are the headquarters' requirements? (e.g., buyer must pass headquarters' approval)

Transfer Fee: Will headquarters charge a high transfer fee upon sale?

Brand Value: Are franchise stores of this brand popular on the secondary market? What price range can they typically command (e.g., 2-3 times annual profit)? Consult franchise brokers for insights. A healthy franchise system typically maintains stable or even appreciating resale values for its stores.

Chapter 2: Framework Demonstration: Applying the Handyman vs. Massage Therapy Industries

We've just crafted a Swiss Army knife called "C.O.R.E.S." Now, to help you master its use, let's walk through a demonstration. I've deliberately selected the "Handyman Business" and "Massage Therapy" industries. One represents a "Skill-Based Service" franchise, while the other embodies an "Experience-Based Service" franchise—offering valuable contrast. Note: We're discussing industry categories, not specific brands, to help you grasp how to apply this framework.

Case Study 1: The Handyman Business

C (Cash Flow): Initial investment is relatively low (typically doesn't require expensive street-front retail space—a warehouse or home office suffices), meaning your capital efficiency may be higher and your return on investment shorter. However, the average transaction value is low, requiring a high volume of orders to generate significant cash flow.

O (Operations): Core focus is scheduling and technician management. You need an efficient system to handle customer requests, dispatch technicians, manage schedules, and collect payments. The software system provided by headquarters is critical here. Reliance on technicians is extremely high, making recruitment and retention of reliable professionals the biggest operational challenge.

R (Brand): Brand reputation acts as a "stepping stone" here. A well-known national brand gives you a head start in gaining customer trust. Customers are more likely to trust a chain brand than an independent "Master Zhang."

E (Ecosystem): When interacting with other handyman franchisees, you'll find discussions often center on: Which customer acquisition channel is most effective? How to manage difficult technicians? How to handle customer haggling? This is a highly pragmatic, problem-solving oriented community.

S (Scalability): Scalability is strong. You can expand coverage by adding vehicles and technicians, or even develop specialized B2B business lines targeting commercial clients.

Case Study 2: "Massage Therapy" Industry

C (Cash Flow): Initial investment is high, as you need to lease and renovate a commercial space that meets standards, plus purchase professional massage beds and equipment. However, it has a high average transaction value and easily locks in long-term, stable cash flow through membership cards, package deals, etc.

O (Operations): Core focus is store management and customer experience. You must create a clean, comfortable, and relaxing environment. The biggest challenge lies in recruiting and managing licensed, skilled massage therapists. High dependence on location.

R (Brand): Here, brand represents a "lifestyle" and "quality commitment." Customers choose you because they trust your brand to deliver consistent, professional, and safe services. A premium brand image helps maintain high average transaction values.

E (Ecosystem): The franchisee community likely focuses more on enhancing customer experience, designing membership packages, and managing seasonal traffic fluctuations. This is a circle emphasizing service details and client relationships.

S (Scalability): Expansion primarily occurs through opening new branches. Due to reliance on physical locations and licensed therapists, expansion speed and flexibility may be lower than for janitorial services.

Head-to-Head Comparison Table

For clarity, I've created the following table:

| Dimension | Handyman Services | Massage Therapy |

|---|---|---|

| Initial Investment | Low to Medium | Medium to High |

| Business Model | B2C/B2B, Skill-Based Services | B2C, Experience-Based Service, Membership Model |

| Operational Focus | Technician Management, Efficient Scheduling | In-Store Experience, Therapist Management |

| Location Dependency | Low | Extremely High |

| Cash Flow Characteristics | Order-Driven, Potential for Significant Fluctuations | Prepaid/Membership-Based, Relatively Stable |

| Core Risks | Technician Turnover, Inconsistent Service Quality | Rent Pressure, Therapist Recruitment Challenges, Compliance Risks |

Chapter 3: Your Turn! Applying the Framework to Real Brands

From Theory to Practice: Step-by-Step Analysis of Two Real Brands You Care About

Alright, the demonstration is over. We just virtually compared two industry categories using the C.O.R.E.S. framework. Now, let's dive into the most exciting part: you get to analyze two specific brands you genuinely care about! This is the most valuable step in the entire due diligence process. I won't tell you who to choose, but I will teach you a method to find the answer yourself.

Step 1: Select Your "Candidates"

Where to find these brands? Start with authoritative franchise portals like:

GlobalFranchiseHub: Our site.

Entrepreneur's Franchise 500® List: One of the industry's most respected rankings.

Franchise Gator: A comprehensive franchise information database.

Action Steps:

1. Visit these websites and select an industry that interests you (e.g., "pet care" or "pizza restaurants").

2. Choose two genuine brands from the list that appeal to you. For example, in the handyman industry, you might compare "Mr. Handyman" and "Ace Handyman Services."

Step 2: Obtain the Most Critical Intelligence—the FDD

The FDD is your "intelligence hub." Proactively contact both brands' franchise development departments, express your interest, and request their FDD documents. By law, they are obligated to provide them once you enter the formal consideration process.

Step 3: Begin Your "Dissection" Using Our Framework and Tools

Now, take our C.O.R.E.S. framework and the checklist from the [Franchise Due Diligence Toolkit]. Like filling in a form, create profiles for your two candidate brands:

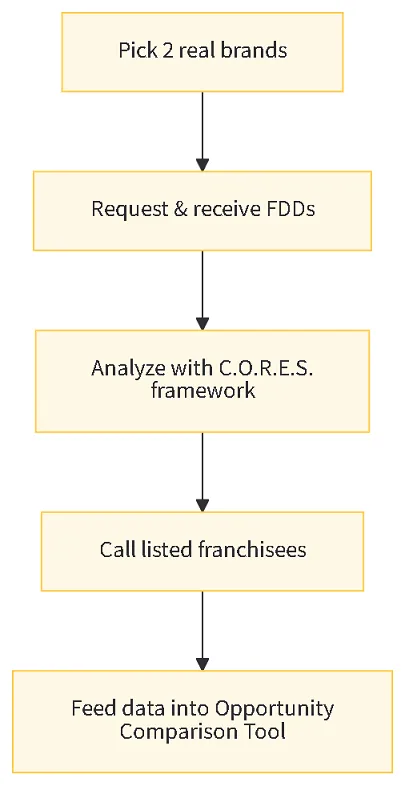

Flowchart: Real Brand Analysis Process

When analyzing C (Cash Flow):

Brand A: Open Section 19 of its FDD and input its average annual revenue and cost structure data into our [ROI Calculator].

Brand B: Do the same for it.

[Tool Integration -> ROI Calculator] Now, you're no longer looking at vague industry averages, but a comparison of the potential profitability of two real brands based on official documents.

A word of caution about using the calculator: Garbage in, garbage out. Remember, the calculator doesn't think—the quality of the data you input determines the value of the results. Use conservative figures from the FDD for initial calculations.

When analyzing E (Ecosystem):

Brand A: Open Section 20 of its FDD, randomly select 5 franchisees to call, and interview them using our prepared "20 Key Questions Checklist."

Brand B: Repeat this process.

You'll be surprised to discover that two seemingly similar brands can have vastly different franchisee experiences and satisfaction levels.

After completing all analyses:

[Tool Integration -> Opportunity Comparison Tool] Input all key information you've gathered (investment amount, projected returns, operational difficulty, headquarters support ratings, etc.) into our [Opportunity Comparison Tool]. This tool consolidates scattered data points into an intuitive, visual comparison report, allowing you to instantly see which brand excels in the dimensions you value most.

Through this process, you cease to be a passive observer. You personally lift the veil of mystery from each brand, evaluating them against unified, objective standards. The conclusion isn't something I tell you—it's one you derive step by step yourself. Only such a conclusion is truly solid and reliable, worthy of your hard-earned investment.

Chapter 4: Are You the Right Fit? A Due Diligence on Yourself

Up to this point, all our analysis has focused on the "business opportunity" itself. But there's one crucial factor we haven't discussed—you. Yes, you. Even the best franchise system will fail if placed in the hands of the wrong person. So before writing a check to any brand, conduct the most honest due diligence on yourself.

This Isn't Just About Business—It's About You

I've seen entrepreneurs bursting with passion, yet become frustrated by the tedious, repetitive tasks of daily operations, ultimately leaving their store management in disarray. I've also seen others who excel at crunching numbers but lack the charm and enthusiasm for connecting with people, failing to build a cohesive team or retain customers. Entrepreneurship, especially franchise entrepreneurship, doesn't require a "genius"—it demands a "jack-of-all-trades." You need to ask yourself some profound questions:

Where does your passion lie? Do you genuinely love this industry, or are you only drawn to its profits? Remember, when challenges arise, only true passion will sustain you.

Do your skills align? Are you better at communicating and building relationships, or at analyzing data and optimizing processes? Choose a business model that leverages your strengths.

What lifestyle do you envision? Do you want weekends with family, or are you willing to work year-round for your business? Some industries (like food service) will inevitably consume your evenings and weekends.

[Tool Integration -> Entrepreneur Assessment]

These questions can be tough to answer. To help you gain a more objective understanding of yourself, we've developed the [Entrepreneur Assessment] tool. It's not a personality quiz, but a questionnaire designed based on the common traits of successful entrepreneurs. By answering a series of scenario-based questions, it generates a personalized profile report across dimensions like risk tolerance, management style, and stress resilience—helping you understand your strengths and potential weaknesses. Think of it as inspecting your gear before heading into battle.

Financial Preparation & Business Planning

After assessing your traits, we return to the money question. You need a clear financial blueprint.

[Tool Integration -> Business Plan Generator]

A solid plan is your best tool for convincing yourself, your family, and the bank. If you're unsure where to start, our [Business Plan Generator] provides an excellent foundation. It guides you through key modules—market analysis, marketing strategy, operational plans, and financial projections—helping you draft a structured, logically coherent business plan. This will serve as an invaluable roadmap for your subsequent financing and operations.

Chapter 5: A "Consultant's" Final Warning: 3 Danger Signs That Should Make You Turn Around Immediately

Friend, in my experience, many failed franchise stories actually had their seeds planted before the contract was even signed. Some red flags are glaringly obvious, yet people often selectively ignore them due to over-excitement or impatience. Now, allow me to convey with utmost seriousness three signals that should make you walk away without hesitation.

Note: This section is critical—it could prevent losses of hundreds of thousands or even millions.

Red Flag #1: Vague Responses and Evasiveness from Headquarters

During your due diligence, you'll pose many pointed questions to headquarters. If their answers consistently remain ambiguous, evasive, or dismissive with phrases like "it depends on individual effort," be immediately wary. A transparent, confident headquarters welcomes your inquiries and answers honestly—even regarding risks and challenges. Remember: how they communicate before signing reflects how they'll support you afterward.

Red Flag #2: Persistently High Franchisee Churn Rates or Numerous Lawsuits

Section 20 of the FDD discloses the franchisee's "turnover rate" over the past three years. If this rate is persistently high or significantly above industry averages, it's a major red flag. Additionally, Section 3 of the FDD discloses major lawsuits involving the headquarters. If legal battles between headquarters and franchisees are constant, ask yourself: Why join a troubled family?

Red Flag #3: Intense Pressure to Sign Quickly

"This offer expires in two days!" "Your area is highly sought-after—decide now or lose out!" When you hear these sales tactics, your internal alarm bells should go off immediately. This is a classic sales technique exploiting ‘scarcity’ and "urgency" to push you into irrational decisions. Never, ever sign a contract that could shape your next decade under pressure.

Chapter 6: Conclusion - Your Transformation from Prospective Investor to Confident Decision-Maker

Your Journey Has Only Just Begun

The end of this article marks the true beginning of your journey as a savvy investor. What you possess now is not merely information, but a capability:

You've acquired a reusable mental framework (C.O.R.E.S.).

You possess a powerful suite of decision-making tools (ROI calculators, opportunity comparisons, etc.).

You've mastered a critical mindset, learning to see beyond superficial appearances.

You no longer need to rely on others' recommendations or be swayed by flashy marketing. You've gained the ability to take responsibility for yourself and shape your own future. Remember, franchise entrepreneurship isn't a lottery ticket—it's a business endeavor requiring meticulous preparation and rigorous execution. Leverage the knowledge and tools you've gained today to confidently conduct your due diligence. Your future is in your own hands.

Chapter 7: Frequently Asked Questions (FAQ)

Q1: What is the most important characteristic in a franchise system?

A: If I had to choose just one, I would select "Ecosystem Health." A system with numerous profitable and satisfied franchisees is nearly a guarantee that all other aspects have received positive market validation. Franchisee word-of-mouth is the most authentic report card for this system.

Q2: How much money can I actually make after joining?

A: There's no standard answer to this. The right approach is to use data from the FDD's Item 19 and interviews with existing franchisees to set realistic, phased profitability goals for yourself.

Q3: Is it better to buy a brand-new franchise or take over a used one?

A: Both have pros and cons. Opening a new location lets you build it entirely to your vision, but the risk is starting from scratch. Taking over an existing store offers built-in customers and cash flow, but you may pay extra for its "goodwill."

Q4: Do I need a lawyer to review the Franchise Disclosure Document (FDD)?

A: It's strongly recommended—even essential. The FDD is a complex legal document. An attorney familiar with franchise law can help you identify risks. This legal fee may be the most worthwhile investment in your entire process.

Final Call to Action

Ready to elevate your research to the next level? To streamline your due diligence journey, we've prepared a complimentary **[Franchise Due Diligence Toolkit]**.

Download the toolkit to gain:

FDD Key Terms Review Checklist (PDF)

Complete List of 20 Essential Questions to Ask Franchisees (PDF)

Detailed Startup & Operating Cost Planning Template (Excel)

Franchise Due Diligence Toolkit.zip Click the link to download now to gain greater leverage in your franchise negotiations!

Franchise Due Diligence Toolkit.zip Click the link to download now to gain greater leverage in your franchise negotiations!

My Personal Perspective & Insights

After all this, I want to share some heartfelt thoughts. Our fascination with "entrepreneurship" and ‘franchising’ often stems from a core desire for "freedom"—financial freedom, time freedom, and freedom from external constraints. This is a beautiful and powerful force. But I must say: the path to freedom first requires enduring a period of extreme "unfreedom." You'll be busier and more anxious than ever before, accountable for every penny spent, every employee's morale, and every customer review.

Franchising, in a sense, trades a portion of "freedom" for a higher "success rate." You cannot freely alter menus or decor styles; you must adhere to the headquarters' rules. This is a trade-off. I believe the most successful franchisees are those who deeply understand this balance and seamlessly integrate headquarters' "systemic advantages" with their own "local wisdom." They are neither blind followers nor rebellious challengers—they are intelligent "system users." They leverage the brand's momentum while acting like independent business owners—cultivating community ties, caring for staff, and innovating local marketing. I hope you can become such an individual.

Risk Warning and Disclaimer

Compliance Notice: The information provided herein is for educational and reference purposes only and does not constitute any form of investment advice, legal advice, or financial advice. Franchise investment involves significant risks, including the potential loss of the entire investment.

Due Diligence: Before making any investment decision, you must carefully read and understand the Franchise Disclosure Document (FDD). It is strongly recommended that you seek professional advice from independent legal, accounting, and business advisors.

Information Accuracy: We strive to ensure the accuracy of the information in this document. However, markets and regulations are constantly changing. Always rely on official documents and the advice of professional advisors.

Tool Usage: Calculators and other tools provided on this website are simplified models based on your input data. Results should not be construed as guarantees or promises of future profitability.

References:

Federal Trade Commission (FTC). "A Consumer’s Guide to Buying a Franchise."

U.S. Small Business Administration (SBA). "Calculate your startup costs."

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.