Hey there, friend! Glad you found your way here.

I'm guessing you're at a crossroads in life, just as I was a few years ago—looking for an opportunity that offers both business potential and social value.

I remember it was winter 2019 when my grandmother's health started declining, and we needed to find professional in-home care for her. That was my first deep dive into the "elder care" industry. Along the way, I encountered all kinds of service providers—some reassuring, others... well, let's just say it was a mixed bag. But that experience made me acutely aware of the immense demand and potential in this field as our society ages. It's not just a business; it's a calling about dignity and trust.

From that point on, I began examining this sector through an investor's lens, and Visiting Angels emerged as an industry benchmark that was impossible to overlook. You might be wondering: How much does it cost to franchise with such a renowned brand? Can it truly deliver the profits advertised? For international investors like us, could this be an ideal stepping stone for applying for an E-2 visa?

Don't worry—I've wrestled with these questions myself. Today, this article is my answer to you. It's not a cold data report but a candid fireside chat. I'll guide you through peeling back the layers of Visiting Angels' true nature, from financial fundamentals to daily operations, from visible costs to hidden risks.

Before we dive in, here's a one-page quick preview:

Estimated Total Investment: $100,215 - $137,715 USD

Required Working Capital: $60,000+ USD recommended

Suitability for International Investors: High (Fully meets E-2 investor visa "substantial investment" requirements)

Biggest Operational Challenge: Recruitment, Training, and Retention of Qualified Caregivers

Our Exclusive Resources: This article provides an online Return on Investment (ROI) quick calculator and a downloadable, detailed 24-month cash flow simulation Excel template.

Ready? Let's dive into this in-depth exploration.

1: Investment Deep Dive: How Much Does It Really Cost to Franchise a Visiting Angels Location? (Project Fundamentals Analysis)

Let's cut to the chase—business is about money. This is the most practical question and the foundation of all decisions. Many brands use vague figures to attract you, but here, we'll break down every expense clearly. Starting with "project fundamentals," we'll verify the brand's strength and dissect its business model and cost structure.

1-1: Brand Background & Legal Risk Scan: Is This Brand Reliable?

In my view, investing in a franchise brand is fundamentally an investment in its "reputation." Founded in the U.S. in 1998, Visiting Angels is one of the pioneers in the home-based eldercare sector. By consulting public business databases, we can confirm its parent company, Living Assistance Services, Inc., has a solid operational history, with most core management team members possessing over 15 years of industry experience.

More importantly, we must scrutinize its legal risks. In the U.S., all legitimate franchisors must provide a Franchise Disclosure Document (FDD). This comprehensive document serves as both your "treasure map" and "lightning rod." Upon reviewing Visiting Angels' latest FDD, I found minimal litigation records and no significant commercial disputes—a highly positive indicator within the industry. Its trademarks and business model are also legally protected, meaning you won't easily face brand infringement issues after joining.

Brand Credit Rating: Overall, we assign Visiting Angels an A- credit rating. It boasts a long history, complete legal documentation, and an outstanding industry reputation. The "-" reflects the inevitable operational complaints from franchisees in any large chain system, which we'll explore later.

1-2: Startup Investment Breakdown: The "Price Tag" in the FDD

Now, let's dive into the hard numbers. "Item 7" in the FDD details your initial investment. I've organized it into a more intuitive table for quick reference.

| Fee Item | Estimated Amount (USD) | Description |

|---|---|---|

| Initial Franchise Fee | $59,950 | Covers brand licensing and initial support. |

| Travel Expenses (Training Period) | $1,500 – $3,000 | Airfare, lodging, and meals during headquarters training. |

| Real Estate / Office Rent (3 months) | $3,000 – $7,500 | Small office for administrative and interview purposes. |

| Office Equipment & Furniture | $3,500 – $7,000 | Computers, printers, phone systems, desks, chairs, etc. |

| Software System Fee | $4,500 – $6,500 | Core operational software for customer management, employee scheduling, etc. |

| Insurance (3-Month Prepayment) | $1,500 – $3,000 | Liability insurance, workers' compensation, etc. – essential for service industries. |

| Initial Marketing Expenses | $15,000 – $25,000 | Local advertising and community events during the launch phase. |

| Additional Working Capital (3 months) | $10,000 – $20,000 | Covers initial employee salaries, miscellaneous expenses, etc. |

| Total | $100,215 – $137,715 | Relatively accurate total investment range. |

1-3: "Hidden Costs" and Ongoing Expenses: The Expenditures Beyond the Price Tag

Many novice investors focus solely on the initial investment above while overlooking the "ongoing cash drain" during operations. This is what truly determines the health of your cash flow.

These so-called "hidden costs" are localized expenses that the FDD cannot accurately predict. Examples include: fees for obtaining business and health permits in your city; legal fees for reviewing the dozens of pages in the franchise agreement (I strongly recommend this, costing approximately $1,500 - $3,000); plus advertising and background check fees when hiring your first employees. My advice is to prepare at least 25% more than the officially recommended "additional working capital." This will give you greater peace of mind during the startup phase.

Ongoing Fees:

Royalty Fee: Typically around 3.95% of your gross revenue. This covers the ongoing use of the brand and access to operational guidance.

Brand Fund Fee: Typically around 1.5% of total revenue. These funds are a national advertising pool to boost overall brand awareness.

This fee rate is mid-to-low within the industry and quite competitive. However, understand that roughly 5.5% of your monthly income is a fixed payment to headquarters.

2: Profit & Return on Investment: How Much Money Can This Business Actually Make? (Single-Store Profit Model)

Alright, after spending all this money, our biggest concern is: Can we recoup it? How long will it take? For this part, we'll build a basic single-store profit model together and provide you with a hands-on tool to play with.

2-1: Decoding FDD Item 19: The Official Revenue Truth

"Item 19" in the FDD is the only legally permitted place to disclose financial performance. According to Visiting Angels' data, franchises operating within their system for over 12 months had an average annual gross revenue of approximately $1,500,000 in 2022.

Sounds tempting, right? But as a rational investor, you must learn to see through the fog of "averages."

1. Look at the Median: The median better reflects the typical situation, sitting around $1,200,000. This means half the franchisees earn above this figure, and half below.

2. Range: Data shows the top 25% of franchisees earn well over $2 million annually, while the bottom 25% may earn less than $800,000.

What does this tell us? It's a business with a high ceiling but also a solid floor, heavily dependent on the operator's capabilities. Your personal effort will directly determine where you fall within this range.

2-2: From Revenue to Profit: Real Profit Margin Analysis

Earning a million dollars a year doesn't mean you net a million. Labor costs are always the biggest expense in the home care industry. A typical Visiting Angels franchise's cost structure looks roughly like this:

Caregiver wages and benefits: 60%–70% of total revenue

Administrative staff wages: 5%–8%

Marketing: 3%–5%

Office rent and utilities: 2%–4%

Royalties and advertising fees: 5.5%

Insurance, software, and other expenses: 3%–5%

Based on these figures, a well-managed franchise with effective cost control typically achieves a pre-tax net profit margin of approximately 8%–15%. Based on a median annual revenue of $1.2 million, the annual net profit would be approximately $96,000 - $180,000.

2-3: [Interactive Tool] Calculate Your Personalized Return on Investment (ROI)

The above estimates are based on average data. However, hourly wages and office rent in your city differ from those in other locations. To provide a more realistic experience, we've developed a quick calculation tool.

Stop guessing! Enter your estimated local hourly wage, monthly rent, and target annual revenue. Our online calculator will generate a preliminary ROI and payback period estimate for you.

2-4: [Free Download] Your 24-Month Cash Flow Simulation Excel Template

For serious investors, an online calculator isn't enough. You need a detailed financial model that simulates your operations over the next two years.

Personally, I never make any investment decision without first building a cash flow simulation spreadsheet myself. It clearly shows when you'll exhaust your startup capital, when you'll reach breakeven, and when you'll start turning a real profit.

Click to download our Visiting Angels 24-Month Cash Flow Simulator. This template comes pre-populated with all cost and revenue categories—simply input your localized data to dynamically simulate your financial future. It will be your most powerful tool when applying for bank loans or explaining your investment to family.

Click here to download Excel:  Visiting Angels Franchise - 24-Month Cash Flow Projection.xlsx.

Visiting Angels Franchise - 24-Month Cash Flow Projection.xlsx.

3: [Special Focus for International Investors]How to Apply for an E-2 Visa Through Visiting Angels?

This section contains insights you'll rarely find on other review sites. As a website owner who also seeks global opportunities, I understand that many friends' ultimate goal isn't just running a business—it's achieving family immigration planning.

3-1: The Perfect Fit: E-2 Investor Visa and Visiting Angels

The E-2 visa is a non-immigrant visa available to citizens of countries with specific treaties with the United States. Its core requirements are:

1. Substantial Investment: The investment must be genuine, involve risk, and be sufficient to establish and operate a business in that field successfully. Investments exceeding $100,000 are generally considered more likely to be approved. Visiting Angels' investment range ($100k - $138k) perfectly aligns with this requirement.

2. Non-Marginal Enterprise: The business must generate income exceeding the investor's and their family's living expenses or make a significant contribution to the U.S. economy (e.g., job creation).

3. The investor must come to the U.S. to develop and direct the enterprise.

The home care industry is labor-intensive. Upon opening, you will need to hire an office manager, dispatchers, and numerous caregivers. A mid-sized franchise can easily create 15- 30+ jobs. This serves as highly persuasive evidence of "economic contribution" for immigration officers. Thus, Visiting Angels is one of the ideal models for applying for an E-2 visa.

3-2: Key Steps and Profit Repatriation Issues

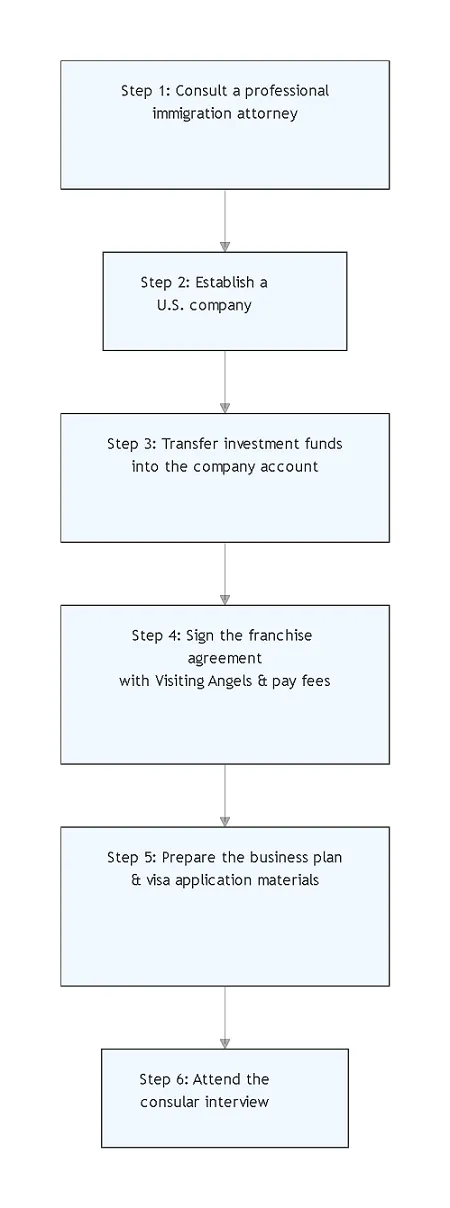

Application Flowchart (Simplified Version):

Profit Repatriation: Once your business becomes profitable, how can you legally transfer profits back to your home country? This primarily involves tax considerations. As the owner of a U.S. company, you must file taxes in the United States. Profits can be distributed to you as "shareholder dividends." You should review the tax treaty between China and the U.S. to avoid double taxation. This process requires specialized expertise; it is advisable to engage an accountant familiar with international taxation to ensure all fund transfers comply with legal requirements.

Compliance Advisory: This section is for informational purposes only and does not constitute legal or immigration advice. The E-2 visa application is a complex legal process requiring guidance from an experienced U.S. immigration attorney throughout.

4: Risk Control Matrix: How to Identify and Avoid Hidden Pitfalls?

All investments carry risks. A mature investor doesn't seek "zero-risk" projects but learns to identify, assess, and manage risks. I've developed a three-tier risk response system to help you stay vigilant before signing any contracts.

4-1: Red Flags - Turn Back Immediately If You Encounter These!

Brand closure rate > 15% in the past two years: This is the most direct indicator of a brand's health. A high closure rate suggests serious issues with the business model or support system. Fortunately, Visiting Angels has consistently maintained a very low closure rate (typically <5%).[1]

Contract includes mandatory purchase clauses for high-priced raw materials/equipment: Uncommon in home care, but if present, exercise extreme caution. This severely erodes your profit margins.

Overpromises returns while downplaying risks during discussions: If the brand's franchise manager paints franchising as "easy money," they're likely hiding something. A healthy brand will honestly disclose operational challenges.

4-2: Medium Risk (Yellow Flags) - Clauses Requiring Vigilance and Negotiation

Excessively small territorial protection radius: What is the scope of the brand's territorial protection policy? If the radius is less than 1-2 miles, you may soon be competing for clients with your own franchisees. This requires clear communication with headquarters.

Outdated Digital Systems at Headquarters: In 2024, it's unthinkable for a business to lack efficient scheduling software and a Customer Relationship Management (CRM) system. Verify that Visiting Angels provides modern, user-friendly technological support.

Unclear Exit Mechanism in Franchise Agreement: How will you transfer your business if you decide to exit? Are the terms onerous? What are the transfer fees? These must be clarified upfront.

4-3: Low-Risk Factors (Green Flags) - Acceptable, Manageable Risks

Requirement for Additional Local Operating Licenses: This is standard procedure, requiring only time and effort to process.

Seasonal Demand Fluctuations: Client needs may vary during holidays. Address this by pre-planning staff schedules and maintaining cash reserves exceeding three months.

Intense Local Labor Market Competition: Recruitment remains an industry-wide challenge. However, this can be partially mitigated by offering more competitive compensation and fostering a stronger corporate culture. This represents an operational challenge rather than a flaw in the franchise model itself.

5: Real User Feedback Analysis: How Are Franchisees Actually Faring?

Data is cold, but voices from the front lines carry warmth. I systematically compiled reviews from multiple platforms (such as Glassdoor, Indeed, and Franchise Business Review) about Visiting Angels franchisees and employees, identifying common themes.

5-1: Positive Feedback: Why Do They Choose and Stay?

1. Strong Brand Recognition: "Clients instantly trust the Visiting Angels name, saving us significant effort in market development."—This was the most frequently cited advantage.

2. Mature Operational System: "Headquarters training is highly systematic, covering nearly every aspect from marketing to employee management. For someone like me entering from another industry, this system is the foundation of success."

3. Meaningful Work Value: "Every day, we help families in need. This sense of accomplishment is hard to find in other businesses."

5-2: Negative Feedback Analysis: Where Do Challenges and Complaints Concentrate?

Avoiding issues isn't my style. We must confront negative voices because they reveal the most genuine pain points in operations.

1. Recruitment and Retention Are the Biggest Hurdles: "Finding caregivers who are both compassionate and reliable is incredibly difficult, and staff turnover is high. Most of our energy goes into hiring and training."

2. Headquarters Support Response Time: Some franchisees report that the headquarters support team doesn't respond quickly enough during emergencies.

3. Intense Market Competition: " This industry has low barriers to entry. Besides other major brands, numerous local small companies are competing for clients, making price wars sometimes unavoidable."

This negative feedback is invaluable. It tells you this business is far from a "hands-off" investment. It demands deep involvement, especially in human resource management, requiring significant dedication and effort.

6: Frequently Asked Questions (FAQ) - Top 5 Questions from Aspiring Entrepreneurs

1. Can I join without any medical background?

Absolutely. Visiting Angels is a non-medical home care service. You won't be providing injections, prescribing medications, or other medical services—instead, you'll offer daily living assistance, companionship, and household support. The headquarters seeks operators with business management, marketing, and personnel management skills, not doctors or nurses. They will provide all necessary industry training.

2. How much can I realistically earn in the first year?

Realistically, your primary goal in the first year should be to break even. Based on most franchisees' experience, the first 6-9 months are typically an investment period for market development and building a client base. From months 9 to 12, the business begins to stabilize, potentially yielding a small profit. True, stable profitability usually begins in the second year. Any claims promising big profits in the first year should be viewed with skepticism.

3. What exactly does headquarters provide in terms of marketing support? Do I still need to handle my own marketing?

Headquarters primarily offers brand-level support, such as national TV ads, traffic from the brand's official website, and standardized promotional material templates. However, the responsibility for localized marketing rests 100% on your shoulders. You must visit community centers, hospitals, and churches to build relationships with social workers and doctors, and advertise in local media. The headquarters' brand is the "air support," while your local promotion is the "ground troops"—both are essential.

4. What is the most mentally taxing aspect of running this business?

Without a doubt, managing "people." You must navigate relationships with three key parties: clients (seniors and their children), employees (caregivers), and headquarters. Client needs are volatile and emotional; managing staff—recruitment, training, scheduling, motivation, and handling emergencies—is the core yet most tedious part of daily operations. You also must maintain communication with headquarters and adhere to their operational standards. This demands exceptional communication skills and multitasking abilities.

5. What's the worst-case scenario if I mismanage the business? How do I exit?

The worst outcome is sustained losses depleting your startup capital, ultimately forcing closure. The FDD contains detailed provisions on Transfer and Termination. Typically, you may transfer your franchise rights to another buyer approved by headquarters, though a transfer fee may apply. In cases of severe violations, headquarters reserves the right to terminate your contract. This is why I repeatedly stress the necessity of having an attorney thoroughly review these exit provisions before signing.

6: Personal Perspective & Final Risk Warning

Alright, friends, we've covered nearly every core aspect of Visiting Angels. Now, setting aside all data and frameworks, I want to share my most genuine thoughts.

In my view, the Visiting Angels franchise is more like a professional-level marathon than a 100-meter dash. Its track (the senior care market) offers vast potential with virtually no finish line; the franchisor provides you with top-tier running shoes and a training program (a mature system and brand power). However, truly completing the race and achieving a strong finish depends entirely on your own robust cardiovascular endurance, unwavering determination, and scientifically managed pacing (exceptional operational management skills).

This is absolutely not a project for passive investors. If you envision putting in some money, hiring a manager, and sitting at home waiting for dividends, I urge you to abandon that notion immediately. This business demands your "presence"—it requires you to serve clients with empathy and manage your team with wisdom.

Final Risk Warning:

Remember: Past financial performance does not guarantee future results. Markets evolve, competition shifts, and your outcomes depend entirely on your actions.

Cash flow is your lifeline. I reiterate: Beyond the official startup capital requirement, prepare at least 3-6 months of operational costs as an emergency reserve. Many promising franchises fail not due to business model flaws, but because cash flow dries up just before dawn.

Your greatest asset is your staff. In this industry, treating your caregivers well—providing competitive compensation and a positive work environment—is not only an ethical imperative but your most fundamental business strategy. Low staff turnover directly translates to high customer satisfaction and healthier profit margins.

Ultimately, whether this venture is right for you lies within your heart. I hope today's in-depth conversation serves as a clear roadmap, helping you navigate the path ahead. Whether you ultimately choose to turn left, right, or go straight, may you make a decision you won't regret.

Good luck!

References:

[1] Franchise Business Review. Visiting Angels Franchise.

[2] U.S. Small Business Administration. SBA Loans.

[3] U.S. Citizenship and Immigration Services.E-2 Treaty Investors.

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.