Hey there, friend!

I know why you're here. You might be tired of the nine-to-five grind, yearning to be your own boss. Or perhaps you've spotted the seemingly endless demand in the commercial cleaning industry, and a fire has ignited within you. Then, big names like Jani-King, Jan-Pro, and Coverall caught your eye. Their ads paint a rosy picture: Invest a sum of money, and you'll gain a proven system, a stable business, or even your own commercial empire. Sounds tempting, right?

Yet a thread of unease and confusion lingers. These three seem formidable—which truly fits me? Is "start your business for as little as $X" really true? What about all those online complaints that "franchising is a trap"? Could my hard-earned money end up down the drain?

Rest assured, I understand every one of your concerns. I'm not here to sell you any brand. On the contrary, I'm here to peel back the layers with you, like an onion, revealing the true nature beneath these brands' glossy facades. My name is Qaolase. Over the past decade, I've observed and analyzed countless successes and failures of small businesses, and witnessed friends take wrong turns on the franchise path. My sole goal is to ensure that every decision you make is based on thorough information and a clear understanding, not impulsive choices.

This article is your "investment roadmap." It will reveal what official websites won't tell you. Before diving into this deep exploration, here's a quick tip: Take two minutes to complete our website's Entrepreneur Assessment tool for a rapid self-evaluation. Understanding your entrepreneurial DNA is the first step toward success.

Part One: Laying the Groundwork—Becoming a Savvy Franchise Investor

Before comparing specific brands, we must first establish a solid foundation of understanding. It's like learning to drive—you need to know the difference between the gas and brake pedals first. Many novice investors fail because they skip this step, getting swept away by salespeople's flashy pitches. Take a few minutes to carefully read the following—it will instantly put you ahead of 90% of your competitors in your future decisions.

1-1: The Core Truth of Franchising: You're Buying a "System," Not a "Guarantee"

This is perhaps the most crucial point to grasp. What exactly are you purchasing when you pay the franchise fee? You're not buying a promise of guaranteed profits, but rather the right to use a "business system." This system typically includes: brand recognition, standardized operating procedures (SOPs), marketing support, and initial training. Think of it like purchasing a premium baking recipe, a full set of professional kitchen tools, and instructional videos from a Michelin-starred chef. You possess all the tools for success, but this doesn't mean you'll automatically bake perfect cakes. You still need to source flour, control oven temperatures, attract customers, and manage your shop. If the cake burns or doesn't sell, you bear the ultimate responsibility. Many franchisees fall into the misconception that they are "consumers" purchasing an "asset guaranteed to appreciate." In reality, you are an ‘operator' who has merely acquired a toolkit that increases your probability of success. Therefore, shift your mindset now: instead of thinking "I bought a franchise," adopt the perspective "I will leverage this brand's system to run my own business." This shift in mindset is crucial.

1-2: The Franchisee vs. Franchisor: Where Does Money Come From, and Where Does It Go?

This section may sound harsh, but it's brutally honest. While you and the franchisor (the brand owner) are partners, your profit models inherently have subtle conflicts. As a franchisee, your core objective is net profit—the money left after subtracting all costs (including franchise fees, material costs, labor, and various payments to headquarters) from total revenue. The franchisor's primary income source, however, comes largely from what you spend.

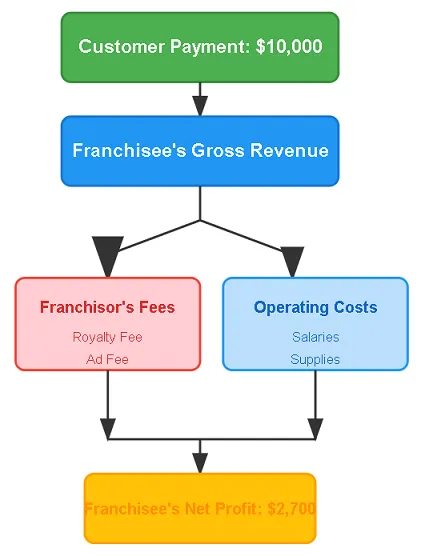

Flowchart example: Your customer pays $10,000 for cleaning services -> Your company account

1. -> Pay 10% royalty ($1,000) to franchisor

2. -> Pay 5% marketing fee ($500) to franchisor

3. -> Pay mandatory material costs ($800) to franchisor

4. -> Pay operational costs (staff wages, insurance, fuel, etc.) ($5,000)

5. -> Your pre-tax net profit: $10,000 - $1,000 - $500 - $800 - $5,000 = $2,700

Got it? The franchisor's primary profit comes from taking a percentage cut of your **Gross Revenue**. This means they earn money whenever you have revenue—regardless of whether you turn a profit. This creates a potential conflict of interest: the franchisor has a strong incentive to sign any contract (even low-profit ones) and assign it to you, because they receive royalties as long as the contract generates revenue. Meanwhile, you might be struggling to manage a contract with slim margins or even operating at a loss. Understanding this explains why there are so many complaints online about being "exploited by headquarters." This isn't to say all franchisors are "bad actors," but in business, you must clearly recognize the inherent logic of this model.

1-3: Decoding Industry Jargon: Don't Let "Lingo" Trip You Up

When talking with franchisor salespeople, they'll throw around a lot of technical terms. If you're confused, you'll easily find yourself at a disadvantage. Master these essential terms:

FDD (Franchise Disclosure Document): Your "magic mirror" and "treasure map." This hundreds-of-pages-long legal document, mandated by the U.S. Federal Trade Commission (FTC), discloses everything about the franchise system—litigation history, franchisee attrition rates, full fee breakdowns, and more. No sales pitch can match the truth in this document. Later, I'll teach you how to focus on the key points when reading it.

Royalty Fee: This is the recurring fee (typically monthly) you pay to headquarters as a fixed percentage of your gross revenue. It covers brand usage and ongoing support. This represents your largest ongoing expense.

Ad Fund: You contribute a portion of your monthly revenue (also usually a percentage) to the headquarters for national or regional brand advertising. You need to understand how much these ads actually benefit your local business.

Territory Rights: The protected operating area granted to you by the franchisor. You must understand the strength of this "protection." Does it grant exclusive rights (no second franchisee of the same brand within the territory), or does it merely mean headquarters won't open company-owned stores in the area (but may develop other franchisees)? The size and strength of territorial protection directly determine your growth potential.

Part Two: The Big Three Face Off—Glory and Shackles

Alright, now that we've covered the basics, let's dive into the battlefield and take a close look at these three heavyweight contenders.

I remember a few years back, my friend Old Wang—a hardworking middle-aged guy—had saved up about $100,000. He was dead set on leaving the factory and starting something on his own. He was immediately drawn to cleaning franchise ads, particularly Jani-King and Jan-Pro. He spent half a year researching them, practically combing through every corner of their websites. Every day, he'd excitedly discuss with me which brand's logo looked better or whose promotional video was more inspiring. I warned him then: "Wang, don't just look at the ads. Read the contracts, study the FDD, and talk to people who've left the franchises." At first, he dismissed my advice, thinking I was just pouring cold water on his dreams. Later, he actually took my suggestion and hired a lawyer specializing in franchising to help him interpret the FDD. This revealed numerous details he had never noticed before. This experience ultimately led him to make a completely different decision. Today, I'll share with you the "part below the iceberg" we uncovered together back then.

2-1: Jani-King: The Glory and Shackles of the "King of Commercial Cleaning"

Jani-King's first impression is undeniably "high-end." They call themselves "the world's largest commercial cleaning franchise," renowned for servicing large venues like hotels, hospitals, stadiums, and office buildings. If you possess ambition and resources and aspire to bid on contracts worth tens or even hundreds of millions of dollars, Jani-King's brand endorsement serves as a powerful stepping stone.

Business Model and Market Positioning

Jani-King's model is straightforward: targeting high-end, large-scale commercial clients. This means individual contracts can be substantial, but it also demands greater scale in your team, specialized equipment, management capabilities, and financial strength. They offer two franchise models: Unit Franchisee, where you roll up your sleeves and work or manage a small team yourself; and Master Franchisee, where you gain the right to develop sub-franchisees across a large territory, effectively becoming a "mini-headquarters." The investment for the latter is astronomical, so we'll focus primarily on the former here. Jani-King's brand reputation does offer an advantage when pursuing major clients. Imagine negotiating with a five-star hotel manager and introducing yourself as part of the "King of Commercial Cleaning"—it certainly carries more weight than "XX Housekeeping Services."

In-Depth Cost Structure Analysis: The Price of Prestige

Jani-King's "crown" is heavy, with a cost structure notoriously complex within the industry. You'll struggle to find a clear pricing list on their official website. Based on our analysis of past FDD documents and third-party data, their fees extend far beyond just the initial franchise fee and royalties. An anonymous former franchisee shared on an industry forum that beyond the roughly 10% royalty, there are various management fees, accounting fees, marketing fees, and more. Combined, these fees can sometimes reach 25%-30% of the total contract value! This means that for a $10,000 contract, you'd owe nearly $3,000 to the "King" before even starting work. This steep "tax" severely squeezes franchisees' profit margins. You must carefully weigh the cost of wearing this "crown."

Franchisee Reviews: A Tale of Two Extremes

Searching online for Jani-King reviews reveals starkly polarized content. On one hand, you'll find success stories where franchisees secured major contracts with headquarters' support, achieving significant business growth. They praise the brand's strength and the system's thoroughness. On the other hand, you'll also encounter numerous negative reviews and even news of class-action lawsuits. These criticisms primarily focus on several points: 1. Excessive fees, leaving franchisees feeling like they're working for headquarters; 2. Contract traps, locking franchisees into long-term agreements with extremely high exit costs; 3. Poor client quality—headquarters promises client referrals but often delivers low-margin, demanding "unprofitable" contracts. My friend Old Wang noticed that Jan-Pro's FDD disclosed more litigation history than other brands, which raised red flags for him.

2-2: Jan-Pro: The Business Reality Behind "Technology-Driven"

Jan-Pro's strategy is remarkably astute: they don't compete on "biggest" but on "most specialized." Their core concepts are ‘technology' and "health," with their proprietary EnviroShield® electrostatic disinfection system as their key weapon. In the post-pandemic era, this selling point is particularly compelling. They project an image: "We aren't ordinary cleaners—we are environmental health specialists."

Business Model and Technological Barriers

Jan-Pro's model is highly flexible, offering everything from part-time plans starting at a few thousand dollars to large regional franchises costing hundreds of thousands. This approach caters to virtually all types of investors. This low-barrier strategy attracts many individuals like my friend Old Wang—ordinary people with limited budgets but a strong desire to start their own business. Their core competitive edge lies in the EnviroShield® system, which indeed creates a technical barrier when bidding for venues with special hygiene requirements (such as clinics, kindergartens, and gyms). They also promise to provide franchisees with initial clients, enabling you to "start earning money on day one." Sounds perfect, right? But reality is rarely that simple.

In-Depth Cost Analysis: The Low-Barrier "Bait"

Jan-Pro's low entry fee acts like a carefully crafted "bait." Once lured in by the promise of becoming a business owner for just a few thousand dollars, you'll discover the real costs lie ahead. First, that cool-sounding EnviroShield® system requires a purchase or lease. Second, their royalty and management fees combined typically eat up 15%-20% of your total revenue. The most critical point—and a major complaint among franchisees—is the fee for those "clients." Jan-Pro charges a hefty fee based on the initial contract revenue they promise to deliver. For example, if they pledge a $5,000 monthly contract, they might charge you $20,000 upfront. This fee often requires you to take out a loan. The problem is, if those clients later drop out or the contracts themselves turn out to be low-margin, you're still stuck repaying that loan.

Franchisee Reviews: The Arc from Hope to Disappointment

Jan-Pro reviews are equally contradictory. Many new franchisees express satisfaction with the training and systems, feeling they genuinely learned valuable skills and quickly secured their first clients. However, over time, negative feedback grows. The core issue is precisely the "conflict of interest" I mentioned in Part One. A former Jan-Pro franchisee with tens of thousands of YouTube followers documented his experience in detail through videos. He pointed out that Jan-Pro's sales team aggressively bids for contracts at rock-bottom prices to capture market share, then assigns these low-margin "scraps" to franchisees. To survive, franchisees are forced to slash costs and compromise service quality, ultimately losing customers and creating a vicious cycle. His final conclusion: "Jan-Pro was my training ground in this industry. I'm grateful for it, but I wouldn't recommend it. You're better off going solo." This statement resonated deeply with my friend Lao Wang.

2-3: Coverall: The Advantages and Costs of "Health-Centric" Approach

Coverall shares some positioning similarities with Jan-Pro but operates with greater focus. They position themselves as the leader in the "Health-Based Cleaning System®," targeting niche markets with stringent hygiene standards like healthcare, education, and fitness. This specialization is both their strength and potential limitation.

Business Model and Market Segmentation

Coverall's model is relatively straightforward. Unlike Jani-King's complex "mother-and-child" franchise system, it primarily develops single-unit franchisees. Its core competitiveness lies in a comprehensive suite of cleaning protocols and standards targeting specific pathogens and cross-contamination. This gives them strong professional credibility when bidding for contracts with clinics, dental offices, schools, and similar facilities. If you have a background in healthcare or a strong interest in this niche market, Coverall's system could be a perfect fit. They also promise to provide an initial client package to help you get started.

In-Depth Cost Structure Analysis: The Breakdown Behind the Clarity

Compared to Jani-King's "mysterious" approach, Coverall's fee structure is relatively transparent. According to their FDD, total investment ranges from approximately $17,000 to $63,000, depending on the size of your chosen initial client package. Key fees include: an initial franchise fee, royalties (around 5%), and a substantial "administrative fee" of up to 10%. Note that this "administrative fee" is a catch-all charge covering billing processing, customer service, and other administrative tasks. Combined with the royalty, this totals 15% of revenue paid to headquarters. This percentage is not insignificant. You must carefully calculate whether the profit margin remaining after paying this 15% "service fee" is sufficient to sustain your operations and personal living expenses.

Franchisee Feedback: A Mix of Professionalism and Restrictions

Positive reviews of Coverall mostly highlight its "professionalism." Many franchisees acknowledge that the headquarters' training and cleaning systems genuinely set them apart in front of clients and help build trust. However, negative feedback also exists and closely mirrors that of Jan-Pro. In a Reddit discussion thread about cleaning franchises, a user claiming to be a former Coverall franchisee warns: "Be careful! The client packages they promise can be hit or miss, and once you lose a client, they have no obligation to replace them with one of equal quality. The various fees you pay each month will suck the life out of your profits like a vampire." It feels like you've paid for top-of-the-line diving gear only to be told you can only dive in designated shallow waters with few fish, and you have to pay a "site fee" every time you go in.

Horizontal Comparison Summary: See All Key Differences at a Glance

| Feature | Jani-King | Jan-Pro | Coverall |

|---|---|---|---|

| Core Selling Points | Large venues, brand reputation | EnviroShield® technology, eco-friendliness | Healthy Cleaning System, the healthcare sector |

| Franchise Model | Unit franchising & regional development Multi-Tier Franchise Program | Unit Franchise Only | (not provided) |

| Investment Threshold | Medium to High, Lack of Transparency | Low to Medium, Low Entry Barrier | Low to Medium, Relatively Clear Fee Structure |

| Major Points of Controversy | Complex Fee Structure, Numerous Lawsuits | Low Contract Profit Margins, Conflict of Interest | High Fee Percentage, Client Package Quality |

| Ideal Candidates | Capital-rich investors targeting large clients | Entrepreneurs seeking low-cost entry who value technological innovation | Entrepreneurs focused on niche markets like healthcare or education |

By now, you might feel more confused—each option seems to have strengths, yet each also has its "pitfalls." Don't worry, this is normal. If you're torn between three "seemingly good" choices, it means you need more information. Want to compare these three opportunities in depth with other options you're considering? Enter your key metrics (like initial investment, royalty rates, contract duration) into our website's Opportunity Comparison Tool. Let the data speak for itself—clarity at a glance.

Part Three: Insider Reveal

Friend, if Part Two gave you a tour of these three companies' "model homes," Part Three takes you behind the scenes to the "construction site." Here, we uncover the structural issues hidden beneath the paint and wallpaper. This is information you won't find in any official brochure and is selectively ignored by most review articles—yet it's precisely what determines the success or failure of your investment.

3-1: How to Read an FDD (Franchise Disclosure Document) Like an Expert

The FDD is your most powerful tool, but its hundreds of pages packed with legal jargon can intimidate anyone. Don't worry—you don't need to read every word. Just act like a detective and zero in on the most critical "evidence."

Must-See Item #3: Litigation History

This section lists all major lawsuits the franchisor has faced in recent years. Focus on: Has the brand been frequently sued by its own franchisees? What were the reasons? Contract fraud? Territorial protection disputes? If a brand is mired in lawsuits—especially class actions from franchisees—it's a massive red flag. My friend Old Wang discovered a brand he admired had over ten pages of litigation records under Item 3, instantly cooling his enthusiasm. This indicates potentially strained franchisor-franchisee relations and systemic flaws prone to disputes.

Must-See Items #5 & #6: Initial Fees & Other Fees

This is your "fee breakdown." Item 5 lists all initial costs, while Item 6 details ongoing expenses you may incur during operations. Examine these with a magnifying glass! Beyond royalties and advertising fees, are there "software usage fees," "training travel expenses," "mandatory conference attendance fees," "contract transfer fees," "penalties for breach of contract," and so on? List every potential expense, add them up, and see if the total leaves you breathless. Many franchisees ultimately find their profits eroded because they overlooked the seemingly insignificant small fees in Item 6.

Must-See Item #20: Franchisee List and Turnover Rate (Outlets and Franchisee Information)

This is the most valuable section of the FDD! It provides the number of new outlets opened, contracts transferred, agreements terminated, and franchises that ceased operations for any reason over the past three years. Using this data, you can calculate the franchisee turnover rate. If a system experiences over 10% or higher franchisee attrition annually, it's an absolute red flag indicating potential retention issues. More crucially, Item 20 includes a list of current franchisees with names and phone numbers. While the franchisor might provide a curated "success story" list, the FDD roster cannot be fabricated. My advice: Make at least 10 calls! Don't just call those near you—select randomly. When calling, you can ask:

"Hello, I'm considering franchising with XX brand. Could I take 5 minutes of your time for some questions?"

"How much did your actual total investment differ from the FDD estimate?"

"What was the quality and profitability of the customers promised by headquarters?"

"What percentage of your monthly revenue do you actually pay to headquarters?"

"On a scale of 1 to 10, how would you rate headquarters' support?"

The most critical question: "If you could choose again, would you still join this franchise?" These authentic voices from the front lines hold more value than any sales pitch.

3-2: Exit Strategy: What if I want to quit?

Entrepreneurship always carries risks, so we must prepare for worst-case scenarios. If operations falter or better opportunities arise, can you sell or close the franchise? How difficult is it? This is another critical issue most people overlook.

You must carefully examine the contract addendum in the FDD for clauses regarding **"Contract Termination" and "Transfer."** You'll find numerous stringent restrictions:

1. Hefty Transfer Fees: When you find a buyer and want to transfer the store, headquarters may charge a substantial transfer fee.

2. Headquarters' Right of First Refusal and Veto Power: Many contracts stipulate that headquarters has the right to repurchase your franchise rights at the same price, or they can reject your buyer without justification. This puts you in an extremely passive position during negotiations.

3. Non-Compete Clause: This is the most "draconian" clause. The contract may stipulate that for 2-3 years after leaving the franchise system, you cannot engage in any cleaning-related business within dozens of kilometers. This means that even after leaving, you cannot leverage your accumulated experience and customer base to start your own business independently—you are completely "locked in."

I witnessed a case where a franchisee worked tirelessly for three years, building a loyal customer base. Later, finding the fees paid to headquarters too high, he sought independence. Immediately, a cease-and-desist letter arrived from headquarters' lawyers, citing the non-compete clause in the contract. He faced a choice: shut down or pay a massive penalty. Ultimately, he had no choice but to abandon everything he'd painstakingly built. Therefore, before signing any agreement, you must clearly understand the cost you'll incur if you ever decide to "divorce" the franchise.

3-3: Where Do Customers Come From? Unveiling the Truth Behind "Brand-Supplied Leads"

"Headquarters provides customers" is one of the most enticing promises made by all cleaning franchise brands. But you must understand: the "leads" provided by headquarters and the "profitable contracts" that actually make you money are two entirely different things.

The reality is often this:

1. Lead quality varies wildly: The headquarters' call center might treat any inquiry call as a "lead" and send it your way. But the caller might just be looking for a part-time cleaner for their apartment—not your target customer.

2. The consequences of low-ball bidding: As we analyzed earlier, headquarters may aggressively pursue contracts at rock-bottom prices to expand, then force them onto you. These contracts often come with high demands, slim margins, and demanding clients, making them a nightmare to manage.

3. Local marketing remains your responsibility: Brand advertising boosts visibility, but what ultimately wins clients is your local reputation, network, and marketing efforts. You may need to run local Google ads, distribute flyers, and attend chamber events yourself. Expecting headquarters to assign work while you sit at home is extremely unrealistic.

Therefore, you must clarify: Does headquarters guarantee a minimum profit margin for assigned clients? Is there a replacement mechanism if clients are lost? Do my local marketing activities require headquarters approval? These details directly impact your survival and growth.

Part Four: Risk Warnings and Compliance Statement—Your Seatbelt

Friend, we've shared many "insider truths" here—not to scare you off, but to ensure you fasten every seatbelt before soaring to new heights. Investment, especially capital-intensive ventures like franchising, is no game to be taken lightly.

⚠️ Important Investment Risks and Disclaimer ⚠️

All information herein is provided for educational and reference purposes only and does not constitute financial, legal, or investment advice. Market conditions change rapidly, and this document may not reflect the latest market developments or brand policies.

Franchising is a high-risk investment. Past success does not guarantee future returns. Any projections regarding profitability involve significant uncertainty, and you may face the risk of losing part or all of your initial investment.

Before signing any contracts or paying any fees, we strongly, strongly, STRONGLY recommend: Hire an independent, experienced franchise attorney to review the FDD and franchise agreement, and consult a professional accountant to evaluate your financial situation and business plan. Spending a few thousand dollars on consulting fees could save you hundreds of thousands in losses. This is money you absolutely cannot afford to save!

The calculators and tools provided on this site are auxiliary decision-making aids based on generic models and your input data. Their results do not constitute financial advice and cannot replace professional consultation.

Beware the "Pseudo-Entrepreneurship" Trap: Are You Running a Business, or Buying Yourself a High-Risk Job?

Finally, I want to warn you about a "pseudo-entrepreneurship" trap. True entrepreneurship means having autonomy over your product, pricing, market, and customers. Yet many cleaning franchise models, to some extent, resemble spending a large sum to buy yourself a "piecework job." Your service standards, fee caps, customer sources, and even working hours may be tightly controlled by headquarters, while you shoulder all operational risks (staff, insurance, equipment depreciation, etc.). You may be a "boss" in name, but in reality, you might just be a "super employee" with no base salary, no benefits, and bound by a long-term contract. Before investing your life savings, ask yourself: Am I pursuing the freedom of entrepreneurship, or merely the appearance of being a "boss"?

Part Five: Your Action Plan—From Information to Decision

Alright, friend. We've dissected all this information together, and your head might be spinning a bit now. Don't worry—it's time to piece these fragments together into a clear, actionable plan. Follow these steps one by one, and your path to decision-making will become crystal clear.

Step 1: Financial Feasibility Analysis—Let the Numbers Speak

Enough with emotional judgments—it's time for rational financial analysis. You need to conduct a thorough financial "checkup" on yourself.

A. Assess Your Capital: How much cash do you have available for investment? Remember, this should be "risk capital"—money you can afford to lose entirely without impacting your family's basic livelihood. Never invest retirement funds or children's education savings.

B. Simulate Your Profitability: This is the most critical step. Don't trust salespeople's verbal profit promises. Open our website's [ROI Calculator] and begin a serious math exercise:

0. Enter Total Investment: Sum all initial costs listed in FDD Item 5 and Item 7.

1. Enter Projected Monthly Revenue: Refer to FDD Item 19 (if available) or create conservative, moderate, and optimistic estimates based on your local market research.

2. Enter all monthly costs: This is where attention to detail counts! Input all percentage-based fees mentioned in FDD Item 6 (royalties, advertising fees, management fees, etc.), plus your estimated employee wages, insurance, fuel costs, material expenses, office rent (if applicable), and more.

3. Review the results: The calculator will show your pre-tax net profit at different revenue levels and how long it will take to recoup your initial investment (payback period).

Through this simulation, you may be shocked to discover that a business with seemingly high monthly revenue can yield a pitiful net profit after all expenses are deducted. This tool helps burst many unrealistic bubbles.

Step 2: Due Diligence—Gather Intelligence on the Front Lines

Now pick up your phone and execute the "Call 10 Franchisees" plan mentioned in Part 3. This is the most valuable part of your entire decision-making process. Remember: approach this like a journalist uncovering a story, not a salesperson validating your own assumptions.

Who to talk to? FDD Item 20 is your phone book. Be sure to call people from different regions and with varying years of franchise experience. Most importantly, if you can find former franchisees who have exited the system, their opinions are worth their weight in gold! You can try searching for them on LinkedIn or industry forums.

What to ask? Beyond the questions we mentioned earlier, dig deeper: "What was the biggest challenge you faced?" " What support did headquarters provide when you needed it most?" "How much of your personal time did this business consume? Did it match your initial expectations?"

How to listen? Pay attention not only to what they say, but also to what they don't say. Is their tone passionate or weary? Are they genuinely sharing or just going through the motions? These details reveal a lot.

Step 3: Professional Consultation—Let Experts Guide Your Way

Once you've narrowed down your choice to one brand and are ready to sign, pause! Now is the time to take your FDD, franchise agreement, and business plan to professionals for review.

Franchise Attorney: They will meticulously review each clause of the contract, uncover hidden risks and unfair terms, and identify negotiable provisions. They'll clarify the true scope of your "territorial protection" and the strictness of your "exit provisions."

Accountant: They will help you refine your financial projections, analyze cash flow, and provide tax planning advice. They can objectively assess whether your profit projections are realistic.

I know this adds another expense of several thousand dollars. But trust me—this is the most cost-effective "insurance" you can buy for your investment. My friend Old Wang ultimately abandoned a brand he initially loved because the lawyer pointed out several critical risks in the contract, saving him from a major pitfall.

Step 4: Build Your Business Blueprint—Transform Ideas into Action Plans

Once you've completed all the above steps and made a clear decision, congratulations! You've already surpassed 99% of blind investors. Now it's time to solidify all your research and thinking into a professional business plan.

A solid business plan isn't just your ticket to securing bank loans or attracting investors—it's your roadmap for future operations. It forces you to scrutinize every detail of your market, operations, finances, and management.

Don't worry—you don't have to start from scratch. Our website's Business Plan Generator provides a clear framework. Simply input your collected brand information, market data, and financial projections, and it will generate a professionally structured, comprehensive business plan for you.

My Perspective and Final Thoughts

After all this discussion, I'd like to share some of my deepest personal reflections. In my view, franchising—especially in the cleaning industry—is fundamentally an "amplifier." It magnifies your strengths and equally magnifies your weaknesses. If you're inherently diligent, astute, and skilled in management and sales, a strong franchise system can give you wings to soar higher. But if you're merely seeking a "haven," believing money can buy you comfort, this system may well become a "meat grinder," mercilessly shredding your capital and passion.

The most successful franchisees I've encountered share one common trait: they never see themselves as "employees." They proactively seek clients beyond the FDD list, relentlessly optimize their cost structures, and even collaborate with other franchisees to negotiate better policies from headquarters. They treat the franchise brand merely as a tool, a lever—the true driving force being their own formidable entrepreneurial spirit.

So the crux of the matter comes back to you. Are you ready? Are you prepared to handle tedious customer complaints, manage employees who might quit at any moment, and deal with emergency cleaning calls in the dead of night? Are you ready to pore over dry financial statements and rack your brain to squeeze out a 1% profit margin increase? If your answer to these questions is yes, then whether you choose Jani-King, Jan-Pro, Coverall, or ultimately decide to go it alone, your chances of success will be significantly higher.

Summarizing our exploration journey:

1. Recognize the Essence: Franchising is buying a system, not a guarantee. You remain the primary operator responsible for the business.

2. Conduct Thorough Research: Don't trust ads; trust the FDD. Call actual franchisees—their experiences are your most valuable reference.

3. Do the Math: Use an ROI calculator to factor in all costs and puncture unrealistic profit fantasies.

4. Get Professional Guidance: Before signing, have a lawyer and accountant review the agreement.

5. Listen to Your Gut: The final decision hinges on your personality, goals, and risk tolerance.

Final Actionable Advice:

Act Now: Don't just bookmark this article. Download the Franchise Disclosure Document (FDD) for brands you're interested in right now (usually available on official websites or third-party platforms). Flip to Items 3, 6, and 20 to see the details I mentioned firsthand.

Stay Skeptical: Be wary of anyone promising "easy money." There's no such thing as a free lunch.

Keep Learning: Your entrepreneurial journey has just begun. Stay updated on industry trends and build your knowledge in financial management and marketing.

Final Risk Warning:

Remember, all investments carry risks. This article provides you with a map and compass, but the path ahead still requires you to walk it step by step. Make decisions cautiously and take responsibility for your own funds.

Citations:

IBISWorld. "Commercial Cleaning Services in the US - Market Size 2005–2029"

Federal Trade Commission. "A Consumer's Guide to Buying a Franchise"

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.