Introduction:

Friends, we're not just browsing lists—we're becoming savvy investors.

I recall a few years back, a close friend of mine—let's call him David—was exactly where you might be now. He'd grown weary of the nine-to-five grind, his heart burning with entrepreneurial ambition, yet his savings left him daunted by the multi-million-dollar price tags of big-name franchises. So he became obsessed, Googling "affordable franchises" every day. He showed me dozens of bookmarked pages crammed with "business opportunities under $50,000." He was excited, but his eyes betrayed more confusion than anything else. "So many options—which one should I choose? Which is a real opportunity, and which is a trap?" he asked me. I believe this question troubles you as well. The internet gives us a sea of information, yet it also brings the anxiety of information overload.

This article aims to solve David's dilemma—and yours. I don't want to add another link to your bookmarks or another cold list of franchise brands. No, my goal is to give you a set of "fishing gear" and "fishing methods." I'll guide you through the fog of information, provide a clear, actionable decision-making framework, and show you how to use our website's unique free tools to transform from a passive information receiver into an active, informed investor. Together, we'll learn to see beyond the illusion of "affordability," scrutinize a franchise agreement like a detective, and scientifically calculate your future return on investment. Ready? Let's embark on this exciting entrepreneurial journey together.

Disclaimer:

Please note that the information provided herein is for educational and reference purposes only and does not constitute any form of investment, legal, or financial advice. Franchising any brand involves significant risks, including the potential loss of your entire investment. Before making any financial commitment, you must conduct your own due diligence and are strongly advised to consult qualified franchise attorneys and accountants. Any brand names mentioned herein are used solely for illustrative purposes and do not represent our endorsement or recommendation.

1: What Does "Affordable" Really Mean? Unveiling the True Cost of Franchising

When we see the word "affordable," our brains perk up—but danger often lurks here. In franchising, ‘affordable' is never just the tempting "franchise fee" you see. That's merely your "ticket" to join the club. The true cost, what we call the "Initial Total Investment," is like an iceberg—the ticket is just the tip above the surface. To give you a clearer picture, I've created a table to provide a comprehensive overview of the potential expenses involved.

Table: Example Breakdown of Initial Total Investment Costs

| Cost Category | Cost Description | Estimated Range (Example) | Notes |

|---|---|---|---|

| Initial Franchise Fee | Fee for brand licensing and initial support. | $10,000 – $50,000 | Typically, a one-time, non-refundable payment. |

| Real Estate / Lease Fees | Deposit, first month's rent, etc., for leasing or purchasing a storefront. | $5,000 – $25,000+ | May be zero for home-based or mobile businesses. |

| Leasehold Improvements | Costs to renovate the storefront to meet brand specifications. | $10,000 – $100,000+ | This is a major expense with significant cost variation. |

| Equipment & Tools | Kitchen appliances, cleaning supplies, computer systems, etc. | $5,000 – $75,000 | Franchisor may require purchases from designated suppliers. |

| Initial Inventory | Raw materials or products stocked before opening. | $2,000 – $15,000 | |

| Professional Fees | Legal fees, accounting fees, etc. | $1,500 – $7,500 | Essential expenses! |

| Licenses & Insurance | Business licenses, industry permits, liability insurance, etc. | $500 – $5,000 | |

| Initial Marketing | Grand opening promotions, local advertising, etc. | $2,000 – $10,000 | Let your community know you exist. |

| Additional Funds | Working capital to cover the first 3-6 months of operating costs. | $10,000 – $50,000 | Your "lifeline"—absolutely critical! |

| Total | Your true initial investment | $56,500 – $362,500+ |

Seeing this table might shock you. An opportunity advertised as a "$20,000 franchise fee" could ultimately require you to invest over $100,000. Even scarier are the hidden costs. Some franchise brands plant "landmines" in the fine print of their contracts, such as forcing you to purchase daily supplies at inflated prices from them, mandating attendance at costly annual conferences, or imposing irregular mandatory upgrade fees for software systems. These are never mentioned in initial promotions but will steadily drain your profits down the line.

So, how can you avoid falling into these traps? You need a tool to help you simulate the scenario. This is where our website's ROI Calculator comes into play. Before you get swept away by a "low franchise fee," sit down and input every potential cost you can think of. This process itself is invaluable risk screening. It forces you to consider overlooked details and gives you a clearer picture of your future financial situation. Remember: a wise investor always calculates risk before considering reward.

2: Before Seeking Opportunities: Ask Yourself, Are You Truly Ready?

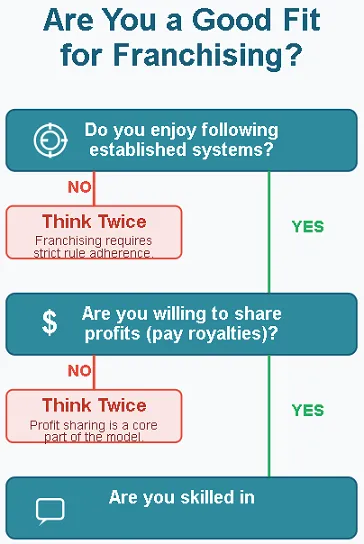

Alright, friend. Before we dive headfirst into those tempting franchise opportunity lists, I want you to pause for a moment. Let's have a candid conversation. This might be more important than any list you'll ever see. Franchising is like marriage—you need to understand the other party, but more importantly, you need to understand yourself. It's not for everyone.

At its core, franchising means trading some of your "freedom" for a proven "system."

The benefits are clear: You don't have to build a brand from scratch, figure out operational models, or test products. You get a complete playbook, supply chain support, and brand recognition. This significantly reduces the risk of failure in the early stages of entrepreneurship.

The costs are equally real: You must strictly adhere to headquarters' rules—from store color schemes to punctuation on menus—leaving little room for independent decision-making. You pay recurring royalty fees regardless of monthly profits or losses. You're not a true "owner," but rather a "senior manager" executing directives.

So ask yourself these soul-searching questions:

Am I a rule-following executor or a free-thinking creator? If you thrive on perfecting things within established frameworks, franchising might suit you well. But if you crave daily experimentation and hate constraints, the franchise system could feel suffocating.

Am I willing to share my profits with others? Ongoing royalties are the franchise model's core. You must mentally accept that a portion of your gross revenue (typically 4%-10%) will never belong to you.

How strong are my interpersonal and management skills? As a franchisee, you'll serve customers, manage employees, and liaise with regional managers sent by headquarters. You must become a communication bridge.

There are no right or wrong answers to these questions, but honestly addressing them can spare you years of future pain. To make this process more scientific and engaging, we've designed a specialized tool: The Entrepreneur Assessment acts like a mirror, using a series of questions to help you analyze your risk tolerance, management style, and entrepreneurial traits. It takes just 5 minutes, but it could save you 5 years and hundreds of thousands of dollars in investment. I've seen too many passionate individuals fail in franchising due to "personality clashes." I sincerely hope you won't be next. Know yourself before you know the world—this is the first step to any successful investment.

3: Top Affordable Franchise Opportunities for 2026 (Curated Case Studies for Your Analysis)

Alright, with your self-assessment complete and a clear understanding of costs, we can finally explore the opportunities available in the market. But remember our initial agreement: this isn't a list of "no-brainer" recommendations. Instead, it's a curated collection of case studies for you to analyze using the "due diligence framework" we'll explore next. I've categorized them into several mainstream segments and listed their publicly disclosed investment ranges for your reference.

3-1: Service-Based Franchises (Low Startup Costs, High Demand)

The biggest advantage of these franchises is that they typically don't require expensive street-front locations—some can even be run from home—significantly reducing the "real estate" and "renovation" costs in your initial investment. They sell skills and services, not physical products.

Case Study 1: Commercial Cleaning (e.g., Jani-King, Anago Cleaning Systems)

Initial Investment Range: Approximately $12,000 - $70,000+ (Source: Entrepreneur.com)

In-Depth Analysis: Why are these franchises "affordable"? Because your primary assets are your cleaning equipment and your ability to secure client contracts. Companies like Jani-King often provide initial client contracts, solving the biggest startup hurdle—where to find customers. Your role is to manage your cleaning team and ensure service quality. The challenge lies in potentially tricky personnel management and relatively fixed profit margins. However, for detail-oriented managers with strong execution skills, this is a highly stable cash flow business. Key considerations include: What is the quality of client contracts provided by headquarters? Are the royalty and management fees reasonable?

Case Study 2: Home Services (e.g., The Patch Boys - Wall Repair)

Initial Investment Range: Approximately $45,000 - $66,000 (Source: The Patch Boys official website)

In-Depth Analysis: This represents a classic "niche market" opportunity. Every household may encounter wall damage, yet few large companies specialize in this area. The Patch Boys targets this small yet lucrative market. Investment is low since you don't need a storefront—just a vehicle and specialized tools. Headquarters provides branding, marketing support, and a standardized repair process. Success hinges on your local marketing skills and customer referrals. Ask yourself: Does my community have a high housing stock? Am I skilled at building partnerships with local real estate agents and property managers?

3-2: Mobile & Home-Based Franchises (Flexibility & Freedom)

These models push "low cost" to the extreme, freeing you from rent by turning your car or home into your office.

Case Study 3: Travel Planning (e.g., Cruise Planners)

Initial Investment Range: Approximately $2,295 - $23,617 (Source: Entrepreneur.com)

In-Depth Analysis: This represents an extreme example of affordable franchising. You can operate from home with just a computer and phone. As part of American Express, Cruise Planners benefits from strong brand endorsement and bargaining power, enabling you to secure travel products like cruises and hotels at discounted rates. Your role involves leveraging headquarters-provided marketing tools and training to develop clients within your network. This model suits individuals passionate about travel, possessing strong social skills, and committed to patient customer service. The drawback is that income is entirely dependent on your sales ability, potentially lacking stability initially. Key considerations: How extensive is my network? Can I consistently execute content marketing and maintain client relationships?

3-3: Niche Food Franchises (Beyond Pizza and Burgers)

The food service industry is often a high-risk investment zone, but some clever niche brands have achieved "affordable" franchising through streamlined models.

Case Study 4: Unique Snacks/Beverages (e.g., Kona Ice - Shaved Ice Truck)

Initial Investment Range: Approximately $150,000 - $175,000 (Source: Kona Ice Official Website)

In-Depth Analysis: You might argue that over a hundred thousand dollars isn't exactly "affordable." Yet compared to McDonald's franchises costing millions, this represents a remarkably accessible food service option. Kona Ice's ingenuity lies in its "mobile" model. A vibrant shaved ice truck serves as both your production facility and a mobile billboard. You can operate at school events, sporting games, community parties, or any crowd gathering—generating excellent cash flow. Headquarters provides a patented flavor system and strong brand identity. The challenges lie in seasonality (what about winter?) and reliance on event channels. Key questions to research: What support does HQ offer during off-peak seasons? Does your region's climate and community events sustain this business?

By now, you might be tempted by several options. Perhaps you're torn between cleaning and home services, or wavering between tourism and specialty snacks. Don't rush—this is precisely why we designed our Opportunity Comparison tool. Input key details (investment amount, royalty fees, strengths, weaknesses) for your shortlisted "cases," and it generates a clear side-by-side comparison. This instantly reveals core differences, enabling rational initial screening.

4: The Investor's Due Diligence Framework: Your 5-Step Safe Investment Guide

This is the most crucial and valuable part of this article. Mastering this framework will not only help you evaluate the cases mentioned above but also scrutinize any franchise opportunity you encounter in the future. This process is the essential homework every professional investor must complete before signing any contract. It may seem tedious, but trust me—spending a few extra hours here today could save you years of financial nightmares down the road.

Step 1: Decode the FDD (Franchise Disclosure Document) Like a Detective

The FDD is a legal document mandated by the U.S. Federal Trade Commission (FTC) that all franchise brands must provide to you before charging any fees. It's typically hundreds of pages long and filled with legal jargon, but it's also your "treasure map" to uncovering all the brand's secrets. You don't need to read every word, but you must act like a detective and pinpoint the following critical "clues" (Items).

4-1: Key Items to Scrutinize

Item 3 (Litigation History): This section documents whether the franchisor and its executives have been involved in significant legal disputes, especially lawsuits with franchisees. If a brand is mired in litigation—particularly class-action lawsuits filed by franchisees—it's a major red flag! This indicates potential serious flaws in their system or support structure.

Item 7 (Estimated Initial Investment): This is the cost breakdown sheet we discussed earlier. You must meticulously verify this table: Are their estimates comprehensive? Have they deliberately underestimated certain costs? For example, if their quoted renovation costs are significantly below market rates, you should be wary.

Item 19 (Financial Performance Representations): This is the most enticing yet dangerous section of the FDD. It may present data like average revenue and gross profit from existing franchise locations. Note: The franchisor may choose not to provide Item 19. If they do, scrutinize how the data is calculated—is it an average across all stores, or only top-performing locations? If they don't provide it, ask a straightforward question: "Why not?" A brand confident in its system is typically willing to showcase its franchisees' financial performance.

Item 20 (Outlets and Franchisee Information): This section is a goldmine. It lists the number and contact details of all franchise outlets opened, closed, transferred, or terminated over the past three years. You must calculate the "franchise closure rate." If a system experiences significant annual closures, run away! More importantly, this section contains contact details for current and former franchisees, which directly leads to our next step.

Step 2: Talk to Real Experts: Current and Former Franchisees

The data in the FDD is cold, but franchisees' firsthand experiences are hot. The list provided under Disclosure Item 20 is your most valuable research material. Your task is to make at least 5-10 calls, including at least 2 former franchisees who have exited or closed their stores. They often reveal the most authentic stories behind the brand's marketing.

Before calling, prepare your list of questions. Don't just ask, "Did you make money?" Be specific:

1. "How helpful was the initial training provided by headquarters for your actual store operations?"

2. "When you faced urgent issues (like equipment breakdowns), how responsive and effective was headquarters' support?"

3. "Was there a significant gap between your total actual investment and the estimate in FDD Item 7? What unexpected expenses arose?"

4. "Do you feel the royalties and advertising fees charged by headquarters are worth the cost? Is their marketing support effective?"

5. "(Ask former franchisees) What was the main reason you ultimately decided to leave?"

6. "If you could turn back time, would you make the same choice?" — This is the ultimate question. The tone and hesitation in their response matter more than any answer.

Step 3: Analyze Your Market and Territory

A brand that thrives in California may not survive in Ohio. You must study your own "territory" like a local expert.

Competitive Analysis: Open Google Maps and search for your potential business (e.g., "wall repair"). How many competitors already operate in your planned area? Are they independent local shops or other franchise brands? What do their customer reviews say?

Customer Profile: Who are your target customers? Where do they live? What is their spending power? (For example, if you want to open a high-end pet grooming salon, you need to ensure your community has enough high-income pet-owning households.)

Territory Protection: Confirm in the FDD how much "Protected Territory" the brand offers. Do they promise not to open another branch within your territory? How large is this area? Is it sufficient to support your business?

Step 4: Build Your Own Financial Model

Now that you've gathered extensive data—official figures from the FDD, real feedback from franchisees, and your local market analysis—it's time to translate this intelligence into financial projections.

Tool Guide: Reopen our ROI Calculator. This time, input precise data from your research instead of rough estimates. For instance, adjust projected monthly revenue and expenses based on franchisee conversations.

Scenario Analysis: Don't calculate just one scenario. Test income and expenses under "Optimistic," "Moderate," and ‘Pessimistic' scenarios to see how your payback period and profit margins shift. If cash flow dries up quickly under "Pessimistic" conditions, this investment may carry too much risk for you.

Step 5: Seek Professional Legal and Financial Advice

This is your final, crucial safeguard before signing any documents.

Franchise Attorney: Engage a lawyer specializing in franchise law to review the FDD and franchise agreement. They can identify "unfair clauses" and potential legal risks you'd never spot as a layperson. This expense is absolutely worth every penny.

Accountant: Have an accountant help evaluate your financial model and advise on future tax planning.

Only after completing these five steps have you truly conducted "due diligence." This process is the "fishing method" we offer you—more valuable than any franchise list.

5: The Biggest Risks of Budget Franchises and How to Avoid Them

While the saying "you get what you pay for" may be a bit absolute, it holds in the franchise world. Many "budget" franchises hide common risks you need to recognize clearly.

Risk 1: Weak Brand Power

Symptoms: You join a brand, but outside your local community, almost no one has heard of it. You won't benefit from the "built-in traffic" effect of a well-known brand, leading to extremely high customer acquisition costs.

Mitigation Strategy: During due diligence, focus on evaluating the headquarters' marketing capabilities. How do they drive traffic to franchisees? What is their national advertising budget? Directly ask existing franchisees: "How do customers primarily find you? How many come specifically for the brand?"

Risk 2: Inadequate Support System

Symptoms: The brand is fiercely enthusiastic when selling you the franchise rights, but vanishes once you open. Your training is rushed, issues go unresolved, and technical systems are outdated.

Mitigation Strategy: This is precisely why you need to speak with numerous existing franchisees. Verify repeatedly whether the support they receive matches the promises made. A robust franchise system should include regular store visits by regional managers, ongoing online training, and an efficient technical support hotline.

Risk Three: Low Profit Ceiling

Symptoms: Due to a simple business model and low average transaction value, even if you're constantly busy, your annual income will struggle to exceed a certain ceiling. It might provide a decent living, but achieving true financial freedom will be difficult.

Mitigation Strategy: Thoroughly examine Item 19 of the FDD (if available) and verify income levels with franchisees. Additionally, use our ROI calculator for long-term projections. Ask yourself: Where does this business's long-term growth potential lie? Do I have opportunities to open multiple locations?

Risk 4: Supply Chain Traps

Manifestation: Contracts mandate sourcing all supplies exclusively from headquarters or its designated vendors at prices significantly above market rates. Headquarters profits stem not from royalties, but from "milking" you.

Mitigation Strategy: Scrutinize the relevant clauses in Item 8 (Restrictions on Sources of Products and Services) of the FDD. Directly ask existing franchisees: Do they find procurement costs reasonable? Are they permitted to source non-core materials from alternative channels?

The core to avoiding these risks remains the "due diligence" we emphasized earlier. Never rely on verbal assurances. Base your decisions solely on the written terms in the FDD and the authentic feedback you gather from franchisees.

6: You've chosen your direction: What's next?

Congratulations! If you've strictly followed the steps above, completed all your research, and finally identified an opportunity that excites you, you've already surpassed 90% of potential investors. Now, you need to consolidate all your research findings and insights into a professional document. This document will serve as both your "stepping stone" for securing bank loans and your "roadmap" for the next two years of operations.

Tool Guide: This might sound complex, but don't worry—we've prepared one final powerful tool for you: Business Plan Generator.

How to Use: Enter all your due diligence findings—market analysis, competitor insights, cost estimates, revenue projections (from your ROI calculator)—into our generator template. It guides you through every critical section: executive summary, company description, market analysis, organization & management, products & services, marketing & sales strategy, and financial projections.

Final Output: You'll end up with a fully structured, logically coherent, and data-rich business plan. Even if you ultimately don't apply for a loan, the writing process itself serves as a definitive review of your entire business concept. It forces you to consider every overlooked detail, ensuring your entrepreneurial journey is built on a solid, rational foundation from the start.

Once your business plan is ready, you can approach SBA-certified lenders or other commercial banks to explore financing options. A business plan backed by data and thorough research significantly boosts your chances of securing a loan.

7. My Personal Perspective and Insights

After all this discussion, I'd like to share some personal reflections. After running this website and interacting with countless entrepreneurs, I've come to realize that the most dangerous aspect of franchising isn't choosing an "expensive" option, but rather opting for what "seems cheap." Expensive brands like McDonald's use their high entry barriers as a screening mechanism. Their systems, brand equity, and support have been proven over decades, making risks relatively transparent. Cheap options, however, are a mixed bag, rife with unknowns.

In my view, choosing a franchise opportunity is fundamentally about selecting a long-term business partner. What you need to evaluate goes far beyond financial data—it's about the brand's character. Does its leadership have a long-term vision? Do they treat franchisees as partners or as cash cows? Does its culture encourage innovation or cling to tradition? These intangible factors often determine whether you'll be happily profitable or painfully struggling over the next 5 to 10 years.

Therefore, I sincerely advise you to adopt the "due diligence framework" we discussed today as a mindset habit. Don't skip any step just because it seems tedious. Every extra minute you invest today in calls, emails, and research is purchasing the most tangible insurance for your future financial security and business success. Remember, your goal isn't to find the "cheapest" franchise, but to identify the opportunity with the "lowest risk, best fit for you, and one you fully understand." That is true "wise investment."

8. Summary and Action Recommendations

Alright, friends, our deep exploration journey today is nearing its end. Let's quickly recap the tremendous gains you've made:

You've learned how to deconstruct the true meaning of "low-cost" and see through the total cost of franchising.

Through self-assessment, you've gained clearer insight into whether the franchise model suits you.

You've mastered a priceless **"5-Step Due Diligence Framework"** to evaluate any business opportunity.

You know how to leverage our website's four free tools to make complex decisions scientific and straightforward.

You've gained a sobering awareness of the hidden risks behind low-cost franchises and learned how to avoid them.

Now, don't let this knowledge stay in your head. Take action immediately!

Step 1: If you haven't already, go use our Entrepreneur Assessment tool right now to complete your self-evaluation.

Step 2: Select 1-2 franchise brands discussed today or ones that interest you personally, and begin your "due diligence" exercise. Try to locate their FDD and analyze it using the methods we taught you.

Step 3: Record your findings in the Opportunity Comparison tool and perform preliminary financial modeling with the ROI Calculator.

Step 4: Explore additional resources on our website to deepen your understanding.

9. Recommended Reading

To help you explore further, we've curated two articles from our site that complement today's learning:

10. Final Risk Warning

Important Disclaimer: This article and all content on this website are for informational and educational purposes only and do not constitute any form of investment, legal, tax, or financial advice. All investment decisions involve risk, and franchise investments may result in significant losses, including loss of principal. It is your responsibility to conduct thorough, independent due diligence before signing any agreements or committing funds. We strongly and repeatedly recommend engaging independent, qualified franchise attorneys and accountants to review all documents and provide professional advice. Your financial future is in your hands—make decisions with utmost caution.

11. References:

The Patch Boys Franchise Investment.

Entrepreneur.com, Cruise Planners Profile.

15 Best Low Cost Franchises to Own for High Profit

FTC Consumer Advice: A Consumer's Guide to Buying a Franchise

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.