Author Bio:

I am Qaolase, a business analyst and entrepreneurial advisor with over 10-years of experience. I have helped hundreds of entrepreneurs like you sift through, evaluate, and make decisions on complex business opportunities. I understand that one right choice can build a successful venture, while one wrong decision can cost you dearly.

Disclaimer and Risk Warning: Before proceeding, I must clarify: I have no commercial affiliation with WSI. This report provides independent, objective, data-driven analysis and does not constitute investment advice. Joining any business venture carries significant financial risks. Consult your financial and legal advisors before making decisions.

Hello, friend!

Have you ever dreamed of breaking free from the 9-to-5 grind to run your own "high-end" digital marketing business from home—or anywhere you choose? That's precisely when WSI (We Simplify the Internet) might have caught your eye.

It sounds too good to be true, doesn't it? A global brand with nearly 30 years of history, a "work-from-home" business model, a "turnkey" solution promising entry into the limitless world of digital marketing.

But reality is often far more complex than the brochures suggest. I recall in 2021, one of my clients—let's call him Alex—was absolutely enthusiastic about WSI. With a sales background and roughly $100,000 in startup capital, Alex felt WSI was tailor-made for him. But after we dissected its business model and hidden costs together, he realized startup expenses went far beyond just the franchise fee. Behind the "work-from-home" promise lay an extreme test of personal discipline and sales prowess.

This article exists to prevent you from repeating the mistakes Alex nearly made. Together, we'll peel back the layers like an onion to reveal the true nature of the WSI franchise. Using a systematic analytical framework, we'll examine five dimensions—project fundamentals, market viability, operational fit, risk management, and deliverables—to answer one core question:

Is the WSI franchise truly a worthwhile investment of your time, money, and future?

After reading this in-depth 3,000+ word report, you'll gain not just information, but a complete decision-making toolkit and a clear roadmap for action. Let's get started!

1: What Exactly Is WSI? A Deep Dive into Its 30-Year Brand Fundamentals

Before discussing return on investment, we must first understand what exactly we're investing in. It's like buying a house—you need to examine the developer's strength, the building's structure, and its foundation. For WSI, this is its "project fundamentals."

1-1: Brand History & Legal Risk Scan: How Solid Is WSI's "Foundation"?

A brand's history is its credit record. Founded in Canada in 1995, when the internet was just emerging, WSI's survival from the dial-up era to today's AI-driven age proves its resilience and adaptability. Unlike fleeting internet sensations that fade after a year or two, WSI's brand equity represents one of its most valuable assets. Commercial database searches reveal its parent company, WSI World, operates with transparent legal structures. Key executives (verifiable on LinkedIn, such as co-founder Dan Monaghan) possess over a decade of industry experience. This signals a serious, long-term business entity.

But longevity doesn't eliminate risk. For any franchise opportunity in the U.S. or Canada, the most critical legal document is the **Franchise Disclosure Document (FDD)**. This hundreds-of-pages-long document is legally required for franchisors to disclose their "full financial picture" to prospective franchisees, containing all the information deemed "inconvenient" to include in marketing brochures.

After carefully reviewing WSI's recent FDD summaries, several key points warrant your attention:

1. Litigation History (Item 3): Like most major franchise brands, WSI has faced legal disputes with franchisees over the past decades. Focus on the nature and frequency of these disputes. Are they common issues regarding contract interpretation, or individual franchisee operational failures? A sharp increase in lawsuits in recent years signals danger.

2. Franchisee Termination Rate (Item 20): This is one of the most critical metrics in the FDD! It reveals how many franchisees terminated their agreements, declined renewals, or were terminated by headquarters over the past three years. If a brand's average annual termination rate consistently exceeds 15%, I consider this a high-risk signal warranting immediate disqualification. WSI's closure rate typically remains within an industry-acceptable range, but you must verify this by reviewing the most recent FDD.

3. Franchise Credentials: WSI operates in over 80 countries globally, demonstrating proven legal compliance. Its "WSI" trademark is registered in major global markets, ensuring no issues with brand usage rights.

To provide a clearer picture of WSI's position within the industry, I've deliberately selected SiteSwan—a highly representative brand in emerging markets—for a fair side-by-side comparison. This isn't about declaring one superior to the other, but rather about revealing two fundamentally different business philosophies to help you find the path that best suits your needs.

| Dimension of Comparison | WSI (We Simplify the Internet) | SiteSwan Website Business | Analysis & Insights for Entrepreneurs |

|---|---|---|---|

| Brand History & Founding Year | Founded in 1995, with nearly 30 years of history. | Founded in 2011, with over a decade of history. | WSI has survived multiple internet bubbles and economic cycles, proving the resilience of its business model. SiteSwan grew up in the mobile internet era; its model is younger and has not faced the same level of market testing. |

| Core Business Model | Full-Service Digital Marketing Consulting. Offers comprehensive solutions like SEO, PPC, Social Media, and AI Marketing. | Template-Based Website-as-a-Service. Focuses on rapidly building and maintaining websites for small local businesses. | WSI commands higher project values and complexity, requiring franchisees to have strong consulting and project management skills. SiteSwan's model is simpler, easier to start, but has a lower revenue ceiling and thinner profit margins. |

| Global Network & Scale | Hundreds of franchisees in over 80 countries worldwide. | Primarily concentrated in the North American market, with thousands of authorized resellers. | WSI's global network provides broader brand recognition and potential for international collaboration. SiteSwan is more focused on the hyper-local small business market. |

| Executive Team Background | Core executives are often industry veterans with 15+ years of experience and diverse backgrounds. | The founder is a serial entrepreneur, and the team is more technology and product-driven. | WSI's leadership is experienced in strategy and system-building. SiteSwan's team may be quicker to iterate on product features and technological innovations. |

| FDD Key Data: Initial Investment | $80,200 - $122,700 (Includes franchise fee and substantial working capital). | $2,000 - $5,000 (Primarily a platform licensing fee, not a traditional franchise fee). | This is a decisive difference. WSI is a high-investment, "career-level" business. SiteSwan is more of a low-cost, "side-hustle" or entry-level business opportunity. |

| FDD Key Data: Ongoing Fees | 12% of Gross Revenue (10% Royalty + 2% Brand Fund). | Fixed Monthly/Annual Fee (Starts around $149/month, depending on the license tier). | WSI's model is tied to your revenue, typical of a franchise system. SiteSwan's SaaS model is more flexible with a lower initial burden, but a fixed fee can be more advantageous at very high revenue levels. |

| FDD Key Data: Closure/Exit Rate | Approx. 7% - 10% (Considered a normal range for the industry). | Data is not publicly disclosed in the same way (as it's not a traditional FDD franchise), but user churn is a key risk for any SaaS model. | WSI's data is more transparent, making the risk quantifiable. The risk with SiteSwan is that its ecosystem becomes fragile if the platform itself cannot retain its resellers. |

| Brand Credibility & Stability Summary | High. Based on its long history, mature legal framework (FDD), and global operational system. | Medium. Stable as a mature SaaS platform, but its long-term stability as a "business opportunity" is less proven compared to WSI. | Choosing WSI means joining a time-tested, "professional army" with high barriers to entry but a mature system. Choosing SiteSwan is like becoming a well-equipped "guerrilla fighter"—flexible and agile, but requiring more self-reliance and drive. |

In summary, WSI's brand fundamentals are quite solid. It is neither a scam nor a short-term scheme. It is a mature, compliant, globally established brand with deep historical roots. But this is only the first step—a good brand doesn't automatically equal a good business.

1-2: Business Model Breakdown: How Do You Actually Make Money with WSI?

Many people misunderstand WSI's business model, thinking that joining means becoming a technical expert in coding or design. This is a huge mistake.

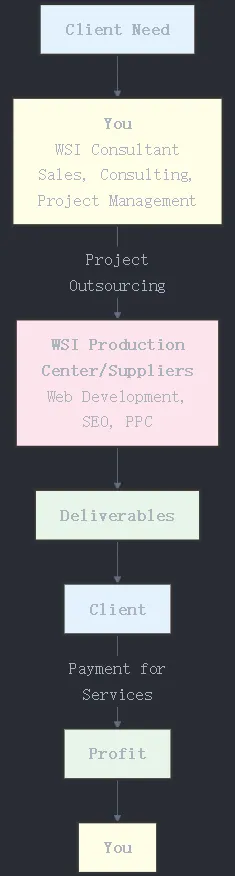

WSI's business model is fundamentally that of a "digital marketing general contractor" or "project manager."

Imagine you're the general contractor for a construction project. You don't personally lay bricks or run wires, but you must understand the client's (homeowner's) needs, integrate the best resources (bricklayers, electricians), manage project timelines, and ultimately deliver a flawless home.

In WSI's model:

You (the franchisee): You are that general contractor. Your core work is sales and client relationship management. You identify small and medium-sized business owners (B2B) who need digital marketing services, understand their pain points (e.g., low website traffic, ineffective ads), and provide them with a solution.

WSI Headquarters and Supplier Network: Your "construction crew." WSI has a vast global network of "production centers" and certified suppliers who handle the actual execution—website development, SEO optimization, social media content creation, etc.

Your Revenue: Comes from the margin between the service fees paid by clients and the costs you pay to suppliers.

The advantages of this model are clear:

1. Asset-light: You don't need to maintain a large technical team, significantly reducing fixed costs and management complexity.

2. High Scalability: Theoretically, as long as you can secure enough clients, you can leverage headquarters' resources to deliver projects indefinitely, creating a high income ceiling.

3. Focus on Core Competencies: You can concentrate on what you do best or should be doing—building client relationships and sales.

But the drawbacks are equally critical:

1. Squeezed Profit Margins: As an "intermediary," you must share profits with headquarters/suppliers. Your gross margin may be lower than that of an independent marketing agency with its own technical team.

2. Limited control over delivery quality: If backend suppliers fail, causing project delays or poor quality, you bear the brunt of client frustration. You must carefully vet and build your own trusted "construction team" from WSI's supplier pool.

3. Intense sales pressure: This is the most critical point. If your sales skills are weak and you can't secure clients, even WSI's robust backend support becomes meaningless. In this business, sales make or break you.

H2: Market Feasibility Analysis: Does Your City Need Another WSI Consultant?

Even the best project is doomed to fail if launched in the wrong market—like selling down jackets in the desert. We must therefore objectively assess whether the WSI model has viability in your target market.

2-1: Localization Adaptation & Competitive Landscape Scan: How Crowded Is Your "Battlefield"?

WSI's B2B model targets local SMEs. Take a map, draw a 30-50 km radius around your home—this is your "battlefield." Now scan this terrain:

1. Cultural Compatibility: Digital marketing is a universal need, so WSI's services themselves require minimal "localization." However, you must consider: How familiar are business owners in your region with digital marketing, and how willing are they to pay for it? Do they place greater trust in ‘relationships' or in professional solutions? If a region's business culture still revolves around "entertaining clients over meals," your professional proposal might be less effective than a dinner invitation.

2. Competitive Landscape Scan: This is the most practical task. Open Google Maps and search for "digital marketing agency near me" or "SEO company in [your city]".

>>>How many competitors exist? List them all—not just other digital marketing firms, but also independent freelancers and web designers.

>>>What are their pricing structures? Browse their websites; many companies offer package deals. For basic website development services, do they charge $3,000,$5,000, or $10,000?

>>>What's their reputation? Check their Google reviews and client case studies.

I recommend creating a simple competitive analysis spreadsheet. You'll find your competitors fall into three main categories:

1. Large, established local marketing agencies: They have stable teams and client bases, making them your primary rivals.

2. Small boutique studios/freelancers: They're flexible, affordable, and target the lower-end market.

3. Other WSI franchisees: Yes, you may also compete with your "fellow franchisees." You need to understand how strict WSI's territorial protection policies are. Typically, if a territory's radius is less than 1 kilometer (or equivalent population/business density), that protection is virtually meaningless.

2-2: Demand Forecasting: How Many Fish Are in Your Pond?

Business relies on data, not gut feelings. We need to estimate how many potential clients exist in your target market.

Step 1: Define your Ideal Customer Profile (ICP). WSI's ideal clients are typically small-to-medium enterprises (SMEs) with annual revenues between $500,000 and $50 million that lack a dedicated full-time marketing director. Examples include local law firms, dental practices, high-end renovation companies, and B2B manufacturers.

Step 2: Estimate the Number of Companies. Use tools like LinkedIn Sales Navigator or local chamber of commerce directories to identify how many businesses in your area match this profile. Suppose you find 5,000.

Step 3: Assess penetration rate. How many of these 5,000 businesses are actively seeking digital marketing services? We can validate this using Google Trends. Enter keywords like "SEO services," "local SEO," or "PPC management" to examine search volume trends in your region. If search volume is consistently rising, it indicates market demand is being educated and unlocked.

Step 4: Determine the potential customer base. Suppose 10% of these 5,000 businesses plan to outsource digital marketing within the next year. Your potential customer pool is 500 companies. Further assume you can reach 20% of them and successfully convert 10%. Your first-year client target is 10.

This straightforward calculation provides an intuitive sense of market size. It answers the question: "Is this market worth investing in, or is it already saturated?"

You can use https://www.statista.com or local government economic statistics websites to query the number and industry distribution of local SMEs, serving as data support for demand forecasting.

3: Operational Fit Analysis: What Does It Take to Launch and Run This Business?

Alright, now that we understand what WSI is and have analyzed the market, we come to the most critical part: money. How much capital is required to launch and operate this business? How long will it take to break even? This directly relates to your "operational fit."

3-1: ROI Calculation: The Most Realistic Cost and Profit Model

This is what all entrepreneurs care about most—and where they're most easily misled. Brands typically only disclose an "initial investment range," but the devil is in the details.

Initial Investment: This goes beyond just the franchise fee.

| Cost Item | Estimated Amount (USD) | Source / Notes |

|---|---|---|

| Franchise Fee | $49,700 | Per WSI FDD disclosure |

| Training Travel | $2,000 – $5,000 | Airfare, hotel, meals for mandatory HQ training |

| Office Equipment | $1,500 – $3,000 | High-spec laptop, printer, extra monitor |

| Software & Subscriptions | $1,000 – $2,000 | CRM, PM tools, design suite, etc. |

| Legal & Incorporation | $1,000 – $3,000 | Entity setup + attorney review of FDD |

| Initial Marketing | $5,000 – $10,000 | Personal brand site, LinkedIn ads, chamber events |

| Working Capital Reserve | $20,000 – $50,000 | Critical! Covers 6-12 months living & ops costs while revenue ramps |

| TOTAL | $80,200 – $122,700 | Bring the upper-bound to sleep soundly |

See that "Working Capital" line? That's the part my client Alex nearly overlooked. He thought paying the franchise fee meant sitting back and waiting for clients to come knocking. But the reality is, you might not sign a single client in the first 6 months—yet your living costs, phone bills, and transportation expenses won't stop coming. Lacking sufficient "ammunition" to survive the startup phase is the direct cause of failure for 90% of small businesses.

Payback Period:

Calculating the payback period involves numerous variables. However, I can provide a simplified model based on sensitivity analysis.

Assumptions:

Each client generates an average monthly net profit of $1,000 (note: net profit, not contract value).

Your average monthly fixed costs (living expenses, software fees, etc.) are $4,000.

Scenario Analysis:

Optimistic Scenario: You're highly capable, securing 2 clients by month 3 and reaching 5 clients by month 6. By month 6, your monthly net profit is $1000*5 - $4000 = $1000. You begin achieving monthly profitability and start filling the "deep hole" of initial investment. The projected payback period is 1.5–2 years.

Neutral Scenario: You proceed steadily, securing 2 clients by month 6 and reaching 4 clients by month 12. At month 12, you break even. The projected payback period is 2.5–3.5 years.

Pessimistic Scenario: You struggle significantly with sales, securing only 2 clients in the first year. You will incur continuous losses, exhaust working capital, and the project will fail.

Calculate Your WSI Payback Period in 3 Minutes Using Our ROI Calculator:

Calculate your potential ROI now! Stop guessing!

Enter your own projected data into our Franchise ROI Calculator to instantly generate a customized profitability forecast report. Remember, all calculations are based on estimated assumptions; actual results may vary depending on your efforts and market conditions.

3-2: Headquarters Support Evaluation: Is the "Service" You're Buying Worth It?

What exactly are you purchasing with your WSI franchise fee and ongoing royalty payments? It's the support from headquarters. But is this support tangible value or just empty promises? We can measure it using several key metrics:

1. Training System: WSI's initial training is comprehensive, but ongoing training is even more critical. The digital marketing industry evolves rapidly—Google algorithms undergo minor tweaks monthly and major shifts every three months. If headquarters fails to organize even one training session annually on topics like "AI Content Creation" or "Latest SEO Strategies," its support system is inadequate. Key Metric: Frequency of new product/strategy development. Annual updates ≥4 times is optimal.

2. Technology Platform: Does WSI provide a sufficiently robust CRM (Customer Relationship Management) and project management system? Is this system a modern SaaS platform or an outdated website resembling a relic from the last century? A poor system will severely waste your time. Key Metric: Does headquarters' digital system integrate AI functionality and support mobile operations?

3. Emergency Issue Response: When facing an angry client due to a supplier's technical issue, do you receive expert assistance from headquarters within 4 hours, or a templated email 48 hours later? Key Metric: Emergency response time <4 hours is optimal.

4. Marketing Support: Does headquarters provide high-quality marketing materials (case studies, whitepapers, proposal templates)? Is there a "Localized Marketing Fund" program that partially funds your participation in local business events? Key Metric: Localized Marketing Fund allocation >10% of revenue is recommended.

In my view, for knowledge-intensive franchise programs like WSI, the value of the support system often surpasses that of the brand itself. You're paying for a continuously updated "operational system," not a static logo.

4: Risk Control Matrix: How to Avoid Fatal Pitfalls?

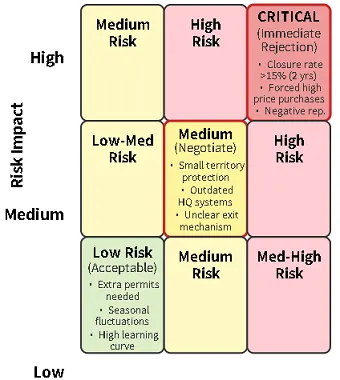

All investments carry risk. Smart investors don't avoid risk entirely—they know how to identify and manage it. I've developed a three-tier risk response system to help you instantly spot deal breakers when evaluating the WSI program.

4-1: High-Risk Items (Immediate Rejection)

If you encounter any of the following situations, I recommend immediately terminating negotiations and walking away.

1. Average store closure rate over the past 2 years > 15%: This can be found in Item 20 of the FDD. It means one out of every six franchisees closes or exits within two years. This is a sinking ship—you don't want to be the next one aboard.

2. Contract contains mandatory high-price procurement clauses: If the contract mandates purchasing a service or software from headquarters' designated supplier at prices significantly above market rates, and this service constitutes a major portion of your cost structure, this is a "tie-in trap."

3. Poor online reputation: Search platforms like Google, Glassdoor, or Reddit for "WSI franchise complaints" or "WSI franchise problems." If you see numerous, persistent negative reviews about the same core issue (e.g., "poor headquarters support," "unfulfilled sales promises"), be highly cautious. Isolated negative reviews are normal, but systemic complaints are a red flag.

4-2: Medium-Risk Items (Requiring Negotiation or Close Attention)

These issues shouldn't immediately disqualify the franchise, but you must engage in serious negotiations with WSI's franchise development representative before signing and secure written commitments.

1. Insufficient Territory Protection Radius: As mentioned earlier, if your "turf" is too small or headquarters retains the right to develop other channel types (like online consultants) within your territory, your operational space will be severely squeezed.

2. Outdated Digital Systems: If their platform lacks AI inventory management, automated marketing, or similar features, you'll need to invest more manual labor and time into low-value repetitive tasks, directly impacting your profit margins.

3. Unclear Exit Mechanism: What is the process if you wish to sell your franchise rights in the future? Does headquarters hold a right of first refusal? What are the transfer fees? If these terms are overly restrictive, it means your "asset" may be difficult to liquidate later.

4-3: Low-Risk Items (Acceptable, but Prepare Contingencies)

These are normal challenges most businesses encounter—you just need to prepare in advance.

1. Requiring Additional Business Licenses: This typically involves only time and minor administrative fees.

2. Significant seasonal fluctuations: For example, many companies reduce budgets before the Christmas holiday season. You should maintain at least three months of cash reserves to weather slow periods.

3. High demands on personal learning ability: Digital marketing knowledge evolves rapidly, requiring a mindset for continuous learning. This isn't inherently risky, but if you're unwilling to learn, it becomes your risk.

5: Deliverables: What Does This Report Offer You?

After systematically analyzing the four dimensions above, it's time to consolidate all information into your final decision-making basis. This section represents the unique value that sets our website apart from any other information platform.

5-1: One-Page Decision Report vs. Competitors

Too much information can be overwhelming. We condense all key metrics into a single "radar chart," giving you an at-a-glance overview of the WSI franchise program.

The six key metrics are:

Brand Strength (Score: 8/10, Reason: Established history, globally recognized)

Profit Potential (Score: 7/10, Reason: High B2B average order value, but sales capability-dependent)

Investment Barrier (Score: 4/10, Reason: High initial investment, significant working capital requirements)

Headquarters Support (Score: 7/10, Reason: Mature systems, but execution details require vigilance)

Operational Difficulty (Score: 5/10, Reason: Demands exceptional personal skills, especially in sales)

Risk Rating (Score: 6/10, Reason: Established business model, but individual failure rates warrant attention)

Additionally, we've prepared a competitive comparison tool for you.

WSI vs. Other Business Opportunities Is WSI your only option? Absolutely not. Use our Opportunity Comparison Tool to benchmark WSI against another digital marketing franchise brand (like SiteSwan) or even a completely different industry (such as a coffee shop franchise). Evaluate which opportunity aligns better with your needs across multiple dimensions—investment amount, payback period, required skills, and more.

5-2: Localization Checklist: Your 120-Day Action Plan

If you've carefully decided to move forward with WSI, here's a 120-day task list to help you stay organized from signing to launch.

Pre-Signing (Days -30 to 0):

Engage legal counsel to review the FDD and franchise agreement

Complete capital preparation and company registration

Conduct calls with at least 5 current and former WSI franchisees

Post-Signing - Pre-Training (Day 1 to 30):

Complete headquarters' online pre-training courses

Prepare office equipment and software

Initially build your local business network (LinkedIn)

Headquarters Training - Launch Operations (Day 31 to 90):

Fully engage in headquarters training

Develop your first 90-day market development plan

Launch your personal brand website and social media

Official Operations (Day 91 to 120):

Begin executing market development plan with goal: secure first paying client

Attend local chamber events, distribute business cards

Conduct weekly reviews with your headquarters mentor

Ready to create your business plan? A solid plan is half the battle. Use our Business Plan Generator to systematically organize the above analysis and your personal goals into a professional business plan. It will serve as your blueprint for future funding and operational guidance.

6: Frequently Asked Questions (FAQ)

6-11. Can I join WSI without any digital marketing experience?

Answer: Yes, but with a caveat. WSI's model was designed to enable individuals without technical backgrounds to enter this industry. Headquarters provides technical training and backend support. However, you must possess or be willing to develop strong B2B sales and consulting skills. If you fear talking to strangers, dread rejection, or struggle to build business relationships, success will be difficult even with technical expertise. WSI seeks "business consultants," not "technicians."

6-2. Is WSI franchising a pyramid scheme?

Answer: No. The core characteristic of a pyramid scheme is the absence of genuine products or services, with income solely dependent on recruiting new members. WSI offers real digital marketing services. Franchisees earn income by selling these services to end clients, not by developing downlines. It is a legitimate franchise system with decades of history.

6-3. Can I guarantee profits after joining WSI?

Answer: Absolutely not. The FDD explicitly prohibits any brand from guaranteeing profits to franchisees. Your success depends entirely on your personal effort, sales ability, market conditions, and a bit of luck. WSI provides a toolkit, a brand, and a methodology, but ultimately, you're the one driving the car. Think of WSI as a high-performance race car—but if you can't drive or are navigating rough terrain, you'll still fail.

6-4. Do I need to commit full-time? Can I run it as a side business?

Answer: I strongly recommend full-time commitment, especially during the first year. As mentioned earlier, the core of this business is sales and client development, which demands significant time and energy to build networks, attend events, and follow up on leads. If you only dedicate an hour or two each evening, you'll likely lack the momentum needed to secure clients and cover costs. Treat it as a serious full-time career to have any chance of success.

6-5. What's the worst-case scenario if I fail?

Answer: Your biggest loss would be your entire initial investment (franchise fee, working capital, etc., potentially exceeding $100,000) plus the opportunity cost of time invested (e.g., quitting a stable job for this). This is why we emphasized risk management and sufficient working capital reserves earlier. You must prepare for the worst-case scenario before entering.

7: My Personal Perspective and Insights

As a consultant who has observed this industry for years, I want to step beyond the data and frameworks to share some heartfelt thoughts.

I refer to business models like WSI's as "empowering platforms." Their greatest value lies in providing a high-starting-point platform for entrepreneurs who possess a strong desire to succeed and excellent soft skills (especially communication and sales), but lack a ‘product' and "system." I've seen individuals leverage this platform to build million-dollar consulting firms within years. Yet I've witnessed far more who, after investing substantial capital, succumb to sales anxiety and quietly exit within a year.

Ultimately, the crux of the matter rests with you. In the quiet of night, ask yourself honestly:

1. Do I genuinely enjoy engaging with business owners and solving their commercial challenges?

2. Can I endure the pressure of facing 10 or 20 consecutive rejections and still muster the energy to make that 21st call?

3. Am I willing to dedicate the majority of my time over the next few years to the slow, deliberate work of learning, networking, and building my personal brand?

WSI isn't a lottery ticket—it's a gym membership. It provides you with top-tier equipment and the best environment, but if you don't lift weights and sweat daily, your physique will never change. If you're seeking a "get-rich-quick" scheme, close this page immediately. But if you're a "business athlete" craving challenges and unafraid of hardship, then WSI might just be the arena worth your all-out effort.

8: Summary, Action Recommendations & Final Warning

8-1: Summary

The WSI franchise program is a mature, legitimate business opportunity that presents both challenges and potential. It offers aspiring digital marketing entrepreneurs a powerful brand and support system. However, its substantial initial investment and extremely high demands on personal sales ability create a significant barrier to entry.

8-2: Action Recommendations

1. Self-Assessment: Use our website's Entrepreneur Assessment Tool to honestly evaluate whether your skills and personality align with the role of a "B2B Sales Consultant."

2. Financial Assessment: Use the ROI Calculator, inputting the most conservative estimates, to determine if you can withstand the potential payback period and financial pressure.

3. Due Diligence: Secure the latest version of the WSI Franchise Disclosure Document (FDD) and thoroughly review Items 3, 7, 19, and 20. Most critically, contact at least five current and former franchisees to hear their authentic experiences.

4. Consult Professionals: Before signing any documents, have your attorney and accountant review the contract and your financial plan.

8-3: Final Risk Warning

The information and analysis provided herein, however comprehensive, cannot replace your own independent judgment and professional advice. There is no foolproof formula for success in business. Investing involves risk; decisions should be made with caution. You bear ultimate responsibility for your capital and future.

9. Further Reading

Interested in more business opportunity analysis? You may also find these articles valuable:

1. Top Cleaning Franchises for Sale: Commercial & House

2. How to Start a Business Step by Step With No Money in 2026: Free Tools & Checklist

3. Franchise Business Review: Top Consultant & Small Business Ideas

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.