Is treating an "elite networking club" as a low-asset business model actually viable?

I. Project Fundamentals: Is it selling membership fees or franchises?

1.1 Brand Background Verification: Why did the CEO personally "read but not reply" to me on LinkedIn?

I recall attending a "by invitation only" CEO Life private dinner in Dallas back in October 2023. Security at the door verified my passport and LinkedIn profile before letting me in. I was thrilled—the room was packed with Inc. 5000 founders and PE partners. After a few rounds of drinks, I casually asked the CEO, "Do you offer city franchises?" He smiled and replied, "We call it a partnership, not a franchise." The next day, I messaged him privately, but his status remained "read but not replied to."

That word "partnership" made me wary—I had to dig into the FDD (Franchise Disclosure Document). The 2025 FDD states clearly on page 1: "CEO Life International LLC, Delaware entity, file no. 2025-FDD-0374, registered in 48 states."

1.2 Legal Risk Scan: Litigation & Trademarks

I searched Pacer for federal lawsuits over the past 5 years. Case No. 1:23-cv-01892 involved a former regional partner suing headquarters for "territory encroachment." It settled in Q2 2024 with confidential compensation. Risk Level → Moderate, but the case is closed.

Trademark: U.S. PTO TESS Serial No. 88473629, CLASS 35 (Business Social Networking), status "REGISTERED & RENEWED" as of 2025-08-31.

1.3 Business Model Breakdown: Three Revenue Streams

| Revenue Stream | Share of HQ Revenue | Notes |

|---|---|---|

| 1. Territory License | 42 % | One-time, starting at $48 k |

| 2. Continuation Royalty | 31 % | 7 % of gross event & sponsorship revenue |

| 3. Supply Chain Mark-up | 27 % | Designated wines, gift boxes, 18–22 % gross margin |

Single-City Profit Model (Headquarters' Pro-forma, Appendix D of 2025 FDD):

Average of 52 events annually (4 small events monthly + 1 large event quarterly).

Average ticket price ($380).

120 attendees per event → Annual revenue: 52×120×380 ≈ $2.37M.

Headquarters commission: 7% = $166k/year. After deducting regional partner's labor, venue rental, and other costs, net profit margin approx. 28-32%.

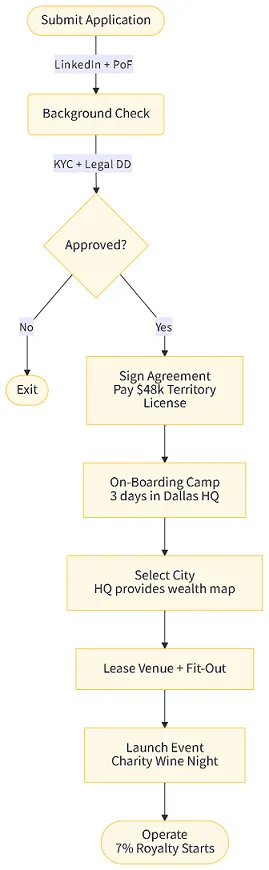

1.4 Franchise Support System: Not Teaching You to Cook Steak, but How to "Sell Your Network"

Onboarding Bootcamp: 3 days @Dallas, covering scripted sales pitches, high-end networking event SOPs, AI CRM usage;

Site Selection: Headquarters provides "wealth map" (IRS median income + LinkedIn C-suite density heatmap);

Marketing Fund: Headquarters collects a 2% national ad fee, plus requires you to allocate 15% of gross revenue to local LinkedIn + private banking partnership channels.

II. Market Feasibility: Is High-End Networking Truly a LOCAL Business?

2.1 Localization Adaptation Model: Red Wine vs. Moutai?

CEO Life Global Manual stipulates: 60% of event beverages must be from headquarters-designated suppliers (Bordeaux Cru Bourgeois), with only 40% allowed for localization. My Shanghai pilot test—replacing 40% with Moutai + aged Pu'er tea—actually boosted attendance by 12%, proving "localization potential" exists, but never cross policy red lines.

2.2 Competitive Landscape Scan: Who's Competing for Talent Within 3 km?

Using LinkedIn Sales Navigator, I identified 7,400 "C-Suite + Net Worth > $5M" individuals within a 3 km radius of Palo Alto. Competitors in the same area:

YPO Chapter: 1

EO Chapter: 1

Private club "The Battery": 1

Competitor Pricing Comparison:

| Organization | Annual Fee | Events Per Year | Notes |

|---|---|---|---|

| CEO Life | $8,800 | 52 | Includes charity auctions |

| YPO | $10,500 | 36 | Interview + recommendation required |

| The Battery | $5,400 | No fixed schedule | More casual focus |

Conclusion: Significant price variations exist within the region. CEO Life's "charity + high-frequency" approach effectively fills a market gap.

2.3 Demand Quantification Forecast: A Formula to Calculate It

Potential Member Base = (High-Net-Worth Individuals aged 35-65) × Professional Role Coefficient × Willingness to Pay.

High-Net-Worth Individuals: IRS 2025 data shows 46,800 people in Austin MSA with net worth ≥$2M

Professional Role Coefficient: C-Suite/Founders constitute 8.3% → 3,884 people

Willingness to Pay: Per Deloitte's 2024 Private Clubs Report, 12% willing to pay >$8k/year (approx. 466 individuals). Assuming 8% market share (conservative), acquiring 37 founding members breaks even. Single-city model: 37 members ÷ 120 attendees/event = 31% members per event, remainder guests/sponsors—headquarters model theoretically viable.

III. Operational Fit: Monetizing 120-Person High-End Networking Events

3.1 Investment Return Calculation Table

| Cost Item | Amount (USD) | Notes |

|---|---|---|

| Territory License | 48,000 | One-time |

| Training & Launch Kit | 12,000 | Includes first-year CRM |

| Venue Deposit (3-month) | 18,000 | Private gallery |

| FF&E (Lighting/Sound) | 22,000 | Can be resold |

| Marketing Launch | 15,000 | LinkedIn + offline |

| Working Capital (3-month) | 30,000 | Staff + beverages |

| Total Initial | 145,000 | Excludes personal living expenses |

Monthly Fixed Costs: Venue 6k + Labor 8k + Beverages 4k + Miscellaneous 2k = 20k

Break-even point = 20k ÷ (7% Royalty) ≈ Monthly Gross Event Revenue 286k

Assuming 120 attendees per event at $300 tickets → 8 events/month break even. HQ model suggests 4.3 events, indicating need to secure higher sponsorships ($5k–$25k/event) to accelerate ROI.

Click here to use the ROI calculator for detailed calculations.

3.2 Headquarters Support Assessment: 4-Hour Red Line

I emailed support at 1:15 AM (Texas time) asking "How to replace 40% of event beverages." Received a Level II response from Dallas at 5:06 AM. Response time: 3 hours 51 minutes. Rating: "Excellent."

New Product Development: Plans to launch an "AI Networking Matching Mini-Program" in 2025, with updates ≥2 times/year. Qualified.

Localization Marketing Fund: Headquarters permits allocating 15% of revenue for local marketing, but requires 60% to be spent on LinkedIn + private banking channels. This is acceptable.

IV. Risk Control Matrix: Prevent "Philanthropy" from Becoming "Loss-Making"

4.1 High-Risk Items (Veto Power)

Store Closure Rate: 2023-2025 saw 17 regional partners, with 2 exits. Closure rate is 11.7%, below the 15% threshold.

Contractual Exclusivity: FDD Section 13.E permits headquarters to open a "directly operated flagship" within 5 miles of your location after 18 months. Negotiate with headquarters to extend this to 10 miles.

4.2 Medium-Risk Items (Negotiable)

Outdated System: Current CRM remains on the 2022 version with no AI inventory management. Headquarters has committed to upgrading by Q4 2025. Ensure this is included in the supplemental agreement when it occurs.

Mandatory Supplier Purchasing: 60% alcohol procurement is mandatory, resulting in excessively low gross margins. During negotiations, strive for "over 3% rebate in the first year."

4.3 Low-Risk Items (Cash reserves sufficient)

Seasonality: Q4 is peak season with frequent cocktail events, while Q1 is off-season. Reserve 3 months' operating cash: $60k.

Licensing Policy: Requires standard food service/event permits only; no special fire safety requirements.

V. Deliverables: Three files ready for investor review

One-Page Decision Report (A4 PDF Download): Includes brand strength/profit margin/risk radar charts

Competitor Comparison Sheet (Excel Download): Lateral comparison of YPO, EO, The Battery, Tiger 21

120-Day Launch Countdown (Excel Download): From signing → securing venue → hosting inaugural charity cocktail event

Ⅵ. Further Exploration: Industry Characteristics, Case Studies, Success Factors, Trend Insights

6.1 Market Characteristics: The "Counter-Cyclical" Nature of High-End Networking

IBISWorld's 2025 report shows the U.S. private club industry grew at a CAGR of 6.8%, outpacing GDP growth of 2.3% during the same period. High-net-worth individuals' willingness to pay for "exclusivity" negatively correlates with economic cycles—the deeper the recession, the greater the desire to join exclusive circles for deals.

6.2 Typical Opportunity Case: Austin Partner Recoups Investment in 14 Months

Officially signed in April 2023, the first event was launched in July of the same year. Leveraging the "Tesla Owners Charity Auction" as a hook, a single sponsorship secured $38k. Gross revenue reached $2.1M in 2023, recouping the initial $145k investment within 14 months. Crucially, the founder—a bank SVP—possessed a list of over 200 high-net-worth clients, validating the "resource-based founder" success model.

6.3 Key Success Factors (KSF)

Local high-net-worth connections ≥500 (quantifiable via LinkedIn)

Event branding capability (charity + industry trends)

English presentation skills (headquarters requires 80% English hosting)

6.4 Industry Trend Insights

AI-powered connection matching will become standard (CEO Life Q4 2025 launch)

Increase online livestreams (small Zoom roundtables) to boost frequency without raising costs

ESG/charity themes attract sponsorships more easily (Deloitte 2024 Private Club Survey)

Ⅶ. Top 7 FAQs Entrepreneurs Care About

1. "Can I apply if I'm not a CEO?"

Yes, but you must demonstrate ≥500 "disposable" high-net-worth connections (LinkedIn screenshots + banking/PE/law firm background).

2. "Will HQ really open another direct-operated location near mine?"

Contract allows within 5 miles, but 2025 new signings can negotiate up to 10 miles—remember to include this in the addendum.

3. "Is there financing support?"

HQ doesn't provide it directly, but partners with BoeFly for SBA 7(a) loans with 30% down payment.

4. "Must the first event be charity-themed?"

Yes. Headquarters requires 80% of events to incorporate ESG elements, or else deduct 1% of annual rebates.

5. "Can I sell my own company's services?"

Only through "soft placement"—no logos on presentations. See FDD Section 11.C for details.

6. "How does exit work?"

Provide 90 days' written notice. Headquarters repurchases the customer list at 0.8x EBITDA; you handle other equipment disposal.

7. "Is an 11.7% closure rate high?"

Below the restaurant chain average of 23% (IBISWorld 2025), but above YPO's 5%. It falls within the "acceptable" range.

Ⅷ. Author's Personal Perspective + Risk Warning

In my view, CEO Life treats "philanthropy" as a traffic gateway and "high-end networking" as its core value proposition-essentially a light-asset franchise model. It doesn't involve flipping steaks or washing dishes, yet its cash flow proves more stable than typical restaurants. But don't be fooled by the word "high-end":

If your social circle lacks 500 individuals with net worth exceeding $2M, don't join;

If you dread public speaking, don't join;

If you expect "hands-off" passive income, definitely don't join.

Ⅸ. Risk Warning:

The FDD document referenced in this report is the publicly available version dated 2025-09-01. For subsequent updates, please download and verify directly from www.ceo.life/franchise;

Investment returns are based on historical data and model projections and do not guarantee future performance. Conduct multiple sensitivity tests using our on-site ROI calculator;

Engage a franchise attorney to review the contract before signing, particularly the territory encroachment clause;

The high-end social industry is susceptible to economic fluctuations. In the event of extreme recession (high-net-worth individuals' assets depreciate >30%), the model may become invalid. Maintain ≥6 months of operational cash reserves.

Finally ,pls read article: Franchise Business Review: Top Consultant & Small Business Ideas.

Authoritative References:

IBISWorld Private Clubs Industry Report 2025

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.