How Much is a McDonald's Franchise? Cost & Profit: A Brutally Honest Analysis for Serious Investors

Introduction: The Halo and Shadows Under the Golden Arches

I still vividly recall that afternoon in 2015 when David, a retired executive, walked into my office. Clutching $1.5 million in cash-the savings of his entire career-his eyes sparkled with that distinctive "entrepreneurial fervor." He excitedly slammed his hand on the table and declared, "I'm buying a McDonald's! It's the world's most foolproof business, right? I just put the money in, hire a manager, and then I can go play golf."

I poured him a glass of cold water-both literally and figuratively. "David," I said, looking him straight in the eye, "you're not buying a money-printing machine. You're buying a high-pressure job that demands 60-hour weeks. If you want to play golf, buy Treasury bonds. If you want to experience being woken up at 3 a.m. by equipment failures, then buy a McDonald's."

Many investors like David ask the same question: "Is McDonald's a franchise?" The answer is yes-it's the godfather of franchising. But if you're searching for a McDonald's franchise for sale, you face more than just a financial hurdle. It's an endurance test of resilience, compliance, and business acumen.

As an analyst with over a decade in franchising, I've seen countless individuals sink into financial quagmires by misjudging McDonald's franchise costs, while true operational masters achieve astonishing McDonald's franchise profits through precision management.

Today, through this in-depth analysis, I will strip away the marketing packaging and guide you through our "Five-Dimensional Business Evaluation Framework" to dissect the underlying logic of the McDonald's business empire. We'll leverage core data from the Franchise Disclosure Document (FDD), combined with our website's exclusive ROI Calculator and Opportunity Comparison tools, to help you calculate the true cost.

This isn't a press release-it's a survival guide for decisions worth millions of dollars.

Part One: Fundamental Project Analysis-What Exactly Are You Buying?

Before discussing how much a McDonald's franchise costs, you must understand what you're purchasing. Many assume they're entering the food service industry, but in reality, the moment you sign the contract, you're entering the world's most complex hybrid system blending real estate, finance, and supply chain management.

1-1. Brand Background Verification and "Moat" Analysis

McDonald's (NYSE: MCD) requires little brand introduction, but as investors, we must examine its "credit rating."

Historical Legacy: Founded in 1940, Ray Kroc pioneered its franchise model in 1955. This isn't just history-it's proof of resilience. It has weathered countless economic downturns and remains steadfast.

Core Team: Current CEO Chris Kempczinski and his executive team place extreme emphasis on digital transformation and delivery services. This means franchisees must keep pace with the "digital" rhythm.

Legal Risk Scan: I reviewed court records from the past five years. While McDonald's has faced lawsuits regarding joint employer status, its Franchise Agreement remains one of the industry's most robust and legally unassailable contracts.

Conclusion: The brand holds an AAA credit rating. You needn't worry about it collapsing tomorrow-your concern should be whether its rules will overwhelm you.

1-2. Business Model Breakdown: The Famous "Real Estate Tycoon" Logic

This is the truth most novice investors overlook. The movie The Founder features a classic line: "You're not in the hamburger business. You're in the real estate business."

Unique Revenue Structure: When you ask how much it costs to franchise a McDonald's, you pay more than just the franchise fee. McDonald's typically owns the land and building where your store operates.

Base Rent: You must pay rent to McDonald's.

Percentage Rent: This is the most ruthless tactic. Typically 10% to over 20% of monthly sales! You pay this even if you're operating at a loss.

Service Fee: 4% of monthly sales.

Ad Fund: 4% of monthly sales.

In-depth analysis: This means roughly 20%-25% of your revenue is taken before you've paid a single cent in employee wages or purchased a single potato. This is why McDonald's franchise earnings are extremely sensitive to operational efficiency.

Single-Store Profit Model:

Average Check: Relatively low ($8–$10), entirely reliant on high frequency and foot traffic.

Gross Margin: Extremely compressed. You're earning profits in pennies, not dollars.

Supply Chain Advantage: This is your lifeline. McDonald's global centralized procurement lets you source beef and potatoes at rock-bottom prices-an advantage no independent burger joint can match.

The Support System:

Hamburger University: This is no joke. You'll undergo 12–18 months of training.

Site Selection Support: You have no say. McDonald's tells you where to build, and you build there. They possess the world's largest real estate database.

Part Two: Market Viability Analysis-Can Your Store Survive?

Brand recognition alone isn't enough. The critical question is whether the market will buy in. In this section, we'll analyze your target market using Google Trends and Statista.

2-1. Localization Model

Cultural Compatibility: In the U.S., McDonald's is infrastructure; in Europe, it's a fast-food choice; in Asia, it might be a family gathering spot. As an investor, you must understand your region's positioning.

Competitive Landscape Scan (The 3-Mile Rule): Within a 3-mile radius of your target location, competitors like Burger King, Wendy's, Taco Bell, or even Chick-fil-A are likely already present.

Red Sea Warning: If a strong Chick-fil-A already exists in the area, your McDonald's franchise profit could face severe pressure, as Chick-fil-A's per-store revenue is typically 1.5 times that of McDonald's.

Policy Compliance: Pay particular attention to local Minimum Wage Laws. California's fast-food worker minimum wage legislation directly impacts McDonald's franchise owner salaries, driving labor costs skyward.

2-2. Demand Quantification Forecast

To determine if the McDonald's franchise cost in the USA is worthwhile, we must examine the demand side.

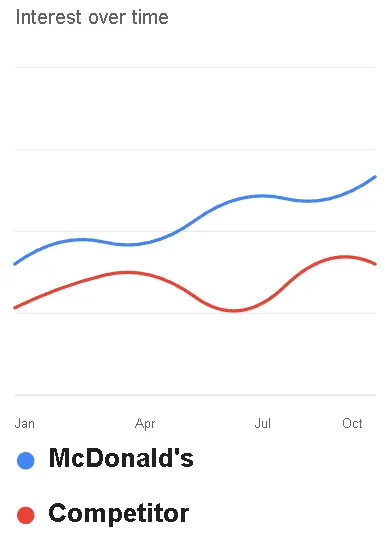

Using Google Trends: Search for the popularity of "McDonald's drive thru" or "breakfast near me" in your city. A steadily rising curve indicates consistent demand.

Demographics: McDonald's core customer base consists of families (driven by Happy Meals) and commuters (driven by breakfast coffee). Review local census data: Are there many young families? Is there heavy traffic during morning and evening rush hours?

Part Three: Operational Fit & Financial Dive – The Secrets Hidden in the FDD

This is the most critical section of the entire article. We'll answer the million-dollar questions: How much does a McDonald's franchise actually cost, and how much do McDonald's franchise owners make?

3-1. Investment Return Calculation: It's Not Just $45,000

Many bloggers misleadingly claim the franchise fee is only $45,000. That's pure nonsense. It's merely the entry ticket.

Real Cost Breakdown (Based on 2024 FDD):

Initial Franchise Fee: $45,000.

Real Estate & Construction: While McDonald's owns the property, you're responsible for renovations, signage, and seating areas.

Equipment: $1,000,000 - $1,500,000. Yes, you read that right. Those automated beverage dispensers, double-sided grills, and self-service kiosks come with a hefty price tag.

Opening Inventory: $20,000 - $40,000.

Travel & Living Expenses during Training: $30,000+. During the year-long training period, you receive no salary and must cover all travel costs yourself.

Miscellaneous Funds: $50,000+.

Total Initial Investment: Typically ranges from $1,370,000 to $2,450,000.

My hard-earned advice:

Never prepare funds based on the absolute minimum. If your ice machine breaks down during opening week, or city roadwork blocks your entrance for a month, you'll need extra working capital to cover payroll.

🛠️ Tool Integration:

Feeling overwhelmed by these numbers? No worries. Use our developed ROI Calculator. Simply input your projected investment and estimated customer traffic, and it will calculate your break-even point based on current interest rates.

3-2. Profits Revealed: How Much Do Owners Really Earn?

Let's be honest about McDonald's franchise profits. According to the latest FDD Item 19 data:

Median Annual Sales: Approximately $3,100,000 (2023/2024 data).

CF (Cash Flow / EBITDA): Well-operated stores typically generate EBITDA between $250,000 and $375,000.

But this isn't your net income! You must deduct:

Equipment loan interest (if you borrowed $1M, this is significant at current rates).

Future store refurbishment reserves (Reinvestment for EOTF).

Income tax.

Answer to "how much does a McDonald's franchise owner make": A diligent, full-time single-unit franchisee ultimately pockets an annual pre-tax income of approximately $150,000 - $250,000. This sounds promising, but considering your $2M investment, the Cash-on-Cash Return is roughly 10%-15%. It's more stable than stocks, but not the "windfall" you might imagine.

🛠️ Tool Integration:

Is this return rate high within the industry? Use our Opportunity Comparison tool to compare McDonald's data against Burger King, Subway, or even 7-Eleven. You'll find McDonald's strength lies in "stability" rather than "high volatility."

Part IV: Risk Control Matrix-Don't Fall Into the Pitfalls

In my consulting cases, failures often stem from ignoring risks. We've established a three-tier risk response system.

1. High-Risk Items - Immediate Rejection Criteria

McDonald's franchise failure rate: While overall rates are low, if you notice consecutive store transfers in a specific region (like certain declining "Rust Belt" cities), absolutely do not take over the franchise.

Contract Exclusivity Clause: McDonald's requires you to operate the franchise full-time. If you wish to retain your current full-time job or aspire to be an absentee owner, stop the application process immediately. They will verify your attendance records.

2. Medium Risk - Negotiate or Prepare

The "Refresh" Trap: McDonald's mandates major upgrades (Experience of the Future) roughly every 7-10 years. Costs can reach $500,000. The FDD explicitly states this is mandatory. Many veteran franchisees are forced to sell their stores because they cannot afford these upgrades.

Labor Shortage: While not explicitly stated in McDonald's franchise requirements, recruitment is often your biggest nightmare. You'll need strong local connections to hire teenage staff.

3. Low Risk - Acceptable

Seasonal Fluctuations: If your location is in a tourist area, winter business can be dismal. This requires building sufficient cash reserves during summer months.

🛠️ Tool Integration:

Ready to tackle these risks? Use our Business Plan Generator to draft a business plan, including risk mitigation strategies automatically.

Part Five: Deliverables & Application Strategy-120 Days? Think 18 Months

If you're searching "how to buy a McDonald's franchise," prepare for a protracted battle. Here's the real localized execution checklist.

5-1. Phase One: Self-Assessment (Month 1)

McDonald's franchise qualifications: You must possess $500,000 in non-borrowed liquid capital. This is a hard requirement. If this money is borrowed, your interview will be rejected outright.

Background Check: Clean criminal record, strong credit score.

🛠️ Tool Integration:

Unsure if you fit their profile? Take our Entrepreneur Assessment test. We analyze your personality traits, financial strength, and management style to see if you have the potential to be a top franchisee.

5-2. Phase Two: Application & Interview (Months 2-3)

Submit Application: Fill out a lengthy online form.

First Interview: The Area Manager will "interrogate" you about your finances and motivations.

On-the-Job Evaluation: They'll send you to work at a store for 3 days. It's not just about whether you can do the job-it's about whether you're willing to roll up your sleeves and wipe tables.

5-3. Phase Three: Hamburger University & Training (Months 4-18)

This is a lengthy process. You receive no pay. You must master every detail from supply chain management to food safety.

Graduation: Only after graduating from Hamburger University are you eligible to take over a store.

5-4. Phase Four: Takeover and Opening (Month 19+)

Waiting for Assignment: You typically cannot purchase a new store; you must wait for an existing franchisee to retire or sell. This waiting period can be lengthy.

Handover: Sign hundreds of pages of contracts, complete the transfer, and officially become the owner.

Part Six: In-Depth Analysis-Why Do People Still Flock to It?

After outlining so many risks and costs, why is McDonald's franchise qualification still as difficult to obtain as Harvard University (acceptance rate <1%)?

6-1. Key Success Factors

Equity Growth: While cash flow is modest, once loans are repaid (typically 7-10 years), the restaurant itself becomes a substantial asset. Selling a well-run McDonald's upon retirement can yield millions in cash.

Countercyclical Nature: During the 2008 financial crisis, McDonald's stock surged. During the 2020 pandemic, McDonald's rebounded fastest thanks to its drive-thru. It serves as a safe haven for capital.

System Power: You don't need to be a genius. You just need to follow the system. The system solves 99% of the problems.

6-2. Typical Opportunity Case Study

I once mentored a client named Sarah. She took over a poorly run McDonald's near a college town. The previous owner had refused to upgrade equipment, leading to inefficient service. After taking over, Sarah invested $300k to upgrade the dual-lane drive-thru and install self-service kiosks. She also launched targeted marketing campaigns for students studying late into the night. Result: Within 12 months, her revenue grew from $2.2M to $3.4M. This is the power of operational fit.

Part Seven: The 5 Most Critical Questions Users Care About (FAQ)

As an entrepreneur, you likely still have these concerns:

Q1: How much to buy into a McDonald's franchise if I have a partner?

A: McDonald's strongly discourages "passive investors." If you have a partner who only contributes capital but doesn't actively manage the business, this won't work. The primary applicant must hold at least 51% ownership and work full-time at the location.

Q2: What is the McDonald's franchise failure rate really?

A: Official data shows extremely low failure rates. But this doesn't mean no one loses money. Typically, before a franchise closes, McDonald's headquarters intervenes, forcing underperforming franchisees to sell their locations to more capable buyers. So you don't see "store closures"-you only see "transfers."

Q3: Can I choose my location?

A: Generally not. McDonald's will tell you where openings exist. You may need to relocate your entire family to that city. This requires significant family commitment.

Q4: How much does a McDonald's franchise earn compared to a generic burger joint?

A: Independent brands might have profit margins as high as 20%-30% (since there's no franchise fee), but their failure rate exceeds 60%. You're buying "certainty," not "maximum profit margin."

Q5: McDonald's franchise cost vs. Chick-fil-A?

A: Chick-fil-A's franchise fee is only $10,000! Yes, just ten thousand. However, you don't own the store-you're merely an "operator" with a small profit share, and you can't sell the store to someone else or pass it down to your children. McDonald's is more expensive, but it's your asset.

Part Eight: Author's Perspective and Action Recommendations

At this point, my feelings are mixed. McDonald's isn't a venture suited for everyone.

My personal take: In my view, purchasing a McDonald's franchise is essentially buying a "high-paying, equity-incentivized general manager position."If you're highly creative and dislike being constrained by rules, you'll find it extremely painful. You'll get fined for wanting to add onion rings to the menu. But if you're highly execution-driven, love optimizing processes, and want to build a stable asset for your family, this is the ultimate business sanctuary.

Compliance & Risk Warning:

Disclaimer: All financial data mentioned (Costs, Fees, Profit) is based on 2024 market estimates and historical FDD data for reference only. Before investing, consult a franchise attorney to thoroughly review the FDD. Investing involves risks; proceed with caution.

Your Next Steps (Action Plan):

Verify Funds: Check your bank account to ensure $500k in liquid assets.

Self-Assessment: Ask yourself, "Am I willing to come home smelling like fries every day for the next 5 years?"

Use Tools: Don't rely on gut feelings. Visit our website and let the data guide you.

9. Recommended Reading

10. Interactive Session (Discussion):

Are you an entrepreneur considering franchising? Or do you find the $2 million threshold too high? Do you think McDonald's "real estate model" is fair to franchisees? If you have any specific questions about McDonald's franchise requirements, or need me to analyze market data for a particular city, please leave a comment below! I will personally respond to every in-depth inquiry.

11. About the Author:

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.