Hey, friend, welcome here.

Have you also been drawn in by that "$10,000 myth" circulating in the startup world? Just a small investment could supposedly leverage a business generating millions in annual revenue, turning you into a respected Chick-fil-A "franchisee." Honestly, it sounds too good to be true, right?

I remember back in 2022, one of my clients-a highly successful IT director-was on the verge of quitting his job for this "$10,000 dream." He was so excited, showing me his financial plan, convinced it was the only shortcut to achieving financial freedom by age 40. But when we sat down and peeled back the layers like an onion, dissecting Chick-fil-A's Franchise Disclosure Document (FDD) page by page, delving deep into the core of its unique "operator" model, his expression shifted from fervor to contemplation, and finally to a sense of relief-like, "Thank goodness I talked to you." He ultimately didn't apply, but he said that afternoon was the most valuable conversation we'd ever had. For the first time, he truly grasped that "opportunity cost" and "personal alignment with a business model" matter far more than any tempting number.

Core Issue Statement: Today, I want to revisit that afternoon's deep conversation with you, but in a more systematic way. We'll employ a professional investment advisor's "Five-Dimensional Evaluation Framework," combined with our website's exclusive analytical tools, to thoroughly unravel the fascinating yet controversial franchise opportunity that is Chick-fil-A.

Preview Value: In this in-depth report, we'll address several core questions you care about most:

Revealing True Costs: Beyond the $10,000 investment, what "hidden" expenses does operating a Chick-fil-A entail?

Income Potential Analysis: How much do so-called "store owners" actually earn annually? What is your real profit margin?

"Boss" or "High-Level Employee"?: What does this unique "operator" model mean for you personally?

Am I a Good Fit?: What traits do you need to stand out in an acceptance rate lower than Harvard's?

What If I Fail?: With tens of thousands rejected annually, what's your Plan B?

Ready? Let's embark on this deep dive together, ensuring every decision you make is grounded in the most comprehensive information and clearest understanding.

1: The Financial Breakdown: How Much Does a Chick-fil-A Franchise Really Cost?

When we talk about costs, most people are drawn to that shiny "$10,000" figure. which is indeed Chick-fil-A's official initial franchise fee. In a fast-food industry where startup costs often run into the hundreds of thousands or even millions of dollars, this seems almost like a joke. But remember, in the business world, there's no such thing as a free lunch. Even at the place serving the tastiest chicken sandwiches, this $10,000 is more like an "entry ticket"-or rather, your "security deposit" as an operator. It grants you the right to run a restaurant where everything is already set up for you. Chick-fil-A covers all major expenses-from real estate acquisition and site selection to restaurant construction, renovation, and all costly kitchen equipment. These investments routinely exceed $2 million, fully funded by the company. That's why the entry barrier appears so low. But the true cost manifests in your ongoing operations. Let's break down these "invisible" yet critical recurring expenses:

1-1: The Famous $10,000 Franchise Fee: What It Covers (and What It Doesn't)

First, we must clarify the nature of this $10,000 fee. By reviewing its latest Franchise Disclosure Document (FDD), we confirm this fee is non-refundable. It grants you the "right" to operate a specific store, not ownership-a crucial distinction. Chick-fil-A, Inc. is a long-established, reputable privately held company controlled by the S. Truett Cathy family. Its legal structure is transparent, with relatively few litigation records in the industry-primarily labor disputes rather than franchisee conflicts. This indirectly attests to the stability of its model and rigorous screening process. Their trademark "Chick-fil-A" is valid and strongly protected. What you acquire is merely the right to use it. This $10,000 represents the "entry fee" to operate under this powerful brand's umbrella. It does not include any tangible assets, nor does it cover your training travel expenses or personal living costs for the initial months.

1-2: Beyond the Fee: The Hidden & Ongoing Costs

This is the core of Chick-fil-A's business model and the most critical aspect for your future cash flow. They deeply bind themselves to you, sharing in your success.

15% Royalty Fee: This is the most critical component: 15% of your restaurant's total monthly sales must be remitted directly to the company. Compared to brands like McDonald's (approx. 4-5%) or Subway (approx. 8%), this rate is substantial. It directly determines that your gross profit margin is significantly smaller than that of traditional franchisees.

Up to 50% Profit Split: After paying the aforementioned 15% fee and all operational costs (staff wages, raw materials, utilities, equipment rentals, etc.), you must further allocate up to 50% of your remaining pre-tax profit to Chick-fil-A. Yes, you read that correctly-half of your profit.

Equipment Rental: All equipment in your store is owned by the company, and you must pay monthly rental fees.

Other Costs: Additionally, you bear advertising and marketing expenses (typically a small percentage of sales), insurance premiums, IT system service fees, etc.

This revenue structure clearly indicates that Chick-fil-A's model resembles a "profit-sharing partnership" rather than a traditional "licensing-fee" system. The company assumes significant upfront capital risk, and in return, it captures the majority of profits during subsequent operations.

1-3: Your Personal Financial Runway: The Unspoken Cost

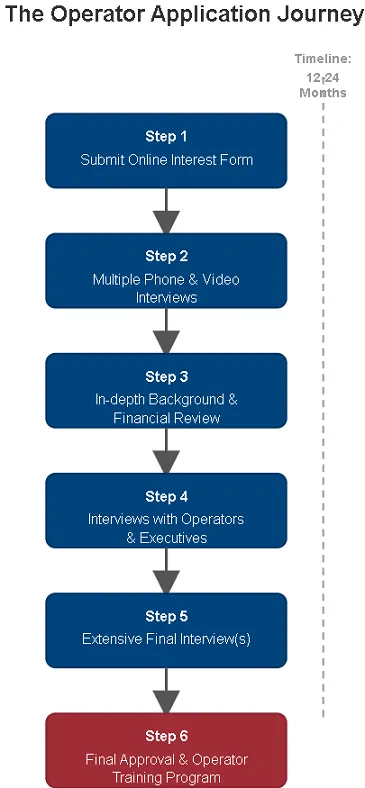

There's another cost that no official document will boldly highlight, but I must remind you: Personal Financial Runway: Chick-fil-A's application process is exceptionally lengthy, potentially taking 12 to 24 months. During this period, you must undergo multiple rounds of interviews and evaluations. Furthermore, once you enter the final training phase (which can last weeks or even months), you will have no income. You must prepare sufficient living expenses to support yourself and your family through this "vacuum period." This sum could easily exceed $10,000. According to Numbeo's cost of living database, basic annual expenses for a family in a mid-sized U.S. city range from $60,000 to $80,000. You must ensure your savings adequately cover this period-this represents a very real, tangible cost of implementation.

1-4: Calculate Your Potential Return on Investment

By now, you might be wondering about these percentages: "What does this actually mean for me?" Don't worry-that's precisely why we developed our tool. Instead of guessing, calculate it yourself.

Take Action Now: Head to our ROI Calculator page. Enter your estimated annual sales (we'll discuss this figure in the next section), and our calculator will automatically deduct the 15% royalty fee and 50% profit share. This clearly shows your approximate pre-tax annual income at different sales levels-the first step in turning abstract numbers into concrete decisions.

2: The Million-Dollar Question: How Much Does a Chick-fil-A Franchise Owner Make?

Alright, we've covered costs. Now let's dive into the most exciting part: income. After all, with such high expenses, the returns must be substantial, right? The answer is: Yes, very significant.

2-1: Industry-Leading Sales Figures: A Look at the Revenue

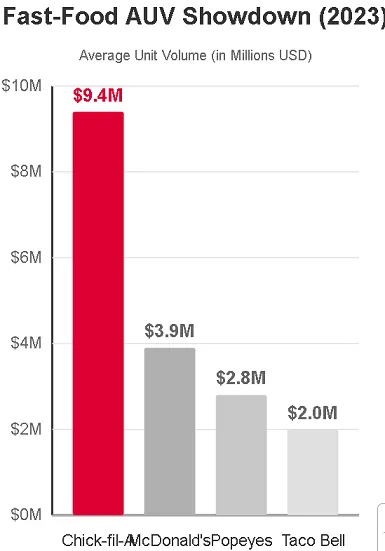

Chick-fil-A is a veritable "cash cow" in the fast-food industry-and that's no exaggeration. According to the latest report from QSR Magazine, a leading food service industry publication, Chick-fil-A achieved an astonishing average annual sales volume per location (AUV) of $9.4 million in 2023. What does that mean? It's nearly triple McDonald's per-location revenue-and achieved while operating only six days a week. This formidable cash-generating capability is the fundamental guarantee for your future income. While its average check isn't the highest ($10–15), it creates an industry miracle through exceptionally high daily customer traffic and table turnover rates.

2-2: Estimating the Operator's Salary: From Gross Revenue to Net Profit

So, out of this $9.4 million in sales, how much could you earn as an operator? Let's run a simplified profitability model calculation. (Note: This is only an estimate based on industry averages; actual results will vary by location and management quality.)

1. Annual Gross Sales: $9,400,000

2. Pay 15% Royalty Fee: $9,400,000 * 15% = $1,410,000

3. Remaining Amount: $9,400,000 - $1,410,000 = $7,990,000

4. Estimated Operating Costs: Typically, comprehensive operating costs in the fast-food industry-including food, labor, rent, etc.-account for approximately 65%-75% of sales. Using an intermediate value of 70%, $9,400,000 * 70% = $6,580,000

5. Total pre-tax profit: $7,990,000 - $6,580,000 = $1,410,000 6. 50/50 split with the company: $1,410,000 / 2 = $705,000

Therefore, under this ideal model, an operator achieving average performance can reach an impressive $700,000 in annual pre-tax income. Even within a more conservative model (e.g., higher operating costs or sales below average), annual income ranging from $150,000 to $250,000 is quite common-far exceeding average salaries in most industries. With an initial investment of just $10,000, the so-called "break-even period" is practically achieved within the first month. But that's beside the point. What truly matters is sustained annual income.

2-3: Comparing Apples to Oranges: How Does This Stack Up?

Seeing these figures, you might think the earlier 15% and 50% fees were entirely justified. But hold on-behind these high incomes lies a completely different business logic.

Take Action Now: Where does this income level rank across the entire franchise market? Compared to investing in a McDonald's requiring $500,000 in startup capital, which offers a higher return on investment? This is precisely what our Opportunity Comparison Tool solves. You can compare Chick-fil-A's data side-by-side with other top brands in our database. Generate your own "one-page decision report" across multiple dimensions-initial investment, payback period, operational model, autonomy, and more-to find the opportunity that best aligns with your financial goals and risk tolerance.

3: More Than an Investor: The "Operator" Philosophy and What It Means for You

So far, we've discussed money, but to truly understand Chick-fil-A, you must grasp its soul-the business philosophy of founder S. Truett Cathy. This is also the key factor in determining whether you "fit" within the system.

3-1: Owner vs. Operator: Why You Don't Truly "Own" Your Restaurant

This is the most critical mindset shift-and the biggest "cognitive trap"-to overcome. As a Chick-fil-A operator, you:

Own no tangible restaurant assets: Land, buildings, and equipment belong to the company.

Cannot sell your franchise: You cannot retire by selling your restaurant like a house.

Cannot pass the business to your children: This is not a family-inheritable enterprise.

Typically operate only one location: The company expects your full commitment.

Must personally manage the store: you cannot be a hands-off owner,

Therefore, what you acquire is not an appreciating asset, but a highly rewarding yet extremely restrictive "job opportunity." I like to call it "golden handcuffs"-it brings you substantial income, but also locks you firmly to this single location. This is a clause requiring extreme caution in legal risk assessments, defining the fundamental relationship between you and the company.

3-2: A Day in the Life: The Hands-On Commitment Required

What does it mean to be an operator? It means you are the soul of this restaurant. You must:

Commit Full-Time: This isn't a side gig-it's your entire career.

Be Hands-On: You must personally recruit and train staff, even packing meals yourself during peak hours.

Lead the Community: Chick-fil-A expects operators to actively participate in community events and build a positive public image.

Live the Brand Values: "Servant Leadership" and "Go the Second Mile" are ingrained requirements,

In exchange, headquarters offers unparalleled support: industry-leading training spanning weeks, dedicated operations consultants responding to your questions (typically resolving urgent issues in under 4 hours), New product development is handled centrally by headquarters (with at least 2-4 seasonal or permanent new items annually), and marketing campaigns are uniformly deployed by headquarters. You only need to focus on in-store operations and community relations. This is a classic "high support, high control" model.

3-3: Are You the Right Fit? The Traits of a Successful Operator

So, who is that "chosen one"? Based on years of observation and insights from FDD documents, successful operators typically possess these key traits:

Servant Leadership: Are you genuinely committed to serving your employees and customers?

Strong Financial Management: Even with headquarters' systems, can you meticulously manage labor costs and material losses?

Community Connector: Do you thrive on participating in local events and getting to know everyone in the neighborhood?

Exceptional Execution: Can you flawlessly implement every single standard set by headquarters?

Resilient Character: Can you endure the lengthy application process and high-intensity workload?

3-4: Assess Your Entrepreneurial DNA

At this point, ask yourself a profound question: "Is this truly the life I desire?" Am I pursuing financial and time freedom, or do I inherently love the service industry and relish hands-on building an exceptional team?

Take Action Now: To help you answer this, we've designed the Entrepreneur Assessment tool. It's not just a simple test-it's a deep self-reflection exercise. By evaluating your leadership style, risk tolerance, work values, and operational skills, you'll gain clarity on whether your "entrepreneurial DNA" aligns with the operator traits Chick-fil-A seeks.

4: The Path to a Chick-fil-A Franchise: A Step-by-Step Application Guide

If, after reviewing all this information, you still feel your heart racing and believe you are the chosen one, then welcome to the selection process's "Hell Mode."

4-1: The Gauntlet: Understanding the 12-24 Month Selection Process

Chick-fil-A's application process is renowned for its length and rigor. Over 60,000 people apply annually, yet fewer than 100 are ultimately accepted-an acceptance rate below 0.2%. It's far more competitive than getting into Harvard.

4-2: Why the Acceptance Rate is Lower Than Harvard's (<1%)

Why is it so difficult? Because Chick-fil-A conducts a two-way "Market Feasibility Analysis." They evaluate not only your ability to successfully operate a restaurant but also whether you as an individual can seamlessly integrate into the specific community they aim to enter. They utilize tools like Google Trends to analyze search popularity in target areas, combined with demographic and consumer data from databases such as Statista, to predict the potential customer base size. Then, they seek a "community ambassador" who perfectly matches this market. Your background, values, and local community connections are key evaluation points. They need assurance you can stand out in the local competitive landscape (e.g., how many McDonald's and Popeyes within 3 kilometers).

4-3: Preparing Your Application: How to Stand Out

I know a successful applicant who wasn't the wealthiest candidate. She did two things: First, she spent a year volunteering at a local nonprofit before applying, building deep community connections. Second, during her interview, she didn't focus on profit potential. Instead, she presented a detailed plan outlining how she would partner with local schools to offer student internships. She demonstrated herself as a "giver" rather than a "taker"-a classic example of a successful application.

Take Action Now: A clear business vision is key to application success. Our Business Plan Generator helps you systematically build your personal leadership blueprint. Even though Chick-fil-A has a set model, preparing a plan detailing how you'll manage teams and integrate into the community instantly makes your profile appear multidimensional and professional to interviewers.

5: The Verdict: Is a Chick-fil-A Franchise the Right Opportunity for You?

Now, let's evaluate this venture through a venture capital lens for our final assessment.

5-1: The Pros: The "Golden Handcuffs"

Extremely low startup barrier: $10,000 leverages a multi-million-dollar business.

Powerful brand backing: You operate under one of America's most beloved fast-food brands.

Exceptional income potential: Successful operators earn annual incomes far exceeding the national average.

Extremely low closure rate: The brand's stability minimizes operational failure risks.

5-2: The Cons: The Price of the Handcuffs

🔴 High-Risk Items (Immediate Rejection):

No ownership or inheritance rights: This fundamentally conflicts with investors seeking to build transferable assets and achieve wealth leapfrogging. Contract exclusivity clauses dictate you remain a "lifetime" operator only.

Extremely low application success rate: If you're not mentally prepared to invest significant time and effort only to potentially fail, the opportunity cost is too high.

🟡 Medium-Risk Items (Negotiable for Modification - But Virtually Impossible Under This Model):

Extremely High Profit Sharing: The 15% + 50% model severely limits your ability to reinvest profits.

Lack of Autonomy: While the headquarters' digital system is advanced, you cannot make any flexible adjustments based on local market conditions.

🟢 Low-Risk Item (Acceptable):

High-Intensity Work: Requires full-time hands-on commitment,

Sunday Off: Impacts weekly total income but is part of the brand culture,

5-3: What If You're Not a Fit? Your Next Best Move

This opportunity is explicitly designed for a specific audience. If it doesn't suit you, it doesn't mean failure. The food service industry currently offers many emerging trends like "Ghost Kitchens" and "Subscription-Based Dining," which provide more flexible, lower-cost entrepreneurship options.

Take Action Now: "Explore broader business horizons by visiting our Business Opportunity Database to find ventures better aligned with your investment goals and lifestyle. Perhaps an emerging brand requiring less capital and offering greater autonomy is your blue ocean."

6: A Final Word: A High-Paying Job or True Business Ownership?

In my view, the Chick-fil-A franchise stands as an "oddity" in the franchising world. It employs an almost ‘paternalistic' rigor to select "children" who best align with its values, then pours all its resources into nurturing and protecting them, ensuring they lead prosperous lives.

The success of this model lies precisely in defying the traditional franchise logic of "freedom." It eliminates potential destabilizing factors from franchisees-such as cutting corners to reduce costs, recklessly altering menus in the name of innovation, or neglecting management for quick cash-outs. By firmly retaining ownership and decision-making authority, Chick-fil-A ensures every global location delivers nearly identical high-standard service and products. This consistency forges its unparalleled brand loyalty and profitability.

Therefore, when evaluating this opportunity, stop asking "What can I own?" and instead ask "Who do I want to become?" Do you aspire to be an investor with diverse assets and strategic control, or a respected, well-compensated service leader deeply rooted in your community? There's no right or wrong answer-only different choices.

If you're the former, then you should thank Chick-fil-A for its candor-it spared you from a "beautiful trap." You should immediately use our website's Opportunity Comparison Tool to find brands that truly align with your dream of "building an empire."

But if you're the latter, congratulations-you may have found that one-of-a-kind, tailor-made "destiny match." Next, all you need to do is pour your heart into showcasing your very best self.

7: Frequently Asked Questions (FAQ) for Aspiring Operators

1. Q: Can I apply with family or friends as partners?

A: Generally no. Chick-fil-A seeks single, fully responsible operators who maintain clear lines of accountability.

2. Q: If I operate successfully, can I apply to open a second location later?

A: Extremely unlikely. Historically, only a handful of operators have been permitted to manage multiple locations. The brand's standard model is "one person, one store."

3. Q: What should I do if I want to retire or exit the business?

Answer: You cannot "sell" your operating rights. You must apply to the company for "retirement." The company will reclaim the restaurant and seek the next suitable operator. You cannot receive any capital appreciation gains from this process.

4. Question: During the application process, do I need to pay the $10,000 franchise fee upfront?

A: No. This fee is only due upon passing all reviews and formally signing the operator agreement.

5. Q: I have no food service experience. Do I have a chance?

A: Yes. Chick-fil-A prioritizes leadership, character, and business acumen over specific food service skills. Their comprehensive training system develops you into an expert.

8. ⚠️ Important Disclaimer and Investment Risk Warning

The information contained in this report is based on publicly available data and industry analysis. All data is current as of December 2025 and is provided for reference only. It does not constitute any form of investment advice, financial advice, or legal advice. Chick-fil-A's franchise policies, fees, and requirements are subject to change. It is essential to obtain and verify the most current Franchise Disclosure Document (FDD) directly through official Chick-fil-A channels.

Investing in any franchise program involves significant risks, including the potential loss of your entire investment. Past performance does not guarantee future returns. We strongly recommend consulting independent financial advisors, accountants, and attorneys before making any investment decisions.

9. About the Author

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

10. Engage with Us

After reading this report, what are your thoughts? Do you consider Chick-fil-A's model a stroke of genius or a trap? What other challenges have you encountered when evaluating franchise opportunities?

Please share your questions and insights in the comments section below. I promise to personally respond within 48 hours. Let's build a stronger knowledge base here together.

11. Continue Exploring

If you're interested in frameworks for evaluating business opportunities or want deeper analyses of other brands, I highly recommend continuing with these articles:

12. Sources cited:

1. Chick-fil-A Official Website, Franchise Information Page

2. Glassdoor, Chick-fil-A Operator Reviews

3. Numbeo, Cost of Living Database

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.