Hey, friend.

Have you ever driven past a brightly lit Taco Bell late at night, watching the steady stream of customers, and quietly thought to yourself: "Wouldn't it be great if this place were mine?"

You're definitely not alone. As an iconic global fast-food giant, Taco Bell has become the "dream project" for countless investors and entrepreneurs thanks to its unique brand culture and powerful market appeal. But between dream and reality often lies one very specific question: how much does a Taco Bell franchise cost?

Don't worry-you've come to the right place. I'm Qaolase, a business intelligence analyst with over a decade of experience. I've helped hundreds of investors like you dissect opportunities ranging from corner cafes to multinational chains. Today, I'll guide you through the most thorough "due diligence" on the Taco Bell franchise opportunity.

This article will address these core questions:

How much capital do you need? We'll break down every expense-from franchise fees to renovations and equipment.

Am I qualified? Revealing the traits Taco Bell truly values in franchisees beyond financial resources.

Is this investment worthwhile? We'll deeply analyze actual profitability and the investment payback period.

What pitfalls are others not telling you about? We'll candidly discuss risks and challenges.

What's the next step? We'll provide a clear action framework from evaluation to decision-making.

So, pour yourself a cup of coffee, and let's uncover the business reality behind Taco Bell's tempting "Live Más" slogan.

1: The Bottom Line: Total Taco Bell Franchise Cost in 2025

Let's cut to the chase-the money. Based on our analysis of Taco Bell's latest Franchise Disclosure Document (FDD) and industry data, opening a new Taco Bell in 2025 requires an initial total investment ranging from $575,600 to $3,370,100.

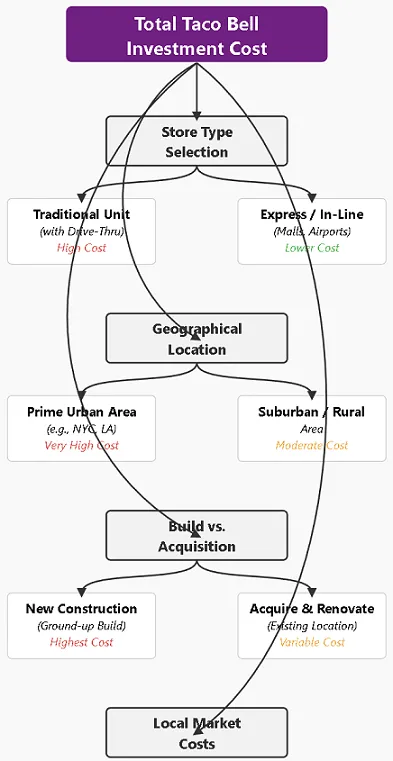

Seeing this huge range might leave you a bit confused. "Why such a big gap?" Good question-this is precisely what a savvy investor needs to figure out first. This difference is primarily driven by these key factors:

Store Format: Are you opening a standard standalone restaurant (Traditional Unit) with a full drive-thru, or a smaller express location (Express Unit) in a mall or airport? The former involves significantly higher building and land costs.

Location: Opening in Manhattan, New York versus a small town in Texas means land, rent, and construction costs can be worlds apart.

New Build vs. Acquisition: Building a new location from scratch is the most expensive option, but you can design it entirely to the latest standards. Acquiring an existing, operational location and renovating it may save some upfront costs, but you also need to consider its operational history and potential maintenance issues.

This range of figures might seem daunting, but don't jump to conclusions. The key is understanding exactly where this money is spent and whether it delivers the expected return.

This reminds me of my friend David. Years ago, he had substantial capital and was eager to franchise a top fast-food brand. He initially fixated on the total investment figure, overlooking a detailed breakdown of costs. Halfway through the project, he discovered "soft costs" far exceeded his expectations, nearly causing his funding to dry up. This lesson underscores that understanding the components behind the numbers is far more crucial than the figures themselves.

To help you avoid repeating this mistake, our website has developed a powerful tool. Try our ROI Calculator. Input variables like approximate rent in your area and estimated store size, and it will generate a preliminary investment estimate tailored closer to your specific circumstances. It's like having a personal financial advisor, transforming broad figures into concrete, meaningful insights.

2: Deconstructing the Investment: Taco Bell Franchise Fee & Other Upfront Costs

Now, let's peel back the layers of this multi-million-dollar investment like an onion. This aligns perfectly with our evaluation framework's Fundamental Project Analysis and Operational Fit Analysis. Only by understanding where every penny goes can you truly assess the project's implementation costs.

2-1: Understanding the Initial Taco Bell Franchise Fee

Among all costs, the first you'll encounter is the Taco Bell Franchise Fee. This fee currently ranges from $25,000 to $45,000 USD.

What is this fee? Think of it as the cost of your "entry ticket." Paying this fee grants you the right to use the powerful Taco Bell brand at a specific location, including its trademarks, proprietary recipes, and a proven operational system refined over decades. This fee is a one-time, non-refundable payment.

However, note that the franchise fee is not the same as the total investment. It represents only a portion of the total investment. Many new investors confuse these two concepts, which is a common pitfall. The franchise fee opens the door, but the money required to build and operate the restaurant must come from your own funds.

2-2: Hard Costs: The Tangible Investments

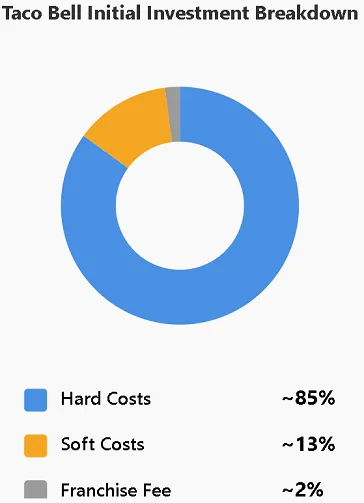

Hard costs refer to the tangible, physical investments you can see and touch. These form the bulk of the total investment and typically include:

Real Estate/Rent: This is the largest expense. If purchasing land and a building, costs can reach millions of dollars. If leasing, you'll also need to pay a substantial security deposit and several months' rent upfront.

Construction and Renovation: Transforming a shell space or existing store into a Taco Bell restaurant meeting global standards usually costs between several hundred thousand and over a million dollars.

Kitchen Equipment and Furnishings: This includes all cooking appliances, refrigeration systems, point-of-sale (POS) systems, tables and chairs, lighting fixtures, etc. This represents a significant expense, generally falling between $100,000 and $500,000.

Signage and Exterior Decor: The iconic purple clock and brand logo also require tens of thousands of dollars.

These hard costs are relatively transparent and can be estimated fairly accurately through quotes from local suppliers.

2-3: Soft Costs: The Hidden Expenses You Can't Ignore

Soft costs are the expenses most easily overlooked, yet they can deliver a fatal blow at critical moments. This is precisely where my friend David fell into a trap. He meticulously allocated his entire budget to hard costs while severely underestimating these "invisible" expenses.

Pre-Opening Working Capital: This is the most crucial soft cost! Taco Bell officially recommends setting aside at least $100,000 in working capital. This fund covers initial operational expenses (typically the first 3-6 months) like staff wages, utilities, and ingredient procurement, since your restaurant likely won't turn a profit right away. David only allocated one month's reserve, and by the second month, he faced financial trouble due to lower-than-expected customer traffic.

Training Costs: While Taco Bell provides free training courses, you must cover travel, lodging, and meals for yourself and your core team during the training period.

Licensing and Legal Fees: Obtaining local business licenses, food safety permits, fire department approvals, and hiring a professional attorney to review the hundreds of pages in the Franchise Disclosure Document (FDD) requires a budget ranging from thousands to tens of thousands of dollars.

Initial Inventory: Before opening, you must stock the first batch of raw materials, which represents a significant expense.

Through this detailed breakdown, you'll discover that becoming a Taco Bell franchisee isn't merely about purchasing brand usage rights-it's launching a complex, system-driven project requiring substantial upfront capital investment.

3: The Ideal Candidate: Does Your Profile Match Taco Bell's Requirements?

Now that we've covered the financial aspect, let's discuss what matters most: the people. Taco Bell isn't merely seeking a wealthy investor. They're searching for a "strategic partner" capable of growing alongside them. This aligns perfectly with the Operational Fit Analysis in our evaluation framework.

3-1: The Financial Threshold: The Uncompromising Hard Metrics

First, we must confront these non-negotiable financial hard metrics. According to Taco Bell's official requirements, the ideal candidate must meet:

Minimum Net Worth: $5,000,000 USD

Liquid Assets: $2,000,000 USD

What is net worth? Simply put, it's the value of all your assets (real estate, stocks, savings, etc.) minus all your liabilities (loans, debts, etc.). What are liquid assets? These are assets you can quickly convert into cash, primarily cash, stocks, etc.

This threshold is extremely high, effectively screening out 99% of ordinary investors. Why so high? Because Taco Bell doesn't want you to stake your entire fortune on just one or two locations. They want you to have sufficient financial cushion to withstand risks and the capacity to open more stores in the future.

3-2: Beyond the Money: The Operator Profile Taco Bell Seeks

If you meet the financial requirements, congratulations-you've just earned an interview invitation. Next, Taco Bell will conduct a deeper assessment to determine if you're the "right fit." They particularly value the following:

Multi-Unit Operations Experience: This is the most critical factor. Taco Bell explicitly prioritizes candidates who have successfully managed multiple restaurants (not necessarily Taco Bell) or retail stores. They need a seasoned operator who understands systematic management, staff training, and supply chain coordination-not a novice requiring training from scratch.

Growth Mindset: They don't want a "small-time" owner content to coast with one location. They seek an ambitious, expansion-minded partner capable of opening 3-5 or more locations within 3-5 years.

Passion for People: Fast food is a people-centric industry. Do you know how to motivate employees, serve customers, and build a positive team culture? These are the soft skills Taco Bell repeatedly assesses during interviews.

In my view, Taco Bell's screening criteria are the core reason behind its strong brand power and operational consistency. By setting high thresholds, they ensure franchisees possess risk resilience and management capabilities, thereby minimizing operational risks.

So how do you know if your background and traits align with these requirements? This goes beyond mere financial considerations-it involves a comprehensive assessment of leadership, risk tolerance, and management style. To help you conduct a more objective self-analysis, we've developed the Entrepreneur Assessment tool. Through a series of questions, it helps you evaluate your entrepreneurial profile and gauge how well you align with Taco Bell's ideal candidate.

4: Unlocking the "Opportunities": What Do You Get for Your Investment?

Alright, assuming you have both the capital and experience, what exactly do you gain by making this substantial investment? Here, we'll dive deep into brand strength from the Project Fundamentals Analysis and profit potential from the Market Feasibility Analysis.

4-1: The Power of the Brand: Riding on the Giant's Shoulders

The greatest value of franchising with Taco Bell is undoubtedly the powerful endorsement of this brand.

Unparalleled Brand Recognition: You don't need to explain what Taco Bell sells to anyone. From teens to middle-aged adults, it boasts an exceptionally broad and loyal customer base. This means your restaurant comes with built-in traffic from day one.

World-Class Marketing: The 4.25% annual marketing fee you pay doesn't go to waste. It flows into a massive fund fueling those highly creative national ads you see during the Super Bowl and on social media. This level of marketing firepower is something an independent restaurant could never achieve on its own.

Continuous Product Innovation: Taco Bell is renowned for its wildly imaginative new product development. From Doritos Locos Tacos to Nacho Fries, it consistently generates buzz and keeps customers coming back. As a franchisee, you'll directly benefit from the R&D efforts of headquarters.

4-2: Training and Support: You're Not Alone

Yum! Brands, Taco Bell's parent company, operates one of the world's most sophisticated franchise support systems.

Yum! University: You and your core management team undergo mandatory training spanning several weeks and hundreds of hours. This comprehensive program covers every detail, from crafting a taco to interpreting financial statements.

Ongoing Operational Support: After opening, you'll have a dedicated Franchise Business Coach who visits regularly to analyze operational data and help boost efficiency and profitability.

Robust Supply Chain: You won't need to source suppliers yourself. Taco Bell maintains a stable, efficient global supply chain system, ensuring you get standardized ingredients at reasonable prices.

4-3: Profitability Deep Dive: A Realistic Look at Your Potential ROI

Now, let's discuss the most exciting part: How much can you actually earn?

According to the latest industry reports, a mature Taco Bell restaurant can achieve an Average Unit Volume (AUV) exceeding $1.6 million annually. Top-performing locations can surpass $2 million.

However, sales do not equal profit. After deducting raw material costs (approximately 30%), employee wages (approximately 25-30%), rent, a 5.5% royalty fee, and a 4.25% marketing fee, a well-managed Taco Bell typically achieves a net profit margin between 10% and 15%.

Let's crunch the numbers:

Assume your store generates $1,600,000 in annual sales.

At a 12% net profit margin, your annual net profit is $192,000.

Now, let's revisit the initial investment. If your total investment is $1.5 million, the theoretical payback period is approximately 7.8 years ($1,500,000 / $192,000). If your investment is higher or your profit margin is lower, the payback period will be longer.

This is only a very rough estimate. Actual profitability will be influenced by multiple factors such as the competitive landscape in your location, management efficiency, and customer traffic.

To gain a more dynamic and personalized understanding of your potential returns, I strongly recommend using our ROI Calculator again. Within this tool, you can adjust variables like projected annual sales and profit margins like playing a simulation game, seeing real-time impacts on your annual profit and investment payback period. This hands-on "simulation" process provides a deeper, visceral understanding of the financial logic behind this business venture.

5: The Hidden Hurdles: Risks and Challenges You Must Consider

As a responsible analyst, I have a duty to show you the shadows behind the sunshine. Every investment carries risks, and franchising with a top brand like Taco Bell is no exception. In this section, we'll build a Risk Control Matrix to help you identify and navigate potential pitfalls.

5-1: The High Cost of Operation: The Never-Ending Fees

Beyond the substantial initial investment, you must also confront ongoing operational costs. With a 5.5% royalty fee and a 4.25% marketing fee, nearly $10 of every $100 you earn goes back to headquarters. This continuously erodes your profit margins, demanding exceptional cost control capabilities.

5-2: The People Problem: The Industry's Biggest Headache

The fast-food industry suffers from shockingly high staff turnover rates, with industry averages sometimes exceeding 150%. This means you might replace an entire crew within a year-or more. The constant cycle of hiring and training consumes significant time and money while making consistent service quality difficult to guarantee. Without a robust personnel management and incentive system, this becomes your worst nightmare.

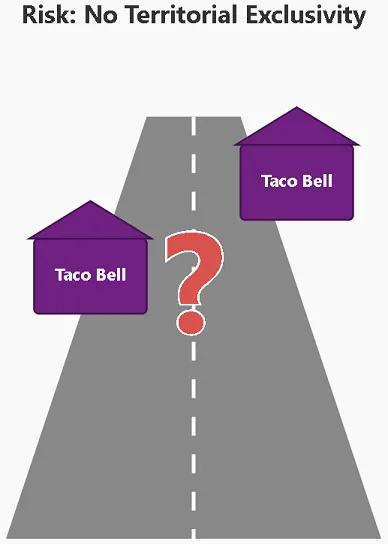

5-3: No Safety Net: The Lack of Territorial Exclusivity

This is the biggest concern for many franchisees. Taco Bell's franchise agreements typically do not offer strict territorial protection. What does this mean? Theoretically, headquarters has the right to approve a new Taco Bell right across the street from your restaurant. While they generally avoid such destructive competition in practice, the possibility remains-like a sword hanging over your head.

5-4: The Multi-Unit Pressure: The Path of No Return

As mentioned earlier, Taco Bell expects you to become a multi-unit operator. This presents both opportunity and immense pressure. Once you successfully open your first location, headquarters will expect you to swiftly initiate plans for a second and third store. This places continuous demands on your financial resources, management capabilities, and energy. If you only wish to operate a single store comfortably, Taco Bell may not be the right fit for you.

These risks are rarely mentioned in the glossy promotional brochures, yet they represent the real challenges every franchisee must confront in daily operations.

6: Your Strategic Next Steps: A Guided Decision-Making Framework

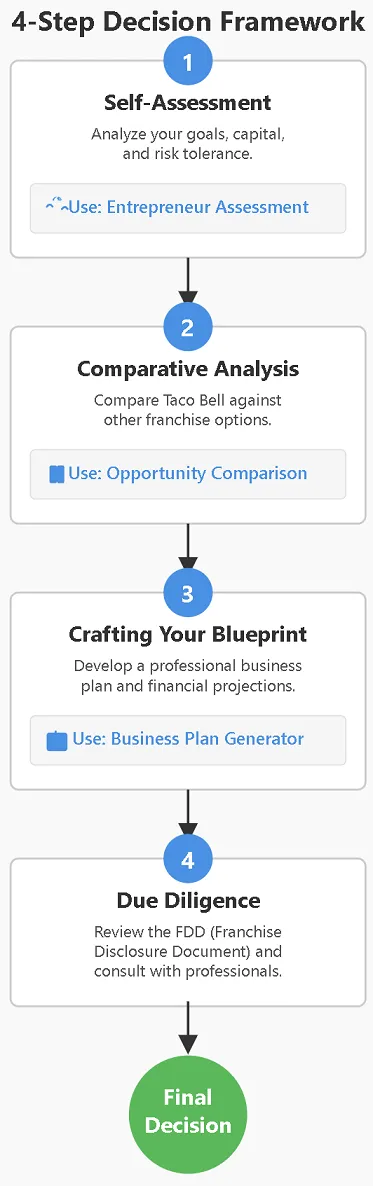

After analyzing all this, you might feel overwhelmed by the information. Don't panic. Next, I'll provide you with a clear, actionable decision-making framework-the core component of our Deliverables. Think of it as a treasure map guiding you step by step toward your final decision.

Step 1: Self-Assessment & Goal Alignment

Before diving deep into the project, dive deep into yourself.

Ask yourself: What are my long-term goals? Am I seeking a steady income, or do I aspire to build my own business empire? How much risk am I willing to take?

Action: Use our website's Entrepreneur Assessment tool to conduct a comprehensive self-evaluation. Answer each question honestly.

Step 2: Comparative Analysis

Don't put all your eggs in one basket. Taco Bell is great, but it's not necessarily your only option.

Ask yourself: Within my budget, what other quality franchise brands exist? Consider McDonald's, Subway, or emerging fast-food brands. How do their investment costs, profitability, and risks compare?

Action: Use our Opportunity Comparison tool. This tool functions like a comparison chart, allowing you to place Taco Bell side-by-side with other brands in our database. It provides a multi-dimensional side-by-side comparison, making strengths and weaknesses immediately apparent.

Step 3: Crafting Your Blueprint for Success

If, after evaluating the first two steps, you still believe Taco Bell is your best choice, it's time to develop a professional business plan.

Ask yourself: Where will my funding come from? In which region do I plan to open? What are my financial projections for the first three years?

Action: Don't start from scratch. Use our Business Plan Generator tool. It generates a fully structured, logically organized business plan framework. Simply fill in the details based on your situation to create a professional document capable of impressing both the Taco Bell review team and bank loan officers.

Step 4: Due Diligence and Professional Consultation

This is the final-and most critical-step.

Action:

Formally contact Taco Bell to request and thoroughly review their Franchise Disclosure Document (FDD).

You must, must, must hire a professional franchise attorney to help you review this document.

Speak with as many current and former Taco Bell franchisees as possible to hear their real experiences.

7: Conclusion: Is a Taco Bell Franchise Your "Live Más" Moment?

Returning to our initial question: Is franchising with Taco Bell truly worth it?

The answer is: It depends on who you are.

For capital-rich, experienced professional operators with ambitions to build a multi-unit fast-food empire, Taco Bell undoubtedly ranks among the premier opportunities currently available. It offers a powerful brand, proven systems, and substantial profit potential.

But for the average investor, or those simply seeking a "steady business," its steep financial barriers, stringent experience requirements, and immense operational pressure may make it an ill-suited choice.

Ultimately, the decision rests with you. I hope this in-depth report, combined with the powerful tools available on our website, will help you see through the fog and gain a 360-degree perspective-empowering you to make a truly wise business decision you won't regret.

8. My Personal Perspective and Insights

As an analyst with over a decade of hands-on experience in this industry, I want to step beyond the data and share my genuine perspective. I believe evaluating projects like Taco Bell requires a perspective beyond that of a decade ago. Three profound shifts are reshaping the fast-food franchise landscape today:

First, the trend toward "capitalization" is increasingly evident. Top brands like Taco Bell are becoming more like a "financial game." They no longer seek traditional "mom-and-pop shop" owners but rather "regional developers" capable of mobilizing substantial capital for rapid expansion. This isn't good news for small investors, but it means a bigger stage for players with substantial resources.

Second, "technological transformation" is reshaping operations. Future competition won't just be about burgers and tacos-it'll be about data analytics, AI inventory management, automated ordering, and delivery efficiency. Taco Bell has invested heavily in this area, giving it a competitive edge. But as a franchisee, you must embrace this shift or risk being left behind.

Third, "experience-driven" offerings are emerging as a new growth driver. Younger consumers (Gen Z) visit Taco Bell not just to fill their stomachs, but for a social experience and brand identity. This demands that franchisees transcend the role of back-office managers to become front-line "ambience creators." The cleanliness of your store, the enthusiasm of your staff, and the appropriateness of your music-these "soft skills" are becoming as crucial as the food itself.

So, if you ask me about Taco Bell's prospects, I'm optimistic. But my expectations for franchisees are more demanding than ever. You must be a triple-threat: a financier who understands capital, a tech-savvy data analyst, and a lifestyle expert attuned to youth culture. Only if you possess these traits will Taco Bell's golden doors truly open for you.

9. Frequently Asked Questions (FAQ)

Q1: I don't have $5 million in net worth, but I'm incredibly passionate. Do I have a chance?

A: Frankly, the chances are slim. Financial eligibility is Taco Bell's primary screening criterion, with virtually no exceptions. They view this as essential to ensure you can withstand risks and support future growth.

Q2: I have no restaurant operation experience. Can I still franchise?

A: It's highly unlikely. Taco Bell explicitly prioritizes candidates with years of multi-unit management experience. If you're a newcomer, we recommend starting with lower-barrier brands or joining an experienced team as a partner. After gaining several years of experience, you can then consider Taco Bell.

Q3: Can I open just one location and not expand?

A: While you may consider this, it likely doesn't align with Taco Bell's expectations. During interviews and follow-up discussions, they will focus on evaluating your "growth plan." Expressing a desire to operate only one location may negatively impact your application success rate.

Q4: Does Taco Bell have a high closure rate?

A: Compared to industry averages, Taco Bell maintains a consistently low closure rate, typically below 5%. This stems from rigorous franchisee screening and strong brand strength. However, this does not eliminate risk-any store may close if poorly managed.

Q5: How should I contact current franchisees?

A: After submitting your initial application and receiving headquarters approval, the Franchise Disclosure Document (FDD) they provide will include a list of current and former franchisee contact information. This is the legitimate channel for obtaining such details. Prior to this, you may attempt to find contacts via social platforms like LinkedIn, but direct outreach could be perceived as abrupt.

10. Action Recommendations and Risk Warnings

Summary: Franchising with Taco Bell represents a top-tier business opportunity characterized by high barriers to entry, significant investment requirements, and substantial pressure-yet it also holds the potential for high returns. It is suited for experienced, well-capitalized professional operators, not first-time entrepreneurs.

Action Recommendations:

Honest Self-Assessment: Utilize our tools to thoroughly evaluate your financial standing and personal attributes.

Comprehensive Comparison: Do not focus solely on Taco Bell; compare it with other opportunities.

Professional Consultation: Before making any commitments, ensure franchise attorneys and financial advisors are involved.

Investment Risk and Disclaimer: This article provides information and analysis for educational purposes only and should not be considered financial or legal advice. Investing in a franchise involves significant risk, including the potential loss of your entire investment. All figures related to costs, fees, and potential earnings are estimates based on publicly available data and can vary significantly. We strongly recommend consulting with a qualified franchise attorney and a financial advisor to review the Taco Bell Franchise Disclosure Document (FDD) and conduct your own thorough due diligence before making any investment decisions. The information on this website is not an offer to sell a franchise.

11. About the Author

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

12. Engage with Us

After reading this report, what are your thoughts? Have you ever considered joining a major brand? What challenges did you encounter during the process? Or, which brand would you like us to analyze next?

Share your insights, questions, or suggestions in the comments section below. I promise to personally respond to every valuable comment within 48 hours. Let's exchange ideas and grow together!

13. Continue Reading

If you're interested in business opportunity analysis, you might also enjoy these articles:

Source:

U.S. Bureau of Labor Statistics, Job Openings and Labor Turnover Survey

Federal Trade Commission, A Consumer's Guide to Buying a Franchise

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.