Kwik Dry Total Cleaning In-Depth Review: An Investor's Ultimate Guide

Hi, I'm Qaolase, a business opportunity analyst. Over the past decade, I've helped hundreds of entrepreneurs like you navigate the foggy business landscape to find their true path.

I recall autumn 2022 when a client named David approached me, standing at a classic "entrepreneur's crossroads." He faced two choices: one was to join a well-known fast-food franchise, requiring an initial investment of $500,000 but offering strong brand recognition and a mature operational system; the other was the opportunity we're discussing today—Kwik Dry, a cleaning service "distributor" opportunity touting "zero franchise fees, zero commissions," with startup costs under $40,000.

David was deeply confused. He asked me, "This sounds too good to be true. What's the catch? Should I choose the expensive but clear path, or take a risk on the cheaper but uncertain one?"

David's question, I believe, mirrors your own doubts right now. You might be Googling "Kwik Dry Total Cleaning reviews," trying to piece together the full picture of this business opportunity from scattered customer feedback. But what you truly need isn't answers about "whether the carpets get clean." As an investor, you need to know: Is this venture worth my hard-earned money and precious time?

Don't worry—this report is tailored for you. In the following sections, I'll thoroughly dissect the Kwik Dry project. Together, we'll:

1. Dig deep into its business model and brand background.

2. Use data to quantify its market potential and actual profitability.

3. Assess operational challenges and headquarters support from your perspective.

4. Establish a risk radar to identify "high-risk signals" that could lead to significant losses.

Most importantly, this article integrates powerful tools like the ROI Calculator and Entrepreneur Assessment available on this website. This ensures you're not just "reading" but actively "interacting" to complete a comprehensive due diligence on the Kwik Dry project.

Ready? Let's lift the veil on Kwik Dry.

Important Disclaimer:

This report is based on publicly available information and industry data models as of September 2025. It is provided solely for your decision-making reference and does not constitute any form of investment, legal, or financial advice. Investing involves risks; proceed with caution. Before making any investment decisions, we strongly recommend consulting professional financial advisors and licensed attorneys, and conducting independent due diligence on your local market.

I. Fundamental Project Analysis (Brand Strength & Business Model)

Any worthwhile investment must have solid fundamentals. It's like building a house - if the foundation is unstable, even the most beautiful structure will eventually collapse. For Kwik Dry, we must act like detectives, uncovering the truth from two core dimensions: brand background and business model.

1-1: Brand Background Verification: Who Are They, Really?

Many entrepreneurs are easily captivated by flashy marketing slogans while neglecting to verify a brand's most fundamental identity information. This is a fatal mistake.

Brand History and Parent Company: Kwik Dry claims to have been founded in the 1990s, specializing in developing quick-dry carpet cleaning technology. It is not a corporate brand backed by a large parent company, but rather an independent entity focused on specific technology and business models. This has both advantages and disadvantages. The advantage lies in its potential for greater focus and flexibility; the disadvantage is that its risk resilience and brand resources may be weaker compared to giants backed by major corporations (such as Merry Maids under ServiceMaster).

Core Team Background: My LinkedIn research indicates Kwik Dry's core management appears notably low-profile with limited public information. This contrasts sharply with star brands whose founders frequently appear in media. As an investor, you must consider: Is this pragmatism or a lack of transparency? When contacting the brand, directly inquiring about the core team's background and industry experience is both your right and a necessary step.

Legal Risk Scan: This is the most critical aspect. Kwik Dry cleverly positions itself as a "Dealership" rather than a "Franchise." Why? Primarily to circumvent the strict FTC Franchise Rule.

>>What is the FTC Franchise Rule? Simply put, it requires franchisors to provide prospective franchisees with a detailed Franchise Disclosure Document (FDD). This document, often hundreds of pages long, discloses sensitive information including the company's financial status, litigation history, full fee breakdown, franchisee rights and obligations, contact details for existing franchisees, and closure rates. It functions like a "prenuptial agreement," maximizing franchisees' right to informed consent.

>>What does Kwik Dry's "distributor" model imply? By avoiding classification as a "franchise," Kwik Dry may have no legal obligation to provide you with an FDD. This means information becomes less transparent. You cannot easily obtain official, audited closure rate data or a list of all distributors. This is definitely a moderate risk signal. You'll face greater difficulty accessing information and must proactively seek and verify details.

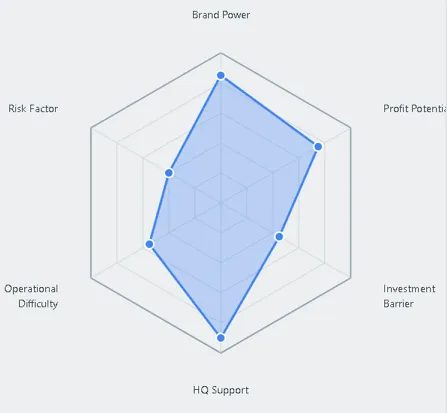

Brand Credit Rating Report (Preliminary)

Brand History: 3/5 (Established history, but not a top-tier brand)

Team Transparency: 2/5 (Core team details are vague, requiring active investigation)

Legal Structure: 2/5 (Dealer model circumvents FDD regulations; information transparency is the primary risk point)

Preliminary Risk Warning: Investors must dedicate more effort to due diligence and cannot rely on standardized disclosure documents.

1-2: Business Model Breakdown: Where Does the Money Come From and Where Does It Go?

Having understood its identity, let's dissect its money-making machine.

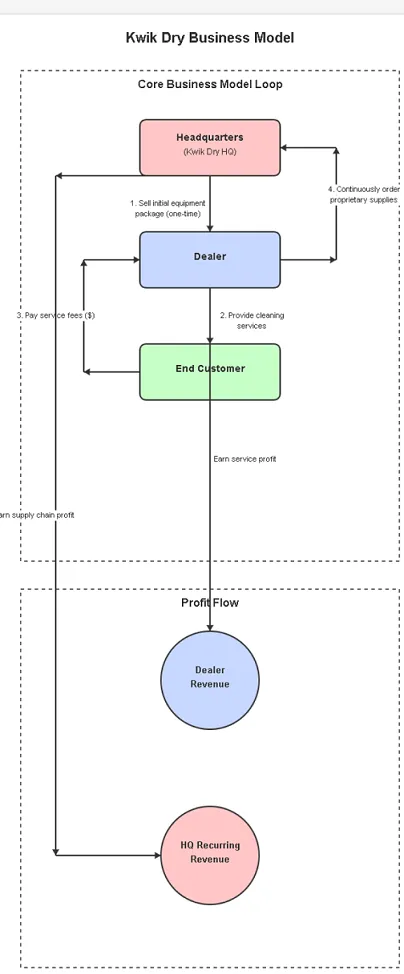

Revenue Structure: Kwik Dry claims "no franchise fee, no royalty fee." So where does its profit come from?

1. Initial Equipment and Product Package Sales: This is its primary revenue source. The approximately $35,000 initial investment includes proprietary cleaning equipment, vehicle decals, initial cleaning agent inventory, and training. This is fundamentally a "product sale" rather than a "licensing fee." You must carefully evaluate whether the equipment and products in this package carry significant markups compared to comparable market offerings.

2. Ongoing Supply Chain Profits: Kwik Dry's model likely requires you to purchase its proprietary cleaning agents and consumables exclusively from headquarters. This is key to its sustained profitability. The risk here is that if its products are priced significantly above market rates, the "no commission" claim becomes a disguised, opaque recurring fee.

Single-Store Profit Model: Let's construct a simplified single-store profit model.

1. Average Ticket Price: Cleaning service pricing varies by region and project. A typical three-bedroom carpet cleaning might charge$200−$300. Duct cleaning could reach $400−$600. Assume a composite average ticket price of $350.

2. Gross Margin: Direct costs for cleaning services are primarily cleaning agents and fuel, typically low. Industry benchmark gross margins reach 80%-90%. We conservatively use 85%. This means for every $350 in revenue, gross profit is approximately $297.5.

3. Daily Jobs: This is the largest variable. Kwik Dry's website claims 2-3 jobs per day can generate substantial income. Let's calculate: If you complete 2 jobs daily over 22 working days per month, monthly gross profit would be $297.5 * 2 * 22 = $13,090. While this figure appears attractive, it does not account for your fixed costs (vehicle loan, insurance, marketing, storage, and your own salary).

Franchise Support System:

1. Training: They offer several days of on-site training. You must clarify: Does the training cover operational techniques for all 8+ services, equipment maintenance, customer communication, and quoting strategies? Is ongoing technical support provided after training?

2. Site Selection Support: For service-based businesses without physical stores, "site selection" becomes "territory demarcation." You need to define the size of your service area and whether territorial protection applies (i.e., headquarters won't develop another dealer within your zone). This is a critical clause that must be explicitly stated in the contract.

3. Marketing Resources: They provide a localized website and some marketing materials. You need to evaluate: How effective is the website's SEO (search engine optimization)? Can it generate organic traffic for you? Do they offer guidance or subsidies for Google Ads campaigns? Or will 90% of customer acquisition fall solely on you?

II. Market Feasibility Analysis (Can it thrive in your territory?)

Even the best project is doomed to fail if it doesn't fit your target market. I've seen too many cases where a model wildly successful in the U.S. flopped spectacularly in another city because it ignored local differences.

2-1: Localization Adaptation Model: Can It Survive in Your Hometown?

Consumer Culture Compatibility: Cleaning services represent a universal necessity, particularly in middle-class communities. People are willing to pay for "time savings" and "professional results." Kwik Dry's core selling point—"fast drying"—precisely addresses the demands of modern fast-paced lifestyles. Thus, from a consumer culture perspective, its compatibility is exceptionally high, requiring minimal localization adjustments. Your primary task is to establish a competitive pricing structure aligned with local spending power.

Competitive Landscape Scan: This is critical to your survival. Don't just stare at Kwik Dry's website. Open Google Maps and search your target area (e.g., within 5 km of your home) for these keywords:

1. "Carpet Cleaning Near Me"

2. "Upholstery Cleaning"

3. "Air Duct Cleaning"

4. Then document: How many competitors exist? Who are they? Are they national chains like Chem-Dry or Stanley Steemer, or local independent shops (we call them "Chuck in a truck")? What are their Google reviews like? Do their websites look professional? Do they offer online quotes?

5. Practical Tip: Pretend to be a customer and call the top three competitors for quotes. This reveals their quoting process, customer service quality, and price range. This firsthand information is more valuable than any market report.

Policy Compliance: Operating a cleaning service company in the U.S., Canada, and similar regions is generally straightforward. You primarily need:

1. Register Your Business (LLC or Corporation): Protects your personal assets.

2. Business Liability Insurance: An absolute must! It can save you if you damage expensive carpets or furniture at a client's home.

3. Special Licenses: Some states or cities may require permits for using specific chemicals—verify these requirements.

Compared to industries like food service or education, cleaning services have relatively lower regulatory compliance barriers, which is an advantage.

2-2: Demand Forecasting: How Many Fish Are in Your Pond?

Potential Customer Base Estimation: Who are your target customers? Homeowners with carpets, apartment renters, offices, restaurants, or hotels?

1. Data-Driven Decision Making: Utilize publicly available government census data (e.g., U.S. Census Bureau) to find median household income, homeownership rates, and other metrics for your area. Areas with higher incomes and homeownership rates typically indicate a larger potential market.

2. B2B vs. B2C: Don't focus solely on residential customers (B2C). Commercial clients (B2B) like offices, hotels, and property management companies offer more stable, higher-value contracts.

Tool Application for Demand Validation:

Google Trends: Enter "Carpet Cleaning" in Google Trends and set the location to your city. You can observe whether search interest for this service exhibits significant seasonal fluctuations (typically peaking during spring and fall cleaning seasons). This helps plan marketing budgets and cash flow.

III. Operational Viability Analysis (Real Money Investment and Returns)

This is the core of the entire analysis report and the part you, as an investor, care about most: How much do I actually need to invest? How long will it take to recoup my investment?

3-1: Investment Return Calculation: The Numbers Don't Lie

Let's translate all vague notions of "low cost" into clear figures.

Initial Investment Breakdown:

1. Kwik Dry Package: ~$35,000 (Equipment, Initial Product Supply, Training, Vehicle Wrapping)

2. Vehicle: You'll need a suitable van. Whether purchasing new, used, or leasing, this represents a significant expense. We estimate $15,000 - $40,000.

3. Insurance: Commercial liability and vehicle insurance, approximately $2,000 - $4,000 annually.

4. Company Registration & Legal Consultation: ~$1,000.

5. Contingency Fund: Prepare at least 3-6 months of operational costs as a contingency fund—this is your lifeline against risks! We estimate $10,000.

6. Total Initial Investment Estimate: $63,000 - 90,000.See, this differs significantly from the $35,000 advertised on the official website, right? This is the actual startup capital you need to prepare.

Monthly Operating Costs:

1. Vehicle Loan/Lease: ~$500

2. Insurance: ~$250

3. Fuel: ~$400 (depending on business volume)

4. Product Consumables: ~$600 (depending on business volume)

5. Marketing: ~$500 (Google Ads, flyers, etc. – higher initial investment required)

6. Phone/Software Fees: ~$100

7. Your Salary: Don't forget to pay yourself! We'll assume $3,000.

8. Estimated Total Monthly Costs: ~$5,350

Payback Period:

1. Previously calculated monthly gross profit is approximately 13,090 (based on 2 orders/day, $350 average order value).

2. Monthly Net Profit = Monthly Gross Profit - Average Monthly Total Cost = $13,090 - $5,350 = $7,740.

3. Payback Period = Total Initial Investment / Monthly Net Profit ≈ $63,000 / $7,740 ≈ 8.1 months.

Sensitivity Analysis:

What if only 1.5 orders per day? Monthly net profit plummets to $4,317.5, extending the payback period to 14.6 months.

What if intense competition forces the average order value down to $300? The payback period would also significantly lengthen.

Tool Usage:

"Feeling overwhelmed by all these variables? Don't worry! That's exactly where our website's ROI Calculator shines. Open it now, input your local vehicle costs, insurance fees, estimated average order value, and daily order volume. It will generate a fully personalized, dynamic ROI analysis report tailored to your specific situation—far more accurate than any estimates I could provide here!"

3-2: Headquarters Support Assessment: Are They Your Partner or a "Toll Booth"?

A good brand partner should lend a hand when you need it most.

Key Metrics for Quantitative Evaluation:

1. Emergency Response Time: How quickly can you get technical support from headquarters when your core equipment breaks down at a customer's home? Do you get a live person or a voicemail? Ideally, you should receive an effective solution within 1 hour. (<4 hours is optimal)

2. New Product/Technology Development Frequency: The cleaning industry evolves constantly—think greener detergents, more efficient equipment. A vibrant brand should roll out at least 1-2 technical or service updates annually. (≥2 updates/year is acceptable)

3. Localized Marketing Support: Does headquarters provide customizable local marketing materials? Do they assign dedicated marketing consultants to analyze your regional market? Do they freely transfer sales leads from your region obtained through their official website? The value of such "soft support" often surpasses monetary compensation.

IV. Risk Control Matrix (Filtering Out 90% of Pitfalls)

In my view, successful investing isn't about seizing opportunities but avoiding fatal traps. This risk control matrix serves as my "trap filter" for clients.

4-1: High-Risk Items (Red Alert: Immediate Rejection)

If you encounter any of the following situations, I advise you to walk away immediately, no matter how tempting it sounds.

1. Brand closure rate > 15% over the past 2 years: This is the most critical metric. While Kwik Dry may not provide an FDD, you can find ways to investigate. For example, before signing, request contact information for all franchisees in your state (their refusal is itself a red flag). Then privately reach out to several, especially those who have exited. A brand with high closure rates is like a sinking ship.

2. Contract contains mandatory high-price purchasing clauses: If the contract mandates purchasing all supplies exclusively from headquarters at prices significantly above market rates (e.g., 30% or more higher), then "no commission" is a lie. This severely erodes your profit margins.

3. Plagued by negative litigation: Check public legal databases (like Pacer) for extensive litigation disputes between the brand and its franchisees.

4-2: Medium Risk (Yellow Alert: Negotiate Modifications)

These issues aren't deal-breakers, but must be resolved through negotiation before signing and clearly stipulated in the contract.

1. Insufficient territorial protection radius (<1 km or no protection): Without clear, sufficiently large territorial protection, headquarters may develop a new distributor right next to you just as your business gains traction, leading to cutthroat competition. For service-based businesses, I recommend a minimum territorial protection radius of 5-10 kilometers.

2. Outdated Headquarters Digital Systems: By 2025, a brand still managing customers and orders with pen and paper will be severely inefficient. A robust system should enable online scheduling, CRM, route planning, and similar functionalities.

3. Unclear exit mechanism: Contracts must explicitly state whether your dealership can be transferred if you wish to exit, the conditions for transfer, and whether headquarters will repurchase your equipment.

4-3: Low-Risk Items (Green Alert: Acceptable, Prepare)

These are normal challenges most businesses face. With advance preparation, they pose no significant threat.

1. Requires additional business licenses: As long as the licenses aren't specialized or scarce, follow the standard application process.

2. Significant seasonal fluctuations: Understand the peak and off-peak seasons for cleaning services in your area. Build up cash reserves during peak periods to weather the off-season.

3. Requires significant self-driven market development: This is standard for all startups. Don't expect headquarters to provide all your clients. Your own sales and marketing capabilities are fundamental to success.

Tool Recommendation:

"Concerned about lacking experience in identifying these risks? Don't worry. Our Entrepreneur Assessment tool includes a ‘Risk Tolerance and Identification’ module. Completing it will help you understand your risk capacity, empowering you during negotiations with franchisors."

V. Deliverables (Your Custom Decision Toolkit)

By now, you've gained a deep understanding of Kwik Dry. I'm now providing you with a ready-to-use decision toolkit that distills all complex analysis into clear, actionable outcomes.

5-1: A4-Page Decision Report

Designed for CEOs like you. This report consolidates all key metrics onto a single page for instant clarity.

Key Metrics Summary:

1. Estimated Total Investment: $63k - $90k

2. Projected Payback Period: 8 - 15 months (Highly dependent on business volume)

3. Core Advantages: Low startup costs, no ongoing royalties, flexible operational model.

4. Core Risks: Lack of transparency (no FDD), high demands on franchisee's personal capabilities, hidden costs (mandatory consumable purchases).

5. Final Recommendation: (Leave blank for user to fill based on personal circumstances)

5-2: Competitor Comparison Matrix

Choosing Kwik Dry means forgoing other options. This table helps you make a more informed side-by-side comparison.

| Feature | Kwik Dry | Chem-Dry (Typical Franchise) | Local Independent Cleaning Company |

|---|---|---|---|

| Business Model | Dealer | Franchise | Independent Operation |

| Initial Investment | Medium (US $60 k–90 k) | High (US $100 k–200 k+) | Low (< US $20 k) |

| Ongoing Costs | Supplies Profit Share | 5 %–10 % Royalty + Marketing Fund | None |

| Brand Strength | Moderate | Strong | Weak / None |

| Headquarters Support | Moderate | Strong | None |

| Operational Freedom | High | Low | Very High |

| Risk Profile | Information Opacity | Strong Contractual Constraints | Lone Operator, Weak Risk Resistance |

| Ideal Candidates | Hands-on Sales-oriented Entrepreneurs | Investors Seeking Proven Systems | Experienced Technical Masters |

Tool Usage Guide:

"This table is just a starting point. Use our website's Opportunity Comparison tool to add more brands you're interested in. Compare them in detail across over 20 dimensions to find the perfect fit for you."

5-3: Localization Execution Checklist (120-Day Launch Countdown)

Once you decide to invest, a clear roadmap is essential.

Pre-Signing (Days -30 to -1):

Consult a lawyer to review the contract

Complete funding preparation/loan application

Contact at least 3 current/former dealers

Post-Signing (Days 1 to 30):

Register the company, open a business bank account

Purchase/lease a van

Schedule training dates with headquarters

Preparation Phase (Day 31 to 90):

Complete training

Vehicle modification and window tinting

Purchase commercial insurance

Build localized website and social media accounts

Launch Phase (Day 91 to 120):

Initiate local marketing (flyers, community outreach, Google Ads)

Prepare all equipment and supplies

Grand opening!

Tool Guide:

"Feeling overwhelmed? Don't panic. Enter this checklist into our Business Plan Generator, and it will automatically generate a professional business plan with a detailed timeline and task breakdown. Update your progress anytime—everything stays under control."

VI. Key Insights & Trends

6-1 Market Characteristics & Success Factors

Market Characteristics:

The home services industry is a classic "long-tail market" with strong resilience against economic cycles. Regardless of economic conditions, dirty carpets always need cleaning. The market is vast yet highly fragmented, offering ample opportunities for new entrants.

Typical Opportunity Case:

One of my clients, formerly an IT engineer, grew weary of office politics and transitioned into a similar home services business. His success hinged on leveraging his IT background to build a highly professional local website. Through precise SEO and Google Ads campaigns, he secured 50% more online inquiries than competitors within his first three months of operation. This demonstrates that in this seemingly traditional industry, "modern marketing thinking" serves as a powerful weapon for competitive advantage.

Key Success Factors:

1. Sales Ability: You're not just a technician—you're a salesperson. Your ability to persuade clients to choose you and purchase higher-value service packages determines your income ceiling.

2. Customer Service: Be punctual, courteous, professional, and leave a spotless workspace. A strong reputation generates substantial repeat business and referrals—the cheapest and most effective marketing.

3. Efficiency Management: How do you optimize routes to serve more clients daily? How do you manage equipment and supply inventory? Efficiency equals money.

Industry Trend Insights:

1. Eco-Friendly & Health-Conscious: More clients prioritize cleaning products safe for children and pets. Services emphasizing "green" and "eco-friendly" cleaning command higher brand premiums.

2. Service Bundling: Don't just sell carpet cleaning. Promote deep-clean packages like "Carpet + Sofa + Mattress" or "Spring Cleaning" bundles (including duct cleaning) to significantly boost average transaction value.

3. Subscription Models: Test "Quarterly Maintenance" or "Annual Cleaning" subscription services. This locks in future revenue and provides stable cash flow.

Ⅶ.Entrepreneur FAQ

1. What's the difference between Kwik Dry's "Dealer" model and "Franchise"? How should I choose?

Answer: The key difference lies in legal protections and support systems. Franchises (like Chem-Dry) are protected under FDD regulations, offer transparent information, and have mature support systems—but they come with high fees, numerous restrictions, and you function more like a "senior manager." Kwik Dry's dealer model offers lower costs and greater autonomy—you're more like a "true owner." However, you bear more responsibility for due diligence, and headquarters support may be less systematized. Your choice depends on your personality: if you're an experienced "field commander" craving freedom, choose the dealer model; if you're a "regular army" seeking structured guidance with robust backup, choose franchising.

2. The official website states $35,000 is needed to start, but your report says $35,000is needed to start, yet your report cites $60k-$90k. Who should I believe?

Answer: Believe both, but understand their different perspectives. The $35,000 is paid to KwikDyCompany as an "entry fee," granting you brand usage rights and core equipment. My calculated

$35,000 is the "entry fee" paid to KwikDry Company, granting you brand usage rights and core equipment. My calculated

$60k-$90kis the total capital. This includes the most critical "ammunition"—vehicles and reserve funds. Preparing only90k is the entire capital required to truly get this "business" operational. It includes the most critical "ammunition"—vehicles and reserve funds. Trying to open with just 35,000 is like buying a gun but no bullets—extremely dangerous.

3. I have no cleaning experience—can I really run this business?

Answer: The skills can be learned, and Kwik Dry provides training. But you must ask yourself a more crucial question: Do you enjoy interacting with people? Do you relish the sales process? Success in this business is 50% technical skill and 50% your communication and sales abilities. If you're an introverted, taciturn technical expert, you might find it challenging. Conversely, if you're a chatty, trust-building "social butterfly," even with limited technical skills initially, you'll likely succeed more easily.

4. How many jobs can I realistically get each day? What if I don't get any?

Answer: This is the biggest unknown and the core problem you must solve as the owner. Initially, you can't expect orders to come knocking. You need to:

1. Proactive outreach: Design attractive flyers and distribute them door-to-door in target neighborhoods.

2. Build partnerships: Collaborate with local real estate agents, property managers, and interior designers to get referrals.

3. Digital marketing: Invest in Google Local Services Ads—one of the fastest ways to attract customers.

4. Word-of-mouth marketing: Deliver exceptional service on every job, then ask satisfied clients to leave positive reviews on Google or Yelp. Initially, you might get only one job a day—or none at all. But if you keep doing the right things, your business volume will gradually climb.

5. If I decide to quit after two years, can I recoup my investment?

Answer: This is a great question that many overlook. Your investment consists of two main parts: tangible assets (vans, equipment) and intangible assets (your dealer status, client list). The truck and equipment can be sold as used assets, but they depreciate significantly. The key lies in whether your "dealer status" can be ‘sold’ to the next owner along with your customer list. This entirely depends on the terms of your contract with Kwik Dry. Therefore, before signing, your lawyer must specifically scrutinize the "Transferability Clause"—it's your last line of defense for preserving asset value.

Ⅷ. My Personal Perspective and Final Recommendation

At this point, I'd like to step out of my analyst role and share my candid thoughts.

I believe business models like Kwik Dry's precisely target a specific market gap: they provide a springboard for grassroots entrepreneurs—those with dreams and drive but limited startup capital. Unlike traditional franchises that wrap you in high barriers and layers of rules to make you a "safe" but mediocre operator, it equips you with a set of tools (technology and brand) and then pushes you into the market to fight your own battles.

So, who is Kwik Dry for? It's not for investors seeking stability or expecting headquarters to solve every problem for them like a "nanny." If that's your mindset, a mature franchise system like Chem-Dry would be a safer choice. It's perfect for those "hungry" entrepreneurs with a wolf-like drive. You may lack substantial capital, but you possess an intense desire to succeed; you may not master every technique, but you're a natural salesperson; you may be tired of working for others and crave 100% control over your business and income. If this describes you, Kwik Dry offers an opportunity to leverage a high-profit market with relatively low costs. Its risk lies in "uncertainty," yet its allure stems from the boundless possibilities that uncertainty unlocks.

My Final Action Recommendations:

1. Self-Assessment: Honestly ask yourself - are you a "field army" or a "regular army"? Use our website's Entrepreneur Assessment tool to guide you.

2. Data Modeling: Don't trust anyone's verbal promises—including mine. Open the ROI Calculator, input your own data, and personally calculate your profit potential.

3. Deep Dive Discussion: Bring all the questions from my report to an in-depth, candid conversation with a Kwik Dry representative. Observe whether their answers are transparent or evasive.

4. Legal Protection: If you reach the contract stage, absolutely, absolutely hire a professional business attorney to review your agreement. This few thousand dollars in legal fees could save you hundreds of thousands in losses.

Entrepreneurship is a game for the brave. Kwik Dry offers you an entry ticket, but winning the game ultimately depends on you. Good luck!

Risk Disclosure:

Please note once again that success in the home services industry is highly dependent on the operator's personal effort, sales skills, and customer service quality. All financial data in this report is based on industry benchmark estimates; your actual results may vary significantly. Conducting thorough, independent due diligence is your personal, non-delegable responsibility before committing any funds.

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.