Hello, friend. I'm Qaolase, and welcome to our Business Opportunity Insights Center.

I recall it was around 2018 when I first delved deeply into the fast-food franchising sector. At the time, I was evaluating several top brands for a client, including Burger King. I spent weeks buried in thick FDDs (Franchise Disclosure Documents) and spoke with several anonymous current franchisees. I discovered an interesting phenomenon: the publicly available figures online—like franchise fees and investment amounts—are merely the beginning of the story. What truly determines success or failure lies hidden behind those numbers: for instance, why do investment costs vary by over $4 million? How substantial is the “robust support” promised by headquarters? And most crucially, after deducting all costs, how much profit actually ends up in your pocket?

These questions are rarely addressed in the cookie-cutter articles found online.

That's why, in this report, I don't want to just give you a pile of cold, hard numbers. Instead, I want to guide you through a systematic, in-depth analysis of the Burger King franchise opportunity—like a seasoned analyst. We won't just figure out “how much it costs”; we'll also determine “whether it's worth the investment,” “if you can actually turn a profit,” and “what pitfalls to avoid along the way.”

This comprehensive analysis will address these core questions:

How much capital is truly required to launch and operate a Burger King franchise? (Including all “hidden costs”)

Why does the official investment range vary so widely? Which store format should I choose?

What is the actual profitability and investment payback period for a Burger King outlet?

Do I meet Burger King's stringent franchisee criteria?

Compared to McDonald's, what are Burger King's real strengths and weaknesses?

What steps must I take from application to opening, and how can I mitigate risks along the way?

Ready? Let's lift the veil on Burger King's fast-food empire franchise system.

1: Fundamental Project Analysis: How “Hardcore” Is Burger King?

Before committing real capital, we must investigate this brand's background like detectives. This is “fundamental analysis”—it determines whether your investment rests on solid ground or quicksand.

First, the most basic question: Is Burger King a franchise?

The answer is: Absolutely, and it's central to their business model. Over 99% of Burger King locations are owned and operated by independent franchisees. Its parent company—Restaurant Brands International (RBI)—is a behemoth managing multiple brands including Burger King, Tim Hortons, and Popeyes. RBI's strategy is crystal clear: focus on brand management, marketing, and supply chain while delegating day-to-day operations to franchisees with stronger local expertise. This “asset-light” model enables rapid expansion while shifting most operational risks to franchisees.

1-1: Brand Strength and Business Model Breakdown

A brand's strength extends beyond its name recognition. We must examine its internal framework to assess its underlying robustness.

Brand Background Verification: Burger King traces its origins to 1954, boasting a rich heritage. Its parent company, RBI, is publicly traded on the Toronto and New York Stock Exchanges (Ticker: QSR), meaning its financials are transparent and subject to rigorous oversight. You can readily access its annual reports to understand its global strategy and revenue performance. Key executives, such as CEO Joshua Kobza, are seasoned industry veterans with years of experience. This level of established credibility far surpasses that of emerging internet-famous brands.

Legal Risk Assessment: As a mature multinational corporation, Burger King maintains a robust legal framework. Its Franchise Disclosure Document (FDD) spans hundreds of pages, detailing both parties' rights, obligations, and potential litigation history. According to the latest FDD, while minor disputes with franchisees exist (inevitable in any large franchise system), no major class-action lawsuits or legal risks capable of undermining the system's foundation have been identified. Its trademark “Burger King” and core product “Whopper” enjoy rock-solid patent protection.

Business Model & Profit Structure: Burger King's revenue primarily comes from three sources:

One-time Franchise Fee: This is your “entry ticket” to join.

Ongoing Royalties: Typically 4.5% of your monthly gross sales, covering the use of its brand and operational systems.

Advertising Fee: 4% of monthly gross sales, allocated to global and regional marketing campaigns. Note: Burger King (RBI) also captures a portion of supply chain profits by selling specified equipment and ingredients to franchisees (though not all items are mandatory), though this is not a core revenue stream.

What does the single-store profit model look like? According to QSR Magazine data, a mature Burger King outlet achieves an average annual sales volume (AUV) of approximately $1.6 million. Let's do a rough calculation:

Gross Margin: Assuming food and paper costs account for 30%, the gross margin is approximately 70%.

Primary Operating Costs: Labor costs (approx. 25-30%), rent (highly variable, assuming 5-10%), royalties and advertising fees (total 8.5%), utilities, maintenance, insurance, etc. (approx. 5-10%).

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Ideally, 70% - 30% - 10% - 8.5% - 10% = approximately 11.5%. This implies that a store with annual sales of $1.6 million could achieve an annual EBITDA of approximately $184,000. Of course, this is an extremely simplified model; your management capabilities and local market conditions will significantly impact this figure.

Franchise Support System: Burger King provides a standardized “turnkey” solution.

Training: Comprehensive training spanning several weeks covers everything from burger preparation to financial management.

Site Selection: Headquarters employs a robust data analytics team to assist with trade area evaluations and location selection, helping you avoid critical mistakes.

Marketing: The 4% monthly advertising fee translates into extensive marketing campaigns across TV and social media—a scale unattainable for independent restaurants.

Overall, Burger King's fundamentals are exceptionally solid. It represents a mature, transparent business system proven by long-term market validation.

2: Investment and Returns: How Much Does It Cost to Franchise with Burger King? (Operational Fit Analysis)

Alright, now that we've covered the theory, let's get down to the most practical matter—money. Here, we'll deeply analyze your return on investment, specifically your operational fit.

2-1: The Core Numbers: Key Financial Thresholds

This is the first hurdle you must clear. The table below summarizes the core financial requirements from Burger King's 2024-2025 Franchise Disclosure Document (FDD):

| Item | Amount/Requirement | Notes |

|---|---|---|

| Initial Franchise Fee | $50,000 | For a standard 20-year contract |

| Total Estimated Investment | $316,100 – $4,730,500 | Significant variance explained below |

| Net Worth Requirement | $1,000,000 | Your personal or company's total assets minus total liabilities |

| Liquid Capital Requirement | $500,000 | Cash, stocks, and other assets that can be quickly liquidated |

| Ongoing Royalties | 4.5% of monthly sales | |

| Advertising Fee | 4% of monthly sales |

Notice that eye-popping investment ranges from $316,000 to $4.73 million? This is precisely where most new investors get confused. Don't panic—this is exactly what we'll break down next.

2-2: Deep Dive: Why the $4 Million+ Investment Gap?

This massive gap stems from Burger King offering diverse store formats to suit varying business environments—a testament to its strong market adaptability.

Low-end investment range ($300k–$800k): Non-Traditional Locations

What is this? Think of the Burger King counters you see in airports, train stations, university campuses, or mall food courts—these are non-traditional locations.

Why lower costs? You don't need to purchase land or build a structure. Typically, you lease a space of several dozen square meters, with simplified renovations and equipment. You can also share common facilities (like seating areas and restrooms) with the property owner.

Advantages: Low startup costs and rapid entry into enclosed commercial zones with massive built-in foot traffic.

Disadvantages: Restricted operating hours (must close when the mall closes), potentially limited menu options, and customer flow stability entirely dependent on the mall's performance. Additionally, rent deductions can be high.

High-End Investment Range ($1.8M - $4.7M): Traditional Freestanding Restaurants

What is it? This is the familiar Burger King we know best: a standalone building on a city corner, featuring a prominent logo and typically equipped with a drive-thru lane.

Why the high cost? The bulk of expenses lies in land and construction. You may need to purchase land (especially in U.S. suburbs) or sign a long-term lease, then design and build the restaurant according to Burger King's global standards. Land and construction alone can cost millions of dollars.

Advantages: Complete brand identity, flexible operating hours (can be 24/7), drive-thru generates significant revenue (especially in North America, accounting for over 70% of sales), dedicated parking lot, and delivers the most comprehensive dining experience.

Disadvantages: Massive investment, higher risk, and stricter location requirements.

How should I choose? This entirely depends on your financial strength, experience, and target market.

Tool Guide: Entrepreneur Assessment

Are you a “Heavy Cavalry” with substantial capital, extensive experience, and ready to make a big splash? Or are you a “light cavalry” looking to move fast and light, starting with a low-cost “outpost”? There's no absolute right or wrong. Complete our website's exclusive Entrepreneur Assessment tool. It analyzes your financial situation, risk tolerance, and management experience to determine which investment tier best aligns with your profile.

2-3: Beneath the Surface: Hidden Costs You Must Know

The figures on the FDD are just the tip of the iceberg—there are significant funds you must reserve beneath the surface. I once knew a franchisee friend who nearly ran out of cash flow during the initial launch phase because he underestimated these “soft costs.” It was a painful lesson.

Initial Inventory (approx. $20,000 - $40,000): You must stock all ingredients and packaging materials needed for the first month of operation.

Pre-Opening Operating Reserve (3-6 months, minimum $50,000): This fund covers employee wages, rent, and utilities until the restaurant reaches breakeven.

Local opening marketing expenses (approx. $10,000 - $20,000): While headquarters provides advertising support, you must also fund local community promotions, flyer distribution, and similar activities.

Professional service fees (approximately $10,000 - $50,000): You'll need to hire a lawyer to review the Franchise Disclosure Document (FDD) and lease agreement, as well as an accountant to establish financial systems.

Various permits and deposits: Fees are required for business licenses, fire permits, health permits, etc., plus security deposits for the landlord and utility providers.

Only when you add all these together will you have the true startup capital you need to prepare.

3: Profitability and Risk: Is This Really a Good Business? (Risk Control Matrix)

Now we tackle the million-dollar question: How much money can you actually make by opening a Burger King?

3-1: Average Sales vs. Real Profit

Earlier, we mentioned that a store's average annual sales (AUV) are around $1.6 million. But sales don't equal profit. The real key lies in profit margins.

Based on industry analysis and franchisee feedback, a well-managed Burger King outlet typically achieves an EBITDA margin between 8% and 15%.

Why the variation?

Rent: Whether you're in Manhattan, New York or a small town in Texas makes a world of difference in rental costs.

Labor Costs: Minimum wage standards and labor market tightness in different regions directly impact your staffing expenses.

Management Efficiency: Can you effectively control food waste? Can you schedule shifts efficiently to avoid unnecessary labor costs? This entirely depends on your management skills.

Therefore, for the same $1.6 million in sales, an 8% profit margin yields an annual EBITDA of $128,000, while a 15% margin yields $240,000. The gap is substantial.

3-2: Calculate Your Potential Return on Investment (ROI) and Payback Period

The payback period is the primary concern for all investors. It is calculated as: Total Investment / Annual Net Profit.

Suppose you invest in a traditional standalone store with a total cost of $2 million.

Optimistic Scenario: With excellent management and a favorable market, annual net profit (after taxes, depreciation, etc.) reaches $250,000. The payback period is 200 / 25 = 8 years.

Moderate Scenario: Annual net profit is $180,000. The payback period is 200 / 18 = approximately 11 years.

Pessimistic Scenario: Facing intense competition or poor management, annual net profit drops to $100,000. The payback period extends to 20 years, essentially signifying investment failure.

According to Vetted Biz analysis, the average payback period for Burger King franchisees is around 10 years.

Tool Guide: ROI Calculator

Theoretical analysis remains theoretical. I strongly urge you to open our website's ROI Calculator now. Enter your region's estimated rent and labor costs, and then select different sales scenarios. It will generate a highly personalized investment return forecast report. Experience firsthand how different variables impact your final profits—this is a crucial step toward making informed decisions.

3-3: Risk Control Matrix: Identifying and Avoiding “Fatal Pitfalls.”

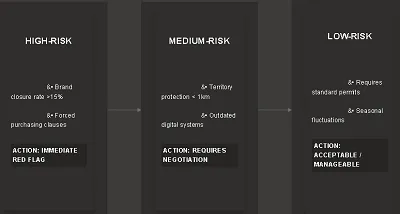

All investments carry risks; the key lies in recognizing and managing them. I've developed a-tier risk response system to help you spot potential landmines before signing any contracts.

High-Risk Items (Veto-Worthy):

Brand's recent closure rate > 15%: Based on public data and industry observations, Burger King's closure rate in recent years is well below this dangerous threshold and remains within a healthy range. However, if you're evaluating other brands, this is a critical warning sign.

Contract contains mandatory high-price procurement clauses: The FDD will clearly specify which items must be purchased from headquarters. If non-core supplies (e.g., cleaning products) mandated by headquarters are priced significantly above market rates, this signals risk.

Medium-Risk Items (Negotiation or Critical Evaluation Required):

Regional protection radius too small (<1 km): Ensure the contract includes explicit territorial protection clauses to prevent headquarters from opening a new location adjacent to your restaurant.

Outdated headquarters digital systems: Today, a fast-food brand lacking smart inventory management, mobile payments, and integrated online ordering systems struggles to compete. Fortunately, Burger King has invested heavily in advancing its digital systems.

Low-Risk Items (Acceptable, but prepare contingency plans):

Seasonal Fluctuations: For example, stores in tourist areas experience significant traffic differences between winter and summer. You need to set aside sufficient reserves to weather the off-season.

Local Policy Changes: For instance, minimum wage hikes require mental preparedness and contingency plans.

4: Market & Competition: Is Burger King Still “Hot” in Today's Market? (Market Feasibility Analysis)

4-1: Market Characteristics and Industry Trends

Today's fast-food market exhibits several distinct features:

Health-consciousness and personalization: Consumers increasingly prioritize ingredient sourcing and health attributes. Burger King is adapting with offerings like the plant-based Impossible Whopper to align with this trend.

Digitalization and convenience: Mobile ordering, delivery, and drive-thru are absolute mainstream. A brand's digital capabilities directly determine its market share.

Experience-Driven: Restaurants are not just dining venues but social spaces. Store design, cleanliness, and service attitude have become more critical than ever.

4-2: Key Success Factors

To successfully operate a Burger King in this market, you must possess:

Exceptional Operational Management: Controlling costs, motivating staff, ensuring food quality and speed—these are core competencies.

Sharp Site Selection Instincts: Even with corporate support, your own understanding of the local market is crucial.

A Mindset Embracing Change: Actively adopt new technologies, menus, and marketing campaigns from headquarters.

4-3: Burger King vs. McDonald's: More Than Just Numbers

This is an eternal rivalry. As investors, we must look beyond the surface and examine strategic differences.

| Comparison Dimensions | Burger King | McDonald's |

|---|---|---|

| Brand Strategy | Bold, youthful, rebellious. Marketing often relishes “trolling” McDonald's. Targets younger male demographics. | Steady, family-oriented, globally consistent. Emphasizes the universality of “I'm Lovin' It.” Targets all age groups. |

| Investment Threshold | Wider investment range; non-traditional outlets offer lower entry options. | Higher overall investment threshold; extremely stringent financial and experience requirements for franchisees. |

| Menu Innovation | Relatively more flexible; frequently launches bold limited-edition flavors. | More classic and stable menu; extremely high requirements for global core product consistency. |

| Operational Support | Provides robust support systems. | Hailed as the “West Point of franchising,” its operational support and training systems set industry benchmarks. |

| Profitability | Lower average unit volume (AUV) per store, approximately $1.6M. | Extremely high average unit volume (AUV) per store, exceeding $3.5M |

My Perspective: McDonald's resembles a “blue-chip stock” with extremely high entry barriers but exceptional stability once established. Burger King, however, offers a more flexible, challenging path that may yield differentiated success. It suits entrepreneurs who resonate with its brand personality and possess the confidence to carve out a niche through meticulous operations amid fierce competition.

Tool Guide: Opportunity Comparison

Is Burger King truly your best choice? Perhaps Wendy's model suits you better? Or are you considering non-burger options like Taco Bell? Use our website's Opportunity Comparison Tool to benchmark key metrics across these top fast-food brands and make the decision that best aligns with your circumstances.

5: Your Action Blueprint: From Application to Opening (Deliverables)

If, after careful consideration, you decide to pursue the Burger King franchise, here is your action roadmap.

Submit Online Expression of Interest: Complete the preliminary application on the Burger King official website.

Qualification Review & Initial Communication: Headquarters reviews your financial status and background, followed by a phone call.

In-Depth Interview & FDD Review: Meet with the Regional Development Manager and receive the Franchise Disclosure Document (FDD). (Hire a professional attorney at this stage!)

Background Check & Final Approval: Headquarters conducts comprehensive background and credit investigations.

Sign Contract & Pay Fees: Sign the franchise agreement and pay the franchise fee.

Site Selection & Restaurant Construction: Complete site selection, lease signing, design, and construction with headquarters' assistance.

Attend Training: You and your core management team must complete headquarters' training program.

Grand Opening!

This process typically takes 6 to 18 months.

Tool Guide: Business Plan Generator

A professional business plan serves as your “key to success” when submitting applications to headquarters and applying for bank loans. However, writing one from scratch is extremely time-consuming. Don't worry—we've got you covered. Use our website's Business Plan Generator. It intelligently integrates all the analysis, data, and insights you've encountered in this report into a structured, comprehensive business plan draft. Simply customize it to reflect your unique vision, saving you significant time.

6: Entrepreneur FAQ: Your Top 5 Concerns

1. Can I join Burger King without food service experience?

Answer: The likelihood is extremely low. Burger King explicitly requires franchisees, especially those seeking to open traditional standalone locations, to possess substantial experience in the quick-service restaurant (QSR) industry or multi-unit management. If you're a complete novice, I recommend starting by gaining experience as a QSR manager or considering franchise brands with lower experience requirements.

2. Can I apply for a loan if I lack sufficient funds?

Answer: Yes. Burger King is an SBA-approved franchise brand, meaning you can more easily apply for an SBA loan. However, remember that banks will still require you to contribute a significant portion of your own funds (typically 20-30% of the total investment). That $500,000 in liquid assets requirement is precisely to demonstrate this capability.

3. After franchising, do I have to work in the restaurant myself?

Answer: Burger King expects franchisees to be deeply involved in daily restaurant operations, not just be absentee owners. You can hire a capable store manager to handle day-to-day execution, but you must be thoroughly familiar with the restaurant's finances, staffing, and operational status, and regularly visit the location to oversee operations.

4. If my operations underperform, will headquarters assist?

Answer: Yes. Headquarters will dispatch regional operations consultants for regular store visits to analyze issues and offer improvement recommendations. If performance continues to decline, they will intervene with more intensive guidance. However, remember that headquarters' support is supplementary—you remain the primary responsible party for success. They won't solve every problem for you.

5. Can I decide the menu or run localized promotions?

Answer: The core menu is globally standardized and cannot be altered arbitrarily. However, you have flexibility in marketing. With headquarters approval, you may conduct small-scale, creative promotions targeting local communities (e.g., nearby schools or companies).

7: My Personal Perspective and Final Thoughts

Alright, friends. We've completed this deep dive together.

In my view, the Burger King franchise is like a heavyweight boxing match. Its strengths and weaknesses are equally pronounced.

The advantages: You're backed by a globally renowned brand with a mature supply chain, powerful marketing firepower, and a proven operational system. You're not fumbling in the dark alone—you're walking a well-trodden path with clear signposts. For an experienced, well-capitalized investor, this offers a reliable path to stable cash flow and business success.

But the drawbacks are equally lethal: the entry ticket is exorbitantly expensive, with extremely stringent requirements for the “contestant's” background. You'll face brutal competition from peers like McDonald's and Wendy's, while also grappling with rising rents and labor costs. Your operational freedom is minimal, as you must strictly adhere to headquarters' rules—like a dancer shackled in chains. This isn't a game for entrepreneurs chasing “small but beautiful” ventures or dreaming of overnight riches.

My core advice is:

If you're an industry veteran with ample capital and ambitions to manage multiple locations, Burger King is a top-tier option worthy of serious consideration.

If you're a novice with limited funds and inexperience, I sincerely advise you to bookmark this article and seek out brands requiring smaller investments and simpler models as your starting point. Don't dive straight into “hell difficulty.”

Actionable Recommendations:

Self-Assessment: Honestly evaluate your capital, experience, and risk tolerance.

Utilize Tools: Reuse our website's ROI Calculator and Entrepreneur Assessment to validate your intuition with data.

Field Research: Visit several Burger King locations in your city—both high-performing and underperforming. Observe customer flow, staff morale, and operational details. Chat with employees to gauge the real work environment.

Seek Professional Guidance: Consult a franchise attorney and accountant before making any decisions.

8. Risk Warning & Legal Notice

Important Notice: This report is based on publicly available information, industry data, and expert analysis. It is provided for research and reference purposes only and does not constitute investment advice or financial commitment. Fast-food franchising is a high-risk investment; past performance does not guarantee future returns. All precise financial data and contractual terms must be verified against the latest Franchise Disclosure Document (FDD) provided to you by Burger King. Before signing any legal documents or committing funds, you must seek independent legal and financial professional advice. Investing involves risks; exercise caution in decision-making.

9. Author Information and Interaction

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

Now, I'd like to pose a question to you:

When evaluating the Burger King franchise opportunity, what are your biggest concerns?

Have you researched other fast-food brands? How do you think they compare to Burger King?

What other franchise brands or business opportunities would you like to explore in depth?

Share your thoughts, questions, or experiences in the comments below. I promise to personally respond to every valuable comment within 48 hours. Together, let's make the entrepreneurial journey less about “falling into pits” and more about gaining genuine insights.

10. Continue Reading

If you're interested in other opportunities within the fast-food industry or want to learn more about business planning, I recommend continuing with these articles:

References

QSR Magazine. (2023). The QSR 50.

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.