Hey, friend, welcome here.

I know why you're here. Maybe you're tired of the nine-to-five grind. Maybe you've got some capital and are looking for a solid project to grow it. You might have already typed "Jersey Mike's franchise" or "how much does a Jersey Mike's franchise cost?" into Google, only to feel a bit overwhelmed by the flood of information.

That's perfectly normal. Making a decision that could cost you hundreds of thousands or even millions of dollars is never easy.

So today, we're cutting straight to the chase. This isn't a marketing piece-it's a tailored, no-nonsense franchise analysis report. I'll guide you like a seasoned investment manager, peeling back Jersey Mike's glossy exterior to examine its structure, muscle, and even the risks lurking in the shadows.

In this in-depth report, you'll get clear answers to these core questions:

How much will it cost? We'll break down every expense, from franchise fees to renovations and utilities.

How much can I earn? We'll dissect official financial disclosures to estimate realistic owner income levels.

Am I qualified? What hard (capital) and soft (experience, traits) requirements must franchisees meet?

Where are the biggest pitfalls? What hidden risks and challenges won't competitors or the brand disclose?

How does it compare to Subway? We'll pit it against major competitors in a brutal side-by-side comparison.

My name is Qaolase, and over the past decade, I've analyzed over 100 mainstream franchise brands, helping entrepreneurs like you make smarter decisions. I've seen too many people get bogged down by impulsive choices, and I've seen others achieve tremendous success by doing their homework.

I recall a client named Mark in 2022 who was highly enthusiastic about Jersey Mike's and was about to sign a lease in a newly developed commercial area. But I insisted he hold off. We spent an entire afternoon stress-testing that location's foot traffic, competitive landscape, and rent-to-revenue ratio using a framework similar to today's report. The results revealed that the "promising" location had far lower actual lunch-time foot traffic potential than anticipated. He ultimately abandoned that spot and found a location six months later with lower rent but more stable community foot traffic. Two years later, his store has become a regional sales star.

This story teaches us: Passion is the engine, but data and rational analysis are the steering wheel.

Today, I'll share this analytical framework with you in full. Better yet, at key points throughout this article, you can use our website's exclusive tools-the ROI Calculator, Entrepreneur Assessment, Opportunity Comparison, and Business Plan Generator-to transform theoretical analysis into your own personalized decisions.

Ready? Let's dive into this deep exploration together.

1: Core Financial Breakdown: How Much Does It Really Cost to Open a Jersey Mike's? (Jersey Mike's Franchise Cost)

Let's talk money first, my friend. This is the most practical and crucial step. When discussing Jersey Mike's franchise cost, it's far more than just the franchise fee listed on the official website. It's a comprehensive investment encompassing numerous components. I'll break it down completely, giving you a clear picture of how much ammunition you'll need to prepare.

1-1: Initial Franchise Fee: Your One-Time Entry Ticket

First up is the "entry ticket" to this club-the initial franchise fee. According to Jersey Mike's latest Franchise Disclosure Document (FDD), this fee is $18,500.

What does this money get you? It grants you the right to use the powerful "Jersey Mike's" brand, along with the full operational system, initial training, and launch support.

In my view, relative to its brand recognition and ongoing support, this price is quite competitive within the top-tier quick-service restaurant (QSR) sector. Many comparable brands charge franchise fees ranging from $25,000 to $50,000. This also reflects Jersey Mike's strategy of attracting higher-quality franchisees rather than relying solely on franchise fees for revenue. But remember, this is only a small portion of your total investment-the real "big chunk" comes later.

1-2: Total Investment Range Breakdown (Item 7 of FDD): Your Actual Startup Capital

Now, let's examine Item 7 in the FDD document-the brand's estimated total investment range. This is the number you should truly focus on. I've organized it into a clear table with my interpretation, so you understand where every penny might go.

| Expense Item | Estimated Range | Analyst's Notes |

|---|---|---|

| Initial Franchise Fee | $18,500 | Fixed cost-your entry ticket. |

| Real Estate/Rent | $4,000 – $15,000 | This is only an estimated rent for the first 3 months. Actual cost depends on your city and location. This is the biggest variable! |

| Leasehold Improvements | $89,641 – $434,149 | Huge fluctuation. If you're taking over a "raw" space, costs will approach the upper limit. Converting a former restaurant can save significantly. |

| Equipment, Furniture, Signage | $95,000 – $150,000 | Includes ovens, meat slicers, POS systems, etc. This cost is relatively fixed as the brand has designated suppliers. |

| Architectural Fees | $8,500 – $22,000 | Professional design is crucial for maintaining brand consistency and ensuring smooth operational workflows. |

| Opening Inventory | $10,000 – $18,000 | Includes all opening ingredients: meat, cheese, bread, beverages, etc. |

| Training Expenses | $15,000 – $25,000 | Covers travel and living expenses for you and your core team during headquarters training; excludes training program fees. |

| Grand Opening Advertising | $15,000 | Mandatory expenditure to rapidly build brand awareness and attract initial customers during launch. |

| Insurance | $3,500 – $7,500 | Covers liability insurance, property insurance, and other protections for your investment. |

| Miscellaneous Costs/Permits | $5,000 – $15,000 | Includes legal fees, accounting fees, and costs for obtaining various business licenses. |

| Additional Funds (3 Months) | $50,000 – $150,000 | Critically important! This is your reserve fund to cover operational expenses during the initial launch period (typically the first 3 months) until cash flow becomes positive. |

| TOTAL ESTIMATED INVESTMENT | $314,141 – $870,149 | This is the actual range of funds you need to prepare. |

So, when you ask "how much does a Jersey Mike's franchise cost?", a responsible answer is: prepare at least $350,000 to $900,000. The vast majority of new franchisees' startup costs land around $500,000. This figure might make you gasp, but it's the reality of establishing a brick-and-mortar brand business.

1-3: "Hidden Costs": The Money Not Detailed in the FDD

Beyond the items listed in the table above, I want to highlight several "hidden costs" or easily overlooked expenses.

Due Diligence Costs: Before signing, hiring a professional attorney to review the hundreds of pages of the FDD contract and an accountant to analyze the financial model is absolutely essential. This expense (approximately $3,000 - $8,000) can help you avoid future pitfalls worth hundreds of thousands of dollars.

Personal Living Expenses: There may be a 6- to 12-month gap between quitting your job to focus fully on this project and the store becoming profitable enough to pay you a salary. You need to prepare sufficient living expenses for yourself and your family.

Contingency Fund for Cost Overruns: Renovation cost overruns are almost inevitable. I always advise my clients to set aside an additional 10%-15% contingency fund beyond the total budget, just in case.

Now you have a comprehensive understanding of the total investment. Feeling a bit overwhelmed? Don't worry-the investment is meant to yield returns.

Want to know how long it might take to recoup this six-figure investment? Stop guessing. Enter your estimated rent, labor costs, and other figures into our custom-built ROI Calculator. It generates personalized payback period and annualized return projections based on various sales scenarios. This is your first step in translating macro data into personalized decision-making.

Investment Risks & Disclaimer

The information provided herein is for reference and educational purposes only and does not constitute financial or investment advice of any kind. Franchising involves significant financial risks, and past performance does not guarantee future results. All costs and profitability figures mentioned are estimates and may differ significantly from your actual circumstances. Before making any investment decisions, we strongly recommend consulting a professional financial advisor and attorney, and carefully reviewing the latest Franchise Disclosure Document (FDD) provided by Jersey Mike's.

2: In-Depth Analysis of Profit Potential: The Real Income of Jersey Mike's Franchise Owners (Franchise Owner Salary & Profitability)

Alright, we've invested heavily to get the store up and running. Now, it's time to answer that most exciting question: How much can I earn? That's what people often search for when looking into the Jersey Mike's franchise owner salary.

First, let's be clear: as a business owner, you don't receive a fixed "salary." Instead, you earn the store's "profit." Your income directly depends on the store's performance. So, how profitable is a well-run Jersey Mike's location?

2-1: Decoding FDD Item 19: The Officially Disclosed "Wealth Code"

Item 19 (Financial Performance Representation) in the FDD is the only legally permissible document disclosing franchisee income. This forms the cornerstone of our analysis. Based on the latest data, Jersey Mike's Average Unit Volume (AUV) is exceptionally strong.

In 2022, Jersey Mike's reported that among over 1,900 stores operating for more than 12 months, the average annual sales reached an impressive $1,238,913.

However, averages can obscure many details. It's more important to examine the performance across different tiers of stores:

Top 25% of stores by sales: Average annual sales of $1,757,191

Middle 50% of stores by sales: Average annual sales of $1,211,131

Bottom 25% of stores by sales: Average annual sales of $748,417

What does this mean? It means that with the right location and strong operations, your store has the potential to become a nearly $2 million annual business. Even average performance can reach the million-dollar level. But if location or operations falter, revenue can drop significantly. Your goal is to strategically plan and work hard to position your store among the top 25%.

2-2: From Sales to Net Profit: Where the Money "Leaks" Away

$1.2 million in annual sales sounds impressive, but this isn't your net profit. We must subtract various operating costs. In the quick-service restaurant (QSR) industry, the primary cost structure is as follows:

Cost of Goods Sold (COGS): Typically accounts for 28%–33% of sales. Jersey Mike's is known for its high-quality ingredients, so we'll use a relatively mid-to-high range, such as 31%.

Labor Cost: Includes employee wages, benefits, and taxes. This is usually the second-largest expense, accounting for 25%–30% of sales.

Rent: Ideally, rent should be kept between 6%–10% of sales.

Royalty Fee: Jersey Mike's royalty fee is 6.5% of total sales.

Marketing Fee: Used for national and regional brand promotion, typically 1% of sales.

Other Operating Expenses: Includes utilities, maintenance, insurance, credit card processing fees, software costs, etc., accounting for approximately 5%–8%.

Let's perform a simplified profitability calculation using an average store with annual sales of $1,200,000:

$1,200,000 (Sales)

$372,000 (31% Food Cost)

$336,000 (28% Labor Cost)

$96,000 (8% Rent)

$78,000 (6.5% royalty fee)

$12,000 (1% marketing fee)

$72,000 (6% other expenses) = $234,000 (pre-tax net profit, EBITDA)

This $234,000 represents the store's pre-tax operating profit. It amounts to approximately 19.5% of sales. In the restaurant industry, an EBITDA margin of 15%-20% is considered a very healthy and excellent level.

2-3: So, how much is the owner's "salary"?

You can decide how to allocate this $234,000 profit. You may:

Pay yourself a salary: As the store manager, you can set a reasonable salary for yourself (e.g., $60,000 - $100,000), which is accounted for under labor costs.

Repay loans: If your startup capital came from loans, you'll need to allocate a portion of the profit each year to cover principal and interest payments.

Reinvest: Use part of the profit for store upgrades or opening new locations.

Shareholder Dividends: The remaining amount, after paying corporate income tax, represents the net profit you take home.

Therefore, it's entirely realistic for a well-managed Jersey Mike's franchisee to achieve annual personal total earnings ranging from $150,000 to $250,000 or higher. This explains why countless investors remain eager despite the high initial investment.

2-4: Side-by-Side Comparison: Jersey Mike's vs. Subway vs. Firehouse Subs

Self-praise isn't enough-let's compare it against familiar brands.

| Metric | Jersey Mike's | Subway | Firehouse Subs |

|---|---|---|---|

| Initial Investment Range | $314k – $870k (High) | $237k – $568k (Medium) | $200k – $938k (High) |

| Initial Franchise Fee | $18,500 | $15,000 | $20,000 |

| Royalty Fee | 6.5 % | 8 % | 6 % |

| Average Annual Sales Per Store (AUV) | ~$1.2 M (Very High) | ~$480k (Lower) | ~$990k (High) |

| Sales / Investment Ratio (AUV ÷ Investment) | ≈ 2.4 (based on $500k investment) | ≈ 1.2 (based on $400k investment) | ≈ 1.5 (based on $650k investment) |

| Brand Growth Momentum | Strong growth | Store contraction, undergoing re-branding | Steady growth |

| Analyst Perspective | High investment, high returns, strong brand premium | Low barrier to entry, aging brand, thin profit margins | High investment, good returns, unique community firefighter culture |

The conclusion is clear: Subway has lower entry barriers, but its per-store profitability and brand momentum fall significantly short of Jersey Mike's. Firehouse Subs is a strong competitor, yet Jersey Mike's demonstrates remarkable efficiency in the critical metric of "sales-to-investment ratio." Simply put, every dollar invested in Jersey Mike's may generate higher annual sales than its rivals.

3: Entry Barriers: What Does It Take to Become a Jersey Mike's Franchisee? (Franchise Requirements)

By now, you may be intrigued by Jersey Mike's profitability. But hold your horses-the brand is also "selecting" its partners. Think of it as a two-way interview: you're evaluating them, and they're evaluating you. Let's examine the qualifications you need.

3-1: Financial Hard Metrics: Your Capital Strength

This is the first-and toughest-hurdle. Per official requirements, you must possess:

Minimum Net Worth: $300,000

Minimum Liquid Capital: $100,000

What is net worth? Simply put, it's all your assets (real estate, stocks, savings, etc.) minus all your liabilities (mortgages, car loans, etc.).

What is liquid capital? This refers to cash or equivalents (like stocks, funds) you can access at any time, excluding real estate.

In my view, this threshold is set very "intelligently." $100,000 in liquid capital is clearly insufficient to cover the total investment, meaning the brand wants you to:

Have a solid credit history to secure bank financing.

Or, have partners to co-invest.

Or, possess actual financial strength far exceeding this minimum requirement.

They don't want you to bankrupt yourself or exhaust all liquidity just to open a store. A financially healthy franchisee is better equipped to handle risks and focus on long-term operations.

3-2: Experience & Background: Do They Really Require Food Service Experience?

This is a common question. The answer is: Not necessarily required, but it's definitely a plus.

Jersey Mike's places greater emphasis on your business management experience and leadership skills. Have you successfully run a business? Managed a team? Possess basic financial literacy?

They have a highly developed training system (8-10 weeks of intensive training) that can transform a "food service novice" into a competent operator. But what they can't teach is innate entrepreneurial spirit, customer service mindset, and the wisdom to manage employees.

Therefore, if you're a successful project manager, small business owner, or seasoned retail store manager-even if you've never made a sandwich-you stand a strong chance of being favored. Conversely, if you're purely a financial investor seeking a hands-off role, Jersey Mike's may not be the right fit. They strongly emphasize the Owner-Operator model.

3-3: Brand Culture Fit: Do you embrace the "A Sub Above" philosophy?

This might sound abstract, but I consider it the most crucial factor. The core of Jersey Mike's brand culture is "A Sub Above." This doesn't just mean sandwich quality above all else; it also extends to service and community contributions that exceed industry standards.

Their renowned "Day of Giving" initiative donates 100% of a full day's sales to local charities. This is compelling community marketing and a direct reflection of their brand values.

During interviews, the brand will deeply explore your perspective on this culture. Are you someone who enjoys helping others and actively participates in community activities? Do you genuinely love interacting with people and creating positive experiences for customers?

If you view this merely as a money-making machine with no connection to the brand's culture, you'll struggle to integrate into the system and genuinely motivate your staff to live out this culture. Ultimately, this will reflect in your store's performance.

"I have business acumen, but I'm unsure if I'm the ‘helpful' type of leader." This self-doubt is normal. Try our Entrepreneur Assessment tool. Through a series of psychological and behavioral questions, it helps you analyze your strengths, weaknesses, and compatibility with different business models (like community-service oriented ones). This can deepen your self-understanding

4: From 0 to 1: Application Process and Success Secrets

If you meet the financial requirements and share our vision, congratulations-you're halfway there. Next comes the "from 0 to 1" phase of turning your idea into reality. This journey is long and complex, but following the right roadmap will help you navigate it more steadily.

4-1: Seeking Opportunities: How to Find a Jersey Mike's Franchise for Sale

You have two ways to start your Jersey Mike's business:

Open a New Location: This is the most common approach. You need to find a suitable storefront within a territory opened by the brand.

Purchase an Existing Location: Occasionally, long-time owners retire or sell due to other reasons. You can find listings on commercial brokerage websites or the brand's resale channels.

The advantage of buying an existing location is its established cash flow and customer base, which may seem lower risk. But the pitfalls lie here. You must conduct deeper due diligence: Why is the previous owner selling? Is the market saturated? Has a new competitor opened nearby? Or does the equipment require significant investment for upgrades? In one case I handled, a client wanted to buy a "profitable" franchise, but our investigation revealed the lease had only one year left, and the landlord explicitly stated they wouldn't renew. That was a massive trap.

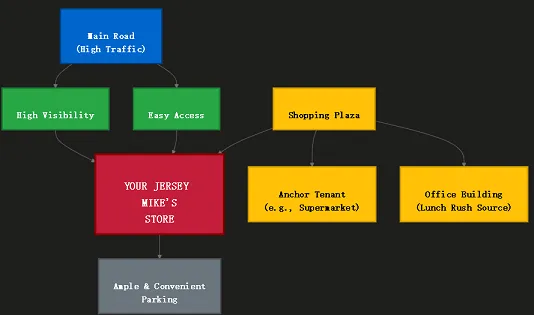

4-2: The Critical Step: The Art and Science of Site Selection

Location, Location, Location! This golden rule of real estate holds true-and even more critically-in the restaurant industry.

A great location can make your business thrive, while a poor one can spell disaster. Jersey Mike's site selection team provides expert guidance and data support, but the final decision rests with you.

A prime location typically features:

Visibility: Your storefront and signage are clearly visible from major thoroughfares.

Accessibility: Customers can easily drive in, with ample parking available.

Synergy: Surrounding areas include large retailers (e.g., Walmart, Target), office buildings, schools, hospitals, or large residential communities. These provide steady lunch and dinner traffic.

Demographic Profile: Population density, household income levels, and spending habits within a 1-3 mile radius should align with your brand positioning.

Don't rely solely on the brand's data. I strongly recommend conducting your own field research. During weekday lunchtime (11:30 AM–1:30 PM) and weekend dinners, park across from your target spot and manually count foot and vehicle traffic. Observe queue lengths at potential competitors (like nearby Panera Bread or Chipotle) during peak hours. This firsthand intelligence holds more value than any data report.

4-3: The Path to Financing: Crafting a Business Plan That Wins Over Banks

Unless you can pay in full, you'll likely need to apply for an SBA loan (guaranteed by the U.S. Small Business Administration). The key to securing this loan is an impeccable business plan.

What do banks look for in your business plan?

You've done your homework: You possess deep knowledge of the Jersey Mike's brand, target market, and competitors.

You have clear financial projections: You provide detailed startup cost budgets, sales forecasts, cash flow statements, and profitability projections.

You demonstrate repayment capacity: Your projections show the store's profits sufficiently cover monthly loan principal and interest payments.

You are a credible operator: Your personal background and management plan indicate your ability to successfully run this location.

Writing a multi-page business plan is an extremely time-consuming and specialized task. Many promising entrepreneurs get stuck at this stage.

This is precisely why we developed the Business Plan Generator. You don't need to start from scratch. Our tool guides you through filling in all critical information and automatically generates a professional format compliant with bank SBA loan requirements. Focus solely on content accuracy and data integrity-we handle the formatting and structure. This saves you at least 40 hours of valuable time.

5: What Your Competitors Won't Tell You: Challenges, Risks, and Exit Strategies

Friend, so far we've covered the bright side. But as a responsible analyst, I must show you the flip side of the coin. Every investment carries risks, and the key to success lies in identifying, managing, and mitigating them.

I've categorized these risks into three tiers, forming a dynamic early-warning system.

5-1: "A Day in the Life of a Franchisee": The Real Routine of Running a Jersey Mike's

Before signing the contract, you must understand this is no easy job.

9:00 AM: Arrive at the store, check inventory, prepare ingredients for the day, and ensure bread is freshly baked.

10:30 AM: Team morning meeting, assign tasks for the day, and inspect equipment.

11:30 AM - 2:00 PM: Lunch rush! You may need to roll up your sleeves-behind the meat slicer, at the register-to ensure order speed and service quality.

2:30 PM: Lunch break shift. Handle emails, review backend sales data, and arrange afternoon restocking.

4:00 PM: Process supplier payments and create next week's schedule.

5:30 PM - 7:30 PM: Dinner minor rush.

8:30 PM: Begin closing procedures: cleaning and daily inventory count.

9:30 PM: Lock up and head home.

This is just a smooth operating day. You'll also need to handle unexpected situations like sudden employee absences, equipment breakdowns, and customer complaints. It demands immense energy and passion. If you envision a life of daily golf outings and remote "boss" control, this venture might truly be unsuitable for you.

5-2: Common Pitfalls (High-Risk & Medium-Risk)

Based on my analysis of numerous failed franchise cases, I've identified several recurring "traps":

Poor Location Selection (High-Risk): The number one killer. Choosing a low-traffic "dead zone" for cheap rent is a recipe for disaster-even a miracle worker couldn't save it.

Cash Flow Breakdown (High-Risk): Underestimating startup costs and early losses, coupled with insufficient reserves, leads to collapse just before dawn.

Poor Personnel Management (Medium Risk): Inability to recruit suitable staff or retain key employees leads to significant declines in service quality and operational efficiency. Remember, your employees are the bridge between your brand and customers.

Neglecting Localized Marketing (Medium Risk): Over-reliance on headquarters' national advertising campaigns while ignoring local community outreach-such as sponsoring local high school teams or establishing lunch partnerships with nearby offices.

Contract Pitfalls (High Risk): Failing to thoroughly review the Franchise Disclosure Document (FDD) and becoming trapped by unfair terms. For instance, the franchisor may mandate sourcing all supplies-even items like paper towels-from designated, high-cost vendors, severely eroding your profits. While Jersey Mike's has a solid reputation in this area, you still need a lawyer to meticulously review each clause.

5-3: Your Exit Strategy (Risk Management)

Before investing a single penny, plan your final step: How will you exit?

A healthy business should function like a tradable asset. Your goal is to build your store into a "hot commodity" that can be sold at a premium when you eventually retire or pivot to other ventures.

A solid exit strategy includes:

Clear Financial Records: Maintain clean, standardized accounting so potential buyers can see everything at a glance.

Standardized Operations: Establish SOPs (Standard Operating Procedures) so the store's operations don't depend solely on you.

Stable Core Team: Develop a capable store manager and several key employees.

Good Store Maintenance: Keep equipment and fixtures in excellent condition.

Typically, a consistently profitable franchise can sell for 3 to 5 times its annual profit. That means if your store earns $200,000 annually, you could potentially sell it for $600,000 to $1 million. This represents one of the ultimate returns on your investment.

6: Conclusion: Is Jersey Mike's the Right Next Business Opportunity for You?

Alright, friends. We've taken a long but necessary deep dive together. We've thoroughly examined the Jersey Mike's franchise opportunity-from finances and profitability to entry barriers, operations, and risks.

Now, let's circle back to the original question: Is it a sound investment?

My conclusion: For the right investor, Jersey Mike's stands as one of the finest fast-food franchise opportunities currently available.

Its core strengths are exceptional:

Strong brand and product appeal: Customers willingly pay a premium for its high-quality sandwiches.

Remarkable single-store profitability: Average Unit Volume (AUV) significantly outpaces most competitors, with healthy profit margins.

Robust growth momentum: The brand is in a rapid expansion phase, allowing you to capitalize on its upward trajectory.

Mature support system: Headquarters provides comprehensive assistance from site selection and training to day-to-day operations.

However, its challenges are equally evident:

Significant initial investment: This is not a low-barrier "mom-and-pop shop" venture.

High commitment required from owners: You must be prepared to roll up your sleeves and dedicate yourself fully.

Intense market competition: The food service industry remains a red ocean; sustained effort is essential to maintain an edge.

So, who is the "right investor"?

You possess at least $100k in liquid funds and $300k in net worth, with the ability to secure additional financing.

You have proven business management or team leadership experience.

You align with the brand's culture, are passionate, and committed to deep community engagement.

You aren't seeking a "passive income" venture but are prepared to fully commit to building your own business.

If this description fits you, Jersey Mike's deserves a prominent spot on your shortlist.

Now you have all the key facts about Jersey Mike's. But this is just theory. Your final decision requires evaluating your personal circumstances and comparing it with other options.

This is precisely where our Opportunity Comparison tool shines. Input Jersey Mike's key metrics (investment amount, return rate, risk rating) alongside other ventures you're considering (like another food brand or an online business). The tool generates an intuitive radar chart, helping you visualize which opportunity best aligns with your goals and resources.

Don't make decisions based on gut feelings. Let data and tools be your most reliable copilot. Start your final showdown now!

7: Entrepreneur FAQ (Frequently Asked Questions)

Q1: Can I be a hands-off owner and hire a manager to run the store?

A: Theoretically, yes, but I strongly advise against it, especially during the first 2-3 years. Jersey Mike's culture and success model are built on hands-on ownership. You need to personally establish the culture in your store, train staff, and interact with customers. Only after the store is fully mature and stable, and you've developed an extremely trustworthy and capable General Manager, might you gradually reduce your time in the store.

Q2: What's the biggest challenge in opening a Jersey Mike's?

A: Beyond the significant upfront investment, the biggest challenge is people management. High employee turnover is a common issue in the food service industry. Recruiting, training, motivating, and retaining top-tier staff who consistently deliver "A Sub Above" service is the ultimate test of your leadership.

Q3: If my city already has many Jersey Mike's locations, is there still an opportunity for me?

A: Yes, but it requires more detailed site analysis. This is called "market penetration." You need to work closely with the brand's regional development manager to carefully study the distribution of existing stores and their protected territories to identify "gaps." Sometimes, even in saturated markets, specific communities-like newly developed residential areas or office parks-can present significant opportunities.

Q4: What are the advantages of franchising with Jersey Mike's over starting my own sandwich brand?

A: The biggest benefit is avoiding the immense uncertainty of building something from scratch. You gain a market-proven business model, strong brand recognition, an established supply chain, and comprehensive operational support. You don't need to develop menus, design logos, or experiment with marketing strategies. You stand on the shoulders of giants, focusing your efforts on scaling from 1 to 100 through operational excellence and localized execution-achieving a far higher success rate than starting from scratch.

Q5: What's the worst-case scenario if I mismanage the business?

A: The worst outcome is losing your entire investment and being saddled with outstanding bank loans. This is why thorough due diligence, financial planning, and risk assessment are crucial upfront. You must have a cut-off plan-for instance, deciding whether to seek headquarters assistance or consider reselling the store to recoup partial investment after six or twelve months of sustained losses. Never start without an exit strategy.

8: Personal Perspective & Deep Insights

As a seasoned business analyst, I'd like to conclude this report by sharing some deeper personal observations. Jersey Mike's success, in my view, stems from its unwavering commitment to two fundamental business principles: product-centricity and community-centricity.

In an era where everyone seeks "shortcuts"-relying on central kitchens and pre-made meals to cut costs-Jersey Mike's goes against the grain. It insists on "freshly sliced" meats and cheeses, and uses only high-quality ingredients. This near-obsessive pursuit of product quality has built formidable customer loyalty and brand moats. Patrons know they'll get a sandwich made with real ingredients they can trust at Jersey Mike's. That trust is something no flashy marketing campaign can replicate.

Its "community-first" ethos shines through initiatives like "Day of Giving" and its emphasis on local franchisees. Unlike some corporate giants, it hasn't become a cold, impersonal chain machine. Instead, it encourages each franchisee to become an integral part of their community, forging connections with local schools, charities, and sports teams. This approach infuses the brand with warmth and humanity. In an increasingly digital world, such authentic community ties have become a rare and valuable resource.

So when you invest in Jersey Mike's, you're investing not just in a sandwich recipe, but in a proven business system that wins over both customers' stomachs and hearts. Precisely because of this, its demands on franchisees are exceptionally high. You must genuinely embrace and be willing to execute this "cumbersome" yet effective philosophy. If you do, the rewards will be immense-not just financially, but in the fulfillment of being a respected community entrepreneur.

9: Action Recommendations & Final Summary

Self-Assessment: Honestly evaluate your financial situation and personal traits. Use our Entrepreneur Assessment tool.

Deep Research: Don't just read this article-download a complete FDD sample document and read it word for word.

Field Visits: Visit at least 5 different Jersey Mike's locations. Observe during varying hours and experience them as a customer. If possible, speak with staff or even the owner.

Financial Modeling: Use our ROI Calculator for preliminary estimates, then hire an accountant to create detailed financial projections.

Seek Professional Advice: Before signing any documents, have a specialized business attorney review everything.

Joining Jersey Mike's is a marathon, not a sprint. It demands thorough preparation, significant investment, and sustained endurance. But for the entrepreneur who is ready, the view at the finish line is undoubtedly magnificent.

10: Author Bio

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

Are you considering joining a franchise? Or do you have questions about this article? Share your story or questions in the comments below-I promise to respond personally within 48 hours!

11: Continue Reading

12: References & Data Sources

Guide to Understanding Franchise Disclosure Documents (FDD)

Subway Franchise Costs and Information (Forbes)

Firehouse Subs Franchise Costs and Information (Entrepreneur)

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.