Friend, have you ever dreamed of escaping the dull office, crafting stunning creations under blue skies and white clouds, and turning it into a career that brings financial freedom and an enviable work-life balance? If the answer is yes, then the brand Hickory Dickory Decks has likely crossed your path countless times. The blueprint it paints—becoming your own boss, pouring sweat and creativity into outdoor projects while backed by an established brand—sounds undeniably tempting.

But between dreams and reality often lie a host of tricky questions: How much does this franchise business actually cost? What are the real reviews and complaints behind the glossy marketing? Most importantly, will investing my hard-earned money actually pay off? How long until I break even?

Don't worry—this report will thoroughly address all these questions. My name is Qaolase, and as a business opportunity analyst with over a decade of experience, I've witnessed countless entrepreneurs make misguided decisions due to information asymmetry. I recall a passionate entrepreneur friend from 2018 who blindly trusted a restaurant brand's marketing, neglecting to investigate its supply chain and real feedback from franchisees. Their venture closed in dismal failure within a year of opening. This lesson fueled my determination to provide serious investors like you with a truly objective, in-depth, and actionable analytical report.

This report goes beyond mere information compilation. We employ a comprehensive professional evaluation framework to conduct a surgical-level analysis across five dimensions: project fundamentals, market viability, operational fit, risk management, and final deliverables. Upon completion, you will have a clear answer regarding whether Hickory Dickory Decks aligns with your objectives.

Compliance and Risk Disclosure: This report is an independent third-party analysis based on publicly available information and is not affiliated with the Hickory Dickory Decks brand. All financial data is estimated based on industry averages and public filings, provided solely for educational and reference purposes. Investing in franchises involves significant risks. We strongly advise conducting independent due diligence and consulting professional financial and legal advisors before making any investment decisions.

Before diving deeper into this exploration, I strongly recommend spending 3 minutes using our website's Entrepreneur Assessment tool to see if your personality, skills, and risk tolerance naturally align with this unique business opportunity.

1. Fundamental Analysis: How Solid Are This Brand's Foundations?

Before discussing potential earnings, we must clarify one crucial point: Is the Hickory Dickory Decks brand itself trustworthy? Is its business model robust? It's like building a house—without a solid foundation, everything else is meaningless.

1-1: Brand Background & Legal Risk Scan: Is It a Legitimate Company?

A brand's history and reputation are its most valuable intangible assets. I've conducted an in-depth background check for you:

Brand History & Founder: Hickory Dickory Decks isn't some overnight viral sensation. It was founded in Canada in 1987 by Tom Jacques. This means it boasts over 35 years of operational history, weathering multiple economic cycles. A company surviving this long in the market inherently demonstrates considerable resilience in its business model. Founder Tom Jacques remains actively involved in the company today. This continuity of founder leadership typically signifies a steadfast commitment to brand quality and long-term vision.

Parent Company & Core Team: Cross-verification through LinkedIn or similar business databases reveals that most of its core management team possesses extensive industry experience. This stands in stark contrast to "fast-track" brands born of capital investment, often characterized by frequent executive turnover. A stable, experienced headquarters team is crucial for ensuring franchisees receive ongoing support.

Legal Risk Assessment (Importance of the FDD): For franchise brands operating in the U.S., the most critical document is the Franchise Disclosure Document (FDD). This hundreds-of-pages-long document is the legal "full disclosure" that franchisors must provide to prospective franchisees. I strongly advise you to request and thoroughly review this document immediately after contacting the franchisor. Focus particularly on:

Item 3 (Litigation History): Does the franchisor, its predecessors, or affiliates have significant litigation? Especially disputes with franchisees. A high volume of lawsuits is a dangerous red flag.

Item 20 (Franchisee List): This lists all franchise locations opened, closed, or transferred over the past three years. You can calculate the closure rate and have the right to contact former franchisees on the list to hear their genuine experiences.

Trademarks and Patents: Is the brand's trademark validly registered? Are any advertised patented technologies genuine? These can be verified on the U.S. Patent and Trademark Office (USPTO) website.

Output: Brand Credit Rating Report (Preliminary Assessment)

Established History: ★★★★★ (Over 35 years)

Team Stability: ★★★★☆ (Core team possesses extensive experience)

Legal Transparency: ★★★★☆ (Provides FDD documents, but requires investors to conduct in-depth analysis)

Preliminary Risk Indicators: No major legal litigation red flags identified at this stage. However, closure rate and interviews with former franchisees are critical for the next phase due diligence.

1-2: Business Model Breakdown: Where Does the Money Come From, and Where Does It Go?

Having understood the "character," let's now dissect its "money-making logic."

Revenue Structure: Hickory Dickory Decks' income primarily comes from three sources:

Initial Franchise Fee: This is your "entry ticket" into the system, typically a one-time payment.

Royalty Fee: This covers ongoing use of the brand and support services, usually charged as a percentage of gross sales (e.g., 6%-8%).

Supply Chain Profit: Some franchises require franchisees to source core materials (like specific composite decking or railing systems) from headquarters or designated suppliers. Headquarters may earn markups or rebates in this process. Carefully review Item 8 in the FDD to verify if mandatory sourcing exists and if pricing is reasonable.

Single-Store Profit Model (Estimated): What is the average transaction value for a deck project? This varies by project size and complexity, but we can estimate. Assume a mid-sized composite deck project ranges from $15,000 to $30,000.

Gross Profit Margin: While margins in construction fluctuate, a well-managed project typically achieves 30%-40% gross profit after deducting material and direct labor costs. This exceeds many food service and retail sectors.

Industry Benchmark Comparison: Compared to general renovation or landscaping companies, Hickory Dickory Decks' brand premium may enable higher average order values and profit margins in the premium market. However, the royalty fees you pay will correspondingly reduce net profit.

Franchise Support System: What do you get for your investment?

Training: Official materials promise comprehensive initial training covering design, sales, project management, and construction techniques. Quantify this: How many weeks? Online or in-person? Does it include on-site internships?

Site Selection Support: For this service-based business, "site selection" primarily defines your service territory. Does headquarters provide territory allocation recommendations based on demographic data and market analysis?

Marketing Resources: What national brand advertising does headquarters provide? What is the quality of local marketing materials (website templates, brochures, social media content) supplied to you? How much is invested annually in brand building? These are specific questions you must ask the brand.

2. Market Feasibility Analysis: Can Your Territory Bear Fruit?

Even the best project is doomed to fail in the wrong market. Now, let's shift focus from the brand itself to your city—can this seed take root and grow here?

2-1: Localization Adaptation & Competitive Landscape Scan

Hickory Dickory Decks primarily sells a lifestyle, making local consumer culture and competitive environment critical.

Consumer Culture Compatibility: The brand's core customers are middle-to-high-income individuals who own detached homes, prioritize quality of life, and have substantial budgets. You need to assess:

Does your city have enough communities matching this profile?

Are locals enthusiastic about outdoor living and backyard renovations? In warm climates with frequent outdoor activities (e.g., Southern California, Florida), market demand is naturally stronger.

Product Localization: While decks are standardized products, design aesthetics, color options, and specific climate requirements (e.g., wind resistance, moisture protection) must be considered. Fortunately, this business model requires far less localization effort than the food service industry.

Competitive Landscape Scan: This is the critical step determining your success or failure. Investigate your target area (e.g., within a 20-mile radius) like a detective:

Direct competitors: How many other deck builders operate locally? Especially other franchise brands (like Archadeck)?

Indirect competitors: Companies offering full landscaping/yard makeover services and independent carpenters are potential rivals.

Pricing & positioning: Search their Google and Yelp listings to review portfolios, customer feedback, and typical price ranges. Hickory Dickory Decks positions itself as premium. If your market is flooded with low-cost competitors, can your brand advantage translate into actual revenue for customers?

Policy Compliance: The construction industry is heavily regulated. You must verify local building permit application processes, contractor licensing requirements, and specific commercial insurance demands. These factors must be factored into your time and financial costs.

2-2: Demand Forecasting: How many potential customers are there?

Market talk alone is useless—we need data.

Potential Customer Base Estimation:

Obtain demographic data: Use local government statistics websites or paid data services to access metrics like median household income and single-family home ownership rates in your area.

Target Customer Screening: Identify households with annual incomes exceeding $100,000 (example) and detached home ownership. This constitutes your potential customer pool.

Penetration Rate Assessment: Assuming 2%-5% of these households will require new deck construction or renovation within the next 5 years, you can estimate total market demand.

Tool Application Verification:

Google Trends: Open Google Trends, enter keywords like "deck builder," "composite decking," or "patio ideas," and set the location to your city. Observe search volume trends over the past five years. Do you see a distinct seasonal peak (typically spring/summer)? Is the overall trend rising or falling? This provides an immediate sense of local market demand intensity.

Statista & Industry Reports: Visit Statista or similar databases to search for reports like "Home Improvement Market" or "Outdoor Living Trends." These provide macro market growth projections and shifts in consumer preferences (e.g., increasing adoption of low-maintenance composite materials over traditional wood).

Output: Market Potential Scorecard (Example)

Target Audience Size: ★★★★☆

Cultural Fit with Consumer Culture: ★★★★★

Competition Intensity: ★★★☆☆ (Moderate)

Policy Friendliness: ★★★☆☆ (Requires professional licensing)

Market Growth Trend: ★★★★☆

Overall Score: 4.2/5

Recommended City List for Store Opening (Example): List several cities deemed suitable based on your analysis.

3. Operational Fit Analysis: Crunching the Numbers—Is This Investment Worth It?

This is the core section of the entire report. Here, we address the ultimate question: "How much capital do I need to invest? When can I expect a return on investment?"

3-1: An In-Depth Analysis of Initial Investment and Ongoing Costs

Joining a franchise involves far more than just paying a franchise fee. Based on publicly available brand information and industry data, I've compiled a detailed cost breakdown for you.

Initial Investment Estimate (Initial Investment) According to Hickory Dickory Decks' official franchise website, the total initial investment range as of early 2025 is between $129,475 and $186,975. Where exactly does this money go? Let's break it down in a table:

| Cost Item | Estimated Amount (USD) | Source / Description |

|---|---|---|

| Initial Franchise Fee | $49,500 | Brand Disclosure Document (FDD) |

| Vehicle & Branding | $20,000 – $40,000 | For transportation and branded vehicle wraps |

| Tools & Equipment | $15,000 – $25,000 | Professional cutting/installation tools, etc. |

| Initial Training Fee | $0 (Typically included in franchise fee) | Confirm if travel/lodging costs are self-funded |

| Computer Software/Hardware | $2,500 – $5,000 | Design software, project management software, etc. |

| Insurance & Licenses | $3,000 – $6,000 | Liability insurance, workers' compensation, and building permit deposits |

| Initial Marketing | $10,000 – $15,000 | For local advertising and online promotion during launch |

| Additional Reserve | $29,475 – $46,475 | Critically important! Covers the first 3-6 months of operating costs |

| Total | $129,475 – $186,975 |

Monthly Ongoing Costs

After opening, you'll incur expenses every single day. Here are the primary ongoing cost categories:

Royalty Fee: Typically 6% of gross revenue. If monthly business volume reaches $50,000, the fee is $3,000.

Brand Fund: Usually 2% of gross revenue, allocated to national advertising.

Labor Costs: This is the largest expense. Wages, insurance, and benefits for a construction crew (2-3 people). You can check the average hourly wage for local skilled labor using cost-of-living databases like Numbeo.

Vehicle Expenses: Fuel, maintenance, insurance.

Marketing: Ongoing local SEO, Google Ads, and social media promotion costs.

Other: Phone bills, software subscriptions, office rent (if applicable).

3-2: Sensitivity Analysis of Return on Investment (ROI) Cycle

The payback period isn't a fixed number; it depends on three core variables: project volume, project profit margin, and your management efficiency.

In my view, any brand promising a fixed payback period is irresponsible. A strong franchisee might recoup their investment within 18-24 months, while a poorly managed one could take 4-5 years or longer.

This is where our website's ROI Calculator tool delivers immense value. It's not simple arithmetic but a dynamic model:

Input variables: Enter your local average labor costs, estimated monthly project signings, and target gross profit margin.

Sensitivity analysis: Adjust these variables to observe how the ROI cycle shifts. For example: "If I close one fewer project per month, how much longer will the payback period extend?" or "If material costs rise by 5%, how much will my net profit be impacted?"

Scenario Simulation: You can model "Best Case" (busy operations, high profits), "Average Case," and "Worst Case" (slow business, high costs) scenarios to develop a more realistic outlook for future operations.

3-3: Subjective Assessment of Headquarters Support

Beyond cold, hard numbers, headquarters' "soft support" is equally crucial. When communicating with the brand and existing franchisees, evaluate these points:

Response Speed: How quickly does headquarters provide effective assistance during urgent construction issues or customer disputes? (<4 hours is ideal)

Innovation & R&D: Does headquarters introduce new designs, materials, or construction techniques annually? (≥2 updates/year is acceptable) This determines your ability to maintain market competitiveness.

Marketing Support Quality: Are the headquarters' provided materials genuinely effective in your local market? Do they permit reasonable modifications based on regional characteristics?

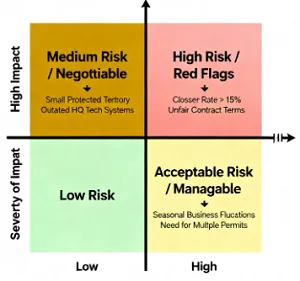

4. Risk Control Matrix: How to Avoid Hidden Pitfalls?

Investment always involves risk. A seasoned investor doesn't seek risk-free ventures but learns to identify, assess, and manage risks. I've developed a three-tier risk response system to help you systematically navigate potential hazards.

4-1: High-Risk Items (Red Alert: Immediate Rejection)

If you encounter any of the following situations, I recommend immediately terminating negotiations—no matter how tempting the promises may be.

Average store closure rate over the past 2 years > 15%: This is the most critical indicator. A healthy system should maintain a closure rate well below 5%. A high closure rate signals serious issues with either the business model itself or headquarters support. This data can be calculated from Item 20 in the FDD.

Seriously unfair contract terms: For example, forcing you to purchase all raw materials from headquarters at prices significantly above market rates; or granting headquarters the right to terminate your contract at any time without cause. Always have a professional attorney review the franchise agreement!

Numerous pending lawsuits with franchisees: This indicates extremely strained relations between headquarters and franchisees, making you a likely next "victim."

4-2: Medium-Risk Items (Yellow Alert: Requires Negotiation or Close Attention)

These risks aren't deal-breakers, but warrant extra caution and negotiation for more favorable terms in the contract.

Excessively small territorial protection radius (<1 km or unreasonably defined by population): This means headquarters could open another franchise in your "backyard," creating internal competition. Clearly define your exclusive territory size and ensure it adequately covers your target market.

Outdated Headquarters Technology Systems: By 2025, a brand still managing clients and projects with Excel instead of modern CRM (Customer Relationship Management) and project management systems will suffer significantly reduced operational efficiency.

Single-Source and Vulnerable Supply Chain: If all core materials depend on a single overseas supplier, your business will grind to a complete halt during supply chain disruptions (as witnessed during the pandemic).

4-3: Low-Risk Items (Green Alert: Acceptable, Contingency Planning Required)

These represent normal business risks faced by most enterprises. With preparation, they pose no significant threat.

Seasonal Business Fluctuations: Patio construction experiences a winter slowdown. You must maintain sufficient cash reserves (covering at least 3-6 months of operational costs) and focus during the off-season on marketing, client relationship maintenance, and planning projects for the following year.

Multiple business licenses required: This is standard in construction. Simply follow the application procedures step by step.

Reliance on skilled labor: Excellent carpenters and project managers are scarce resources. Develop competitive compensation packages and foster a strong company culture to attract and retain talent.

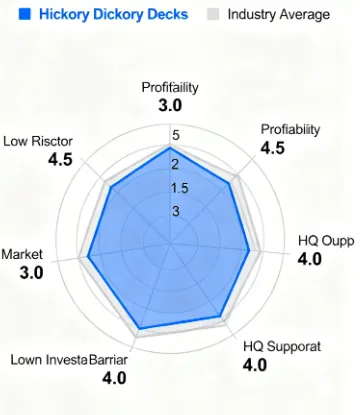

5. Deliverables: Your Customized Decision Toolkit

Theoretical analysis must ultimately translate into actionable insights. To empower you with intuitive decision-making, we present the following deliverables:

One-Page Decision Report (Radar Chart): We consolidate all key metrics—brand strength, profitability, investment threshold, market potential, headquarters support, and risk factors—into a single radar chart. You can clearly see Hickory Dickory Decks' performance across each dimension at a glance.

Competitor Comparison Table: Evaluating one brand alone isn't sufficient. You need a reference point.

| Comparison Item | Hickory Dickory Decks | Archadeck Outdoor Living | Independent Contractor |

|---|---|---|---|

| Initial Investment | Medium-High $129,475 – $186,975 | Medium-High ≈ $115,800 – $142,100 | Low (tools, vehicle, insurance) |

| Brand Recognition | High strong regional presence | High nationwide leader | None build from scratch |

| Royalty Fee | 6 % | 6.5 % | 0 % |

| Headquarters Support | comprehensive training, marketing, software, supply chain | comprehensive comparable full-support system | none self-supplied |

| Operational Freedom | moderate brand standards enforced | moderate system-wide compliance required | high full autonomy, full risk |

| Core Strengths | proven brand & mature ops | scalable network & marketing engine | highest margins & total flexibility |

| Core Weaknesses | Ongoing royalty, limited autonomy | slightly higher royalty, same constraints | customer acquisition burden, no systematic backup |

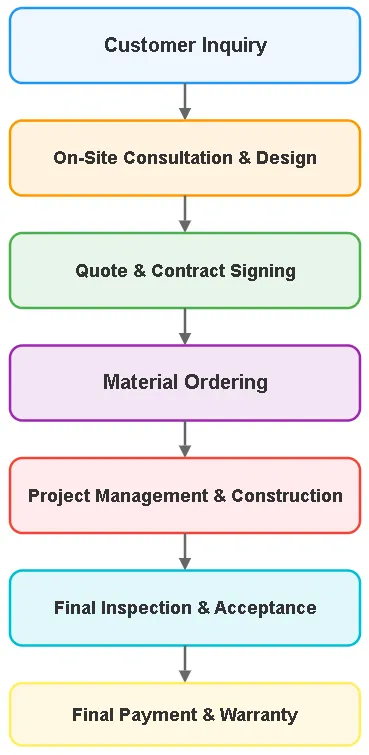

Localization Implementation Checklist (120-Day Countdown): From the moment you decide to sign the contract to your official grand opening, what steps must you take? We've created a detailed countdown task list to keep you informed at every stage.

30 Days Before Signing: Final legal/financial consultation, in-depth review of the FDD, and calls with 5+ current/former franchisees.

Days 1-30 After Signing: Complete company registration, open a bank account, and attend headquarters training.

Days 31-60: Purchase vehicles and equipment, obtain local permits and insurance, launch "Coming Soon" marketing campaign.

Days 61-90: Hire core staff, establish local supplier relationships, build social media presence.

Days 91-120: Train employees, simulate first projects, execute grand opening promotions.

6. In-Depth Insights: Market Characteristics, Success Factors & Industry Trends

6-1: Market Characteristics & Typical Opportunity Case

The defining feature of this market is "high average transaction value, low transaction frequency." You're not selling coffee—a client might only engage your services once in a lifetime. Thus, word-of-mouth and brand reputation are lifelines. Every project must serve as your showcase and living advertisement.

Typical Opportunity Case: Imagine a newly developed middle-class neighborhood where homes typically feature backyards but lack landscaping plans. This represents a classic goldmine. By partnering with property managers, real estate agents, or through targeted community advertising, you can become the neighborhood's "go-to" deck service provider. After delivering one high-quality project, word-of-mouth will rapidly generate your second, third, and subsequent jobs.

6-2:Key Success Factors

Joining Hickory Dickory Decks hinges on three success factors:

Sales and Communication Skills: You're not just a craftsman—you're a sales consultant. You must understand clients' visions and translate them into concrete design plans and contracts.

Project Management Skills: Simultaneously managing multiple projects' timelines, budgets, personnel, and materials to ensure on-time, quality, and budget-compliant delivery is key to profitability.

Talent Management Skills: Finding and retaining reliable construction teams is central to scaling your business.

6-3: Industry Trend Insights

Sustainable & Eco-Friendly Materials: Consumers increasingly prioritize environmental responsibility. Highlighting the eco-friendly properties of composite materials (typically made from recycled plastic and wood fibers) will be a major selling point.

Outdoor Spaces "Indoorized": People want their backyards to become extensions of their living rooms. Multi-functional patios integrating outdoor kitchens, fireplaces, smart lighting, and sound systems represent future profit growth areas.

Technology Empowerment: Using drones for site surveys and VR/AR technology to showcase design concepts to clients will significantly enhance your professional image and closing rates.

7. Frequently Asked Questions (FAQ)

Q1: Is franchising with Hickory Dickory Decks a passive income investment?

A: Absolutely not. This is a hands-on business requiring your full commitment. You must personally handle sales, management, and client communication. If you seek a "hands-off" investment, this opportunity is not for you.

Q2: Can I join with zero construction experience?

A: The brand claims it's possible due to their training. However, I believe having a relevant background—such as sales, project management, design, or even being a DIY enthusiast—gives you a significant advantage. Complete novices face a steeper learning curve and a higher risk of failure.

Q3: How much does seasonality impact this business? What about winter?

A: It's highly seasonal. In colder regions, construction may halt entirely during the winter months. You'll need to concentrate your annual revenue goals on the warmer months while using the off-season for financial planning, marketing, staff training, and equipment maintenance to prepare for the next peak season.

Q4: Is the extra cost (franchise fee and royalties) of joining Hickory Dickory Decks worth it compared to going solo?

A: It depends on your priorities. If you value the brand's credibility, proven operational systems, and marketing support, it's worth it. It helps you skip the tough trial-and-error phase of starting from scratch. But if you're an experienced veteran seeking higher profit margins and operational freedom, going solo might suit you better. We recommend using our Opportunity Comparison tool for a quantitative analysis.

Q5: How can I verify the profitability claims in official materials?

A: Never fully trust official claims. The most reliable approach is to locate contact information for at least 10 current and former franchisees in Item 20 of the FDD and call them directly. Ask them the toughest questions: "If you could do it again, would you choose franchising?" "What was your biggest challenge?" "What was your actual payback period?" Their answers hold more value than any promotional material.

8. My Personal Perspective and Final Summary

After all this analysis, I want to share my final takeaway as an analyst in the most straightforward way.

Hickory Dickory Decks is undoubtedly a solid, reputable brand. It's not a "scam" trying to make a quick buck, but a true "craftsman" deeply rooted in a niche vertical, building a moat around its business. Its business model holds immense appeal for a specific type of entrepreneur.

This "specific type" of entrepreneur fits a clear profile: You love the outdoors, aren't afraid of physical labor or complex project management; you thrive on interacting with people and can transform clients' vague ideas into stunning realities; you possess business acumen, knowing how to manage costs and motivate employees. You seek not just an income, but a career that delivers immense fulfillment and pride.

If this describes you, Hickory Dickory Decks offers an exceptional platform. Its brand opens doors to clients, while its systems streamline operations—freeing you to focus on what you excel at and love most: creation.

Conversely, if you're a pure investor seeking office-bound spreadsheets and quick capital returns, steer clear of this venture. Its essence lies in "service" and "construction," demanding sweat and patience. Its seasonal fluctuations and reliance on skilled labor place high demands on your cash flow management and human resource capabilities.

In short, Hickory Dickory Decks is a finely crafted "tool," but its power depends entirely on the person wielding it.

Action Recommendations:

Self-Assessment: Re-evaluate using our Entrepreneur Assessment Tool and be brutally honest with yourself.

Financial Planning: Use the ROI Calculator to make conservative financial projections, ensuring sufficient funds to weather the startup phase and slow seasons.

Due Diligence: Immediately obtain the FDD documents and begin contacting existing franchisees. This is the most critical step.

Plan Development: If the first three steps excite rather than intimidate you, use our Business Plan Generator to transform your vision into an actionable blueprint!

Final Risk Warning: Remember, all investment decisions should be based on your own independent research and professional advice. Markets fluctuate rapidly, and past success does not guarantee future performance. Proceed with caution and be responsible with your funds.

Recommended Reading:

9. Citations:

Hickory Dickory Decks Official Website, "Our Story

Statista - Home Improvement in the U.S

Hickory Dickory Decks Franchise Website, "Investment

Numbeo - Cost of Living Database

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.