1. Your Expert Guide: Turning the FDD from "Gibberish" into Your Wealth-Building Roadmap

I'll never forget the moment years ago when I first held that FDD (Franchise Disclosure Document) in my hands. It was a sunny afternoon, and I held the franchise documents for my dream coffee brand in my hands, feeling like I was clutching a golden key to the future. But when I opened it, my heart sank instantly. That thick, hundreds-of-pages-long document, densely packed with legal jargon and numerical tables, didn't fill me with excitement—instead, it brought an overwhelming, suffocating sense of pressure. I believe you, reading this now, might be experiencing the same feelings I did back then: one hand holding a burning entrepreneurial dream, the other gripping a cold, impenetrable legal document, your heart filled with confusion and unease.

Don't worry—you've come to the right place. The sole purpose of this article is to rescue you from this predicament of "passively absorbing information." I won't just dryly explain what an FDD is—I'll give you a "action guide." More importantly, I'll show you how to leverage our website's unique entrepreneur toolkit (ROI calculator, entrepreneur assessment, opportunity comparison, business plan generator) to break down this complex FDD step by step into a clear, actionable plan that guides your decisions.

As an advisor who's served thousands of entrepreneurs over the years, I understand your pain points intimately. So grab a cup of coffee, and let's embark on this journey together. By the end, you won't be a novice fumbling with the FDD—you'll be a prospective entrepreneur who can review documents like an expert and take control of your investment destiny.

2: Foundation: Two Golden Rules You Must Know Before Diving In

Before diving into the details of those 23 sections, we must lay a solid foundation. It's like building a house—if the foundation is unstable, no matter how tall the structure, it will eventually collapse. In the world of the FDD, this foundation is understanding its essence and the fundamental rights it grants you.

2-1: What Exactly Is the FDD? Why Is It So Important?

First, let's break down what an FDD really is in plain language. Think of it as a "mandatory prenuptial agreement." Before you (the prospective franchisee) and the franchise brand (the franchisor) "tie the knot," the Federal Trade Commission (FTC) requires the brand to fully and honestly disclose everything about itself—its history, financial status, legal disputes, requirements for you, and the support it can provide, among other things. This document isn't meant to scare you away. Quite the opposite—its core purpose is to protect you, investors like us, from making poor decisions due to information asymmetry. It ensures you get a clear view of your future business partner's true nature before committing your life savings. So don't see it as an obstacle—view it as the most powerful "X-ray vision" the law grants you. Every page, every word, deserves your time and attention, for at stake is the future of your business and the well-being of your family.

2-2: Golden Rule #1: The Sacred "14-Day Cooling-Off Period" (FDD Waiting Period)

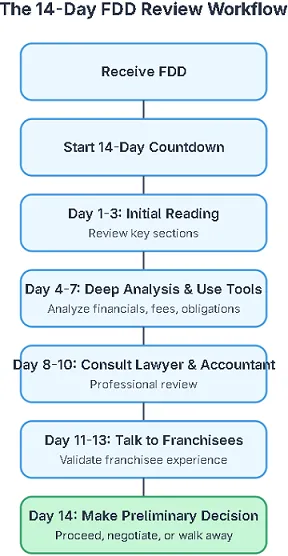

This is the first and most crucial rule I want you to engrave in your mind. Under FTC regulations, the franchisor must provide you with the complete FDD at least 14 calendar days before you sign any binding contract or pay any fees. Note: "at least 14 days." I've seen too many impatient entrepreneurs treat these 14 days as a "sprint period," rushing to finalize everything. This is a completely wrong understanding! These 14 days are not for sprinting—they are a legally mandated "mandatory cooling-off period". Its purpose is to give you ample time to read, think, and consult professionals (like lawyers and accountants), rather than deciding in the heat of the moment under pressure from the brand's enthusiastic sales pitch and "limited-time offers." Remember this: Any brand that pressures you to shorten this waiting period or rushes you into a decision during it is a major red flag. A truly confident and responsible brand will encourage you to take time for thorough research because they trusts its system can withstand scrutiny.

3: Core Analysis: A Practical Workflow, Not Just a Boring Checklist

Alright, with the foundation laid, let's dive into the core. Traditional FDD guides list all 23 sections sequentially, telling you to read from start to finish. Honestly, this approach is incredibly inefficient and easy to get lost in the details. Through years of practice, I've developed a more effective "Thematic Analysis Method." Instead of going through each section individually, imagine the FDD as telling four interconnected stories: The Money Story," "The People Story," "The Rules Story," and "The Risk Story." This approach instantly clarifies your thinking.

3-1: "The Money Story": Your Investment, Expenses, and Potential Returns

This is what everyone cares about most. How much does it cost to open a store? How much do I pay monthly? Can I actually make money? The sections in the FDD address these questions.

Sections 5, 6, 7 (Initial Investment & Ongoing Costs):

Section 5 details the one-time "entry fee"—the initial franchise fee.

Section 6 is an ongoing "bill," listing all recurring payments you'll make, including core royalties (typically a percentage of sales), marketing fees, software usage fees, and more.

Clause 7 is the most critical table, estimating your total initial investment required to open the store. This isn't just the franchise fee—it includes renovations, equipment, initial inventory, rent deposits, and even the working capital needed for the first three months of operation.

Pause now. Don't just stare at these numbers. Open our website's ROI Calculator. This is where it shines!

In the "Total Initial Investment" field, enter both the highest and lowest investment ranges from Clause 7. I always recommend using the highest figure for worst-case planning.

In the "Ongoing Operating Costs" or "Monthly Expenses" section, convert the royalty percentage, marketing fees, etc., mentioned in Clause 6 into estimated monthly expenditures. This is just the first step—we haven't entered revenue yet—but you now have a clear cost framework. This gives you a very concrete and realistic sense of the scale of funds you're about to commit, rather than a vague concept.

Item 19 (Financial Performance Representation - FPR): This is the most anticipated yet easily misunderstood section of the entire FDD. It's the only place where the franchisor can legally show you "how much you could potentially earn." However, note that the law does not require franchisors to provide Item 19.

If provided, you need to scrutinize it. Does it show Gross Sales or Net Profit? Is it data from all locations or only flagship stores? What store size and geographic location does the data represent? These details are crucial.

If not provided, the franchisor will explicitly state that they make no profit projections. This isn't necessarily negative—some established brands choose not to give this to avoid legal risks. But it means your only legal source for profit information is talking to existing franchisees.

Action Steps & Tool Integration

If Item 19 provides specific sales or profit figures—great! Now return to your ROI calculator and input these data points (preferably using the median or average) into the "Estimated Monthly/Annual Revenue" field. The calculator will instantly generate a preliminary payback period projection. This number provides an intuitive sense of how quickly this business can recoup its investment.

If Item 19 is blank, the most critical task on your to-do list is: "Contact at least 10 existing franchisees and ask them for their real, unvarnished financial performance."

3-2: "The Human Story": Who Are You Partnering With?

At its core, franchising is a people business. You're not buying a product—you're choosing a long-term business partner. Whether this partner is reliable, experienced, and trustworthy directly determines your success or failure.

Clauses 1 & 2 (Franchisor Background and Management Team): This section details the brand's history and evolution. When was it founded? Who is the parent company? What are the backgrounds and resumes of the core management team members? I recommend not just reading this section, but actually searching the executives' names on LinkedIn. Are they truly industry experts as described? Do their past career histories show stability? A brand with a stable, experienced leadership team is generally more trustworthy.

Item 20 (Number of Franchises and Franchisee Information): If there's a "treasure trove" within the FDD, it's undoubtedly Item 20. This table reveals how many new stores the brand opened, how many closed, how many were sold, and how many had their contracts terminated over the past three years. A high franchise closure rate or high attrition rate is an extremely dangerous red flag! This may indicate flaws in the brand's support system or a business model that's lost its competitive edge. Crucially, Section 20 must provide contact details for all current franchisees and former franchisees who left the system within the past year. This is your most, most, most valuable resource for due diligence!

Action Steps: This contact list is your "intelligence network." My advice: Don't just call the "star franchisees" recommended by the brand. Act like a detective—select randomly and be sure to call franchisees from different regions and with varying years in operation. Crucially, make an effort to contact several former franchisees who have left the system. They no longer have reservations and can often tell you the most truth. Not sure what to ask? Don't worry—we've prepared a checklist for you. Talking to Franchisees Your Must-Ask List of 50 Tough Questions.pdf

3-3: "The Rules Story": Your Rights, Obligations, and Operational Boundaries

Franchising means operating within a defined framework—the brand's "rules." Understanding these rules clarifies the boundaries of your future daily operations.

Clauses 8, 12, 16 (Suppliers, Territory, and Restrictions):

Clause 8 specifies whether you must source equipment or raw materials from designated suppliers. This impacts your costs and operational flexibility.

Clause 12 defines your "turf"—your exclusive territory. Is this territory protected? Can the franchisor open a company-owned store next door or authorize another franchisee? This is a critical point to verify with your attorney.

Clause 16 specifies what you can and cannot do. For example, are you restricted to selling only products approved by the franchisor?

Clause 11 (Franchisor Assistance, Advertising, Computer Systems, and Training): This clause describes your "backup support." What startup support and ongoing guidance does the brand promise to provide? How long does their training last, and what does it cover? What kind of marketing support do they offer? Is this support free, or will you incur additional costs? A robust support system is crucial for new franchisees to succeed.

Now is the time to use our Business Plan Generator.

In the "Operations Plan" section of the generator, document key rules you've identified from these terms. For example: "Must source coffee beans exclusively from Company A," "Protected territory is a 3-kilometer radius," "Mandatory attendance at a 3-day annual headquarters training," etc.

In the "Marketing Plan" section, record the marketing support provided by the brand and the responsibilities you must handle independently. Through this process, you're no longer passively reviewing clauses—you're actively building a real operational blueprint for your future business. This draft business plan will give you an incredibly clear preview of your future day-to-day operations.

3-4: "The Risk Story": Litigation, Bankruptcy, and Financial Health

Finally, we must examine the project's potential "landmines" like a venture capitalist.

Clauses 3 & 4 (Litigation & Bankruptcy): Clause 3 discloses the brand's current or past significant litigation cases. Pay particular attention to lawsuits initiated by franchisees. If a brand is embroiled in frequent legal battles, especially with its own franchisees, this is a major red flag. It indicates deep-seated, irreconcilable conflicts within the system. Clause 4 discloses whether the franchisor or its executives have a history of bankruptcy. A leader with bankruptcy in their past warrants extra caution in your evaluation.

Clause 21 (Financial Statements): This section contains the franchisor's audited financial statements for the past three years. I know these statements can seem like gibberish to those without a financial background. But you should at least focus on a few key points:

Is the company profitable or operating at a loss? How can a persistently loss-making company support you?

Is the company's cash flow healthy?

What is the primary source of revenue? Is it healthy royalty income, or does it rely heavily on selling new franchise rights (which could be a red flag)? If you're completely lost, that's okay. Flag this section and hand it directly to your accountant. This is their area of expertise.

Now, let's tie all the clues together.

If Clause 3 (Litigation) shows a high number of franchisee lawsuits, and Clause 20 (Franchisee Information) reveals a high closure rate, what does this mean? It's practically screaming at you: This system is toxic! Franchisees are voting with their feet to leave, while those remaining are fighting back with legal weapons.

If Section 21 (Financial Statements) reveals poor company finances, while Section 11 (Support) offers vaguely defined support promises, what does this imply? It suggests those commitments are likely empty promises—they simply lack the financial capacity to deliver.

By cross-referencing information across these different storylines, you uncover the deeper issues hidden behind individual data points.

4: The Smartest Investment: Why You Absolutely Need an FDD Review Attorney

By now, you might feel you've grasped the essence of the FDD. But here's a harsh truth: self-analysis alone is woefully inadequate. I've seen too many entrepreneurs who thought they understood the FDD, only to fall into contractual traps after signing. Their lessons were painful.

The FDD is a legal document meticulously crafted by opposing counsel to maximize protection for the franchisor. As a non-professional facing a team of legal experts, what are your odds? This is precisely why hiring a professional FDD review lawyer or FDD attorney is the smartest, most essential investment in your entire decision-making process.

Let me explain why this money is absolutely well spent:

They translate "legalese": Attorneys decipher seemingly innocuous yet potentially devastating legal jargon. For instance, "The franchisor reserves the right to modify the operations manual at any time without franchisee consent" could mean your operational costs and rules could be unilaterally altered at any moment.

They spot "legal but unfair" clauses: Many terms are legally compliant yet grossly unfair to franchisees. Consider an overly broad non-compete agreement that could bar you from related industries for years after leaving the franchise. You might miss these pitfalls, but a skilled attorney spots them instantly.

They know where to negotiate: While core FDD terms (like royalties) are typically non-negotiable, lawyers know where room exists (e.g., territorial protection scope, store transfer conditions, personal guarantee liability). They can help secure more favorable contract terms.

Action Steps: Don't hesitate. Search Google now for "fdd review lawyer near me" or consult your local bar association. My advice is to schedule initial consultations with at least 2-3 attorneys specializing in franchise law. Their fees (typically a flat fee of several thousand dollars) are negligible compared to the hundreds of thousands or even millions you're about to invest. This isn't just paying for a review report—it's investing in insurance for your future business.

5: Your Unique Advantage: 360-Degree Decision-Making with Our Tools

Alright, the FDD text analysis and legal review are complete. Now we enter a phase no competitor can offer you—using our powerful toolkit to execute a comprehensive, multidimensional decision-making process.

5-1: Is This Opportunity Truly Right for "You"?

I've witnessed too many failures not because the brand was flawed, but because the opportunity simply didn't align with the entrepreneur. A tech expert who struggles with social interaction might find it difficult to run a children's education brand requiring extensive community engagement. Before signing, be honest with yourself. Use our website's Entrepreneur Assessment tool. It will help you gain clarity about yourself across multiple dimensions: risk tolerance, management style, skill set, work intensity expectations, and more. Then, compare your assessment results with the brand culture and operational requirements revealed in the FDD. Are you a good fit?

5-2: How to Make the Best Choice Among Multiple Opportunities?

Often, you may have FDDs for more than one brand. Brand A requires low investment but offers limited support; Brand B has high brand recognition but demands high royalties. How can you compare them scientifically? This is where our Opportunity Comparison tool comes into play. Create a comparison chart to align key data from different brand FDDs—such as initial investment (Section 7), royalty rates (Section 6), territorial protection policies (Section 12), and financial projections (Section 19). This visual comparison instantly highlights each opportunity’s strengths and weaknesses, preventing emotional decision-making.

5-3: From Analysis to Action: Your First Business Plan

Whether securing bank loans, attracting partners, or simply clarifying your own thinking, you need a business plan. Now, consolidate all your prior analysis—ROI calculator projections, operational rule insights, market risk assessments—into our Business Plan Generator. It will guide you in transforming this scattered information into a well-structured, logically coherent business plan. Upon completion, you'll discover your understanding of this venture has reached a whole new level of depth.

5-4: A Reminder About Using Our Tools

Remember, our tools are powerful decision-making aids, not crystal balls. The quality of their output depends entirely on the accuracy of your input data. As the saying goes, "Garbage in, garbage out." Be sure to use real data obtained from the FDD and your due diligence. Furthermore, the tool's calculations cannot replace professional accounting advice or legal counsel from an attorney.

6: My Personal Perspective and Insights

In my view, the process of reviewing an FDD is far more than just evaluating a business opportunity. It is actually your first and most crucial lesson as an entrepreneur: due diligence and risk management. Too many people view franchising as "buying a job," assuming that once they pay the fee, the brand will handle everything. This is a fatal misconception. Successful franchisees are never passive executors; they are proactive business partners who leverage the system's strengths.

This FDD is your window into understanding this "partner." You must learn to read between the lines like a detective, scrutinize numbers like an accountant, and stay vigilant about risks like a lawyer. This process itself is a tremendous exercise in honing your business acumen. When you can confidently close an FDD and clearly articulate the three strengths and three potential risks of the opportunity, you've grown—regardless of whether you ultimately invest.

One more point I want to emphasize: Never fall in love with a brand. Emotion is extremely dangerous in business decisions. You might adore a particular coffee brand, but that doesn't mean its franchise system is necessarily excellent. Completely separate your emotions from your rational analysis as an investor. The FDD and our tools are your best weapons for maintaining that rationality.

7: Summary, Action Recommendations, and Final Warning

Summary: We've journeyed together through this FDD decryption process. You've mastered the "Thematic Analysis Method" to break down complex documents into four narratives about money, people, rules, and risks; you understand the sacred inviolability of the 14-day cooling-off period; and most crucially, you know how to leverage our unique toolkit to transform static information into dynamic decision-making insights. The FDD is no longer your adversary—it is the most powerful spotlight in your arsenal.

7-1: Action Plan Checklist:

Upon receiving the FDD, immediately initiate the 14-day cooling-off period countdown.

Conduct an initial analysis using the "Thematic Analysis Method" and perform data projections with our tools.

Prepare your list of questions and contact at least 10 current franchisees and 2-3 former franchisees.

Engage a specialized franchise attorney for legal due diligence.

Compile all information, finalize your business plan, and make your final decision.

7-2: Important Disclaimer:

The information provided herein is for educational and reference purposes only and does not constitute legal, financial, or investment advice of any kind. Investing in franchises involves significant risks, including the potential loss of your entire investment. Past financial performance does not guarantee future results. Before making any legally binding commitments or paying any fees, you must consult a qualified, independent franchise attorney and accountant for professional advice tailored to your specific circumstances. Your investment decisions are ultimately your responsibility.

8. Continue Reading:

To help you gain a more comprehensive understanding of the business world, we recommend continuing with the following articles:

15 Best Low Cost Franchises to Own for High Profit

What is an FDD? Your Ultimate Guide to the Franchise Disclosure Documen

9. Source Citation:

Federal Trade Commission. (n.d.). A Consumer's Guide to Buying a Franchise

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.