Hey there, friend! I'm Qaolase.

Did you just receive the Franchise Disclosure Document (FDD) for that franchise brand you've been eyeing? You open it up to find over 200 pages packed with dense legal clauses and financial data—suddenly feeling like a huge weight has landed on your chest. I know exactly how you feel—on one hand, you're filled with boundless excitement for your entrepreneurial dream, while on the other, you're overwhelmed by confusion and fear at this seemingly impenetrable document. You might be thinking: "What is this even about? Where do I start? What if I miss some crucial detail and my investment goes down the drain?"

Don't worry—you're not alone in this struggle. In my years as a business consultant, I've seen countless passionate yet bewildered entrepreneurs just like you. I recall a client named David who approached me in 2019, ready to invest his life savings into franchising an emerging coffee brand called GreenLeaf Cafe. Holding that thick FDD, he looked utterly disheartened: I feel like I'm reading a legal document written in alien language. Can I really make the right decision?"

Today, I'm writing this article to completely dispel those doubts. This isn't a dry legal primer. It will be your personal guide, walking you step-by-step through the entire process of deciphering the FDD. More importantly, I'll show you how to leverage our website's exclusive tools to transform this complex document into your sharpest, most powerful decision-making weapon. By the end, you'll not only fully grasp the meaning of FDD but also master a practical methodology to confidently evaluate any business opportunity.

Important Notice: The information provided herein is for educational purposes only and does not constitute financial or legal advice. The FDD is a complex legal document. We strongly recommend engaging a qualified franchise attorney and a Certified Public Accountant (CPA) to jointly review it before making any investment decisions. The tools offered on our website are designed to assist your analysis but cannot replace professional consultation.

1. First, what exactly is an FDD? Why is it so important?

Before diving into details, let's spend a few minutes laying the foundation. What does FDD stand for? FDD stands for Franchise Disclosure Document.

Think of it as a comprehensive, truthful "pre-marital background check report" that the law requires your partner to provide before entering a high-risk "business marriage." This document exists because the U.S. Federal Trade Commission (FTC) mandates it through a law called the Franchise Rule. Its sole purpose is to protect you—the potential franchisee (investor).

In the franchise world, a significant information asymmetry exists between the franchisor (brand owner) and the franchisee (investor). The franchisor possesses comprehensive knowledge of their company's financial health, legal disputes, and operational history, while you have limited insight. The FDD was created to dismantle this information barrier, compelling franchisors to disclose all their "assets"—both positive and negative—in a standardized format. Under FTC regulations, the franchisor must provide you with this FDD document at least 14 days before you sign any binding contract or pay any fees. This 14-day period is your "cooling-off period"—a legally mandated window for conducting due diligence and seeking professional advice. So remember: a Franchise Disclosure Document (FDD) isn't just a piece of paper—it's your legally mandated shield and spotlight, the cornerstone for making informed decisions.

2. How to Navigate the FDD Without Getting Lost: My Exclusive Four-Step Strategic Analysis Framework

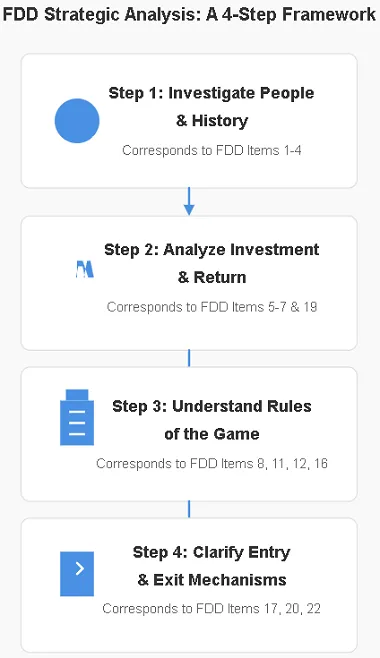

Alright, now we know the FDD is important. But faced with those 23 standard items, most people's first reaction is still confusion. Read straight from Item 1 to Item 23? Trust me, you might want to quit by Item 5. This is an extremely inefficient method that easily misses key points.

Through years of practice, I've developed a more efficient, strategic "Four-Step Analysis Framework." This framework breaks down the FDD into four logically structured modules, enabling you to examine the business opportunity like a professional detective—analyzing it from multiple angles.

2-1: Step 1: Investigate the People and History Behind the Brand (Review Items 1-4)

Imagine partnering with a stranger in business. What would you want to know first? Certainly not how much money they can make, but rather: "Is this person trustworthy?" "Have they deceived others?" "What about their family and team?" This is precisely the first step in analyzing the FDD. Items 1 through 4 conduct a comprehensive background check on the franchisor, its parent company, predecessors, and key management personnel.

Item 1: The Franchisor and Its Affiliates. This section reveals the company's "family tree," its history, and the overall context of the franchise opportunity it offers.

Item 2: Business Experience of the Management Team. This lists the resumes of all key executives. You need to scrutinize whether these "captains" have proven industry success or if they're a group of inexperienced "rookies."

Item 3: Litigation History. This is absolutely critical! It discloses all major lawsuits against the franchisor or its management. Pay special attention to lawsuits filed by franchisees, such as those alleging fraud or breach of contract.

Item 4: Bankruptcy History. Has the company or its key executives ever filed for bankruptcy? This directly impacts the company's financial stability and the credibility of its management.

My Real-World Experience: Remember my client David and "Green Leaf Coffee"? The first thing we did was review this section. Under Item 3, we found an alarming red flag: while no franchisees had sued the company, its founder had been involved in two lawsuits with investors over previous business ventures. This wasn't an absolute "red flag" on its own, but it immediately put us on high alert. I told David, "This suggests the founder may have issues handling partnerships. In later steps, we need to pay special attention to the contract clauses regarding dispute resolution and exit mechanisms."

Red Flag Alert If you encounter any of the following in this section, raise a red flag immediately:

Numerous lawsuits initiated by franchisees alleging fraud or breach of contract.

Key management lacking relevant industry experience.

Recent bankruptcy records for the franchisor or its founders.

The core of this step is building trust. If you can't trust the "people," even the most impressive financial data later on could be a trap.

2-2: Step Two: Analyzing the Numbers—Your Investment and Potential Returns (Review Items 5-7 & 19)

Alright, once you've confirmed the "people" are fundamentally trustworthy, it's time to get down to the nitty-gritty of crunching the numbers. Entrepreneurship isn't romance; passion doesn't pay the bills. Ultimately, we must return to the essence of business—return on investment. This section is the most thrilling part of the entire FDD, and also where you need to keep your eyes wide open.

Item 5: Initial Fees. This typically refers to a one-time franchise fee. You need to clarify what this fee covers: Is it just brand usage rights? Or does it include pre-opening training?

Item 6: Other Fees. This is where the devil hides. Expect a massive table listing all recurring operational expenses:

Royalty Fee: Typically paid monthly or weekly as a percentage of your sales revenue.

Ad Fund Fee: Contributions toward national or regional marketing campaigns.

Technical Support Fee, Software Usage Fee, Transfer Fee, Renewal Fee... and so on.

Item 7: Estimated Initial Investment. This is a crucial table! It estimates the total startup capital required to open a store—covering rent, renovations, equipment, initial inventory, and a reserve fund for the first three months of operation. This is the real "ammunition" you need to prepare.

Item 19: Financial Performance Representations (FPR). This is the "Holy Grail" of the FDD! If the franchisor makes any statements about a franchisee's potential income or profits, all data and calculation methods must be fully disclosed here. Note: The law does not require franchisors to provide Item 19. An FDD lacking Item 19 doesn't automatically signify a bad brand, but its absence becomes an invaluable asset for your financial projections.

My Real-World Experience: The FDD for "Green Leaf Coffee" included Item 19. Data showed that in 2018, among franchises operating over a year, the top 25% of stores averaged $800,000 in annual gross revenue. Meanwhile, Item 7 indicated the total investment to open a store ranged from $250,000 to $400,000. Seeing these figures, David became very excited. But I immediately calmed him down and delivered a crucial message: "David, numbers alone hold no meaning unless we analyze them alongside your own expectations. Now, let's input these figures into our tool."

⭐ Unique Selling Points & Tool Integration ⭐

This is where our website shines! I had David open our website's ROI Calculator . Together, we entered the maximum investment of $400,000 from Item 7 as the "Total Investment," input the 6% royalty and 2% advertising fee from Item 6, and made some conservative cost estimates based on the $800,000 annual revenue from Item 19. Within minutes, the calculator generated a clear chart showing the projected payback period and annualized return rate. For the first time, David saw the business's potential profitability so clearly. He exclaimed, "Wow, this is 100 times clearer than my own Excel guesswork! Now I not only see the best-case scenario but can adjust revenue and costs to see what the worst-case looks like."

2-3: Step Three: Understanding the Rules of the Game—Your Rights and Obligations (Review Items 8, 11, 12, 16)

Before deciding whether to "tie the knot," you need to understand the rules of married life, right? Franchising is no different. You're not buying a job; you're buying a proven business system. This means you'll receive significant support, but you'll also be subject to strict obligations. This section helps clarify your rights and responsibilities with the franchisor.

Item 8: Restrictions on Sources of Products and Services. Are you required to purchase raw materials, equipment, or services from designated suppliers? This could impact your costs and profit margins.

Item 11: Franchisor's Assistance, Advertising, Computer Systems, and Training. This outlines the franchisor's commitments to you. What pre-opening training and ongoing support will they provide? What is their marketing plan? What IT systems do they offer? The quality of this support directly determines whether you, as a newcomer, can get off to a smooth start.

Item 12: Territory. Will the franchisor grant you an exclusive, protected operating territory? In other words, will they open another "Green Leaf Coffee" right next to your store? Territory protection clauses are among the most contentious points in the FDD—read every word carefully.

Item 16: Restrictions on What the Franchisee May Sell. What you can and cannot sell is entirely determined by the franchisor. You cannot unilaterally add menu items or services. This ensures brand consistency but also limits your operational autonomy.

My Real-World Experience: While analyzing Green Leaf Coffee's FDD, David discovered an ambiguous clause in Item 12. It stated a "protected territory" would be provided, but added that "the franchisor reserves the right to open stores in non-traditional locations such as airports or university campuses." I immediately flagged the risk: "David, if your store happens to be next to a university, this means they could theoretically open another location on campus and directly poach your student customer base." Additionally, the "marketing support" promised in Item 11 was also worded very vaguely. These became key points in our subsequent negotiations with the franchisor. This process also prompted David to reflect on a deeper question: What kind of entrepreneur is he?

⭐ Unique Value Proposition & Tool Integration ⭐

I asked David: "Are you someone who prefers strictly following instructions, or someone who craves more creative freedom?" He couldn't answer right away. So I guided him to use our website's Entrepreneur Assessment tool. Through a series of personality and risk preference tests, the report revealed David as a "Steady Implementer" who thrives within mature, rule-based systems rather than uncertain environments. This discovery brought him relief—he realized Green Leaf Coffee's tightly controlled model actually suited him perfectly, provided he could secure key terms like territorial protection. This tool helped him take the crucial step from "analyzing the business" to "analyzing himself."

2-4: Step 4: Define Entry and Exit Mechanisms (Review Items 17, 20, 22)

This final step in our analysis framework is the one that truly matters to your livelihood. It determines how you enter this "business marriage" and, in the worst-case scenario, how you can exit gracefully.

Item 17: Contract Renewal, Termination, Transfer, and Dispute Resolution. This section details your franchise agreement term (typically 5-10 years), renewal procedures upon expiration, circumstances under which the franchisor may unilaterally terminate your contract, and rules governing store sales.

Item 20: Outlets and Franchisee Information. This is another gold mine! It contains detailed statistical tables for all franchise outlets over the past three years, including new store openings, contract terminations, transfers, and more. More importantly, it usually includes contact information for all existing franchisees!

Item 22: Contracts. This section contains templates for all contracts you'll need to sign, including the franchise agreement, lease agreement, and others. These are the legally binding documents.

My Practical Experience: The Item 20 table for "Green Leaf Coffee" showed steady growth in their franchise network over the past three year, with an extremely low closure rate (below 5%)—a very healthy sign. I assigned David a "homework task": "Randomly select 5 franchisees from this list who have been open for over 2 years, plus 3 former franchisees who exited within the past year, and call them." I also provided him with a list of questions.

A week later, David excitedly reported that most franchisees he spoke with were satisfied with headquarters' support and confirmed Item 19's financial data was accurate. Only one former franchisee complained about encountering obstacles during the store transfer process when exiting. This information reaffirmed the importance of scrutinizing transfer terms highlighted in Item 17. At this point, our due diligence on Green Leaf Coffee had become in-depth.

Table: Red Flags vs. Green Flags in the FDD

| Red Flags 🚩 | Green Flags ✅ |

|---|---|

| Item 3: Numerous lawsuits against the franchisor | Item 3: Clean litigation record |

| Item 19: Vague or missing financial data | Item 19: Clear, detailed, and verifiable financial performance |

| Item 20: High closure and transfer rates | Item 20: Stable franchise network with low closure rates |

| Item 12: Vague or absent territorial protection | Item 12: Clear, protected, exclusive operating territories |

| Item 6: Numerous hidden fees, opaque fee structure | Item 6: Clear and reasonable fee structure |

3. When You Have Multiple Opportunities: How to Scientifically "Compare the Pros and Cons"?

Often, you won't just look at one brand. You might be interested in both "Green Leaf Coffee" and another juice brand, "Sunrise Juice." Now you have two FDDs in hand—how do you compare them? By gut feeling? Absolutely not!

In the past, I'd have my clients manually extract key data from both FDDs into Excel spreadsheets—a tedious and error-prone process. But now, we have a better solution.

⭐ Unique Value Proposition & Tool Integration ⭐

This is where our website's Opportunity Comparison tool comes into play. I had David input the key data from both Green Leaf Coffee and Sunrise Juice FDDs—such as the total investment range in Item 7, royalty rates in Item 6, and average annual revenue in Item 19—side-by-side into the tool. The results were immediately clear: Sunshine Fresh Juice required lower initial investment but charged higher royalties, and its Item 19 data showed significantly lower average income than Green Leaf Coffee. Through this tool, David gained crystal-clear insight: while Green Leaf Coffee demanded greater upfront investment, its long-term profit potential appeared substantially higher. This tool helped him eliminate emotional bias, enabling a fully data-driven, rational decision.

3. From Analysis to Action: Building Your Bank-Grade Business Plan

After completing all the steps above, you are no longer a novice. Your understanding of this business opportunity likely surpasses that of 90% of potential investors. Now is the time to compile all your analytical findings into a professional document that will guide your future actions and even help you secure bank financing.

A solid business plan must cover market analysis, competitive landscape, marketing strategies, financial projections, and more. The information you painstakingly extracted from the FDD forms the core, rock-solid foundation for crafting this plan!

⭐ Unique Value & Tool Integration ⭐

You don't need to start from scratch. Our website's Business Plan Generator has already built a professional framework for you. Like an intelligent wizard, it guides you step-by-step to input key data from the FDD—such as investment costs (Item 7), projected revenues (Item 19), and market positioning (Item 1)—into corresponding modules. Ultimately, it generates a draft business plan with complete structure, clear logic, and detailed data. David later used this tool to create his plan and successfully secured partial startup financing from the bank. He told me: "This tool perfectly wrapped up the entire due diligence process. I felt like a CEO, fully in control of my startup venture."

4. My Perspective and Final Recommendation

In my view, the FDD is far more than a legal document. It's a "soul slice" of a brand. Beyond the seemingly cold clauses and numbers, you can sense a company's culture, values, and its genuine attitude toward partners. A brand that presents itself with transparency, clear data, and fair rules in its FDD tends to be more reliable in future collaborations. Conversely, a brand that sets numerous restrictions, uses vague terms, and hides information—no matter how enticing its prospects may seem—should be approached with caution.

I firmly believe the most critical decision in venture investment isn't "what to do," but "who to do it with." Choosing a franchise brand means selecting a long-term business partner. The FDD offers you an exceptional opportunity to understand your future partner deeply. Please don't waste this chance or shy away because of its complexity. An extra hour spent on the FDD today could save you a year of pain and hundreds of thousands of dollars in losses down the road.

4-1: Final Summary and Action Recommendations:

Congratulations on completing this comprehensive guide! You now master the core methodology for analyzing FDDs. FDDs are no longer your enemy—they are your ally.

Now, I recommend taking immediate action:

Click here to download: The Ultimate FDD Review Checklist PDF, print it out, and use it as your action guide.

Select an FDD for hands-on practice: Find a real FDD—whether for a brand you're considering or purely for practice.

Follow the four-step framework using our tools: Manually input data into the ROI Calculator and Opportunity Comparison Tool, complete the Entrepreneur Assessment, and use the Business Plan Generator to synthesize your findings. Practice is the best teacher.

Final Risk Warning: Always remember that entrepreneurship involves inherent risks. The FDD helps you maximize visibility into these risks, but cannot eliminate them. Markets are dynamic, and business operations are complex. Therefore, before signing any documents, you must—and I mean must—consult a professional franchise attorney and accountant with your analysis. Their expert advice is your final, and most crucial, line of defense for investment security.

May you make the wisest decisions on your entrepreneurial journey!

4-2:Please Read:

5. Citations

U.S. Federal Trade Commission (FTC) - The Franchise Rule

Entrepreneur - 10 Things to Look for in a Franchise Disclosure Document

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.