Hey, friend, welcome here.

I know why you clicked on this article. Subway - that name is all too familiar. It's practically everywhere, making it seem like the perfect, "ready-to-go" business opportunity. The barrier to entry looks low, the brand is household-name famous, and it feels like all you need is some cash to easily become a boss, right?

But is that really the case? Between "appearance" and "reality" often lies a chasm made up of financial statements, legal documents, and operational details.

My name is Qaolase. For over a decade, I've worked as a research manager specializing in business intelligence and franchise brands. I've witnessed countless entrepreneurs dive in headfirst due to information asymmetry, only to exit with disappointment. That's why I created this website - with one purpose: to help you cut through the fog and see the true, unvarnished reality behind a business opportunity.

This report will be the most in-depth and candid analysis you'll ever read about Subway franchising. I guarantee it will answer your most pressing questions:

Question 1: What is the total cost to open a Subway franchise from start to finish? Where are the hidden fees?

Question 2: After a year of hard work, how much can you actually earn? What is the so-called "owner's salary"?

Question 3: What qualifications do I need to be considered by Subway headquarters?

Question 4: Is buying an existing Subway location a better idea than opening a new one?

Question 5: Is Subway still worth investing in today? How competitive is it against all the new sandwich brands?

Together, we'll dissect everything behind the official data. I'll also share insider knowledge and lessons learned. Most importantly, I'll guide you through using our website's exclusive tools to transform this information into your own personalized decision-making framework.

Ready? Let's embark on this journey of discovery.

Important Notice: Mandatory Pre-Investment Disclosure

Friend, please remember: All data comes from publicly available FDDs (Franchise Disclosure Documents) and authoritative industry reports. It is provided solely for your education and reference. It does not constitute any form of investment advice. Before making any real-money investment decisions, you must - must personally obtain and thoroughly review the latest FDD provided by Subway, and consult your accountant and attorney. Investing involves risks; every decision should be grounded in thorough due diligence.

1: The Bottom Line Up Front: Key Stats for a Subway Franchise

I know your time is valuable. Before diving into details, I've prepared a one-page decision report with core metrics. This gives you a 30-second overview of the Subway franchise opportunity - the first step in our "Fundamental Project Analysis".

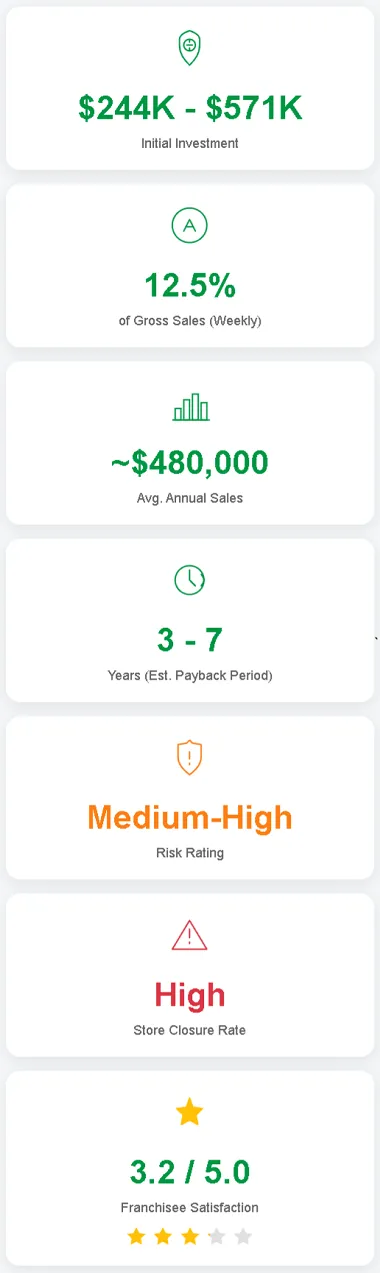

| Metric | Data Range/Rating | Notes |

|---|---|---|

| Initial Investment Range | $244,100 - $571,700 | Includes franchise fee, excludes real estate costs |

| Franchise Fee | $15,000 | Discounts available for veterans |

| Ongoing Fees | 12.5% of Gross Sales | 8% royalty + 4.5% advertising fee |

| Average Annual Sales (AUV) | ~$480,000 | Significantly lower than top brands like McDonald's |

| Estimated Payback Period | 3 - 7 years | Highly dependent on rent and management quality |

| Store Closure Rate (2020-2022) | Net loss exceeding 1,600 locations | High-risk signal, requires close monitoring |

| Headquarters Support | Moderate | System mature, but individual franchisee support feedback varies |

| Risk Rating | Medium-High | Intense competition, high ongoing costs, aging brand |

| User (Franchisee) Rating | 3.2 / 5.0 | Indicates challenges with franchisee satisfaction |

After reviewing this table, you might feel a sinking sensation - yes, Subway's reality is far more complex than imagined, especially regarding "ongoing costs" and "store closure rates." Next, let's peel back the layers of this onion to uncover what each number truly signifies.

2: Deconstructing the Subway Franchise Cost: More Than Just a $15,000 Fee

This marks the first step in our "Operational Suitability Analysis" - and addresses the question on everyone's mind: "How much does it cost to franchise a Subway?" Many are drawn by the seemingly low $15,000 franchise fee, but this is merely the entry ticket - the real "big chunk" lies ahead.

2-1: The Initial Franchise Fee: Your Ticket In

First, let's discuss this $15,000 franchise fee (subway franchise fee). This fee is paid to Subway's parent company, Doctor's Associates LLC, in exchange for brand licensing rights, operational systems, and initial training. It is a fixed, one-time payment. Compared to McDonald's ($45,000) or Taco Bell ($25,000 - $45,000), Subway's franchise fee is indeed very affordable.

Here's a tip: If you're a veteran, Subway offers a program called "U.S. Veterans" that may waive your franchise fee. This is an excellent policy - if you qualify, be sure to inquire with headquarters.

But this $15,000 is just the tip of the iceberg. The real challenge lies in the total investment amount.

2-2: The Real Investment: A Detailed Breakdown (FDD Item 7 Analysis)

Based on Subway's latest FDD (Item 7), opening a new traditional Subway location requires a total initial investment ranging from **$244,100 to $571,700**. Why such a wide gap? Let me break it down for you - this is a crucial part of our Business Model Breakdown:

| Cost Item | Estimated Amount (USD) | Explanation & My Analysis |

|---|---|---|

| Initial Franchise Fee | $15,000 | Fixed cost - your "entry ticket" |

| Store Renovation/Improvements | $75,000 – $200,000 | Biggest variable! Depends on store size, condition, and location. Renovating older spaces can be extremely costly. |

| Equipment Lease/Purchase | $66,000 – $137,000 | Ovens, refrigerators, POS systems, etc. Subway typically has designated suppliers. |

| Security System | $3,500 – $8,000 | Surveillance and alarm systems. |

| Transportation & Installation | $10,000 – $25,000 | Cost of moving equipment from warehouse to your store. Don't underestimate this expense. |

| Opening Inventory | $5,500 – $8,500 | Initial supplies of ingredients, packaging, etc. |

| Miscellaneous Expenses | $4,000 – $8,000 | Includes uniforms, cleaning supplies, office materials, etc. |

| Insurance | $1,200 – $4,000 | This is an annual fee covering liability insurance, property insurance, etc. |

| Training Expenses | $2,500 – $5,000 | Travel, lodging, and meals for you and your manager to attend training. |

| Opening Advertising | $2,500 – $7,500 | Let the surrounding community know you're open. |

| Legal and Accounting Fees | $1,000 – $3,500 | Do not skimp on these! They will help review leases and FDD documents. |

| Additional Funds (3 months) | $40,000 – $90,000 | Lifeline money! Covers rent, wages, and other operational costs for the first three months until cash flow turns positive. |

| Total | $226,200 – $511,500 | This excludes the storefront's security deposit and real-estate purchase costs. |

You see, what truly determines your investment level is "store renovation" and "additional funds." Opening in Manhattan, NY versus a small town in Texas involves vastly different costs - explaining the $300,000+ range.

Tool Recommendation

Feeling overwhelmed by these numbers? Don't worry - it's perfectly normal. That's precisely why we developed the Business Plan Generator. You can open it right now, use the items from the table above as a template, and start building your own clear startup budget based on your local conditions. This plan will be crucial when you apply for bank loans in the future.

2-3: Hidden & Ongoing Costs: The 12.5% Question

If the initial investment is a one-time pain, then ongoing costs are like having your flesh cut away every week - the most overlooked yet deadliest trap for newcomers.

Weekly, you must remit 12.5% of your total sales (note: gross revenue, not profit) to headquarters:

8% as Royalty Fee

4.5% as Advertising Fee

Let me share a real story. A friend of mine - let's call him Alex - franchised a Subway near a college town years ago. He focused solely on the $15,000 franchise fee and seemingly strong foot traffic. I warned him about that 12.5% figure, but he dismissed it, thinking, "If sales are high, paying a bit more is no big deal."

After opening, his store was doing $8,000 in business weekly. He was thrilled, but his smile vanished every Monday when he saw the financial statements. Without fail, he had to pay $8,000 * 12.5% = $1,000 to headquarters every week. That's $4,000 a month, and $52,000 a year! This money was deducted directly from his gross revenue - before he paid rent, employee wages, utilities, or ingredient costs!

Alex later told me: "That 12.5% was like a faucet I could never turn off. It constantly drained my cash flow, leaving my profits razor-thin. I felt like I wasn't working for myself - I was working for Subway headquarters."

This story painfully illustrates that 12.5% is on the high side for fast-food franchising. Many brands operate at total rates between 6% and 9%. Those extra percentage points erode your net profit significantly over time - a critical factor you must consider when conducting your ROI analysis.

3: How Much Profit Can You Really Make? (FDD Item 19 & Reality Check)

Alright, having covered all this, let's dive into the most exciting topic: returns. How much do Subway franchise owners actually make? What is the so-called Subway franchise owner salary really?

First, let's be clear: as a franchisee, you don't receive a fixed "salary." Your income is the store's net profit.

Net Profit = Total Sales - Food Cost - Employee Wages - Rent - 12.5% Franchise Fee - All Other Operating Expenses

3-1: What the Numbers Say: Average Unit Volume (AUV)

Subway's Franchise Disclosure Document (FDD) has a notable feature: it omits Item 19 (Financial Performance Statement). This means headquarters won't officially disclose average franchisee earnings - a red flag in itself.

However, we can estimate using industry reports and data analysis. According to authoritative sources like QSR Magazine, Subway's average annual sales per store (AUV) in the U.S. is approximately $480,000.

What does this number mean? Let's compare:

McDonald's: ~$2,900,000

Chick-fil-A: ~$5,000,000

Jersey Mike's (Subway's direct competitor): ~$1,100,000

See the gap? Subway's per-store sales capability lags far behind top fast-food brands, and it's even outperformed by its direct competitor Jersey Mike's by more than double. This means your "ceiling" is relatively low.

3-2: From Revenue to Reality: Calculating Your Net Profit

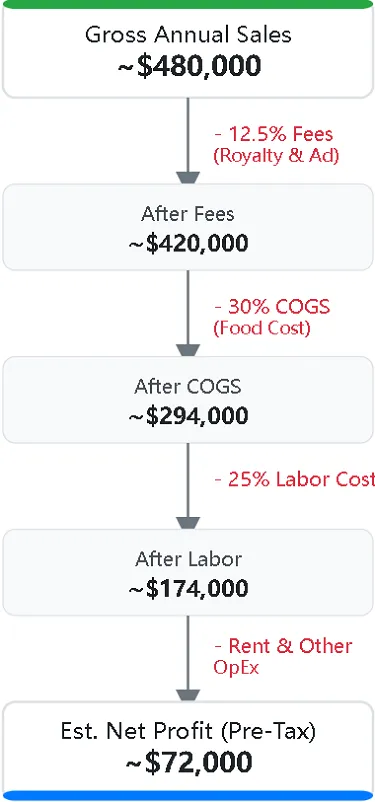

Now, let's do some brutal math based on $480,000 in annual sales - the core of the single-store profitability model:

Annual Sales: $480,000

Minus: Recurring Expenses (12.5%): -$60,000

Minus: Food and paper costs (COGS, approx. 30%): -$144,000

Minus: Employee wages (approx. 25%): -$120,000

Minus: Rent (assumed $5,000 monthly): -$60,000

Minus: Other operating expenses (utilities, insurance, maintenance, etc., approx. 5%): -$24,000

Annual net profit (pre-tax): $72,000

Therefore, under ideal, well-managed conditions, a Subway franchise achieving average annual sales yields the owner approximately **$72,000** in net income per year. This is what's commonly referred to as the "owner's salary."

How does this income level compare? If you invested $400,000 in initial capital and earn $72,000 annually, it would take approximately 5.5 years to break even (assuming everything runs smoothly with no unexpected major expenses).

Of course, if you manage costs more effectively or secure an exceptionally prime location driving far above-average sales, your profits could be higher. Conversely, if your sales fall below average, you're likely to face losses in the first year.

Tool Recommendation

Does this calculation excite or worry you? Don't jump to conclusions - the model above uses averages, and your situation will differ. Open our ROI Calculator. Enter your estimated initial investment, potential annual sales in your area, and rent. It will instantly generate your personalized ROI and payback period, giving you a clearer picture of your financial prospects.

4: Subway Franchise Requirements: Do You Qualify?

After addressing the financial aspects, let's examine the "human" factor. Subway isn't a franchise you can join simply by having money. They have a clear set of requirements for franchisees, which is the "human" component of our Operational Fit Analysis.

4-1: The Financial Hurdle: Net Worth & Liquid Cash

These are non-negotiable hard requirements. According to the latest standards, applicants must possess:

Minimum Net Worth: $150,000

Minimum Liquid Cash: $100,000

Net worth refers to the total value of all your assets (real estate, stocks, savings, etc.) minus all liabilities (mortgages, car loans, credit card debt, etc.). Liquid cash refers to cash or cash equivalents readily available for immediate use.

Subway needs to ensure you not only have the capital to open a store but also sufficient reserves to handle unexpected situations. They don't want to see franchisees go out of business due to a cash flow crisis.

4-2: Beyond the Money: Experience and Training

Beyond finances, Subway values certain "soft skills." While they don't mandate a background in the food service industry, experience in business management, marketing, or customer service is a significant plus.

In my view, they prioritize whether you demonstrate an "entrepreneurial spirit": Are you willing to roll up your sleeves and get hands-on? Do you know how to manage a small team of 5-10 people? Are you passionate about the service industry?

Once your application is preliminarily approved, you and/or your designated manager must attend and complete Subway's comprehensive training program. This training typically consists of two parts:

Online Learning: Complete a series of online courses at home covering brand history, operational standards, food safety, and more.

In-Store Internship: Spend approximately two weeks at a designated training location gaining hands-on experience. You'll learn every detail - from sandwich preparation and inventory management to operating the POS system.

This training is crucial. It transforms you from a novice into a qualified owner and offers your best opportunity to immerse yourself in Subway's culture and operational systems.

Tool Recommendation

"Do I have an entrepreneurial spirit?" This is a challenging question to answer. To help you better understand yourself, we've developed the Entrepreneur Assessment tool. Through a series of psychological and behavioral questions, it quickly evaluates your business acumen, management potential, and risk tolerance to see if you're naturally cut out to be a boss.

5: The "New" Subway: How the 'Eat Fresh Refresh' Changes the Game

When discussing Subway, we must mention its most significant transformation in recent years - the "Eat Fresh Refresh" initiative. This dynamic variable is essential to consider during our Market Feasibility Analysis.

5-1: A Double-Edged Sword: New Menu, New Look

Since 2021, Subway has invested heavily in a brand upgrade, introducing over 20 menu updates. These include new bread options, enhanced protein choices (like upgraded turkey and roast beef), and the entirely new "Subway Series" menu - 12 "Chef's Choice" sandwiches meticulously designed by headquarters. Simultaneously, they mandated store renovations featuring brighter, more modern designs.

What impact has this had?

On the positive side: The new menu has indeed enhanced customer experience and increased average transaction value to some extent. The "Subway Series" streamlined the ordering process, reduced congestion during peak hours, and attracted some returning customers who had previously left.

The challenging side: For franchisees, this means additional costs. You may need to invest tens of thousands of dollars to update your store's decor and equipment to align with the new brand image. New ingredients may also mean more complex inventory management.

In my view, this overhaul is a necessary survival move for Subway amid fierce competition. However, it shifts some pressure and costs onto franchisees. For new investors, this means your initial investment budget may need to exceed the figures stated in the Franchise Disclosure Document (FDD).

5-2: Competitive Landscape: Facing Jersey Mike's & Co.

We must confront a harsh reality: competition in the sandwich market has reached a fever pitch, and Subway is no longer the sole option.

Rising competitors like Jersey Mike's, Firehouse Subs, and Jimmy John's are aggressively capturing market share. Their shared characteristics include:

Higher average transaction value and AUV: Positioned as premium brands, they use freshly sliced meats to project a "higher quality" image.

Stronger brand momentum: They're perceived as cooler, fresher brands with greater appeal to younger consumers.

Healthier franchisee relationships: Especially Jersey Mike's, renowned for its franchisee-friendly policies and high profitability.

This means when you open a Subway, you're not just competing with the other Subway on the corner - (yes, Subway's excessive store density has long caused "cannibalization"), but also against these formidable new rivals. You must ask: In your target area, why would consumers choose Subway over the seemingly upscale Jersey Mike's next door? This is the question you must answer when developing your localization adaptation model.

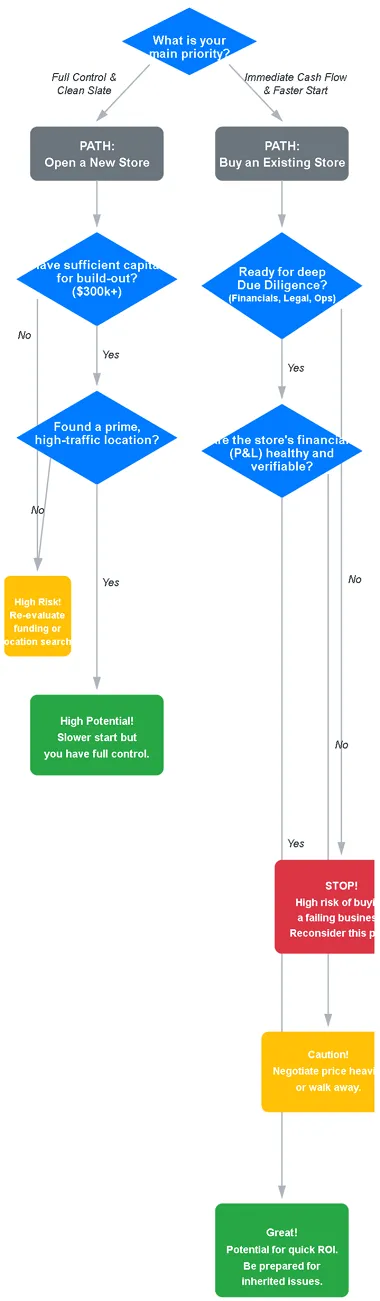

6: Buying a "Used" Subway: A Guide to Subway Franchises for Sale

Beyond opening a new location, you have another option: purchasing a Subway franchise by acquiring an existing one. Opportunities for Subway franchises for sale consistently exist in the market. This can be a shortcut - or a trap.

6-1: Pros and Cons of Buying an Existing Store

Advantages:

Immediate Cash Flow: The store is already operational, generating income from day one.

Established Team and Customer Base: You avoid starting from scratch with hiring and building a clientele.

Verifiable Financial Data: You can request to review the past 3-5 years of Profit and Loss (P&L) statements, gaining clear insight into its profitability.

Lower Startup Costs: Typically cheaper than opening a new location since renovations and equipment are already in place.

Cons:

You may be inheriting a "mess": Why is the previous owner selling? Is it unprofitable? Or due to outdated equipment or difficult staff?

Outdated renovations and equipment: You may need to invest a significant amount immediately to renovate and meet the latest corporate standards.

Poor reputation: If the store has a bad reputation in the community, you'll need to put in considerable effort to turn it around.

6-2: How to Value an Existing Subway: A 5-Step Checklist

If you're considering purchasing an existing franchise, conduct thorough due diligence like a detective - this is a critical step in our Risk Control Matrix:

Review Financial Statements: Request and meticulously examine at least three years of profit and loss statements and tax returns. Engage an accountant to analyze them.

Conduct on-site observations: Visit the storefront during peak hours (lunch rush, dinner rush, weekends) to personally count foot traffic and observe customer demographics.

Inspect physical condition: Thoroughly examine all equipment for functionality, assess whether the decor is outdated, and evaluate sanitation standards.

Communicate with Headquarters: Contact Subway's regional manager to confirm the store's reputation and whether any upgrade requirements remain unfulfilled.

Have an in-depth conversation with the previous owner: Frankly ask why they are selling the store and what the biggest operational challenges were.

My personal advice is: a healthy fast-food restaurant for sale typically commands 2-4 times its annual net profit. If a seller demands far above this range, proceed with extreme caution.

7: The Human Element: A Day in the Life & Common Challenges

So far, we've discussed numbers and strategies, but running a store ultimately revolves around "people" - embodying the "Experience" in E-E-A-T.

7-1: From Dawn Till Dusk: The Reality of a Franchisee

Don't assume being a boss means sleeping in. A typical day for a responsible Subway owner looks like this:

8:00 AM: Arrive at the store, review the previous night's sales data, and begin inventory checks and meal prep - chopping vegetables, toasting bread.

10 a.m.: Staff arrive gradually. Hold a brief morning meeting to assign tasks for the lunch rush.

Noon - 2 p.m.: Peak hours. You may need to jump in personally - prepping ingredients in the kitchen or assisting with orders and payments at the counter while handling unexpected situations.

3 p.m.: The rush ends. Schedule staff meal breaks while grabbing a quick sandwich yourself. Begin administrative tasks: scheduling shifts, placing orders, responding to headquarters emails.

5 PM: The evening rush begins - another round of chaos.

9 PM: Send off the last customer. Start cleaning, counting daily cash, and taking inventory.

10 PM: Lock up and head home, still mentally planning tomorrow's promotions.

Yes, this is reality - especially during the first year of operation. You must invest significant time and energy; it's far from an easy "side hustle."

7-2: The Top 3 Headaches and Their Solutions

Based on interviews with numerous franchisees, they commonly face these three challenges:

Employee Recruitment and Retention (High Turnover): The fast-food industry suffers from extremely high staff turnover. You'll find yourself constantly hiring and training new employees.

Solution: Offer slightly higher hourly wages than competitors, create a positive and respectful work environment, and implement simple performance-based incentives.

Localized Marketing (LSM): Headquarters advertising budgets primarily fund national brand campaigns. Marketing around your own store is entirely your responsibility.

Solution: Build relationships with nearby schools, businesses, and communities; offer group order discounts; leverage social media to promote daily specials; conduct small promotional events at your storefront.

Cost Control (Especially Food Costs): Food waste, shrinkage, and even employee theft directly erode your already slim profit margins.

Solutions: Strictly enforce inventory management processes; conduct daily counts of key ingredients; Leverage headquarters' systems to analyze sales data, optimize inventory, and minimize waste.

8: Conclusion: Is a Subway Franchise a Good Investment for You?

Alright, friends, we've journeyed through this lengthy analysis together. Now it's time to answer the ultimate question:

8-1: A Balanced Summary: The Good, The Bad, and The Ugly

The Good:

Strong Brand Recognition: You don't need to explain to anyone what Subway sells.

Mature Operational System: From supply chain to POS systems, everything is standardized - no trial and error required.

Relatively Low Initial Franchise Fee: The $15,000 entry fee is genuinely appealing.

The Bad:

High Ongoing Fees: The 12.5% royalty rate acts like a shackle, severely limiting your profit margins.

Lower Per-Store Sales: Your "ceiling" is significantly lower than other mainstream brands.

Fierce External Competition: You face challenges from numerous trendier, more profitable sandwich brands.

The Ugly (Negative Aspects):

High-density store openings and internal competition: Subway has long faced criticism for opening new locations near existing franchisees,

High closure rate: The net decrease in store numbers in recent years is a warning sign indicating potential system-wide strain,

8-2: Your Final Decision Framework

Subway is not a "scam"; it is a genuine, legitimate business opportunity. However, it is absolutely not an investment that will make you "easy money."

In my view, Subway may be suitable for the following types of investors:

Hands-on Operators: You are willing and able to be present in the store daily, personally managing every detail and strictly controlling costs.

Ambitious Multi-Unit Operators: Opening one Subway may not make you rich, but successfully operating 3-5 locations to achieve economies of scale can yield substantial income.

Individuals with a strong affinity for the Subway brand and high risk tolerance.

However, if you fall into any of these categories, I strongly advise you to reconsider:

Investors seeking passive income: If you want to be a hands-off owner, Subway will leave you in the red.

Those with tight finances, risking nearly their entire savings: Subway's profit margins are thin, leaving little room for major risks or unexpected setbacks.

Individuals lacking passion for the food service industry, merely seeking an investment project.

Final Tool Recommendation

Before finalizing your decision, I strongly advise using our website's Opportunity Comparison tool to conduct a comprehensive side-by-side analysis of Subway versus other brands in our database (e.g., Jersey Mike's, Firehouse Subs). Evaluate multiple dimensions - investment amount, ongoing costs, AUV, franchisee satisfaction - to determine which opportunity truly aligns best with your goals.

9: My Personal Perspective and In-Depth Insights

After discussing all this objective data and analysis, I'd like to share a few heartfelt thoughts with you.

In my view, the 2026 Subway franchise opportunity is like a classic but somewhat outdated Ford car. It still runs, and many recognize it, but its engine (profitability) pales in comparison to newer Teslas (like Jersey Mike's competitors). Plus, its fuel consumption (ongoing costs) is exceptionally high. You need to be an extremely skilled driver (operator) with intimate knowledge of the road conditions (market environment) to handle it well. One misstep, and it could break down mid-journey.

I believe Subway's biggest issue right now is its declining "value proposition." For franchisees, you're investing effort and ongoing costs on par with or exceeding industry averages, yet the returns (AUV and net profit) fall short of many competitors. While the brand is strong, 'strong' doesn't equate to "profitable."

If you're genuinely interested in the sandwich business, I'd suggest broadening your horizons. Why not delve deeper into Jersey Mike's? Its initial investment may be higher, but its per-store sales exceed Subway's by more than double, and franchisee satisfaction and profitability are generally higher. Your "return on investment" could be significantly better.

Of course, this doesn't mean Subway has no chance at all. If you find a "dream" location with extremely low rent and no competitors nearby, and you happen to be a genius at operations management, then Subway could still be a decent starting point. But such opportunities are rare and hard to come by.

Ultimately, investment decisions are deeply personal, tied to your capital, capabilities, passion, and risk tolerance. I hope this report serves as a clear map, helping you navigate the path ahead. Whether you ultimately choose to turn left, right, or even make a U-turn, may it be a wise, well-considered decision.

10: Action Recommendations & Final Risk Warning

Don't act impulsively: Allow yourself at least 3-6 months for careful consideration and due diligence before signing any documents.

Talk to actual store owners: Locate several Subway locations in your area. Visit them as a customer, then find an opportunity to speak with the owner or manager. Ask about their genuine experiences running the business.

Hire professionals: Have a lawyer review the FDD and lease agreement, and an accountant analyze the financial model. This is money well spent.

Warning reiterated: Subway's high closure rate in recent years is a serious red flag. Thoroughly investigate Subway store openings and closures in your area over the past few years.

11: Frequently Asked Questions (FAQ)

Q1: I have no food service experience. Can I really franchise Subway?

A: Yes, Subway's training system is designed for "zero-experience" individuals. However, you must possess a strong willingness to learn and a hands-on management mindset. They value your business acumen and management potential above all.

Q2: Can I just invest and hire a manager to handle everything?

A: Theoretically possible, but I strongly advise against it - especially in the early stages. Subway's profit margins are tight. Without the owner personally overseeing costs and operations, losses are likely. This model suits seasoned operators who already successfully run multiple locations.

Q3: Will Subway headquarters help me find a location?

A: They provide location support and evaluations, analyzing factors like foot traffic and visibility for a site. However, the actual work of finding a space and negotiating leases falls primarily on you. Headquarters only approves or rejects your chosen locations.

Q4: What if another Subway opens in my operating area?

A: This is one of the biggest challenges for Subway franchisees. The "territorial protection" clause in your franchise agreement typically covers a very limited area. Headquarters retains the right to approve new stores near yours. Your best approach is to focus on enhancing your store's service and local marketing efforts to retain your customers.

Q5: Compared to other fast-food brands, what is Subway's biggest advantage?

A: The greatest advantage lies in its exceptionally high brand penetration and relatively flexible store model. Subway can operate in many non-traditional locations inaccessible to other brands (e.g., hospitals, gas stations, campuses), potentially offering you unique site selection opportunities.

12: About the Author

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

13: Connect with Us

After reading this in-depth report, what are your thoughts? Have you ever considered joining Subway? Or are you already a Subway owner with experiences or pitfalls to share?

Leave your questions or stories in the comments below! I promise to personally respond within 48 hours. Let's build a stronger knowledge base here together to help more friends explore their entrepreneurial journey.

14: Continue Reading

If you want to learn more about evaluating business opportunities, I recommend continuing with these articles:

15: Source

Subway 2025 Franchise Disclosure Document (FDD) QSR Magazine "The QSR 50" Report (2025)

Franchise Business Review, "Top Food and Beverage Franchises 2023

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.