Have you also been bombarded by that iconic pink box all over social media? Or found yourself drawn to the rich, warm, sweet aroma wafting from a Crumbl Cookies storefront, unable to resist stopping in? I admit, I'm one of those people.

I remember first encountering Crumbl in 2021 while evaluating several fast-growing food brands for a client. Its meteoric rise was astonishing-it felt less like a traditional bakery and more like an internet company born on TikTok and Instagram. This piqued my curiosity, and like countless potential investors, my first question popped into my head: Is this viral brand actually a viable franchise opportunity?

If you're reading this, you likely share the same doubts-and probably have even deeper concerns:

How much does it really cost to open a Crumbl? Are those online figures reliable?

Is the "franchisee earning a million a year" claim true? What's the real profit margin?

Beyond money, what else do I need to succeed?

How long will this brand's hype last? Am I just catching a falling knife by jumping in now?

What's the entire process like? Where do I even start?

Don't worry-you've come to the right place. I'm Qaolase, a business consultant and franchise analyst with over a decade of experience. In this article, I'll take you on a "forensic-level" dissection, examining the Crumbl Cookies franchise opportunity inside and out. We won't just look at the glossy "A-side"-we'll dig deep into the risks and challenges hidden within the FDD documents, its "B-side."

This isn't just an information roundup-it's your exclusive, systematic Crumbl franchise analysis report. By the end, you'll gain:

A clear portrait of Crumbl's fundamentals.

A practical model for assessing market viability.

In-depth calculations of operational fit and real investment returns.

A decision matrix for identifying and managing risks.

A final deliverable with actionable steps.

Ready? Let's uncover the secrets inside this pink box together.

Important Disclosure and Investment Warning

This report is based on publicly available Franchise Disclosure Documents (FDD) and industry analysis, provided for informational and educational purposes only. All financial data is historical or projected and does not constitute any promise or guarantee of future profitability. Investing in franchises involves significant risks, including the potential loss of your entire investment. Before making any investment decision, you must carefully read and understand the latest version of the FDD provided by Crumbl and consult independent legal, accounting, and business advisors.

Part One: Project Fundamentals Analysis (The "What") - Deconstructing Crumbl's Brand Strength and Business Model

In my view, evaluating any franchise opportunity must start with examining its "foundation." No matter how compelling a brand's narrative, if its fundamentals are unstable, it's a castle built on sand. So let's play business detective and conduct a thorough background check and business model analysis of Crumbl.

1.1 Brand Background Verification and Legal Risk Scan

A healthy brand should have a clear, traceable history. By reviewing public business databases (like Crunchbase), LinkedIn profiles, and relevant legal documents, I've pieced together Crumbl's "credit report."

Brand Background Check: Crumbl was founded in Utah in 2017 by cousins Jason McGowan (CEO) and Sawyer Hemsley (COO). Interestingly, their initial entrepreneurial journey was steeped in internet-style A/B testing. They would hand out freshly baked cookies for free to passersby, solely to test the optimal combination of flavor, texture, and packaging. This relentless pursuit of product perfection and data-driven decision-making form the most crucial part of Crumbl's DNA. Their leadership team predominantly comes from tech and marketing backgrounds rather than traditional food service, explaining why Crumbl's approach is so unconventional. The brand's parent company is Crumbl, LLC, with clear registration information and a solid track record.

Legal Risk Scan: This is the most critical step. I reviewed Crumbl's Franchise Disclosure Document (FDD). The FDD is a legally regulated document requiring the franchisor to disclose all material information to prospective franchisees, including litigation history.

Litigation History: Under Item 3 of the FDD, Crumbl disclosed several lawsuits it was involved in. Most were labor disputes with former employees or commercial contract disputes with suppliers-which is within the normal range for a large system with nearly a thousand locations. However, it is noteworthy that Crumbl has also faced legal disputes over "trade dress" with other small cookie brands due to its unique "weekly rotating menu" model. This indicates Crumbl actively defends its intellectual property, but also signals intensifying competition in this sector.

Franchise Qualifications: Crumbl possesses legal authorization to sell franchises in all U.S. states. Its trademark "Crumbl" and iconic pink packaging are registered and legally protected.

Output: Brand Credit Rating Report

Brand Credit Rating: A-

Rating Rationale: Rapid brand growth, market-validated business model, and a leadership team with strong credentials and innovative spirit. The brand enjoys deep consumer recognition, particularly holding dominant market share among younger demographics.

Risk Indicators:

Management Risks Amid Rapid Expansion: Accelerated growth may dilute franchisee support and intensify supply chain pressures.

Legal Disputes: While current litigation remains manageable, heightened competition may trigger increased intellectual property challenges.

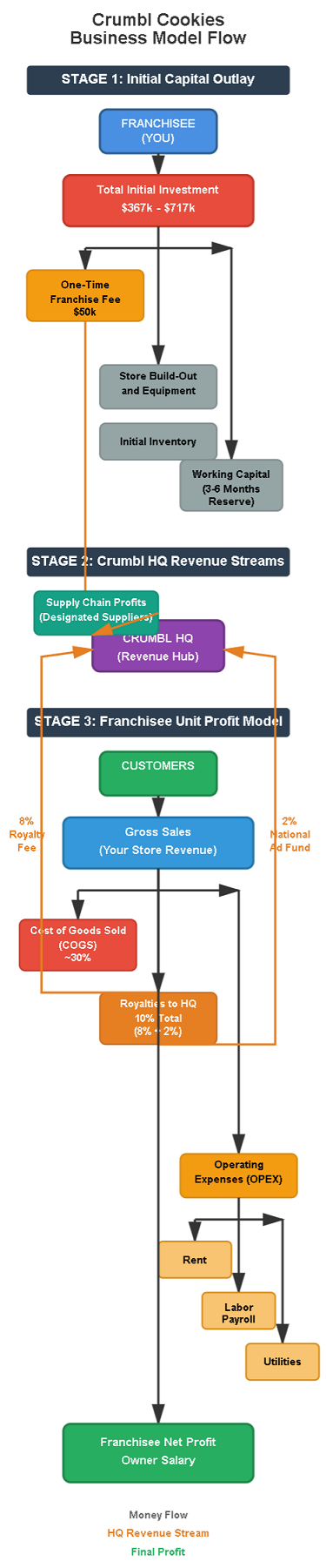

1.2 Business Model Breakdown: How Does Crumbl Generate Revenue?

Crumbl's success is no accident-it operates through a meticulously engineered commercial system.

Revenue Structure:

Franchise Fee: A one-time payment currently set at $50,000. This serves as your "entry ticket" into the Crumbl family.

Ongoing Fees: The primary revenue source for headquarters. Includes an 8% Royalty Fee-8% of your weekly gross sales must be remitted to headquarters. Additionally, a 2% national marketing fund (Ad Royalty Fee) supports headquarters' brand promotion activities. This means for every $100 worth of cookies sold, $10 goes to headquarters.

Supply Chain Profit: This represents a "hidden" profit point in many franchise systems. Crumbl requires franchisees to source most raw materials from designated suppliers, including their proprietary dough, frosting, and packaging. While this ensures consistent quality, it also implies headquarters may capture a portion of supply chain profits. This is detailed in Item 8 of the FDD.

Unit Economics:

Average Ticket Size: Crumbl's cookies command a premium price, typically $4-$5 each. However, due to its signature 4-pack and 6-pack pink boxes, customers often purchase multiple cookies at once, driving the average ticket size to $15-$25-significantly higher than traditional dessert shops.

Daily Foot Traffic: This varies by location, but an average-performing store can see 150-250 daily visitors. Weekend and holiday traffic is typically higher.

Gross Margin: The food service industry typically operates at a gross margin of 60%-70%. While cookie ingredient costs are relatively manageable, Crumbl's high-quality standards and complex weekly new releases may slightly reduce margins below the industry peak. A reasonable estimate falls between **55%-65%**. This means that for every $20 cookie sold, after deducting ingredient costs, you retain approximately $11-$13. This amount must cover rent, labor, utilities, and headquarters fees.

Franchise Support System:

Training: Crumbl provides a mandatory 5-day initial training program at its Utah headquarters. This covers everything from dough preparation and baking processes to store management. I believe 5 days is quite intensive for a novice, meaning you'll need significant self-study and hands-on practice after opening.

Site Selection Support: Headquarters provides location guidelines and standards, evaluating and approving your chosen site. They utilize data models to analyze population density, income levels, and consumer habits in a given area, but the primary responsibility for securing the actual location rests with the franchisee.

Marketing Resources: Headquarters handles national brand marketing, particularly viral campaigns on social media. Your 2% marketing fee is allocated here. They also provide guidance and materials for local marketing, but execution and additional investments are your responsibility.

Part Two: Market Feasibility Analysis (The "How") - Is Your City Right for Crumbl?

I've seen too many failed franchise cases. Often, it's not that the brand is weak, but rather that "an orange grown south of the Huai River is an orange; grown north of it, it becomes a zizyphus." A model that thrives in California may not replicate in Kansas. Therefore, before committing real money, you must conduct a cool-headed, objective feasibility analysis of your target market.

2.1 Localization Adaptation Model

Consumer Culture Compatibility: Crumbl's products are highly standardized American desserts. Its core selling points are "big, sweet, and novel." You must assess whether your city's consumer culture embraces these high-calorie, high-sugar "indulgent" treats. In health-conscious, light-eating communities, you may need to invest more in marketing. The good news is Crumbl's strong social appeal-it's not just food, but a shareable, show-off experience that largely transcends cultural barriers.

Competitive Landscape Scan: My favorite part of every market research project. Open Google Maps, pin your top location candidates, then search for "dessert," "cookies," and "bakery."

Competitors within 3km: How many direct competitors (e.g., Insomnia Cookies)? How many indirect competitors (e.g., Starbucks, local dessert shops)?

Price Range: What are their prices? Where does Crumbl's pricing sit in the market? High-end, mid-range, or low-end?

Peak Foot Traffic: Observe customer flow during weekday evenings and weekend afternoons. This helps gauge local spending habits.

Policy Compliance: In the U.S., food industry regulations are stringent. You must understand local Health Department requirements, Fire Department permits, and other business licenses beforehand. International investors also need to know foreign investment restrictions and visa requirements. These represent hidden time and financial costs.

2.2 Demand Quantification Forecast

Talking about market potential is useless-we need data.

Potential Customer Base Calculation:

Demographics: Identify the demographic data for your target area (accessible via local government websites or paid databases). Crumbl's core customer base consists of young adults aged 18-35 and families with children. What percentage of your target area falls into this demographic?

Income Level: Crumbl falls under "affordable luxury" consumption, requiring customers to have sufficient disposable income. What is the median household income in the area?

Spending Habits: Is online delivery penetration high? (Crumbl heavily relies on third-party platforms like DoorDash). Are people accustomed to paying a premium for high-quality desserts?

Tool Applications:

Google Trends: I just ran a quick search on Google Trends. Enter "Crumbl Cookies" to see its search volume across different states and cities. If your target city consistently shows high search volume, that's a very positive sign.

Statista/Census.gov: Use data from Statista or the U.S. Census Bureau (Census.gov) to find detailed information on consumer spending, demographic composition, and more for specific regions.

Output: Market Potential Scorecard

| Evaluation Dimension | Weight | City A Score (1–10) | City B Score (1–10) |

|---|---|---|---|

| Core Customer Base Share | 30 % | 8 | 6 |

| Median Household Income | 20 % | 7 | 9 |

| Competition Intensity | 20 % | 5 | 8 |

| Google Search Heat | 15 % | 9 | 5 |

| Rental Cost Level | 15 % | 6 | 7 |

| Weighted Total Score | 100 % | 7.15 | 7.05 |

Through this model, you may discover that City B-with higher incomes and pricier rents-doesn't outperform City A overall, which boasts a more concentrated core customer base and less competition.

Part Three: Operational Fit Analysis (The "Payoff") - Your Investment vs. Returns

Alright, now for the most exciting part-crunching the numbers. How much does it cost to open a Crumbl? And how much can I earn? We'll conduct a thorough return-on-investment analysis using official documents and real-world data.

3.1 Investment Payoff Calculation

Startup Cost: According to Crumbl's latest FDD (Item 7), the total investment for opening a new location ranges from $367,666 to $717,833. This is a very broad range-why? Because the biggest variable is real estate. Opening in Manhattan, New York versus a small town in Texas means rental and renovation costs are worlds apart.

Let's create a more detailed cost breakdown and provide a relatively fair estimate (using a standard commercial space in a mid-sized city as an example):

| Cost Item | Official Range (FDD) | Median Estimate | Notes |

|---|---|---|---|

| Initial Franchise Fee | $50,000 – $50,000 | $50,000 | Fixed expense |

| Real Estate / Lease Deposit | $10,000 – $100,000 | $40,000 | 3 months' rent, highly variable |

| Construction / Renovation Costs | $150,000 – $300,000 | $220,000 | One of the largest expenses |

| Equipment / Signage / Furniture | $85,000 – $150,000 | $110,000 | Ovens, mixers, etc. |

| IT Systems / POS | $7,500 – $20,000 | $12,000 | Crumbl has high-tech requirements |

| Initial Inventory | $7,000 – $10,000 | $8,500 | Flour, sugar, packaging boxes, etc. |

| Professional Service Fees | $5,000 – $25,000 | $15,000 | Legal fees, accounting fees |

| Opening Marketing Expenses | $3,000 – $8,000 | $5,000 | Local promotional activities |

| Additional Reserve Fund | $50,000 – $100,000 | $75,000 | Critical! At least 3–6 months of operating capital |

| Total Estimated Cost | $367,666 – $717,833 | $535,500 | Funding required to launch your project |

Average Monthly Operating Costs: Opening is just the first step; maintaining store operations requires ongoing investment.

Rent: $5,000 - $15,000 (depending on location and size)

Labor: 8-12 employees, monthly expenses approx. $20,000 - $35,000

Raw Materials (COGS): Approx. 25%-35% of sales revenue

Headquarters Fees: 10% of sales revenue (8% royalty + 2% marketing fee)

Other: Utilities, internet, insurance, maintenance, etc., approx. $2,000 - $4,000

Payback Period & Profitability Outlook (Owner Salary): This is the primary concern for all prospective owners. Based on Item 19 (Financial Performance Statement) of the FDD, we can examine actual data. In 2022, all Crumbl locations open for over one year averaged annual sales of $1,835,998 and net profit of $290,749.

But! Averages are highly misleading. The same report shows profit ranges from a loss of $23,276 to a profit of $759,978. This is the reality.

Why such huge variation? Let's examine through a scenario analysis:

Scenario A: "High-Performing" Owner Sarah

Location: Opened in a bustling commercial district adjacent to a college town, surrounded by numerous apartment buildings.

Management: Sarah personally oversees operations, rigorously trains staff, and ensures the quality and speed of every cookie produced. She excels at scheduling to maximize staffing efficiency during peak hours.

Local Marketing: Sarah actively partners with university clubs, sponsors events, and cultivates strong relationships within the local food blogger community.

Results: Her store achieves annual sales of $2,200,000 with an 18% net profit margin, yielding $396,000 in annual net profit. Her payback period is under 2 years.

Scenario B: "Low-Performance" Owner Tom

Location: To save on rent, he chose a new development in the suburbs with unstable foot traffic.

Management: Tom was a hands-off owner who rarely visited the store. Employee turnover was high, service quality and product consistency fluctuated wildly, and customer complaints frequently appeared in local online communities.

Local Marketing: Relying solely on headquarters' national advertising with zero local investment.

Result: His store generates only $1,200,000 in annual sales. Due to mismanagement causing waste and excessive labor costs, the net profit margin is just 5%, yielding an annual net profit of $60,000. His payback period may take 7-8 years or longer.

Conclusion: Your "Owner Salary" isn't a fixed figure-it's the ultimate outcome of every decision you make as a business operator. Crumbl offers a platform with high ceiling potential, but whether you reach that ceiling depends entirely on you.

3.2 Headquarters Support Evaluation

Emergency Issue Response: Based on information from franchisee forums, Crumbl headquarters' response speed is above average. Urgent IT system issues are typically resolved within hours. However, non-urgent operational inquiries may require waiting 1-2 days.

New Product Development: This is Crumbl's strength. New items are introduced weekly, year-round. While this ensures customer novelty, it also places significant operational pressure on franchisees.

Local Marketing Fund: A mandatory 2% national marketing fee applies. While headquarters encourages local marketing, there are no mandatory local spending requirements or matching funds provided. This means your local market impact depends entirely on your own additional investment.

Your Personalized ROI Analysis

By now, you may feel excited or anxious about these figures. But remember, these are estimates based on averages. What will your actual situation look like?

Use our website's ROI Calculator now!

Simply input your estimated local rent, labor costs, and projected daily customer traffic. Our calculator will generate a personalized ROI forecast report for you, including your estimated payback period and annual profit range. This is the first step in transforming general information into your personal business decision!

Part Four: Are You the Right Franchisee? (The "Who")

Crumbl is not a "get rich quick" scheme. It seeks specific partners. While evaluating Crumbl, Crumbl is also evaluating you.

4.1 What Kind of Partners Does Crumbl Seek?

Financial Requirements: This is a hard threshold. Per the latest information, Crumbl requires franchisees to have at least **$150,000 in liquid capital and $500,000 in net worth**. They need assurance you have sufficient funds to launch the project and withstand the financial pressures during the initial opening phase.

Operational Experience: While Crumbl states "food service experience is not required," they highly value multi-unit management experience. This means managing multiple retail locations, large teams, or complex projects is a significant advantage. They seek "operators," not just "investors."

Brand Passion: Throughout the interview process, they will repeatedly assess your passion for and understanding of the Crumbl brand. Do you align with their culture? Are you passionate about delivering an exceptional customer experience?

I once assisted a client with a strong financial background who was rejected quickly because he showed disinterest in day-to-day operations during the interview and only wanted to be an investor. Conversely, another client with slightly weaker finances impressed the interviewers with her deep knowledge of her community, love for Crumbl products, and a comprehensive local marketing plan, ultimately securing the franchise.

4.2 Do you possess the DNA of a successful entrepreneur?

To thrive as a Crumbl store owner, you must embody these traits:

Strong leadership: Manage a team of about 10 young employees-motivate them, train them, and handle all personnel matters.

Meticulous attention to detail: From cookie placement angles to in-store cleanliness, the devil is in the details.

Stress resilience: During holiday peaks, orders will flood in like a tidal wave. Can you stay calm and direct your team methodically?

Data analysis skills: You must review daily sales data, analyze top-selling products and peak traffic times, then optimize inventory and staffing schedules accordingly.

Do you possess the DNA of a successful entrepreneur?

Exceptional management is key to high profits. But "management skills" is an abstract concept. Do you truly understand your strengths and weaknesses?

We strongly recommend spending 5 minutes completing our website's Entrepreneur Assessment.

This tool evaluates your business potential across dimensions like leadership, risk tolerance, and financial acumen, generating a personalized report. It helps you objectively assess whether you're suited for a high-intensity operation like Crumbl.

Part Five: Risks and Challenges Behind the Opportunity (The "Reality Check")

Any high-return investment comes with high risk. If someone tells you joining Crumbl is a surefire win, they're lying. Let's build a "Risk Control Matrix" to categorize potential risks into three tiers, helping you anticipate issues early.

Three-Tier Risk Response System

🟥 High-Risk Items (Red Light - Immediate Rejection or Extreme Caution):

Brand closure rate > 15% over the past 2 years: Based on public data and industry analysis, Crumbl's current closure rate is well below this threshold, remaining within a healthy range (<5%). However, this is a metric you must continuously monitor. If this figure surges in the future, it signals significant systemic issues within the brand.

Contracts Contain Mandatory High-Priced Procurement Clauses: Crumbl requires sourcing core ingredients from designated suppliers. During due diligence, you must determine whether these ingredient prices significantly exceed market rates. Excessive markups could severely erode your profit margins.

Social media popularity plummets: Crumbl's success is closely tied to TikTok's popularity. You must consider: if TikTok loses traction or Crumbl's buzz fades, what core competitive advantage remains? This is a fundamental question about the brand's long-term viability.

🟨 Medium Risk (Yellow Light - Negotiate or Monitor Closely):

Insufficient territorial protection radius: Crumbl typically offers territorial protection based on population density or a specific geographic radius. Carefully review this clause in your contract. If the protected area is too small, headquarters may open a new store near yours, directly siphoning off your customers.

Outdated headquarters digital systems: While Crumbl's current IT systems are industry-leading, However, technological iteration is rapid. If their systems fail to keep pace with trends like AI inventory management or automated CRM in the coming years, operational efficiency will decline.

Market oversaturation: In popular cities, Crumbl locations are already densely concentrated. Entering these markets now means facing intense internal competition. You must assess whether your desired area still has sufficient market space.

🟩 Low-Risk Factors (Green Light - Acceptable Business Risks):

Requires Additional General Business License: These are standard procedures for opening a store, requiring only time and minimal investment to resolve.

Seasonal Fluctuations: Dessert sales peak during summer and winter holidays but may decline in spring and fall. You must allocate sufficient reserves in your financial planning (at least 3 months' operating costs) to weather slow seasons.

Staff Recruitment and Training Pressure: High employee turnover is common in the food service industry. Establish standardized hiring and training processes to manage constant staff changes.

I once witnessed a franchisee fall into a trap. They failed to scrutinize the territorial protection clause in their contract. A year later, headquarters approved a new store within 2 kilometers of their location, causing their sales to plummet nearly 30%. This lesson underscores that the devil is always in the contract details.

Part Six: Your Action Roadmap: From Application to Opening (The "How-To")

If you remain confident in Crumbl after all this analysis, it's time to turn your vision into action. I've outlined a clear roadmap with deliverables below.

6.1 Step-by-Step Application Guide

Submit Preliminary Application Online: Complete a simple form on Crumbl's official franchise website.

Initial Communication & Qualification Review: If you meet basic financial requirements, headquarters' business development team will contact you for a phone call.

Submit Detailed Application & Business Plan: This is the most critical step. You must submit a complete application package, including financial documentation and a preliminary business plan.

Interviews: You may undergo multiple rounds of interviews, including meetings with the Regional Development Manager and headquarters executives.

FDD Disclosure and Review: Headquarters will formally provide you with the Franchise Disclosure Document (FDD). You have at least 14 days to review this multi-hundred-page document. It is strongly recommended to hire a professional franchise attorney to assist with its interpretation.

Signing the Franchise Agreement and Paying the Fee: Once you decide to proceed, you sign the agreement and pay the $50,000 franchise fee.

Site Selection, Store Build, and Training: Next comes the lengthy process of finding a location, renovating the store, hiring staff, and attending headquarters training.

Grand Opening!

6.2 Due Diligence: Essential Pre-Signing Research

In Step 5, you must conduct independent due diligence.

Interview existing franchisees: The FDD lists contact information for all current franchisees. Make at least 10 calls! Don't just pick the ones that seem successful. Ask them tough questions:

"Was your actual total investment higher or lower than the FDD estimate?"

"What was headquarters' biggest help? What was their biggest frustration?"

"If you could choose again, would you still join Crumbl?"

"How many hours do you work daily? How has this business impacted your life?"

Hire Professionals:

Franchise Attorney: They can help you spot "gotchas" in the contract.

Accountant: They can assist with more accurate financial projections and tax planning.

6.3 Build Your Success Blueprint

Our website's value extends beyond providing information-it offers tools to turn insights into action.

One-Page Decision Report: After completing all research, use our information to create your own "One-Page Decision Report."

Competitor Comparison Chart:

| Comparison Item | Crumbl Cookies | Insomnia Cookies | Great American Cookies |

|---|---|---|---|

| Initial Investment | $367 k – $717 k | $157 k – $536 k | $200 k – $380 k |

| Royalty Fee | 8 % | 6 % | 6 % |

| Core Selling Points | Weekly rotations, social appeal | Late-night delivery, classic flavors | Cookie-cake focus, mall locations |

| Target Audience | Young adults & families | College students & young pros | Families & mall shoppers |

Localization Implementation Checklist (120-day countdown):

Day 1-30: Sign contract, hire attorney, establish company, begin site selection.

Day 31-60: Finalize location, sign lease, complete store design, start hiring core staff.

Day 61-90: Store renovation, equipment ordering & installation, attend headquarters training.

Day 91-120: Staff training, initial inventory arrival, local marketing pre-launch, trial operation, Grand Opening!

Turn Your Blueprint into Reality

Feeling overwhelmed and unsure where to start?

Use our Business Plan Generator: This tool guides you step-by-step through creating a professional business plan-not only a required document for franchise applications, but also your roadmap for future operations.

Still undecided? Try our Opportunity Comparison: Compare Crumbl side-by-side with other brands you're interested in. Score them across multiple dimensions like investment, returns, and risk to help you make the most rational choice.

VIII. Frequently Asked Questions (FAQ)

Q1: I don't have enough capital, but I really want to join Crumbl. Are there any options?

A: Yes, there are several avenues. First, consider SBA loans (Small Business Administration loans), which are low-interest loan programs provided by the U.S. government for small business owners. Franchise projects typically have a high approval rate. Second, you can seek one or more partners to co-invest. However, it is essential to draft a clear partnership agreement with a lawyer outlining responsibilities and rights.

Q2: I have no food service experience. Can I really succeed?

A: Yes, but it will be extremely challenging. Crumbl's operations are highly standardized. Your focus should not be on innovation, but on strict execution. You'll need to invest several times more time and effort than experienced operators to learn management processes, control costs, and train staff. Your strengths should lie in leadership, customer service, and marketing-not baking itself.

Q3: Could Crumbl cookies just be a passing fad that quickly goes out of style?

A: That's the million-dollar question. I believe Crumbl's "weekly rotation" model inherently combats obsolescence by keeping the brand perpetually fresh. The risk lies in its heavy reliance on headquarters' innovation capacity and sustained social media exposure. Long-term, Crumbl must build brand loyalty beyond its "viral sensation" label-through exceptional customer experiences and community connections.

Q4: What are the most common conflicts between franchisees and headquarters?

A: They typically center on two areas. First, supply chain costs-franchisees always want lower procurement costs, while headquarters has its own profit considerations. Second, the balance between innovation and standardization. Some franchisees may want to make "micro-innovations" based on local tastes, but this is usually not permitted because headquarters needs to maintain global brand consistency.

Q5: If my store underperforms, will headquarters provide assistance?

A: Yes, but it's limited. Headquarters will dispatch an operations consultant to diagnose issues at your location and offer improvement recommendations. They may help analyze financial statements or optimize staffing schedules. However, they won't directly invest funds or assist in dismissing unsatisfactory employees. Ultimately, the responsibility to turn a loss into a profit rests with you, the store owner.

IX. My Personal Perspective and Insights

At this point, I'd like to step out of my analyst role and share my personal take on the Crumbl opportunity.

I believe Crumbl is one of the most "sexy" and "dangerous" franchise opportunities I've seen in recent years.

It's "sexy" because it perfectly hits all the sweet spots of our era: social media-driven viral spread, extreme product-centricity, powerful brand momentum, and a mouthwatering financial return model. It offers ordinary people a chance to participate in a business miracle with sky-high potential. For energetic young entrepreneurs skilled in marketing and meticulous management, it's almost a perfect stage.

But calling it "dangerous" stems from its dazzling success aura, which easily obscures underlying risks. Crumbl is like a Ferrari racing at breakneck speed-it delivers extreme thrills but demands exceptional skill from the driver. You must maintain constant focus, accurately assess road conditions (the market), and handle unexpected situations with precision. If you're merely a "passenger" looking to invest money and wait for dividends, you're likely to crash on this high-speed race car.

Its high investment threshold, demanding requirements for franchisees' deep operational involvement, and reliance on social media buzz all act as potential "filters." This venture isn't for everyone. It's unsuitable for risk-averse investors seeking stability. Nor is it for affluent individuals who merely wish to be absentee owners.

It best suits the "player-type" entrepreneur. You love the game, relish the challenge, and are willing to step onto the field yourself to lead your team to victory. If this describes you and you're fully prepared, then Crumbl's pink box may truly hold gold for you.

X. Summary, Action Recommendations, and Final Risk Warning

Summary:

Crumbl is a franchise opportunity with solid fundamentals, a clear business model, and extremely high profit potential.

Success heavily depends on the franchisee's individual capabilities, including site selection, management, and local marketing.

It features a high investment threshold, intensive operations, and risks including market cooling and increased internal competition.

Action Recommendations:

Self-Assessment: Honestly ask yourself-are you a "player" or a "passenger"? Use our Entrepreneur Assessment tool.

Financial Evaluation: Do you meet the hard financial thresholds? Use our ROI Calculator for preliminary financial projections.

Market Research: Grab your phone, hit the streets, and conduct the most authentic "competitive landscape scan."

In-Depth Research: If the above steps are clear, begin thoroughly studying the Franchise Disclosure Document (FDD) and contact existing franchisees.

Seek Professional Help: Before signing any documents, make lawyers and accountants your trusted advisors.

Final Risk Warning:

Remember, this article is a powerful tool in your decision-making process, but it cannot replace your own due diligence and professional consultation. Investing involves risk; proceed with caution. No business opportunity offers a 100% guarantee of success. Your future is in your own hands.

XI. Author Information and Interaction

I am Qaolase, the founder and lead writer of this site. I'm not some financial titan with countless credentials-I'm just like you, an ordinary entrepreneur driven by curiosity and passion for the business world. Over the past decade, I've immersed myself in the realm of business opportunities and franchising, analyzing hundreds of brands and helping friends like David and countless online readers avoid investment pitfalls to find their own paths. My motivation for creating this site is simple: to share the most valuable business insights in the most authentic and accessible language, helping you navigate fewer detours on your entrepreneurial journey.

Now, I want to hear your story:

What aspect of Crumbl interests you most? What concerns you the most?

In your city, who do you consider Crumbl's biggest competitor?

What other questions about franchising have we not addressed?

Please share your thoughts and questions in the comments section below. I promise to respond personally within 48 hours. Together, let's make your entrepreneurial journey more stable and far-reaching.

XII. Continue Reading

If you're interested in the restaurant franchising sector, you might also enjoy these articles:

XIII: Sources Cited

Statista - The Statistics Portal

Please be respectful and constructive in your comments. Spam and inappropriate content will be removed.